Cash Flow

advertisement

Unit 7

ADMS 3530 2011-12

Classroom Version

1

Read chapter 8 of your text

2

Unit 6

Different investment criteria for evaluating projects:

NPV is the gold standard

NPV = - CF0 + CF1 +

(1+r)1

CF2

+ CF3 … +… CFn

2

(1+r)

(1+r)3

(1+r)n

All variables such as the cash flows (CF’s) and discount rate (‘r’)

were given to us.

Unit 7

We will identify the cash flows (CFs) used for NPV calculations.

This process is called discounted cash flow (or DCF) analysis or

capital budgeting.

3

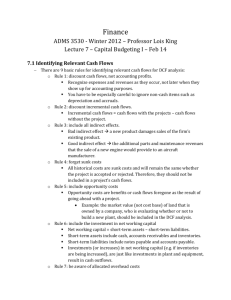

Module 7.1 – Identifying Relevant Cash Flows

Module 7.2 – Basic Steps in DCF Analysis

Module 7.3 - Review of Depreciation and CCA

Module 7.4 - Present Value of CCA Tax Shields

Module 7.5 - Putting It All Together – a DCF Example

Module 7.6 - Summary

4

There are 9 Basic Rules for Identifying Relevant Cash Flows

for DCF Analysis:

Rule 1: Discount cash flows, not accounting profits.

Recognize expenses and revenues as they occur, not later

when they show up for accounting purposes.

You have to be especially careful to ignore non-cash items

such as depreciation and accruals.

5

7.1 Identifying Relevant Cash Flows

Rule 2: Discount incremental cash flows

Incremental Cash flows =

Cash flows with the project – Cash flows without the project

Rule 3: Include all indirect effects

Bad indirect effect a new product damages sales of the firm’s

existing product.

Good indirect effect the additional parts and maintenance

revenues that the sale of a new engine would provide to an

aircraft manufacturer

6

7.1 Identifying Relevant Cash Flows

Rule 4: Forget sunk costs

All historical costs are sunk costs and will remain the same

whether the project is accepted or rejected. Therefore, they

should not be included in a project’s cash flows.

Rule 5: Include opportunity costs

Opportunity costs are benefits or cash flows foregone as the

result of going ahead with a project.

Example: the market value (not cost base) of land that is owned

by a company who is evaluating whether or not to build a new

plant, should be included in the DCF analysis.

7

Rule 6: Include the investment in net working capital

Net working capital = short–term assets – short-term liabilities.

Short term assets include cash, accounts receivables and

inventories.

Short-term liabilities include notes payable and accounts

payable.

Investments (or increases) in net working capital (e.g., if

inventories are being increased), are just like investments in

plant and equipment, result in cash outflows.

8

7.1 Identifying Relevant Cash Flows

Example: Net Working Capital

What is the net effect on a firm’s working capital if a new project requires:

$30,000 increase in inventory, $10,000 increase in accounts receivable,

$25,000 increase in machinery, and $20,000 increase in accounts payable?

Solution

Change in working capital is:

= increase in accounts receivable + increase in inventory – increase in

accounts payable

= $10,000 + $30,000 - $20,000 = $20,000.

This $20,000 is a net increase which is a cash outflow and must be included

in project analysis.

(Note: the $25,000 increase in machinery is a capital cost - not a working

capital item, and is omitted from the calculation!)

9

7.1 Identifying Relevant Cash Flows

Rule 7: Be aware of allocated overhead costs

You should Include only extra overhead expenses that result from

a project

Rule 8: Discount nominal cash flows by the nominal

interest rate.

If using ‘real” cash flows, discount by the real interest rate.

10

Rule 9: Separate Investment and financing decisions.

First assess a project as if it were all-equity financed.

Do not include any interest or debt payments incurred as a

result of project financing. (We will learn the logic behind this

reasoning in Unit 11).

11

7.1 Review Question

Question 1

A firm is considering an investment in a new manufacturing plant. The

site is already owned by the company but existing buildings would need

to be demolished. Which of the following should be treated as

incremental cash flows?

i) The market value of the site.

ii) The market value of the existing buildings.

iii) Demolition costs and site clearance to be incurred.

iv) The cost of a new access road put in last year.

v) Lost cash flows on other projects due to executive time spent on the

new facility.

vi) Future depreciation of the new plant.

A) i, ii, and iii only

B) ii, ii, iii and iv only

C) i, ii, iii and v only

D) All of the above

12

7.1 Review Question

This correct answer is C.

iv) the cost of a new access road incurred last year is a historical or

sunk cost and should be excluded.

vi) future deprecation of the new plant is a non-cash item and

should be excluded.

The other items are incremental cash flows and should be included

in project analysis.

13

7.1 Review Question

Question 2

Allocations of overhead should not affect a project's incremental

cash flows unless the:

A)

project actually increased overhead expenses.

B)

overhead cannot be recovered at the end of the project.

C)

overhead cannot be allocated to other projects.

D)

accountant is required to allocate costs to this project.

Please choose the correct answer.

14

7.1 Review Question

The correct answer is A.

You should Include only extra overhead expenses that result from

a project

15

Step 1. Identify all relevant project cash flows (Module 7.1)

Step 2: Separate the cash flows into 4 main categories:

i. Plant & Equipment (this is usually CF0),

ii. Net working Capital,

iii. Cash Flow from Operations (most difficult part!)

iv. Salvage Value

Step 3: Determine the cost of capital (we will do this in Unit 10)

Step 4: Discount all relevant cash flows

Step 5. Find NPV and if NPV>0 then proceed with the project

16

7.2 Basic Steps in DCF Analysis

Step 2: Finding Cash Flow from Operations (CFop)

Method 1: CFop = revenues – cash expenses – taxes paid

Method 2: CFop = net profit (after-tax) + depreciation

Method 3: CFop = (revenues – cash expenses) × (1 − t) + (depr. × t)

(note: “t” is the corporate tax rate)

All 3 methods will give you the same answer!

17

7.2 Basic Steps in DCF Analysis

Note on Deprecation:

Recall from Module 7.1:

We do not include depreciation in our project cash flows (as it is

a noncash item).

We need to add it back to our cash flow number if we are trying

to calculate our cash flows from accounting income (where it has

been deducted).

However because we are allowed to use deprecation (or CCA) to

reduce our taxes payable, depreciation savings do affect cash

flow and we do have to incorporate this tax savings which is

called the CCA tax shield.

18

7.2 Basic Steps in DCF Analysis

Step 2 Example:

Calculating Cash Flow from Operations

(using accounting data)

Revenues

200

Method 1:

CFop = 200 - 100 - 36 = $64

Cash Expenses

-100

Depreciation

-20

Method 2:

CFop = 44 + 20 = $64

Pre-tax Profit

80

Taxes @ 45%

-36

Method 3:

CFop = (200-100) x (1- .45) + (20 x .45)

= $64

Profit After Tax

44

Note: All 3 methods produce the same answer!

19

7.2 Review Question

Question

What is the amount of the operating cash flow for a firm with

$750,000 profit before tax, $150,000 depreciation expense, and

a 35% marginal tax rate?

A) $262,500

B) $487,500

C) $554,500

D) $637,500

Please choose the correct answer.

20

7.2 Review Question

The correct answer is D.

Method 2: CFop = net profit (after-tax) + depreciation

= $750,000 x (1 - 35%) + $150,000

= $637,500

21

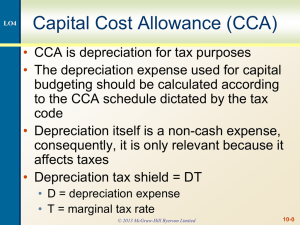

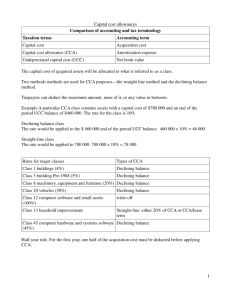

Depreciation

a non-cash expense that reduces the value of an asset as a result

of wear and tear, age, or obsolescence.

Reflects the declining value of their assets over time.

CCA - Capital Cost Allowance

a specific type of depreciation expense that the CRA allows

when businesses calculate taxable income (and hence their tax

returns).

There are over 30 categories or CCA asset classes.

We will use the terms CCA and depreciation interchangeably from

this point on.

22

7.3 Review of Depreciation & CCA

NOTE:

Although CCA itself is a non-cash charge, it does affect cash flow

to the extent that it reduces taxes paid Those tax savings

must be included in the capital budgeting decision.

This tax savings is also called the CCA tax shield or depreciation

tax shield.

23

7.3 Review of Depreciation & CCA

There are two main methods of calculating CCA and accounting

depreciation:

1. Straight-line Depreciation

2. Declining Balance Depreciation

1. Straight-line Depreciation

assumes the asset will lose an equal amount of value each year.

(except for the half-year rule, which we will discuss shortly)

= [Purchase Price – Salvage value] /est. useful life of the asset

It is essentially an annuity series – in that the same dollar

amount of depreciation is expensed each year,

Used for leasehold improvements, patents, and a few other

assets classes

24

7.3 Review of Depreciation & CCA

2. Declining Balance Depreciation

used for most asset classes

the same percentage is applied to the undepreciated asset

value.

= the Class % rate x the Declining asset balance amount

(see p.253 text)

Note: you will be told in the problem whether you have to use

declining balance or straight-line deprecitaion.

25

7.3 Review of Depreciation & CCA

Other CCA terms:

Half-Year Rule

In an asset’s first year of purchase, only one-half of the purchase

cost can be used to calculate CCA (regardless of what part of the

year the asset was purchased).

This rule was designed to stop companies from purchasing assets

in December and then expensing CCA for the whole year.

26

7.3 Review of Depreciation & CCA

Other CCA terms:

A company is entitled to CCA as long as it owns at least one

asset in the asset class.

Q: What happens when the company disposes of its entire pool of

assets in that asset class?

A: We end up with Terminal Loss or Recaptured Depreciation

(but you do not need to know these terms for this course!)

27

7.3 Review of Depreciation & CCA

Depreciation – Example 1

We need to include the tax savings

or the CCA tax shield in DCF

Analysis:

With depreciation (CCA)

Revenues

100

Cash Expenses

-50

Depreciation (CCA)

-20

Pre-Tax Profit

Note the firm’s Net Profit after Tax

is higher ($30 versus $18) when it does

not have depreciation.

Income Taxes @ 40%

Profit After Tax

30

-12

18

With no depreciation

Revenues

100

Cash Expenses

-50

Pre-Tax Profit

Income Taxes @ 40%

Profit After Tax

28

50

-20

30

7.3 Review of Depreciation & CCA

Depreciation – Example 1

Cash Flow OP calculation (method 1)

Note when we calculate CFop, where we

have depreciation, the Cash Flow

number is higher ($38 versus $30).

This is because the depreciation

expense (although a non-cash items)

‘shields” our income from taxes

(which are a cash number).

This savings in cash taxes payable ($20$12 = $8) is called the depreciation or

CCA Tax Shield.

It can be calculated using a short-cut

formula, as shown in the next slide

With depreciation (CCA)

Profit After-Tax

18

Cash Expenses

-50

Income Taxes paid

-12

Cash Flow op

With no depreciation

Revenues

Cash Expenses

Income Taxes paid

Cash Flow op

29

38

100

50

-20

30

7.3 Review of Depreciation & CCA

The value of the CCA Tax Shield in any one year:

= CCA Amount x Tax rate

In the previous example, the CCA tax shield in year one is

= $20 (the CCA amount) x 40% tax rate

= $8 in taxes is saved because of depreciation.

Be careful! Do not mix up the CCA amount and CCA Tax Shield

30

7.3 Review of Depreciation & CCA

Example 2: CCA Tax Shield

You are considering investing in a piece of equipment. The equipment

has an initial cost of $125 and belongs in a 20% CCA class. Assume a 34%

tax bracket and a salvage value of zero. The half-year rule applies. What

is the value of the annual CCA tax shield for year 2 of the project?

Solution:

Year

Net Acquisition

UCC start

CCA Amount

1

$125

125.00

12.50

2

$0

112.50

22.50

UCC end

112.50

(1/2 yr rule!)

90.00

However, we are not finished yet!

CCA tax shield (tax saving ) in year 2 = CCA2 x tax rate

= 22.50 x 34% = $7.65

31

7.3 Review Question

Question

Jensen Industries is considering purchasing a new Drilling Press.

The press costs $100,000, and belongs to a 15% CCA rate asset

class (declining balance method) and the half-year rule applies.

If the tax rate is 40%, what is the amount of the CCA tax shield in

year 1?

A) $3000

B) $6000

C) $7,500

D) $15,000

Please choose the correct answer.

32

7.3 Review Question

The correct answer is A.

The amount of CCA in year 1 is 15% x $100,000 x1/2 = $7,500

The CCA tax shield for year 1 = $7,500 x 40% = $3,000

33

So far we have calculated:

CCA tax shield for a single year but most projects we will last many

years.

We will have a tax shield or tax saving for every year of the

project.

And we have to discount these tax shields.

So….we need to calculate the present value of all the CCA tax

shields over the projects’ life, or the

PVCCATS (Present Value of the CCA Tax Shields)

34

7.4 Present Value of CCA Tax Shields

Recall from Module 7.3 - 2 main methods of calculating depreciation

1.

Straight-line

2.

Declining balance.

(The method used will depend on which asset class the asset you are depreciating

falls into.)

Calculating PVCCATS:

Straight-line depreciation is easy -> finding the PV of an annuity!

Declining balance depreciation – much more complicated!

35

7.4 Present Value of CCA Tax Shields

Example 1- Finding PVCCATS for Straight-line depreciation

Calculate the annual depreciation and PVCCATS for an asset

(such as a trademark) costing $200,000 and a $20,000 salvage

value at the end of year 10. The asset falls into a straight-line

depreciation class. The firm has a 40% tax rate and a 12%

discount rate. The firm’s project is expected to last 10 years.

Solution:

Ignoring the half-year rule, the annual amount of CCA expense is

= $200,000 - $20,000 (Salvage value)/10 years

= $18,000 every year

And the annual CCA tax shield is:

= $18,000 x 40% or $$7,200.

36

7.4 Present Value of CCA Tax Shields

Example 1- Finding PVCCATS for Straight-line depreciation (cont.)

Ignoring the half-year rule!

Annual CCA amount = $18,000

Annual CCA tax shield = $7200

we are dealing with an annuity.

Now find PVCCATS:

Using your calculator:

PMT = $7,200, - =12, n=10, FV=0, COMP PV PV = $40,681.16

This is the PV of the CCA Tax Shields over the project’s life.

37

7.4 Present Value of CCA Tax Shields

Example 2: Finding PVCCATS for Declining Balance Method

Calculate the annual CCA amount and PVCCATS for an asset costing

$200,000 and a $20,000 salvage value at the end of year 10. The asset

falls into a 10% declining balance depreciation method class. The firm has

a 40% tax rate and a 12% discount rate. The firm’s project is expected to

last 10 years.

This table just shows the CCA amount and the CCA tax shield for only the

first 2 years (remember we are ignoring the half-year rule) for simplicity!

Year

1

2

UCC start

200,000

180,000

CCA @10%

UCC end

20,000

18,000

180,000

162,000

CCA tax shield

(CCA x 40%)

$8,000

$7,200

Note: The annual CCA tax shields are different! (not an annuity series).

To find the PV of the tax shields over many years, we have a shortcut!

It’s called the PVCCATS formula!

38

7.4 Present Value of CCA Tax Shields

If you have declining balance method of CCA:

The PVCCATS =

[

CdTc 1 0.5r

SdTc

1

][

] [

][

]

t

r d 1 r

d r (1 r )

where:

C = capital cost of an asset acquired at beginning of year 1

d = CCA rate for the asset class to which the asset belongs

Tc = corporate tax rate

r = discount rate

S = salvage amount from the sale of the asset at the end of year t

Note: do not mix up “d” and “r” !

And yes! This is a shortcut to having to work out each year’s CCA and the

present value of each year’s CCA!

39

7.4 Present Value of CCA Tax Shields

Example 3: Calculating PVCCATS for a declining balance asset

What is the PVCCATS for a firm with a 10% discount rate and in

the 35% tax bracket if it purchased a $50,000 asset and the CCA

rate is 15%? The half-year rule applies and assume no salvage

value.

Solution:

First identify your variables:

d= 0.15

r = 0.10

Tc = 0.35

C = 50,00

S=0

40

7.4 Present Value of CCA Tax Shields

Solution Example 3:

First identify your variables and then input them into the long

PVCCATS formula as shown below. (Note if S=0, the second half of

the equation goes to zero!)

PVCCATS =

[

CdTc 1 0.5r

SdTc

1

][

] [

][

]

t

r d 1 r

d r (1 r )

PVCCATS = {[50,000 x .15 x .35] / (.10 +.15)} x [(1 + .5 x .10)/(1.10)] - 0

= [ 2,625 / 0.25]

x

= 10,500

0.954545

x

[1.05 / 1.10]

= $10,022.73

41

7.4 Present Value of CCA Tax Shields

Q: Why we have to calculate the PVCCATS?

A: It is one of the cash flows affecting a project’s NPV.

If you have a declining balance asset class, then you will most

likely be forced into Method 3 of calculating CFop as we saw in

Module 7.2:

CFop = (revenues – cash expenses) × (1 − Tc) + (CCA × Tc)

Where (CCA × Tc) = CCA tax shield and you need to calculate the

PV of these tax shields (the PVCCATS) when calculating the

project’s NPV!

42

7.4 Review Question

Question

Jensen Industries is considering purchasing a new printing press

that costs $100,000, and belongs to a 15% CCA rate asset class

(declining balance method) and the half-year rule applies.

Assume there is zero salvage value. The discount rate is 10% and

the tax rate is 40%. What is the present value of Jensen’s CCA

tax shield?

A) $5,367

B) $11,667

C) $19,419

D) $22,909

43

7.4 Review Question

The correct answer is D.

Identify your variables and input them into the PVCCATS formula:

$100,0000 15 % 40% 1 0.5 10%

PVCCATS

$22 ,909 .

10% 15 %

1 10 %

44

Review:

NPV = - CF0 + CF1 + CF2 + CF3 … +… CFn

(1+r)1

(1+r)2

(1+r)3

(1+r)n

This unit which cash flows (CFs)should be included?

The cash flows can be broken down into 4 categories:

1.

Plant & Equipment,

2.

Net working Capital,

3.

Cash Flow from Operations = CFop (which includes PVCCATS)

4.

Salvage Value.

45

7.5 Putting it all Together – A DCF Example

Review (cont.)

For Cash Flow from Operations, there are 3 methods to calculate it:

Method 1: CFop = revenues – cash expenses – taxes paid

Method 2: CFop = net profit (after-tax) + depreciation

Method 3: CFop = (revenues – cash expenses) × (1 − Tc) + (CCA × Tc)

Notes:

1.

These formulas just give us CFop for a single year and we must take the

present value of each annual CFop to find NPV for the project.

1.

If we have declining balance depreciation then we are usually forced

into Method 3 where we calculate CFop without depreciation and then

add back the depreciation tax shield separately.

46

7.5 Putting it all Together – A DCF Example

Comprehensive Example – DCF Analysis

Bleeper Industries is considering a project which costs $100,000

and produces after-tax operating cash flows (excluding CCA tax

shields) of $23,000 per year for six years. The project requires a

$5,000 increase in net working capital in Year 0; the working capital

is recovered in Year 7, one year after the end of the operating cash

flows. The CCA rate is 15% (declining balance method) and the halfyear rule applies. Initially assume there is zero salvage value. The

discount rate is 14% and the tax rate is 40%.

47

Comprehensive Example – DCF Analysis

A) What is Bleeper’s total cash flow in Year 0, excluding CCA tax

shields?

Solution: CF0 = -100,000 -5,000 = -$105,000

(Note: both the outlay for the project and the increase in net working capital must be

included for year 0.)

B) What is Bleeper’s CCA in Year 1?

Solution: CCA amount in year 1 = 100,000 x 15% x ½ = $7,500

(Note: don’t forget the half-year rule!)

48

7.5 Putting it all Together – A DCF Example

Comprehensive Example – DCF Analysis (cont.)

C) What is the present value of Bleeper’s operating cash flows,

excluding CCA tax shields?

Solution:

We are dealing with an annuity and can use our calculator to solve:

Input; PMT = $23,000, n=6, i=14%, COMP PV PV= $89,439.35

Note: in this example our CFop ($23,000) were already after-tax so we did

not have to adjust them for taxes.

49

7.5 Putting it all Together – A DCF Example

Comprehensive Example – DCF Analysis (cont.)

D) What is the present value of Bleeper’s working capital recovery,

which occurs in Year 7?

Solution:

We will recover the $5000 increase in net working capital at the

end of year 7,

PV working capital recovery = 5000

(1.14)7

= $1998.19

50

7.5 Putting it all Together – A DCF Example

Comprehensive Example – DCF Analysis (cont.)

E) What is the present value of Bleeper’s CCA tax shield?

Solution:

Since we are dealing with a declining balance asset class, we

have to use the long PVCCATS formula:

Where PVCCATS =

[

CdTc 1 0.5r

SdTc

1

][

] [

][

]

r d 1 r

d r (1 r ) t

= $19,419

51

7.5 Putting it all Together – A DCF Example

Comprehensive Example – DCF Analysis (cont.)

F) Should Bleeper accept the project?

Solution:

Now we put all of our discounted cash flows together:

->Initial outlay + PV [CFop] +PV[working capital recovery] + PVCCATS

NPV = -105,000 + 89,439.35 +1998.19 + 19,419 = $5,865.54

Since NPV > 0, yes! Bleeper should go ahead with the project.

52

7.5 Putting it all Together – A DCF Example

Comprehensive Example – DCF Analysis (cont.)

G) By how much will the NPV increase if Bleeper is able to obtain a

$10,000 salvage value at the end of Year 6? (instead of zero)

Solution:

Salvage comes into play in 2 ways!

1. The salvage value received at the end of the project is a positive cash

inflow which must be discounted back to time zero.

PV Salvage Value = 10,000 / (1.14)6 = 4,555.87

2. Since S is no longer zero, we must recalculate the PVCCATS formula

New PVCCATS = 19,419 – 942.59 =18,476.41 (try it yourself!)

NPV will change: 4,555,87 + (18,476.41 - 19,419)= $3613.28 increase in

NPV.

53

7.5 Review Question

Big Question!

Your firm is considering investing in a supercomputer to implement a

new revolutionary web service. The pre-tax cash flow (excluding CCA tax

shields) is expected to be $18 million for each of the 10 years of the

project's life. The equipment has an initial cost of $85 million and

belongs in a 45% CCA class. Assume a 30% tax bracket, a discount rate of

12%,and a salvage value of $35 million. We assume that the firm will still

have equipment in the same CCA class and that the half-year rule

applies. What is the project’s NPV?

A) $11.27 million

B) $13.85 million

C) $31.24 million

D) $71.19 million

54

7.5 Review Question

The correct answer is B!

1. The PV of the after-tax cash flows (excluding CCA tax shields)

over the life of the project is: $71.19 million

2. The PV of the CCA tax shield in the presence of the half-year rule

is: $16.38 million (Use PVCCATS formula!)

3. The PV of the salvage is: $35/(1+0.12)10 = 11.27 million

Project NPV = $(-85 + 71.19 + 16.38 + 11.27) = $13.85 million!

Co

55

Financial managers evaluate potential projects for a firm.

In Unit 6 we learned that NPV is the single best rule to use when

evaluating projects, as a company will maximize shareholder

wealth by accepting all projects that have a positive NPV.

NPV = - CF0 + CF1 +

(1+r)1

CF2

+ CF3 … +… CFn

(1+r)2

(1+r)3

(1+r)n

In this unit, we learned to identify which cash flows (whether

they are cash inflows or outflows) belong in project analysis.

Identifying the cash flows + discounting them for NPV calcs.

= Discounted cash flow (or DCF) analysis.

= Capital Budgeting.

56

7.6 Summary

DCF Analysis

Only include incremental cash flows (not accounting profits) in

the numerator and also how to include working capital, salvage

and CCA tax shields into our analysis.

CCA does make the analysis more complicated especially if

declining balance method applies.

If you are having trouble with this Unit, try to attend one of the

Help sessions or final exam review sessions.

In the next unit, we will expand on Project Analysis by trying to

figure out how sensitive the project NPV is if our estimates of the

cash flows vary.

57

In addition to the Progress Quiz for Unit 7, you should attempt

the following Ch. 8 problems from your text:

#’s 3, 5, 11, 18, 20, 25, 27

Also, you should download and print out the Final Exam Formula

Sheet found under the ‘Other Course Materials’ folder on the

course website.

58

End of Unit 7

59