here - Universities South West

advertisement

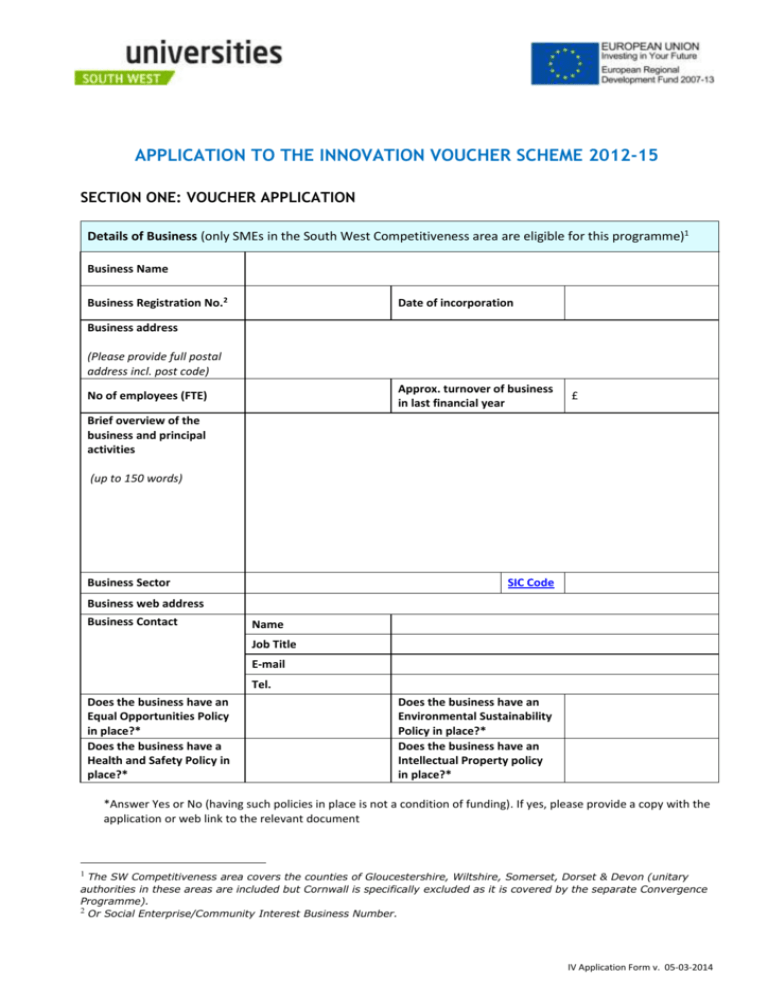

APPLICATION TO THE INNOVATION VOUCHER SCHEME 2012-15 SECTION ONE: VOUCHER APPLICATION Details of Business (only SMEs in the South West Competitiveness area are eligible for this programme)1 Business Name Business Registration No.2 Date of incorporation Business address (Please provide full postal address incl. post code) Approx. turnover of business in last financial year No of employees (FTE) £ Brief overview of the business and principal activities (up to 150 words) Business Sector SIC Code Business web address Business Contact Name Job Title E-mail Tel. Does the business have an Equal Opportunities Policy in place?* Does the business have a Health and Safety Policy in place?* Does the business have an Environmental Sustainability Policy in place?* Does the business have an Intellectual Property policy in place?* *Answer Yes or No (having such policies in place is not a condition of funding). If yes, please provide a copy with the application or web link to the relevant document The SW Competitiveness area covers the counties of Gloucestershire, Wiltshire, Somerset, Dorset & Devon (unitary authorities in these areas are included but Cornwall is specifically excluded as it is covered by the separate Convergence Programme). 2 Or Social Enterprise/Community Interest Business Number. 1 IV Application Form v. 05-03-2014 DECLARATION BY APPLICANT (An authorised Officer of the Business should complete this Declaration). I confirm that ↘ YES/NO The Business Is a Small to Medium Sized Enterprise (SME) based in the South based in the South West Competitiveness Area 3 The Business will use the Innovation Voucher only for eligible activities under this programme4 The Business is solvent and no distress or execution has been levied against it The amount of grant received by the business through the Innovation Voucher will be compliant with the ‘De Minimis’ Aid regulations which place a ceiling on state aid received by any one business during the current and previous two financial years (currently €200,000). Note: a de minimis declaration must be completed prior to voucher redemption (see Appendix Two). Business Statement: I certify below that the information given on this form regarding my business is accurate to the best of my knowledge. I understand that if it is later established that my business does not qualify for this programme then the business will be required to pay in full for the services received under this scheme. Name of Authorised Officer: Signature: Date: Project Details Value of voucher requested: Maximum value normally up to £10,000 with a minimum of £3,000 (Note: this is the total project amount inclusive of both the grant and the matching funding from the business but excluding any VAT payable) SME Contribution to the Project: Cash Value (The Business contribution is normally 60% of the gross project cost plus any VAT payable) VAT payable £ £ £ Project Title: Brief summary of the proposed project (no more than 100 words) All small-to-medium enterprises (SMEs) in the South West Competitiveness Area (excludes Cornwall) are potentially eligible to partner with a Knowledge Base Provider for an Award. SMEs are defined as organisations that are registered companies, employ between 1- 250 employees and have an annual turnover of less than €50 million (currently c.£40m) What is an SME? - Small and medium sized enterprises (SME) 4 See Appendix One for guidance on eligible and ineligible activities under this programme. 3 2 Further details of the proposed project (up to 50 words per section) What are the expected benefits both for the business and the South West Economy? Route to Market (Indicate the commercialisation process proposed for any new product, process or service expected to arise from this project): Explain why input from a knowledge base partner is necessary to develop the project, how it is innovative and why it cannot be developed through business to business activity: Outline the skills / expertise / facilities required from the knowledge base to undertake the project (up to 100 words) Brief sound bite for promotional purposes and company logo (insert or attach as appropriate): Expected Duration of Project (in weeks from contract placement) Proposed Start date Proposed Completion date Thank you for completing the application. The application form should be sent electronically to Jo.johns@usw.ac.uk or via your Knowledge Base contact. The Innovation Voucher scheme is part-financed by the European Union through a grant from the European Regional Development Fund under the South West Competitiveness Programme, 2007 – 2013. The project partners wholeheartedly support the principle of Equal Opportunities for their staff, students and all others associated with this scheme. 3 SECTION TWO: IV APPLICATION ASSESSMENT Business Name Business Registration No. Eligibility Checks (to be completed only by authorised programme assessors) The applicant is an SME based in the South West Competitiveness Area The applicant has not previously been awarded an Innovation Voucher through this Programme The proposed project fits within the parameters of innovation under this programme (See Appx. One) No ineligible sectors are included in the work (e.g. primary production in agriculture, fisheries, synthetic fibres, banking & insurance) There are no ineligible activities or costs proposed (see list in Appendix One) The Business is providing the required matching funding for this project (normally 60% of costs + VAT) A state aid declaration has been completed certifying that the aid received through the voucher programme will be within the current ‘De Minimis’ state aid limits (€200k) The project is a ‘new collaboration with the knowledge base’ as defined by the ERDF guidance The project contributes appropriately to the Outputs, Results and Impacts of the overall programme If there is intellectual property included in the project, the business is prepared to sign appropriate IPR agreements with the KBP partner prior to project initiation The applicant is based in the Western Peninsula area (this is not an essential criterion for approval but is a priority within the overall programme ) All questions in the application form have been completed and checked The application is signed and dated by an authorised officer of the business I confirm that this application has been fully checked and is to the best of my knowledge eligible for the award of an Innovation Voucher: Name of Authorised Assessor: Date: Signature: If the application is not approved, please outline the reasons why below: Note: The voucher will expire 3 months from the date of approval if not activated. The business has up to 6 weeks to select a suitable KBP to work with and a further 6 weeks to conclude and sign the collaboration agreement with the KBP. 4 SECTION THREE: IV PROJECT ENGAGEMENT To be completed when the application has been approved and the KBP selected. Business Name Business Registration No. Knowledge Base Partner (KBP) selected by the Business: KBP Name Department Name KBP Project Officer Lead Academic Lead E-mail Tel. No. Contact Address: (Please provide full postal address) E-mail Tel. No. Please outline how the collaboration between the business and Knowledge Base Partner has arisen i.e. how the KBP was identified and selected Is there any intellectual property associated with this project (background or foreground)? Y/N If yes, give brief details of any intellectual property agreements or confidentiality agreements required between the partners for this project: Confirmation that such agreements have been signed by all partners will be a condition of grant. Have there been any previous collaborations… YES/NO Between the Business and the KBP? Between the Business and this KBP department? If the business has collaborated previously with this department, outline how this is a new partnership. Describe how the award will be used (up to 100 words): 5 Detail funding source Please list the key activities and milestones needed to deliver the project. The grant allocated to each task should be clearly outlined: Activity Person Responsible Time (days) Estimated cost £ Deliverables/Milestones Totals Any additional information: Company signature: Name of Authorised Officer: Signature: knowledge base partner signature: Date: Name of Authorised Officer: Signature: On completion, the signed and dated form should be submitted to Universities South West via the Knowledge Base Partner. 6 Date: SECTION FOUR: IV FINAL PROJECT REPORT AND CLAIM To be completed by the project partners when the collaboration project has concluded. Business Name Business Registration No. KBP Name Department Name Were the objectives of the original project proposal met (up to 150 words) Describe how the objectives were met If they were not met describe briefly why not Please refer to the original milestones listed in the project engagement form Total cost of the project: Gross (inc. VAT): £ Net of VAT: £ To reclaim the Innovation Voucher contribution to the project costs, it is essential that you provide copies of the KBP invoice and business bank statement to evidence payment (these are required by the ERDF programme):Copy of invoice showing full cost of project provided? (YES/NO) Copy of business’s bank statement (as evidence of invoice payment) provided? (YES/NO) How will the outcomes of the project be taken forward by the Business / KBP? What outcomes / impacts have resulted for both partners? Give brief details of any new products, processes or services resulting from the project? Will the partners continue to collaborate beyond this initial project? (YES/NO) Gross Value Added (GVA) to the business attributable to the project* Number of additional jobs created * Number of additional jobs Safeguarded* 7 £ How has this activity contributed to the equality and diversity outcomes of the programme? How has this activity contributed to the environmental sustainability outcomes of the programme? Please give any feedback in terms of lessons for future delivery of the scheme/level of satisfaction etc. Are you willing to contribute to a short case study to promote the collaboration using non confidential information? (YES/NO) Has the project complied with ERDF publicity requirements and used the correct logos to acknowledge ERDF support? (YES/NO) Has the project complied with state aid regulations as agreed in the original application and completed a ‘de minimis’ aid statement (see Appendix Two) certifying that state aid limits have not been breached? (YES/NO) Statement: I certify that the project has made every effort to comply with ERDF regulations and that the information given on this form is accurate to the best of my knowledge. Name of Authorised Officer of the Company: Date: Signature: * Guidance on how these outputs are measured is available from your Knowledge Base Partner contact. Thank you for completing the final report and claim. The form should be submitted to the IV programme via your Knowledge Base IV contact. The Innovation Voucher scheme is part-financed by the European Union through a grant from the European Regional Development Fund under the South West Competitiveness Programme, 2007 – 2013. The project partners wholeheartedly support the principle of Equal Opportunities for their staff, students and all others associated with the project. 8 Appendix One - Parameters of Innovation (revised Feb 2014) Innovation Vouchers: What can they be used to buy / what is included under ‘innovation’? What is meant by innovation? Innovation can take many different forms. It could mean finding more cost effective ways of doing things, adding additional dimensions to existing business products or services or accessing new markets. It could also provide information and expertise on new materials and products, improve business processes or offer research to find a solution to a specific business problem. An innovation project should add value to the business, helping it to improve competitiveness and profitability. Examples of eligible activities could include: Innovation or technology audits; Tailored training in innovation management; New, innovation driven business model development; New, innovation focused service delivery; New and bespoke software development Market assessment or research, including analysis of potential markets for innovative products, processes or services; Innovative service development; Technical validation of a technology; Developing a prototype or demonstrator; Consultancy from experts or specialists (including early career researchers) where this is not available from the private sector; Consultancy from students through live projects where these are additional to existing provision; Using knowledge-based facilities or equipment; and Product and service testing. These examples are drawn from practice in other similar schemes that have operated nationally. Eligible companies will be predominantly SMEs, with little or no significant prior interaction with the selected knowledge base partner and will have the willingness and potential to collaborate on developing innovative products, processes or services. Vouchers will support innovation activities in most sectors, but specific sectors generally ineligible under ERDF rules include: fisheries and aquaculture; primary production, processing & marketing of agricultural products; coal, steel & shipbuilding; synthetic fibres (all generic types of fibre and yarn based on polyester, polyamide, acrylic or polypropylene), banking & insurance. Companies will be able to use the innovation vouchers to get help with projects where they themselves do not have the technology, facilities or expertise they need to develop their business. It may be possible for small companies to form cluster groups to use vouchers for 9 shared access to knowledge base services, e.g. in the creative industries, where many companies are micro sized. Ineligible activities: The aim of the programme is to deliver innovation, and so there are a number of areas of activity that are specifically excluded from voucher support. These are: Achieving compliance with statutory regulations or legislation; Standard* training courses (i.e. those available from private providers); Software purchases and standard* software development services; Intellectual property protection; Standard* sales and marketing activities - these include marketing and communications strategies (inc. use of social media), market trends and standard* website design, development and search optimisation and Google analytics (the only exception would be the exploitation of new web technology for business); Advertising and promotional activities e.g. design of posters, leaflets etc.; Accreditations; Capital items, e.g. Equipment purchases; Travel costs; Legal advice; General business advice and general business diagnostic advice and guidance; Takeovers, mergers and acquisitions advice; Company structure; How to write and writing of business plans; Staffing and HR advice, skills and training advice; Project management; Stock control; and Graduate placements. * ‘Standard’ services are those that are readily accessible from the private sector 10 Appendix Two – De Minimis State Aid Declaration ELIGIBILITY TO RECEIVE AID UNDER THE DE MINIMIS EXEMPTION This form can be used to determine the value of any relevant aid previously received by a potential beneficiary, in order to ascertain whether there is scope to provide further aid under the De Minimis exemption. Specialists may wish to build the relevant information into their application forms, depending on the nature of the project. The Grant Recipient will need to make its own assessment of the contents as the Secretary of State does not make any representations in connection with the same. [Sample Letter to business beneficiary – issue prior to voucher redemption]: INNOVATION VOUCHERS SCHEME (SOUTH WEST COMPETITIVENESS ERDF) STATE AID: DE MINIMIS AID In order to avoid public funding distorting competition within the European common market the European Commission sets limits on the levels of assistance which the public sector can provide to businesses (“the State Aid rules”). You should note carefully the requirements needed to comply with the European State Aid rules and if need be, refer to the relevant legislation. It is proposed that the assistance provided will comply with the State Aid rules by applying the De Minimis exemption under EC Regulation 1998/2006 as published in the Official Journal of the European Union on 28 December 2006. Under the De Minimis exemption an undertaking can receive up to €200,000 of De Minimis aid in the current financial year and the two previous financial years, subject to how much assistance it has received during that period under (1) the De Minimis exemption and (2) the Small Amounts of Compatible Aid Scheme. Please complete the Statement of Previous Aid received under the De Minimis exemption and Small Amounts of Compatible Aid Scheme, and arrange for a director of your business to sign the declaration. Using this information we will assess your eligibility to receive assistance. The value of the aid under this service is £ [ ] which at the current European conversion rate is € [ ]. You will need to declare this amount to any body who requests information from you on how much De Minimis aid or Small Amounts of Compatible Aid Scheme assistance your business has received. Therefore we strongly recommend that you maintain a record of this De Minimis assistance for future reference. For the purposes of the relevant legislation, you must retain this letter for 3 years from the date on this letter and be able to produce it on request by the UK public authorities or the European Commission. You may need to keep this letter longer than 3 years for other purposes. If you are in any doubt as to whether previous assistance received would constitute De Minimis assistance please raise your concerns as soon as possible. Having read the above we would be grateful if you could arrange for the attached statement confirming your business’s eligibility for support to be signed and returned as soon as possible. 11 STATEMENT OF PREVIOUS AID RECEIVED UNDER THE DE MINIMIS EXEMPTION AND SMALL AMOUNTS OF COMPATIBLE AID SCHEME I confirm that [NAME OF UNDERTAKING] has received the following De Minimis / Small Amounts of Compatible Aid Scheme aid during the previous 3 fiscal years (this being the current fiscal year and the previous two fiscal years): Body providing the assistance/aid Value of assistance Date of assistance Nature of assistance TOTAL AID: I acknowledge that I am authorised to sign on behalf of [ NAME OF UNDERTAKING ] and understand the requirements of De Minimis (EC Regulations 1998/2006). I acknowledge that if [ NAME OF UNDERTAKING ] fails to meet the eligibility requirements, [ NAME OF UNDERTAKING ] may become liable to repay the full price that would otherwise be payable in respect of the services received. [ NAME OF UNDERTAKING ] is not a business “in difficulty” as defined at 2.1 of the Community Guidelines and State Aid for Rescuing and Restructuring Firms in Difficulty (2004/C22/02) at the date of this declaration. The information set out above is accurate for the purposes of the De Minimis exemption. SIGNATURE: NAME: BUSINESS: POSITION: DATE: 12