GBER presentation for NI seminar - Department of Enterprise, Trade

advertisement

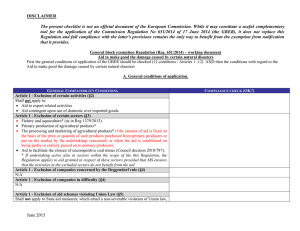

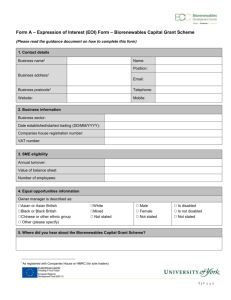

The General Block Exemption and De Minimis Regulations 2 The General Block Exemption Regulation • Allows you to give aid without having to go through the approval process. Aid giver reviews GBER and puts in place processes to ensure compliance. • Inform Commission within 20 days via SANI system • In May 2014, Commission adopted new GBER. New rules will be in force from July 2014. http://ec.europa.eu/competition/state_aid/legi slation/block.html#gber 3 GBER: Main changes from July • Increased notification thresholds • Addition of new aid measures and broadening of existing block exemption categories • Help with interpretation of GBER: Ability to submit questions to Commission via BIS. Will be able to view questions from other MS and response. BUT: • Light touch approval process required for evaluation processes for larger schemes (>Euro150M) • Transparency requirements: national public register of individual awards of aid 4 Types of Aid Permitted Under GBER • • • • • • • • • • • • • • • Regional aid SME aid Access to finance for SMEs Environmental protection Consultancy and participation in trade fairs for SMEs Risk capital R&D&I Training aid Disadvantaged and disabled workers Natural disasters Social aid for transport for remote regions Broadband Culture and heritage Sport and recreational infrastructure Investment aid for local infrastructure 5 Main changes to Aid for access to finance for SMEs • Block exemption of risk finance measures up to €15m to cover full development cycle (and no cap in Guidelines). • Less prescriptive; concept of equity by destination to embrace wide range of aid instruments. • More refined approach for aid to start-ups, covering loans guarantees and grants. Maximum grants amounts can be doubled for small and innovative enterprises. • New ability to provide aid for alternative trading platfoms, and for scouting costs in relation to risk finance and startup aid. 6 NEW: Aid for infrastructure • Broadband infrastructure • Sport & multifunctional recreation infrastructures • Local infrastructures – Must have open access & transparency – Some allow preferential access to private investors – Aid amount cannot exceed ‘funding gap’ 7 Aid following natural disasters • Covers the costs of making good the damage from natural disasters – Must be formally & officially recognised as a natural disaster – Must be a causal link between the disaster and the damage – Can cover 100% of both material damage and loss of income (maximum of six months) – Aid must be granted with in four years of the disaster 8 Culture & heritage conservation • Culture & heritage conservation – Can be investment or operating aid – Investment aid shall not exceed funding gap – Operating aid shall not exceed operating losses & a reasonable profit • Aid for audio-visual works – Aid to the production, pre-production and distribution of audio-visual works – Can only be used for ‘cultural products’ – Can tie production to a particular location 9 De Minimis Aid Commission Regulation 1407/2013 • Aid of up to € 200,000 to one company over a 3 year period. • All de minimis aid over rolling 3 year period must be cumulated. Aid giver responsible for checking and ensuring that ceiling is not breached. • Recipient must be told that they are receiving de minimis aid and must declare this if offered de minimis aid in the future. 10 Other sources of support • GBER text – http://eur-lex.europa.eu/legalcontent/EN/TXT/PDF/?uri=CELEX:32014R0651&from=EN • De Minimis text: – http://ec.europa.eu/competition/state_aid/legislatio n/de_minimis_regulation_en.pdf • FAQ document expected very soon • Ability to ask questions directly – via UK state aid unit - and get response within 15 working days