The emotional embeddedness of corporate entrepreneurship

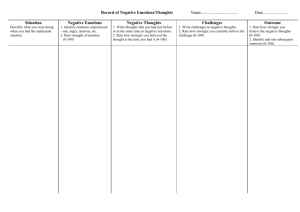

advertisement