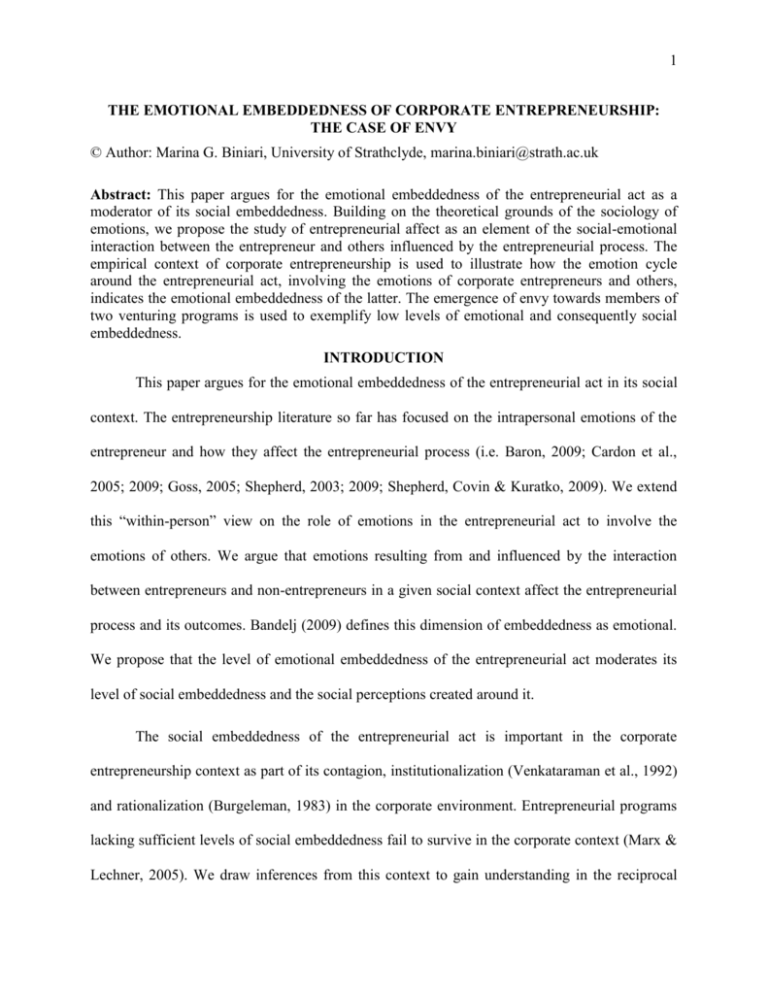

The emotional embeddedness of corporate entrepreneurship

advertisement