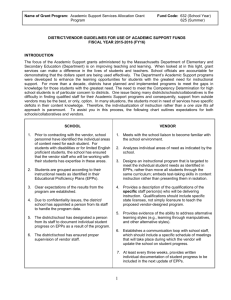

Ethics for Public Vendors

advertisement

75 Livingston Avenue, Roseland, NJ 07068 (973) 622-1800 ETHICS FOR PUBLIC SCHOOL VENDORS Presented by: Leslie G. London, Esq. March 18, 2014 School Administrators must ensure and preserve public confidence in the integrity of their office. In doing so, they must avoid conduct which violates the public trust or creates a justifiable impression among the public that such trust is being violated. The Conflict of Interest provisions in the School Ethics Act, N.J.S.A. 18A:12-21 et.seq., provide guidance to school administrators regarding conduct and actions that may or may not be taken to avoid potential ethical issues. While there is no corresponding uniform guidance document that addresses conduct and actions required of a vendor doing business with a school district and interacting with a school administrator, the State Ethics Act’s Conflict of Interest provisions provide guidance, to some degree, regarding what conduct is and is not acceptable from a vendor. As a general rule, vendors should avoid all situations where proprietary and financial interests, or the opportunity for financial gain, could lead to favored treatment for any organization or individual. Vendors should also avoid circumstances and conduct which may not constitute actual wrongdoing, or a conflict of interest, but might nevertheless appear questionable to the general public, thus compromising the integrity of the school district. If you apply the Conflicts of Interest provisions in the State Ethics Act to vendors: A vendor cannot employ an administrator in the business of the vendor or professional activity in which the vendor is involved since under the School Ethics Act, an administrator shall not undertake any employment or service, whether compensated or not, which might reasonably be expected to prejudice his independence of judgment in the exercise of his official duties; A vendor cannot offer to provide any interest, financial or otherwise, direct or indirect, in the business of the vendor, since under the School Ethics Act, an administrator and his “immediate family” (spouse/dependent children) cannot have an interest in a business organization or engage in any business, transaction or professional activity which is in substantial conflict with the discharge of his duties in the public interest; A vendor cannot cause or influence or attempt to cause or influence an administrator to use or attempt to use his official position to secure any unwarranted privileges or advantages for that vendor or for any other person, since under the School Ethics Act, an administrator shall not use his official position to secure unwarranted privileges, advantages, or employment for himself or members of his family; A vendor shall not cause or influence or attempt to cause or influence an administrator in his official capacity in any manner which might tend to impair the objectivity or independence of judgment of the administrator, since under the School Ethics Act, an administrator shall not act in his official capacity in which he has an interest that might reasonably be expected to impair his objectivity or independence of judgment, or has a personal involvement that creates a benefit to the Administrator; 1 528178.1 75 Livingston Avenue, Roseland, NJ 07068 (973) 622-1800 A vendor cannot offer an administrator any gift, favor, service or other thing of value under circumstances from which it might be reasonably inferred that such gift, service or other thing of value was given or offered for the purpose of influencing the administrator in the discharge of his official duties, since under the School Ethics Act, an administrator shall not accept, solicit any gift, favor, loan, political contribution, service, promise of future employment or other thing of value based upon an understanding that the gift, favor, contribution, service, promise or other thing of value was given or offered for the purpose of influencing him directly or indirectly in the discharge of his official duties. Clearly, if the thing of value is being given to influence the administrator, it cannot be given by the vendor. The question then turns to things of nominal value, i.e. food or refreshments of relatively low monetary value, promotional materials of nominal value such as inexpensive pens, pencils or calendars, and whether a vendor can provide such items. Campaign Contributions – Pay to Play and School Boards N.J.A.C. 6A:23A-6.3 – A vendor who has a contract with a school district that exceeds $17,500 is prohibited during the term of the contract, from making a “reportable” contribution (one that exceeds $300 per election) to a school board candidate. If a vendor does not have a current contract with the school district, but anticipates an award of a contract in excess of $17,500, a vendor cannot make a reportable contribution to a school board candidate, during the 12 month period preceding the contract award. N.J.S.A. 19:44-20.26 – A vendor is required to file a Political Contribution Disclosure form not later than 10 days prior to entering into a contract having an anticipated value in excess of $17,500 (applies also to contracts that are publicly bid per N.J.A.C. 6A:23A-6.3(a) 4), which lists all reportable political contributions that were made during the preceding 12 month period. The vendor must also identify the date and amount of each contribution, and the name of the recipient of each contribution. The vendor must disclose contributions to any State, county, or municipal committee of a political party; any legislative leadership committee; or any candidate committee of a candidate for, or holder of, an elective office of the public entity. If a vendor is a business entity other than a natural person, a contribution by any person or other business entity having an interest (ownership or control of more than 10% of the profits or assets; or 10% of the stock if the vendor is a corporation for profit) in the business, shall be deemed to be a contribution by the vendor. Also, a contribution by all principals, partners, officers or other directors or their spouses, and any subsidiaries directly or indirectly controlled by the vendor, are deemed to be a contribution by the vendor. N.J.S.A. 19:44A-20.27 – A vendor, who receives in any calendar year, $50,000 or more in the aggregate, through contracts and agreements with a public entity, must file an annual disclosure statement with the New Jersey Election Law Enforcement Commission by March 31 of the following year. In the annual filing, the vendor must identify all of the vendors’ contracts and agreements with each public entity and the amount of each contract or agreement. The vendor is only required to list reportable contributions made to State, local and county candidates and committees. 2 528178.1