Boiler and Machinery Procedures

advertisement

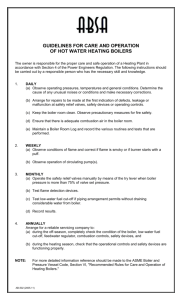

Florida Gulf Coast University Department of Environmental Health and Safety Risk Management and Insurance Procedure No. 2.3 Issue Date: October 20, 2006, revised on 6-8-2011 Title: Boiler and Machinery: Purpose: Obtain university boiler and machinery insurance coverage for university. General overview: The State Risk Management Trust Fund does not cover losses or damage caused by: rupture, bursting, operation of pressure relief devices; or rupture or bursting due to expansion or swelling of the contents of any building or structure caused by or resulting from water; or any loss, which would normally be covered only under a standard boiler and machinery policy, or Mechanical breakdown; including rupture or bursting caused by centrifugal force. Boiler and machinery insurance covers direct, accidental damage to objects within covered locations. Inspections caused by accidents involving boiler, fired vessel, unfired vessel normally subject to vacuum or internal pressure other than the weight of its contents, refrigerating or air conditioning vessel, or any metal piping and its accessory equipment. Definition of Terms: Accident means a sudden and accidental breakdown of the object or part of the object. At the time the breakdown occurs, it must present itself as physical damage to the object that requires repair or replacement. This includes direct loss or damage caused by an explosion of an object unless otherwise excluded by the policy. Covered location is defined at any location on schedule with the insurance company. Object means any boiler, fired vessel, unfired vessel normally subject to vacuum or internal pressure other than the weight of its contents, refrigerating or air conditioning vessels, mechanical or electrical machine or apparatus for the generation, transmission, or utilization of mechanical or electrical power, and any apparatus used for research, medical, diagnostic, surgical, dental or pathological use is considered an object as defined in this paragraph. Procedures: Environmental Health and Safety has the primary responsibility for reviewing and verifying the boiler and machinery schedule provided to the university by the Department of Management Services. Every year or upon request, the insurance company providing this insurance coverage will inspect university buildings. EHS will update the Fire Insurance Trust Fund with the current list of buildings and their respective contents at actual cash value during the current fiscal year or at the beginning of next fiscal year. Space Utilization has the primary responsibility of providing a current building list identifying any added or deleted buildings to EHS when a building is completed or removed from the space file. Finance and Accounting has the primary responsibility of providing the current content value of each building covered under the Fire Insurance Trust Fund. Deductible: The deductible for this coverage is 10% of the covered loss, with a minimum of $10,000.00. Premium: The Department of Management Services calculates the premium based on the actual cash value of each state insured building and their contents. When invoice for annual premium arrives, the University Budget Office will pay it from the central insurance fund-org or any fund deemed appropriate. Policy: Boiler and machinery policy available upon request, please contact Willie Baca for a copy of policy. Contact: Willie Baca Assistant Director, EHS – Risk Management and Insurance 239-590-1126 Office 239-590-1033 Fax wbaca@fgcu.edu