Homework 2 (key)

advertisement

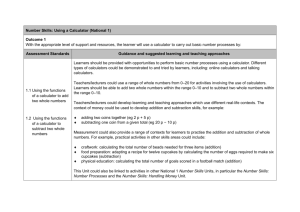

IR 213: Professor Graham Homework 2. Late homeworks are not accepted. 1. Assume that Country A, in the absence of trade, finds itself relatively abundant in land and relatively scarce in labor. The factor endowment theory reasons that with free trade, the internal distribution of national income in Country A will change in favor of: a. Labor b. Land c. Both labor and land d. Neither labor nor land 2. According to the specific factors trade theory: a. Owners of factors specific to export industries suffer from trade, while owners of factors specific to import-competing industries gain b. Owners of factors specific to export industries gain from trade, while owners of factors specific to import-competing industries suffer c. Both owners of factors specific to export industries and owners of factors specific to import-competing industries gain from trade d. Both owners of factors specific to export industries and owners of factors specific to import-competing industries suffer from trade 3. Mongolia is land-abundant and capital scarce. Raising sheep to produce wool requires a lot of land and not much capital. a. Without trade, would the price of wool in Mongolia be higher or lower than the world price? lower b. If trade in wool became more free, what would happen to the price of wool in Mongolia? It would rise c. If trade in wool became more free, what would happen to the returns (i.e. profits) to land owners in Mongolia? They would rise d. If trade in manufactured products (i.e. cellphones, motorbikes) becomes more free, what happens to the cost of living for Mongolian people? It goes down e. If trade in agricultural products becomes more free, what happens to the income of workers in developing countries? It goes up [DO NOT TAKE OFF POINTS IF STUDENTS MISS THIS QUESTION] 4.Qatar is capital-rich but labor is scarce. Making clothing requires a lot of labor but relatively little capital. a. Without trade, would the price of clothing in Qatar be higher or lower than the world price? higher b. If trade in clothing became more free, what would happen to the price of clothes in Qatar? It would go down c. If trade in clothing became more free, what would happen to the wages of workers who made clothes in Qatar? It would go down 5. Of the following groups, who benefits from the US raising tariffs on sugar, and who is harmed? a. US consumers (i.e. people who buy products made from sugar) hurt b. US producers of sugar (i.e. sugar farm owners and workers) helped c. Foreign producers of sugar hurt 5d. A lot of steel is produced in the state of Pennsylvania. If we consider the impact on both consumers and producers, then protection of the steel industry is: a. In the interest of the United States as a whole, but not in the interest of the state of Pennsylvania b. In the interest of the United States as a whole and in the interest of the state of Pennsylvania c. Not in the interest of the United States as a whole, but it might be in the interest of the state of Pennsylvania d. Not in the interest of the United States as a whole, nor in the interest of the state of Pennsylvania Figure 4.1. Import Tariff Levied by a "Small" Country We refer to Mexico as a “small” country here to emphasize that we are assuming that changes in the domestic market in Mexico do not affect the world price. 6a. In completely free trade, how many calculators would Mexico produce? 10 6b.How about with no foreign trade? 60 6c. How about with a tariff in place? 40 7a. How many calculators would Mexico import with a tariff in place? 40 7b.How about with no tariff in place (i.e. totally free trade)? 100 8.What price do consumers pay for calculators in Mexico if there is no tariff (i.e. free trade?) $3 9. How about if there is a tariff? $6 10. Imagine Mexico put a quota in place instead of a tariff. a. If Mexico limited calculator imports to 40 per year, what would the price be? $6 b. How many calculators would be produced in Mexico? 40 c. Is this more or less than the number that would be produced domestically in the absence of a quota (i.e. with totally free trade)? more 11a. Whom does a tariff/quota on calculator’s help? Mexican calculator producers 11b. Whom does it harm? Mexican calculator consumers 11c. Overall, is Mexico made richer or poorer by the tariff/quota? Poorer 12. Last step. Imagine that there was no tariff and no quota, but there was a subsidy for domestic calculator producers in Mexico – the government pays a $3 to Mexican firms for each calculator produced. How many more calculators do Mexican firms make with the subsidy than they would produce without the subsidy? 30 What is the change in price that consumers pay for calculators? $0 13. Tariffs and quotas raise the price of goods paid by consumers. Subsidies do not raise the price, and in large economies, they lower it slightly (by increasing supply and thereby slightly lowering the world price). What domestic group is harmed by subsidies? taxpayers