UNIT 3

EXPLORING MY PERSONAL FINANCES

LESSON 1 – Investigating Income and Defining your Relationship to Money

Essential Question (Lessons 1 – 4): “How can learning about money help me plan for the life I want?”

Power Standard (Lessons 1 – 4): People can make more informed education, job, or career decisions by

evaluating the benefits and costs of different choices.

Learning Outcomes:

Students will identify their relationship with money now and in the future.

Students will develop an understanding of why personal finance is important.

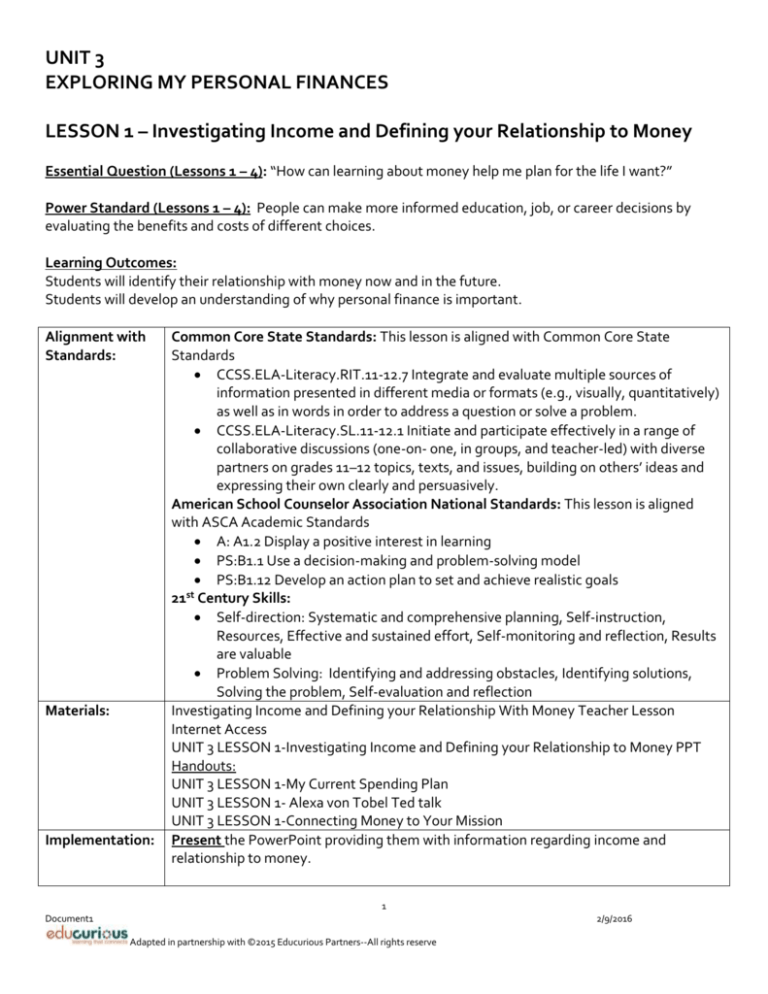

Alignment with

Standards:

Materials:

Implementation:

Common Core State Standards: This lesson is aligned with Common Core State

Standards

CCSS.ELA-Literacy.RIT.11-12.7 Integrate and evaluate multiple sources of

information presented in different media or formats (e.g., visually, quantitatively)

as well as in words in order to address a question or solve a problem.

CCSS.ELA-Literacy.SL.11-12.1 Initiate and participate effectively in a range of

collaborative discussions (one-on- one, in groups, and teacher-led) with diverse

partners on grades 11–12 topics, texts, and issues, building on others’ ideas and

expressing their own clearly and persuasively.

American School Counselor Association National Standards: This lesson is aligned

with ASCA Academic Standards

A: A1.2 Display a positive interest in learning

PS:B1.1 Use a decision-making and problem-solving model

PS:B1.12 Develop an action plan to set and achieve realistic goals

st

21 Century Skills:

Self-direction: Systematic and comprehensive planning, Self-instruction,

Resources, Effective and sustained effort, Self-monitoring and reflection, Results

are valuable

Problem Solving: Identifying and addressing obstacles, Identifying solutions,

Solving the problem, Self-evaluation and reflection

Investigating Income and Defining your Relationship With Money Teacher Lesson

Internet Access

UNIT 3 LESSON 1-Investigating Income and Defining your Relationship to Money PPT

Handouts:

UNIT 3 LESSON 1-My Current Spending Plan

UNIT 3 LESSON 1- Alexa von Tobel Ted talk

UNIT 3 LESSON 1-Connecting Money to Your Mission

Present the PowerPoint providing them with information regarding income and

relationship to money.

1

Document1

2/9/2016

Adapted in partnership with ©2015 Educurious Partners--All rights reserve

Instruct the student to reflect on and respond to the following questions. Allow time for

students to share with the entire class.

1. What was the last thing you spent money on?

2. What hopes do you have for yourself regarding money in your future?

3. How much do you hope to make a month/in a year?

4. How much do you currently spend in a week? Make in a week?

5. How much do you think you will need to make to feel comfortable in life in your

20s? 30s? Beyond?

6. Do you currently work with a budget? Why or why not?

7. Do you currently save any money? Why or why not?

8. What’s the most confusing thing about “grown up” money issues you wish you

knew more about?

Here’s a resource to draw from if you need more inspiration for questions:

http://www.thesimpledollar.com/reflections-on-money-20-valuable-questions-to-askyourself/

Introduce the student project.

Say Many adults wish they could have taken the very unit you are in right now—a unit

about something we deal with every day: money! Today’s lesson will introduce you to the

project you’ll be working on for the next 3-4 weeks, but it will also help you investigate your

future income and your current relationship with money. Let’s get started!

You’ll be creating your own TED talk for this unit. As you watch Alexa von Tobel in this TED

talk, you will be paying attention to two aspects of the talk—her delivery and organization

as well as the content. Your goal is to create a life-changing TED talk, so pay attention to

what is compelling about this one!

Watch “One Life-Changing Class You Never Took: Alexa von Tobel at TED Wall Street”

https://www.youtube.com/watch?v=8jkri0AeZWQ

Instruct the students to complete the reflection questions here to capture your insights

on personal finance.

a.

Why does Alexa say we need to pay more attention to personal finance?

b.

What mistakes did “uneducated Jessica” make?

c.

What 5 principles does Alexa suggest we teach in a financial literacy class?

d.

How is “educated Jessica’s” life better?

e.

What other insights did you gain from this TED talk?

Say Now that you’ve seen Alexa von Tobel’s talk, you get to move into some specifics and

take action for your own future! In your last unit, you investigated careers you’re interested

in. Pick one of those careers and identify the income per year, per month, and/or per week

of someone in the job you have selected. (Note: this may vary depending on where you plan

to live, entry-level pay, etc. Also, take home pay may differ. Account for years of experience,

taxes, and withdrawals for unions, medical benefits, retirement, etc.)

2

Document1

2/9/2016

Adapted in partnership with ©2015 Educurious Partners--All rights reserve

If a student does not have an amount from the person you interviewed, they can use the

average income in Snohomish County as a baseline to work from, which is $45,796.

Say Congratulations! You have some money to work with this month! Now, this is the part

that gets hard. How will you spend it? How will you “boss your money around” in ways that

line up with your goals, your mission, and your personal vision?

Instruct the students to complete the Connecting Money to Your Mission document to

identify what matters to them and how they wish to manage their money.

Tell the students that once they have completed to the activity to discuss their responses

with their neighbor. Make any changes you want to after your discussion.

Instruct the students to complete Studio Day 1 document to help them understand the

actual format and structure of a TED talk and observe three additional examples.

Lesson Activities:

** My Current Spending Plan complete the activity sheet which is located in the lessons

on Moodle.

** Alexa von Tobel Ted talk complete the activity sheet which is located in the lessons

on Moodle.

**Connecting Money to Your Mission complete the activity sheet which is located in

the lessons on Moodle.

Additional

Resources:

The Simple Dollar: 20 Valuable Personal Finance Questions to Ask Yourself http://www.thesimpledollar.com/reflections-on-money-20-valuable-questions-to-askyourself/

3

Document1

2/9/2016

Adapted in partnership with ©2015 Educurious Partners--All rights reserve