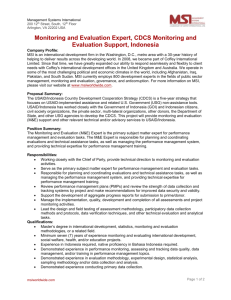

RMSE Comparison: ARIMBI with Extended External Sector

advertisement

ARIMBI with Extended External Sector BANK INDONESIA Rizki E. Wimanda Tarsidin Tri Winarno Idham1 December 2013 Abstract Indonesia’s economy is getting more integrated with the global economy. Potential impact of global economy shocks to domestic economy propagated through trade channel and financial channel are increasingly pronounced. Risk of sudden reversal following large capital inflows poses a serious threat to Indonesia’s economy. Meanwhile, Indonesia’s own domestic concerns regarding high current account deficit as a result of high growth of imports have yet to abate. To cope with these growing concerns on external sector, Bank Indonesia’s FPAS needs to be equipped with macroeconomic model with a more complete features of external sector. This paper explores modelling of the dynamics of current account and capital flows, and its incorporation into ARIMBI + Macroprudential model. Here we add external block to ARIMBI + Macroprudential model. This extension consists of two equations, i.e. current account gap and capital flows gap. In addition, output gap equation is modified to accomodate current account linkage to GDP. Meanwhile credit growth gap equation is modified to account for impact of BOP surplus/deficit to domestic liquidity. Simulation of the model shows that its impulse response function is in line with theoretical background while the behaviour of main variables is maintained to be similar with ARIMBI + Macroprudential. Through financial accelerator mechanism, procyclicality of real and financial sector is revealed. The simulation shows that monetary and macroprundential policy mix can mitigate unintended impact of business cycle and financial cycle, as well as bring the external sector variables (current account and capital flows) to a more sustainable level. Its forecasting performance is also improved. Thus the model is recommended to be used in FPAS. JEL Classification: F41, F47 Keywords: Macroeconomic Model, External Sector, Exchange Rate 1 The research team of Bank Indonesia consist of Rizki E. Wimanda (Senior Economist), Tarsidin (Economist), Tri Winarno (Senior Economist), and Idham (Economist). The authors thank Prof. Dr. Ari Kuncoro, Dr. Denny Lie, Dr. Solikin M. Juhro, Dr. Harmanta, and participants of seminar in Bandung, 14-15 November 2013, for their comments. Address: Research Specialist of Macroeconomic Modelling, Economic Research Group, Department of Economic and Monetary Policy, Bank Indonesia, Jl. M.H. Thamrin No. 2, Jakarta 10350. The views in this paper are solely from the authors and do not necessarily represent views or policies of Bank Indonesia. 1 1. INTRODUCTION 1.1. Background With the advent of greater global economic openness and integration, the influence of the world economy towards the domestic financial system is increasing. Global economic shocks could impact the domestic economy through the trade channel (imports/exports) and the financial channel. Although Indonesia has a proven track record for its resilience against crises, for instance during the global financial crisis of 2008, external sector shocks still demand vigilance. Currently, for example, Europe is embroiled in several crises stemming from inability to service sovereign debt. Additionally, large capital inflows have inundated Indonesia over the past few years, which also create vulnerabilities in the domestic economy. These influx of capital inflows appreciated the rupiah, thereby undermining exports and stimulating imports. On the other hand, sizable capital inflows also brought excess liquidity into the domestic economy. Consequently, failing to channel the capital inflows to productive sectors would trigger a surge in speculative activity and, subsequently, the formation of asset price bubbles. The domestic economy is also vulnerable to shocks emanating from economic shifts or economic transformations. Indonesia’s economy is currently experiencing a transformation, where a growing middle class population is driving robust import growth. Furthermore, commodity prices are trending downwards, leading to a deceleration in terms of export growth and, ultimately, a current account deficit. The magnitude of the current account deficit had reached 4.4% of GDP in the second quarter of 2013. Neglecting to bring the current account deficit to a more sustainable level, for instance through depreciatory exchange rate policy and sectoral policy, could disrupt exchange rate stability and price stability. Such an unpropitious backdrop demonstrates the importance of the external sector, which covers an array of international financial and trade activities. Bank Indonesia, which adopts a flexible inflation targeting framework (ITF), actively responds to external sector dynamics through monetary instruments in the form of intervention on the foreign exchange market and capital flow management to curb any adverse effects. Therefore to optimally support the flexible ITF, the economic model used to project and simulate policy under Bank Indonesia Forecasting and Policy Analysis System (FPAS) requires greater depth in capturing the dynamics of the external sector. In addition, Bank Indonesia’s response to external sector shocks could give rise to further policy complexity, thereby necessitating a monetary and macroprudential policy mix to also be modeled. Based on the aforementioned considerations, it is necessary to further develop the ARIMBI model in order to better capture the external sector dynamics. In this regards, the external sector enhancements will be adopted to the ARIMBI + Macroprudential model, which is the latest version of the ARIMBI model developed in 2012. 2 1.2. Scope of the study This research aims to enhance the external sector in the ARIMBI + Macroprudential model to include current account and capital flow dynamics. Maintaining that the ARIMBI + Macroprudential model is an aggregate and parsimoneous model, the enhancement will be kept simple and uses as few additional equations and variables as possible. The selected variables, among others, include the current account (CA) gap and capital flow (CF) gap. This external sector expansion will also maintain consistency with other variables as well as utilize existing variables. 1.3. Research Objectives The objectives of the research are as follows: 1) To explore possible external sector enhancements in the ARIMBI + Macroprudential model, while ensuring that the resulting model, “ARIMBI with Extended External Sector”, is robust and can accurately and consistently forecast and simulate policy. 2) To improve the applicability of the ARIMBI + Macroprudential model in supporting the policy formulation at Bank Indonesia. By expanding the external sector in the ARIMBI + Macroprudential model, greater range of issues in the external sector could be better analysed and, subsequently, more accurate simulation of policy mix responses to address them. 3 2. LITERATURE REVIEW In line with increasing dynamism in the global economy, as a consequence of greater economic openness and integration, the external sector is rightfully receiving considerable attention. A plethora of research exists regarding the dynamics of the external sector, the role of the exchange rate and the policy instituted by the central bank. 2.1. Current Account Dynamics Over the past few periods, the current account (CA) of Indonesia has run a substantial deficit, peaking at 4.4% of GDP in the second quarter of 2013. The current account deficit is primarily attributable to excessive import growth in line with stronger domestic demand. The current account gap (defined as the difference between the current balance of the current account and current account norms) is widening. Lee, et al. (2008) stated that CA norms are the equilibrium current account balance. In this context, the value of CA norms is a function of the fiscal balance, oil balance, economic growth, relative income and demographic variables like population growth and the dependency ratio. CA norms in Indonesia are presently in the range of –1.7% (CA/GDP ratio). Conceptually, there is a certain level of exchange rate in line with CA norms, otherwise known as the equilibrium real exchange rate. According to Lee, et al. (2008), based on a macroeconomic balance approach, the magnitude of exchange rate appreciation/depreciation required to achieve the equilibrium real exchange rate is the inverse of the CA gap divided by the elasticity of the current account (CA). However, in this case the CA gap is defined as the difference between the underlying current account balance (namely the current account balance when the output gap is zero, domestically and in trade partner countries) and CA norms. The definition of the CA gap as specified by Lee, et al. (2008) is different to that defined within this research, which is elaborated in the following section. 2.2. Capital Flows Dynamics As a consequence of the global financial crisis (GFC) in 2008-2009, which adversely impacted the economies of advanced countries, large foreign capital flowed into emerging economies, including Indonesia. With persistently robust economic growth, coupled with economic and financial stability, Indonesia became an attractive investment destination. This sizable capital inflows to Indonesia continued until 2012, however a capital reversal became increasingly noticeable in 2013. Unsal (2011) stated that the challenge to policymakers, concerning the influx of capital flows, is preventing the domestic economy from overheating and the implications on the rate of inflation, as well as minimising the risks associated with the impact on financial stability, which is predicted to be undermined as credit and financing became more easily accessible. Monetary policy could be utilised to overcome the effect on inflation, however macroprudential policy is required to mitigate the impact on financial stability. According to Capistrán, Cuadra and Ramos-Francia (2011), emerging economies face the very real threat of a capital reversal. In addition to the benefits that can be derived from capital inflows, there is also the risk of a sudden reversal that could endanger financial and 4 economic stability. The potential for a sudden reversal increased as the sovereign debt crisis in Europe proliferated during August 2011. To reveal how a central bank and government should respond to such an external shock, Capistrán, Cuadra and Ramos-Francia (2011) developed a small-scale macroeconomic model using a New Keynesian framework. The results show that credible monetary and fiscal policy can boost the degree of freedom for policymakers in responding to such adverse external shocks. From the literature it is possible to observe a correlation between capital flows, macroeconomic conditions and financial stability. Capital flows increase investment activity which, in turn, drives economic growth. On the other hand, capital flows also spur expansive credit growth. Meanwhile, there also exists procyclicality between the financial sector and real sector, as reflected by real credit growth that tends to mirror GDP growth. The significant impact of capital flows on the economy demands synergy between monetary policy and macroprudential policy in order to mitigate excessive economic and financial turbulence. Juhro and Goeltom (2012) stated that in response to capital flows dynamics, amid inflationary pressures, Bank Indonesia should implement unconventional policy using multiple instruments. The framework applied is enhanced ITF, where the overriding objective is the inflation target. However, the enhanced ITF is more flexible than its normal counterpart. The central bank is not merely focused on achieving the inflation target but also takes into account a number of other considerations, including financial sector stability, the dynamics of capital flows as well as the exchange rate. With such a policy perspective, the achievement of macroeconomic stability is not only related to monetary stability (price stability), but is also related to the stability of the financial system. 2.3. The Exchange Rate in terms of Monetary Policy For a small open economy like Indonesia, the exchange rate plays a central role in the economy. Monetary policy is transmitted, among others, through its impact on the exchange rate. As is widely accepted, monetary policy is transmitted thorough a number of channels, including the exchange rate channel. Changes to the policy rate will influence the rupiah exchange rate through Interest Rate Parity (IRP). Raising the policy rate (which subsequently increased the deposit rates) will appreciate the rupiah and vice versa. Furthermore, changes in the value of the rupiah will have a direct pass-through and/or indirect pass-through effects on exports - imports, GDP as well as inflation. Meanwhile, In response to the increasingly complex task faced by Bank Indonesia, particularly in maintaining financial system stability and macroeconomic stability, the central bank implements a flexible inflation targeting framework (F-ITF). One policy instrument available to Bank Indonesia is intervention on the foreign exchange market. Existing macroeconomic models, however, do not fully support the F-ITF. For example, in the existing ARIMBI core model there is no equation to express foreign exchange intervention. In general, macroeconomic models utilised by countries adhering to an inflation targeting framework tend to institute monetary policy based on the Taylor rule. The basic version stipulates that a central bank only responds to changes in the inflation gap and output gap. Another version specifies that in addition to responding to both of the aforementioned gaps, a central bank also responds to exchange rate dynamics, marked by the inclusion of a variable for the exchange rate in the Taylor rule. Despite inclusion in the Taylor rule, the exchange rate is not a policy instrument. In that context, monetary policy is merely implemented through the Taylor rule. As stated by Taylor (2001), there are several researches dedicated to 5 the inclusion of the exchange rate in the monetary policy rule, including that conducted by Ball (1999), Svensson (2000) and Taylor (1999). In these papers, the exchange rate variable represents one component of the Taylor rule (in this case the real exchange rate). Furthermore, there exists an exchange rate rule, which is used as a guide for the central bank when intervening on the foreign exchange market. The rule responds to the dynamics of the capital account (CA) and capital flows, as detailed by Escudé (2009). 2.4. Modelling the External Sector Modelling the external sector has become an inseparable part of macroeconomic modelling. In the BI Model, namely SOFIE model (Tjahjono, et al., 2010), the external sector is modelled through the inclusion of equations for exports, imports, the nominal exchange rate, the real exchange rate, the interest rate differential and the current account (CA). In this model, the real exchange rate is influenced, among others, by Net Foreign Assets (NFA). Meanwhile, in another Bank Indonesia macroeconomic model, MODBI (Wimanda, et al., 2012), in addition to the previously mentioned variables, portfolio investment as well as the capital and financial account are also modelled. According to MODBI model, NFA also affects the real exchange rate. Additionally, the equilibrium real exchange rate is modelled using the Macroeconomic Balance Approach in a satellite model. In this instance, the exchange rate is particularly susceptible to the level of current account gap (the gap between the GDP to CA ratio and CA norms). Meanwhile, economic fundamentals influence the level of CA norms. The inclusion of Current Account (to illustrate the dynamics of international trade) and the Capital and Financial Account (to exemplify the dynamics of international finance in the form of capital flows) as well as the exchange rate are vital in terms of macroeconomic modelling. The importance of the inclusion of current account and capital flows in a macroeconomic model is highlighted by Ghosh, et al. (2008) as the following: 6 Figure 2.1: Capital Flows and Current Account Balance Figure 2.1. above shows five conditions as follow: (i) conditions where capital inflows respond to the CA financing requirement; (ii) conditions where capital inflows merely used to get a high yield; (iii) conditions where pressures emerge in the balance of payments due to a current account surplus; (iv) conditions where the current account surplus is offset by capital outflows; and (v) pre-crisis and crisis conditions (that transpire due to a current account deficit and/or capital outflows are not offset by capital inflows and/or a current account surplus). The illustration developed by Ghosh, et al. (2008) shows that there is ideal current account and capital flow conditions, where both are found in a state of equilibrium. An exchange rate rule could also be incorporated in the model, similar to that developed by Escudé (2009). In this example a macroeconomic model was developed with monetary policy implemented based on the Taylor rule and exchange rate rule, which concomitantly respond to the dynamics of the economy. The exchange rate rule is a reaction function of the output gap, inflation gap, trade balance-to-GDP gap (the gap between trade balance-to-GDP ratio and its long-run target) as well as the reserve-to-GDP gap (the gap between reserve-toGDP ratio and its long-run target). The results show that a managed exchange rate regime guided by the exchange rate rule produces lower losses than a floating or pegged exchange rate regime. 7 3. CONCEPTUAL FRAMEWORK The macroeconomic model utilised by the central bank for forecasting and policy analysis is continuously refined and thus expected to more accurately capture economic dynamics. In previous research, the core model used in the forecasting and policy analysis system (FPAS) of Bank Indonesia, namely ARIMBI, was developed to accommodate the financial sector in the model, and to model procyclicality as well as macroprudential policy required to control the dynamics of credit growth. The model developed became known as the ARIMBI + Macroprudential model. As mentioned previously, external sector performance is modelled using the ARIMBI + Macroprudential model, not the ARIMBI model currently in use. Therefore, the model will not only accommodate the features of the financial sector but also more detailed features of the external sector. As the global economy becomes more open and integrated, the influence it has on the domestic economy also becomes more profound. Moreover, it is becoming increasingly important to pay due regard to the external sector. The current ARIMBI + Macroprudential model does not fully capture the dynamics of the external sector. Inclusion of the external sector in the ARIMBI + Macroprudential model, among others, is indicated by the presence of the global economy block, that contains equations for the output gap, Phillips curve and Taylor rule of the global economy. The impact on the domestic economy is transmitted through the variables: global output gap (in the output gap equation), international nominal interest rate (that forms part of the Uncovered Interest Parity equation), as well as the rupiah exchange rate, nominal and real. The international price variable influences the domestic economy through the real exchange rate equation. In the ARIMBI + Macroprudential model, the transmission mechanism of international economic variables to the domestic economy is not explicitly modelled because the model uses an aggregate variable in the form of the output gap, excluding the determinant components. Furthermore, the import/export variable is also omitted (showing the transmission from international trade) along with the variable that reflects liquidity from the external sector (showing the transmission from the international financial side). The model does not capture the dynamics of the current account or capital flows as neither is modelled. In fact, both are crucial considering that problems arising in the external sector could be observed from the magnitude of the current account deficit and level of capital flows. Against this backdrop, the external sector in the ARIMBI + Macroprudential model, requires further development. The external sector is enhanced through the addition of equations for the current account (CA) gap and the capital flow (CF) gap, which is in line with ARIMBI + Macroprudential model construction as a gap model. As long as the trend component of one variable remains constant, the dynamics of its gap component will correlate to the dynamics of its level. This condition underlines the assumption of the gap model. Consequently, the CA gap and CF gap could represent the level of CA and CF. In this context, the CA variable is the ratio of the current account to GDP, while the CF variable represents the ratio of the capital and financial account to GDP. As mentioned previously, the CA gap is the difference between the CA to GDP ratio and CA norms. Meanwhile, the CF gap is the difference between the CF to GDP ratio and the optimum level of CF. CA norms are calculated by regressing the variable CA to GDP ratio against the fundamental variables of an economy, applying the Macroeconomic Balance Approach cited by Lee, et al. (2008). On the other hand, an approach to calculate the optimal 8 level of capital flows is yet to be determined. There are only depictions of an optimal CF to GDP ratio in relation to the CA to GDP ratio, as quoted by Ghosh, et al. (2008). Meanwhile, two equations were modified, namely the output gap (in the core model) and the credit growth gap (in the financial block). In addition, the equation of nominal exchange rate appreciation/depreciation expectations was also respecified to simplify interpretation (the equation is an identity equation and the respecification did not alter its behaviour). The relationships between a number of variables in the external sector and their development are illustrated in Figure 3.1. Interest Rate Spread Default Risk Credit Gap World Output Gap Macroprudential Rule LTV, (GWM) RR Real Interest Rate Output Gap Expected Inflation CPI Inflation Gap Taylor Rule International Price Domestic Interest Rate Current Account (to GDP) Expected Apr./Depr. _ = Real Exchange Rate + CA Gap Foreign Interest Rate Risk Premium = CA Norm Nominal Exchange Rate Capital Flow (to GDP) Capital Flow Gap Optimum Capital Flow Legends: : : : : : : : variable linkages in the existing model removed linkages from the existing model variable linkages from the enhanced model core model variables financial block existing external sector variables external block (enhancements) Figure 3.1: External Sector in ARIMBI + Makroprudensial and its Enhancements 9 The equations used in the core model, financial block and external block (representing the model’s development) are presented as follows: Core Model There are four main equations found in the core model, namely IS - output gap, Phillips curve, UIP and policy rule, as well as a number of other equations to represent the rest of the world as follows: Monetary Policy - Taylor Rule 𝑖𝑡 = 𝛾1 𝑖𝑡−1 + (1 − 𝛾1 )(𝑖̅𝑡 + 𝛾2 𝜋̂𝑡𝐶𝑃𝐼 + 𝛾3 𝑦̂𝑡 ) + 𝑒𝑡𝑖 3.1 IS - Output Gap2 ̂ 𝑡 + 𝑒𝑡𝑦̂ 𝑦̂𝑡 = 𝛽1 𝑦̂𝑡−1 + 𝛽2 𝑦̂𝑡+1 − 𝛽3 𝑟̂𝑡 + 𝛽4 𝑦̂𝑡∗ + 𝛽5 𝑧̂𝑡 + 𝛽6 𝑑𝑐𝑟 3.2 Inflation 𝜋𝑡𝐶𝑃𝐼 = 𝑤 𝑎𝑑𝑚 𝜋𝑡𝑎𝑑𝑚 + (1 − 𝑤 𝑎𝑑𝑚 )𝜋𝑡𝑛𝑒𝑡 + 𝑒𝑡𝜋 𝐶𝑃𝐼 Phillips Curve 𝑛𝑒𝑡 𝑛𝑒𝑡 𝜋𝑡𝑛𝑒𝑡 = 𝜆1 𝜋𝑡−1 + (1 − 𝜆1 )𝐸𝑡 𝜋𝑡+1 + 𝜆3 𝑦̂𝑡 + 𝜆4 𝑧̂𝑡 + 𝑒𝑡𝜋 𝑛𝑒𝑡 3.3 Uncovered Interest Parity 𝑖𝑡 − 𝑖𝑡∗ = 𝐸𝐷𝑆𝑡 + 𝑝𝑟𝑒𝑚𝑡 3.4 where: expected nominal exchange rate depreciation/appreaciation: ∗ ̅̅̅𝑡 + 𝜋𝑡𝑇𝐴𝑅 − 𝜋𝑠𝑠 𝐸𝐷𝑆𝑡 = 𝜎𝐷𝑆𝑡+1 + (1 − 𝜎)(2(𝑑𝑧 ) − 𝐷𝑆𝑡−1 ) Rest of the World 𝑦̂∗ ∗ ∗ 𝑦̂𝑡∗ = 𝛽𝑓1 𝑦̂𝑡−1 + 𝛽𝑓2 𝑦̂𝑡+1 − 𝛽𝑓3 (𝑟𝑡∗ − 𝑟̅𝑡∗ ) + 𝑒𝑡 3.5 ∗ 3.6 ∗ ∗ 𝜋𝑡∗ = 𝜆𝑓1 𝜋𝑡−1 + (1 − 𝜆𝑓1 )𝐸𝑡 𝜋𝑡+1 + 𝜆𝑓3 𝑦̂𝑡∗ + 𝑒𝑡𝜋 ∗ ∗ ) 𝑖𝑡∗ = 𝛾𝑓1 𝑖𝑡−1 + (1 − 𝛾𝑓1 )(𝑟̅𝑡∗ + 𝜋4∗𝑡+3 + 𝛾𝑓2 (𝜋4∗𝑡+4 − 𝜋𝑠𝑠 + 𝛾𝑓3 𝑦̂𝑡∗ ) + 𝑒𝑡𝑖∗ 2 3.7 ̂ ) variable in the IS - output gap equation In the Existing ARIMBI Model, there is no credit growth gap (𝑑𝑐𝑟 10 Financial Block Credit Growth Gap ̂ 𝑡 = 𝛿1 𝑑𝑐𝑟 ̂ 𝑡−1 + (1 − 𝛿1 )(−𝛿2 𝑟̂𝑡 − 𝛿3 𝑠𝑝𝑟𝑒𝑎𝑑 ̂ 𝑡 + 𝛿4 𝑦̂𝑡 + 𝛿5 𝑙𝑡𝑣 ̂𝑡 − 𝑑𝑐𝑟 𝛿6 𝑔𝑤𝑚 ̂ 𝑡 ) + 𝑒𝑡𝑑𝑐𝑟 3.8 Interest Rate Spread Gap ̂ 𝑡 = 𝜈1 𝑠𝑝𝑟𝑒𝑎𝑑 ̂ 𝑡−1 + (1 − 𝜈1 )𝜈2 𝑑𝑒𝑓 ̂ 𝑡 + 𝑒𝑡𝑠𝑝𝑟𝑒𝑎𝑑 𝑠𝑝𝑟𝑒𝑎𝑑 3.9 Default Risk Gap ̂ 𝑡 = 𝜃1 𝑑𝑒𝑓 ̂ 𝑡−1 + (1 − 𝜃1 )(𝜃2 𝑠𝑝𝑟𝑒𝑎𝑑 ̂ 𝑡 + 𝜃3 𝑑𝑐𝑟 ̂ 𝑡−1 − 𝜃4 𝑦̂𝑡 ) + 𝑒𝑡𝑑𝑒𝑓 𝑑𝑒𝑓 3.10 LTV Rule ̂ 𝑡 = 𝜇1 𝑙𝑡𝑣 ̂ 𝑡−1 + (1 − 𝜇1 )(−𝜇2 𝑑𝑐𝑟 ̂ 𝑡 ) + 𝑒𝑡𝑙𝑡𝑣 𝑙𝑡𝑣 3.11 GWM (RR) Rule ̂ 𝑡 + 𝑒𝑡𝑔𝑤𝑚 𝑔𝑤𝑚 ̂ 𝑡 = 𝜅1 𝑔𝑤𝑚 ̂ 𝑡−1 + (1 − 𝜅1 )𝜅2 𝑑𝑐𝑟 3.12 External Block To the external block, two equations were added, namely the current account gap and the capital flow gap. Current Account Gap ̂ 𝑐𝑎 ̂ 𝑡 = 𝜗1 𝑐𝑎 ̂ 𝑡−1 + (1 − 𝜗1 )(𝜗2 𝑧̂𝑡 − 𝜗3 𝑦̂𝑡 + 𝜗4 𝑦̂𝑡∗ ) + 𝑒𝑡𝑐𝑎 3.13 The equation of the current account gap (ca ̂ ) shows the size of the gap between the CA to GDP ratio and CA norms. This variable is influenced by past current account gap, real exchange rate gap (ẑ), output gap (ŷ) and global output gap (ŷ ∗ ). As the real exchange rate gap increases (depreciate) the current account gap also increases, while a higher output gap will result in a lower current account gap (considering its impact that drives higher imports). On the other hand, a larger global output gap (representing external/foreign demand) will exacerbate the current account gap (considering its impact which drives higher exports). Regarding the current account gap, the following identity equations are added to the model: 𝑐𝑎 ̂ 𝑡 = 𝑐𝑎𝑡 − 𝑐𝑎 ̅̅̅𝑡 3.14 11 where the trend of the CA to GDP ratio in the long run returns to its steady state, expressed as follows: ̅̅̅̅ ̅̅̅𝑡 = 𝑐𝑎𝑛𝑜𝑟𝑚 + 𝑒𝑡𝑐𝑎 𝑐𝑎 3.15 𝑐𝑎𝑛𝑜𝑟𝑚,𝑡 = 𝜏1 𝑐𝑎𝑛𝑜𝑟𝑚,𝑡−1 + (1 − 𝜏1 )𝑐𝑎𝑠𝑠 3.16 Capital Flow Gap ̂𝑡 = 𝜙1 𝑐𝑓 ̂𝑡−1 + (1 − 𝜙1 )(𝜙3 (𝑖𝑡 − 𝑖𝑡∗ − (𝜙2 𝐸𝐷𝑆𝑡−1 + (1 − 𝜙2 )𝐸𝐷𝑆𝑡 ) − 𝑐𝑓 ̂ 𝑐𝑓 𝑝𝑟𝑒𝑚𝑡 ) + 𝜙4 𝑦̂𝑡 − 𝜙5 𝑦̂𝑡∗ ) + 𝑒𝑡 3.17 ̂ ) indicates the magnitude of the gap between the CF to The capital flow gap equation (cf GDP ratio and the optimum level of CF. This variable is driven by past capital flow gap, uncovered interest rate parity (UIP), output gap (ŷ) and global output gap (ŷ ∗ ). The UIP equation represents factors that affect the dynamics of capital flows, relating to securities in the form of bonds and Bank Indonesia Certificates (SBI), while the output gap and global output gap capture dynamics relating to securities in the form of equity (shares). The UIP equation is determined by the domestic nominal interest rate (i), the global nominal interest rate (i∗ ), nominal exchange rate appreciation/depreciation expectations (EDS) and the risk premium (prem). A higher domestic nominal interest rate will attract capital flows (increasing the capital flow gap), while a higher global nominal interest rate will trigger foreign capital outflows (decreasing the capital flow gap), and higher expected exchange rate depreciation will also lead to foreign capital outflows (decreasing the capital flow gap). On the other hand, a greater level of risk in Indonesia will prompt foreign capital outflows (lowering the capital flow gap). In this case, it is assumed that UIP will not hold because of a lag in the formation of expected nominal exchange rate appreciation/depreciation. An increase in output gap represents improvements in the economy of Indonesia and will attract foreign capital (increasing the capital flow gap). Meanwhile, a larger global output gap denotes improvements in the global economy, thereby diverting foreign capital from Indonesia (decreasing the capital flow gap). Considering Indonesia’s economy is affected by improvements in the global economy, the impact on capital flows is sometimes mixed, depending on the most dominant factor. In relation to the capital flow gap, the following identity equation is added to the model: ̂𝑡 = 𝑐𝑓𝑡 − ̅̅̅ 𝑐𝑓 𝑐𝑓𝑡 3.18 where the trend of the CF to GDP ratio in the long run tends to return to its steady-state value, which can be expressed as follows: ̅̅̅̅ 𝑐𝑓 ̅̅̅ 𝑐𝑓𝑡 = 𝑐𝑓𝑜𝑝𝑡 + 𝑒𝑡 3.19 𝑐𝑓𝑜𝑝𝑡,𝑡 = 𝜅1 𝑐𝑓𝑜𝑝𝑡,𝑡−1 + (1 − 𝜅1 )𝑐𝑓𝑠𝑠 3.20 12 Equation Respecifications As mentioned previously, in addition to including an external block in the model, the output gap and credit growth gap equations are also respecified. The output gap equation originally contained real exchange rate and global output gap. Both variables represented factors that influence the magnitude of exports and imports. Respecification is achieved by replacing the two previous variables with CA gap variable (which also represents the level of exports and imports). Accordingly, the variable, CA gap, is included in the model and the parameters β4 and β5 are set to zero. 𝑦̂ ̂ 𝑡 + 𝛽7 𝑐𝑎 𝑦̂𝑡 = 𝛽1 𝑦̂𝑡−1 + 𝛽2 𝑦̂𝑡+1 − 𝛽3 𝑟̂𝑡 + 𝛽4 𝑦̂𝑡∗ + 𝛽5 𝑧̂𝑡 + 𝛽6 𝑑𝑐𝑟 ̂ 𝑡 + 𝑒𝑡 3.21 Meanwhile, the variable, BOP surplus/deficit (balance of payments), is added to the credit growth gap equation, representing the total of the CA gap and CF gap. The inclusion of the BOP variable intends to capture the impact of more/less liquidity in the economy stemming from the external sector. A current account surplus is not necessarily accompanied by additional liquidity (non-contemporaneous) as export-import transactions are not usually settled using cash, more normally with credit. Conversely, surplus capital flows are generally accompanied contemporaneously by additional liquidity. The differing characteristics of CA and CF in terms of their relationship with liquidity allow the credit growth gap equation in both variables to be separated. Notwithstanding, separating the variables brings its own implications considering the variable, CA, is a component of the output gap, which is also an explanatory variable in the credit growth gap equation. Funds sourced from the current account cannot be directly linked to bank credit/financing, as is a similar case with funds originating from capital flows. A portion of the funds from the current account and capital flows, however, do enter the banking system, which is subsequently allocated by the banks in the form of credit/financing. The inclusion of variable CA gap and CF gap is aimed to represent the presence of additional liquidity in the banking system. Therefore, the combination of the variables, CA gap and CF gap, in the credit growth gap equation can be expressed as a single variable, namely the BOP surplus/deficit. In order to accommodate differences between the characteristics of the current account (CA) and capital flows (CF) as mentioned previously, a lag is applied to the variable, CA gap, while the variable, CF gap, has no lag. Consequently, the credit growth gap equation can be expressed as follows: ̂ 𝑡 = 𝛿1 𝑑𝑐𝑟 ̂ 𝑡−1 + (1 − 𝛿1 ) (−𝛿2 𝑟̂𝑡 − 𝛿3 𝑠𝑝𝑟𝑒𝑎𝑑 ̂ 𝑡 + 𝛿4 𝑦̂𝑡 + 𝛿5 𝑙𝑡𝑣 ̂𝑡 − 𝑑𝑐𝑟 ̂𝑡 )) + 𝑒𝑡𝑑𝑐𝑟 𝛿6 𝑔𝑤𝑚 ̂ 𝑡 + 𝛿7 (𝑐𝑎 ̂ 𝑡−1 + 𝑐𝑓 3.22 Meanwhile, the equation of nominal exchange rate appreciation/depreciation expectations can be respecified as follows: 𝐸𝐷𝑆𝑡 = 4(𝑆𝑡𝑒 − 𝑆𝑡 ) 3.23 ∗ ⁄ ̅̅̅𝑡 + 𝜋𝑡𝑇𝐴𝑅 − 𝜋𝑠𝑠 𝑆𝑡𝑒 = 𝜎𝑆𝑡+1 + (1 − 𝜎)(𝑆𝑡−1 + 2(𝑑𝑧 ) 4 + 𝑒𝑡𝑆𝑒 ) 3.24 13 From the equation it can be observed that expected nominal exchange rate appreciation/depreciation are calculated by comparing the expected nominal exchange rate level and the actual current nominal exchange rate level. Expected nominal exchange rate level are formed from the exchange rate level in the period t + 1 and in the period t – 1, with the addition of a drift that is twice the nominal exchange rate appreciation/depreciation trend. Besides adding an external block and respecifying several equations as detailed previously, it should be emphasised here that the magnitude of appreciation/depreciation required to bring macroeconomic variables overall (including the CA gap and CF gap) to their optimal path (where the gap is zero) is represented by the nominal exchange rate appreciation/depreciation (DS) variable. The level of appreciation/depreciation indicated by the variable is the nominal exchange rate response to economic dynamics. The return of such macroeconomic variables to their optimal paths is not merely the result of appreciation/depreciation but also the outcome of interaction with a number of other macroeconomic variables, including monetary policy and macroprudential policy. The magnitude of appreciation/depreciation indicated by such variables represents the level of appreciation/depreciation that should occur in the economy. Comparing with the exchange rate during a certain period can reveal the level of foreign exchange intervention required by Bank Indonesia to bring the economy back to its optimal path, namely the difference between the nominal exchange rate appreciation/depreciation based on the model and actual appreciation/depreciation. 14 4. METODOLOGI AND DATA 4.1. Methodology The external sector in the ARIMBI + Macroprudential model was developed ad hoc by referring to current literatures, which directly cover macroeconomic modelling as well as partial modelling. Although developed in an ad hoc way, the model is based on sound theory. An ad hoc approach is taken considering that this research aims to develop an existing model, not build a new one. By adding several equations to the ARIMBI + Macroprudential model, the range of parameters in the other equations must also be revisited. To that end, Bayesian estimates are conducted on all or part of the existing equations. Another alternative is to recalibrate the parameters based on the results of other research or based on other models of Bank Indonesia. In this case, an approach is used to integrate the parameters based on recalibration and based on Bayesian estimates. The majority of parameters in the core model and financial block are calibrated using the same parameters as before. Meanwhile, the parameters in the external block and the equations that are respecified, namely the output gap and credit growth gap, are estimated using the Bayesian approach. Only the parameters of variables newly included in the equations are estimated. Using Bayesian estimates requires a prior value of the parameters to be estimated. Accordingly, the prior values are based on several other Bank Indonesia models, like the Short-Term Forecast Model for Indonesian Economy (SOFIE) and the Macroeconomic Model of Bank Indonesia (MODBI), and based on previous research conducted by Bank Indonesia as well as other literatures. As a basis for estimating prior values, parameter estimations are performed on an equation system made up of several equations similar to ARIMBI, using OLS. A structural VAR (SVAR) model is also used for the estimates. There are two alternatives when modelling the impact of external sector dynamics on liquidity in the domestic economy using the credit growth gap equation, namely through the BOP surplus/deficit variable (representing the total of the CA gap and CF gap) and through both variables individually. Departing from the argument that the two variables should be combined as they could represent a single variable (namely the BOP surplus/deficit), the two variables are differentiated when conducting Bayesian estimations on the parameters. In this instance, the same prior values are used. In the development of the model, it is assumed that the existing ARIMBI model currently in use and the ARIMBI + Macroprudential model could already accommodate the dynamics of the external sector. Nevertheless, the dynamics are not modelled explicitly. The addition of an external block in the model can be likened to extending the model without changing the behaviour of the main variables. Consequently, due consideration must be paid to the suitability of the impulse response function (IRF) of the main variables in the current ARIMBI model, the ARIMBI + Macroprudential model and the ARIMBI model with an Extended External Sector. 15 4.2. Data When estimating the parameters, the data is represented by observation variables that are generally defined in measurement equations. At a minimum, the number of observation variables used must equal to the number of residual variables or shocks defined in the model. This research utilises quarterly data for the period from 2000:1 to 2012:4. The observation variables used in the ARIMBI with Extended External Sector model include, among others, real GDP, CPI, the BI rate, the exchange rate, credit, world GDP, US CPI, LIBOR, the Current Account and Capital and Financial Account. 16 5. RESULTS AND ANALYSIS The estimation results are presented in the following section, along with the reparameterisation conducted in order to obtain the best results. The results of the simulations as well as the ability of the ARIMBI model (with an Extended External Sector) in terms of forecasting are then tested to assess the performance of the model. 5.1. Estimations and Calibration As mentioned in the previous chapter, the majority of the parameters in the core model and financial block were calibrated using the existing parameter values, while the parameters in the external block and the new variables in the output gap and credit growth gap equations were estimated using the Bayesian approach 3 . The result shows that the magnitudes of parameters δ7a (lag CA gap) and δ7b (CF gap) are similar. This indicates that the two parameters could be combined into one parameter, namely δ7 , representing BOP surplus/deficit. Parameter δ7 was set at 0.8563 (the average lag of the CA gap and CF gap). Based on the combination of the calibrated and Bayesian estimated parameters, it was found that the impulse response function (IRF) of several main variables sufficiently overlap between the IRF generated from existing ARIMBI model and the IRF from ARIMBI + Macroprudential model. Therefore, the behaviour of the main variables in both models can be maintained. Furthermore, consistency is also demonstrated by the magnitude of external sector variable responses to shocks that occur in the economy, and vice versa, the impact of shocks in the external block on other variables. 5.2. Simulations This section describes the IRF of the ARIMBI model with an Extended External Sector. As shown in Figures 5.1 – 5.5, the response of various economic variables in the ARIMBI with Extended External Sector model to economic shocks is similar to the response in the existing ARIMBI model and the ARIMBI + Macroprudential model. The adoption of external sector block to the model does not undermine the stability of the model or the behaviour of the variables. Therefore, the model is suitable for use without concerns stemming from incompatible specifications. In the simulations, the ARIMBI model with an Extended External Sector (indicated by the broken green line) is presented alongside the existing ARIMBI model (indicated by the solid dark blue line) and ARIMBI + Macroprudential model (in this case using a model with macroprudential instruments in the form of LTV and the reserve requirement (RR), indicated by the broken red line). 3 The calibration and Bayesian estimation results are retained by the authors and are not presented in this paper. 17 1) Positive Output Gap Shock A shock in the form of a 1% increase in the output gap is accompanied by an increase in the level of inflation and responded to by raising the BI rate based on the standard Taylor-type rule mechanism. Thereafter, raising the BI rate will appreciate the rupiah, both nominally and in terms of the real exchange rate. An increase in the output gap will subsequently boost real credit growth, which in turn will catalyse GDP growth as a result of the financial accelerator mechanism. Procyclicality between the real sector and financial sector is clearly evident, thereby requiring a countercyclical macroprudential policy. Furthermore, Bank Indonesia would respond to the acceleration in credit growth by lowering the loan-to-value ratio (LTV) and raising the reserve requirement (RR). Stronger real credit growth would be suppressed moderately due to liquidity reduction because of the ensuing balance of payments (BoP) deficit. In addition, a positive output gap shock would also trigger a 0.35% current account deficit. As domestic demand increases, so would imports to meet the demand. This would lead to a current account deficit. On the other hand, an increase in the output gap and the rate of inflation would prompt Bank Indonesia to raise its policy rate, leading to rupiah appreciation, nominally and in real terms, thus attracting an additional 0.25% of capital inflows into the domestic economy. As illustrated in Figure 5.1, the direction and magnitude of response of several macroeconomic and financial variables are relatively similar between the ARIMBI model, the ARIMBI + Macroprudential model and the ARIMBI model with Extended External Sector. This is in line with the assumption that the existing ARIMBI model (and the ARIMBI + Macroprudential model) could adequately capture the dynamics of the external sector, even if those dynamics is not explicitly modelled. 18 Figure 5.1: IRF – Positive Output Gap Shock 19 2) Positive Credit Growth Shock A shock in the form of a 5% surge in real credit growth would trigger an additional 0.20% of economic growth, as illustrated in Figure 5.2. This subsequently results in a 0.06% increase in the rate of inflation, which would prompt Bank Indonesia to raise the BI rate by 0.08%, thereby appreciating the rupiah, nominally and in real terms. A 5% gain in real credit growth would elicit a response in the form of lowering the loan-tovalue (LTV) and raising the reserve requirement (RR). Stronger economic growth (reflected by rising output gap) stemming from an increase in real credit growth would subsequently spark a current account deficit of around 0.08%. On the other hand, more robust economic growth, a higher BI rate and rupiah appreciation due to a higher policy rate would trigger an additional 0.06% of capital inflows (increase in capital flow gap). A current account deficit that is larger than the capital account surplus would put pressures on liquidity, which would dampen the impact of procyclicality between the real sector and the financial sector. It can be observed that the inclusion of an external block into the model explains the dynamics of the macroeconomic and financial variables more comprehensively. As illustrated in Figure 5.2, the direction and magnitude of response of several macroeconomic and financial sector variables are relatively similar between the ARIMBI + Macroprudential model and the ARIMBI with Extended External Sector model. This corroborates the assumption that the ARIMBI + Macroprudential model could accommodate the dynamics of the external sector, even when those dynamics are not explicitly modelled. It shows that a shock in the form of stronger real credit growth not only has an effect on macroeconomic variables but also on the current account and capital flows. 20 Figure 5.2: IRF – Positive Credit Growth Shock 21 3) Negative CA Gap Shock A 1% decrease in the CA gap would slow economic growth to the tune of around 0.20%, as illustrated in Figure 5.3. Economic growth would slow as the current account (CA) represents net exports, which is a component of GDP. Weaker net exports would clearly undermine GDP and output. The implications of a decline in output would be a decrease in the rate of inflation by around 0.05%, which would subsequently prompt Bank Indonesia to lower its policy rate by 0.08%. This, in turn, would lead to rupiah depreciation, nominally as well as in real terms. This shock would also decelerate real credit growth by around 0.65%. The decline in real credit growth appear as a result of direct pass-through from the decline in CA gap to liquidity or as a result of indirect pass-through, namely through its influence on lowering the output gap. As mentioned previously, procyclicality is prevalent; therefore, a decline in the output gap would lead to a slowdown in real credit growth. Ultimately, a decline in real credit growth would prompt Bank Indonesia to raise the loan-to-value (LTV) ratio and lower the reserve requirement (RR). A slowdown in economic growth due to CA gap shock would, in turn, precipitate lower inflation and prompt a reduction the policy rate. The implications of this would be rupiah depreciation, nominally and in real terms. These combinations of outcome would also result in capital outflows. Accordingly, a 0.06% decrease in capital flows (CF) gap would also undermine real credit growth. The impact of a decline in the CA gap would certainly warrant careful attentions, as it indicates that the balance of payments is experiencing pressures from two sides. A depreciative rupiah exchange rate would constitute an optimal response to restore the external sector, where real rupiah depreciation would support current account adjustment, while nominal rupiah depreciation would alleviate capital outflows. Based on these results, it is clear that the impact of a shock in the external sector, in this case related to a decline in the CA gap, on the real sector and financial sector, could be captured by the model. The policy response of Bank Indonesia to mitigate such a shock, either in the form of monetary policy or macroprudential policy, could also be better simulated. In this context it is crucial to identify whether the current account deficit stems from a CA gap shock, an output gap shock or any other shocks. This is important as different sources of shock have different magnitudes of impact on other variables. 22 Figure 5.3: IRF – Negative CA Gap Shock 23 4) Negative CF Gap Shock A shock in the form of a 1% decline in the CF gap would reduce real credit growth by around 0.50%. The slowdown in real credit growth is triggered by a decline in liquidity flowing into the domestic economy. A substantial deceleration in real credit growth occurs due to procyclicality, where the decline in real credit growth causes a drop in the output gap, which triggers a further decline in real credit growth. Subsequently, the decrease in real credit growth would prompt Bank Indonesia to raise the loan-to-value (LTV) ratio and lower the reserve requirement (RR). As illustrated in Figure 5.4, the deceleration in real credit growth would lead to a slowdown in economic growth of around 0.04%, which subsequently resulted in lower inflation rate. Consequently, Bank Indonesia would lower its policy rate, and in turn, would lead to rupiah depreciation, both nominally and in real terms. The decline in economic growth and reduction in the BI rate would exacerbate the capital outflows, thereby prolonging the outflows period. On the other hand, the depreciatory response of the rupiah exchange rate, nominally and in real terms, would help improve the CF gap. Nominal rupiah depreciation would slow the capital outflows, while real rupiah depreciation would improve the position of the current account. In this case, the CA gap would increase by around 0.02%. Such conditions would clearly bolster improvements in the output gap and subsequently improving CF gap. Figure 5.4 shows that a negative CF gap shocks is followed by an increase in the CA gap. Such circumstances would evidently improve the balance of payments. In terms of magnitude, however, the CA gap would only increase by around 0.02%, which is relatively low compared to the 1% decline in the CF gap. At least it has been shown, however, that the two are unidirectional. Similar to a negative CA gap shock, the simulation shows that a negative CF gap shock in the external sector would have an impact on the real sector and financial sector. This indicates that the model ability to capture the external dynamics is improved. The policy response in confronting such a shock, in form of monetary policy and macroprudential policy, could also be simulated. Furthermore, it is also important to note the source of the shock, whether it actually stems from the CF gap or another source. This is important as the magnitude of its impact on different variables varies accordingly. 24 Figure 5.4: IRF – Negative CF Gap Shock 25 5) Negative Global Output Gap Shock A shock in the form of a 1% decline in the global output gap would be accompanied by a slump in the global nominal interest rate. Such a shock would precipitate a drop in the output gap (economic growth) of Indonesia by around 0.10%. This would be followed by a lower rate of inflation and prompt Bank Indonesia to lower its policy rate. A decline in the output gap would subsequently lead to slower real credit growth, which would spur Bank Indonesia to raise the loan-to-value (LTV) ratio and lower the reserve requirement (RR). A decrease in the global output gap would have a 0.20% impact on the current account deficit due to a larger decline in exports (because of the decrease in the global output gap) than in imports (because of the decrease in the output gap of Indonesia). On the other hand, a more pronounced drop in the global nominal interest rate compared to the BI rate, coupled with the lag associated with the reduction in the BI rate, would trigger capital inflows to the domestic economy, where the CF gap would increase by around 0.20%. Consequently, the rupiah exchange rate would appreciate at the onset of the shock, although subsequently depreciate due to the effect of the narrower global output gap started to affect the macroeconomic variables. For instance, through a slowdown in domestic economic growth, a current account deficit and reductions to the BI rate. 26 Figure 5.5: IRF – Negative Global Output Gap Shock 27 5.3. Accuracy of the Model An RMSE comparison of the ARIMBI with Extended External Sector, for which the parameters are a combination of calibrated and Bayesian estimated as well as the model where parameters are fully calibrated demonstrates that the RMSE model with combined parameters, in general, is smaller during the period from 2000:Q1 – 2012:Q4. This implies that the ARIMBI with Extended External Sector model with a combined estimation methods (calibrated + Bayesian) is more accurate and could be utilised for forecasting. The results of the RMSE comparison are presented in Table 5.5. Observing the forecast error, the RMSE of several main variables in the ARIMBI model with Extended External Sector model (ARIMBI External+) is generally better than the RMSE of the ARIMBI + Macroprudential model. As presented in Table 5.6, the average RMSE of the ARIMBI model with an Extended External Sector for the period from 2000:Q1 – 2012:Q4 is smaller than that of the ARIMBI + Macroprudential model. Therefore, it can be concluded that the results of forecasting and policy simulation using the ARIMBI with Extended External Sector model is sufficiently reliable and the model could be used in as part of the Forecasting and Policy Analysis System (FPAS) at Bank Indonesia. 28 Table 5.5: RMSE Comparison: Calibrated + Bayesian and Calibrated Period 2000:Q1 - 2012:Q4 Period Variable DY DY4 DCPI DCPI4 I DS DCR DCR4 Average Parameter 1Q 2Q 3Q 4Q 5Q 6Q 7Q 8Q Calibrated + Bayesian 1.43 1.19 1.04 1.20 1.32 1.33 1.39 1.44 Calibrated 1.41 1.18 1.04 1.19 1.31 1.32 1.38 1.43 Difference 0.02 0.01 (0.00) 0.01 0.01 0.01 0.01 0.01 Calibrated + Bayesian 0.36 0.57 0.70 0.77 0.76 0.83 0.92 1.01 Calibrated 0.35 0.57 0.70 0.76 0.75 0.82 0.91 1.01 Difference 0.00 0.01 0.01 0.01 0.01 0.01 0.01 0.01 Calibrated + Bayesian 5.28 5.58 5.51 5.62 5.61 5.57 5.54 5.42 Calibrated 5.29 5.58 5.52 5.63 5.62 5.57 5.54 5.42 Difference (0.01) (0.01) (0.01) (0.00) (0.01) (0.00) 0.00 0.00 Calibrated + Bayesian 1.32 2.16 2.84 3.48 3.54 3.47 3.50 3.45 Calibrated 1.32 2.16 2.85 3.50 3.56 3.49 3.51 3.46 Difference (0.00) (0.01) (0.01) (0.02) (0.02) (0.02) (0.01) (0.00) Calibrated + Bayesian 0.84 1.50 2.11 2.40 2.61 2.69 2.75 2.78 Calibrated 0.85 1.52 2.13 2.43 2.64 2.72 2.76 2.79 Difference (0.01) (0.01) (0.03) (0.03) (0.03) (0.03) (0.02) (0.01) Calibrated + Bayesian 19.51 18.48 18.84 19.19 19.07 18.68 18.32 18.27 Calibrated 19.76 18.74 18.99 19.30 19.13 18.72 18.35 18.28 Difference (0.25) (0.26) (0.14) (0.10) (0.06) (0.04) (0.03) (0.00) Calibrated + Bayesian 10.48 10.27 10.29 10.31 10.32 10.38 10.48 10.56 Calibrated 10.42 10.25 10.32 10.35 10.35 10.39 10.47 10.55 Difference 0.06 0.02 (0.03) (0.05) (0.04) (0.01) 0.01 0.01 Calibrated + Bayesian 4.01 5.05 6.03 6.84 6.83 6.93 6.94 7.06 Calibrated 3.99 5.02 6.01 6.84 6.87 6.96 6.96 7.06 Difference 0.02 0.03 0.02 (0.01) (0.04) (0.03) (0.02) (0.00) Calibrated + Bayesian 5.40 5.60 5.92 6.23 6.26 6.23 6.23 6.25 Calibrated 5.42 5.63 5.94 6.25 6.28 6.25 6.24 6.25 Difference (0.02) (0.03) (0.02) (0.02) (0.02) (0.01) (0.01) 0.00 29 Table 5.6: RMSE Comparison: ARIMBI with Extended External Sector and ARIMBI + Makroprudensial Period Variable DY Parameter 1Q 2Q 3Q 4Q 5Q 6Q 7Q 8Q ARIMBI External+ 1.43 1.19 1.04 1.20 1.32 1.33 1.39 1.44 ARIMBI + MaP 1.68 1.22 1.09 1.26 1.38 1.39 1.45 1.47 (0.26) (0.03) (0.05) (0.07) (0.06) (0.06) (0.05) (0.03) ARIMBI External+ 0.36 0.57 0.70 0.77 0.76 0.83 0.92 1.01 ARIMBI + MaP 0.42 0.66 0.77 0.80 0.77 0.90 1.02 1.11 (0.06) (0.09) (0.07) (0.03) (0.01) (0.07) (0.10) (0.10) ARIMBI External+ 5.28 5.58 5.51 5.62 5.61 5.57 5.54 5.42 ARIMBI + MaP 5.50 5.67 5.59 5.64 5.65 5.59 5.54 5.42 (0.22) (0.09) (0.08) (0.02) (0.04) (0.03) 0.01 0.01 ARIMBI External+ 1.32 2.16 2.84 3.48 3.54 3.47 3.50 3.45 ARIMBI + MaP 1.38 2.25 2.95 3.63 3.69 3.60 3.57 3.48 (0.06) (0.10) (0.11) (0.15) (0.14) (0.12) (0.06) (0.03) ARIMBI External+ 0.84 1.50 2.11 2.40 2.61 2.69 2.75 2.78 ARIMBI + MaP 0.88 1.61 2.29 2.64 2.84 2.89 2.89 2.87 Difference (0.04) (0.11) (0.19) (0.23) (0.23) (0.20) (0.15) (0.09) ARIMBI External+ 19.51 18.48 18.84 19.19 19.07 18.68 18.32 18.27 ARIMBI + MaP 21.73 20.02 19.52 19.70 19.30 18.83 18.51 18.35 Difference (2.22) (1.54) (0.67) (0.51) (0.23) (0.15) (0.19) (0.08) ARIMBI External+ 10.48 10.27 10.29 10.31 10.32 10.38 10.48 10.56 ARIMBI + MaP 10.45 10.19 10.37 10.37 10.37 10.46 10.48 10.53 Difference 0.02 0.08 (0.08) (0.06) (0.05) (0.08) (0.00) 0.03 ARIMBI External+ 4.01 5.05 6.03 6.84 6.83 6.93 6.94 7.06 ARIMBI + MaP 4.21 5.13 6.06 6.87 6.86 6.96 6.99 7.08 (0.20) (0.08) (0.04) (0.04) (0.03) (0.04) (0.05) (0.02) ARIMBI External+ 5.40 5.60 5.92 6.23 6.26 6.23 6.23 6.25 ARIMBI + MaP 5.78 5.84 6.08 6.36 6.36 6.33 6.30 6.29 (0.38) (0.24) (0.16) (0.14) (0.10) (0.09) (0.07) (0.04) Difference DY4 Difference DCPI Difference DCPI4 Difference I DS DCR DCR4 Difference Average Difference 30 6. CONCLUSION AND RECOMMENDATIONS 6.1. Conclusion From the results of the analysis and simulations conducted previously, a number of conclusions are put forward as follows: 1) The impulse response functions (IRFs) of the main variables in the ARIMBI with Extended External Sector model are similar to the existing ARIMBI model and the ARIMBI + Macroprudential model. This indicates that the parameterisation in the model is relatively accurate. 2) More comprehensive modelling of the external sector in the ARIMBI model provides more accurate analysis of several issues that occur in Indonesia’s external sector, in this case the current account and capital flows. Therefore, the applicability of the ARIMBI model in terms of supporting monetary policymaking is also improved. 3) The ARIMBI model with an Extended External Sector is more accurate than the ARIMBI + Macroprudential model. This is evident from lower RMSE of several main variables and the average RMSE. Consequently, the model is more robust. 6.2. Recommendations This Paper recommends the following: 1) In addition to more accurately simulation of various macroeconomic variables, the ARIMBI with Extended External Sector is also more comprehensive compared to existing models in illustrating the dynamics of the external sector. Therefore, the model should be utilised in the Bank Indonesia Forecasting and Policy Analysis System (FPAS) as a replacement for the existing ARIMBI model (and the ARIMBI + Macroprudential model). 2) Before the ARIMBI with Extended External Sector model can actually be used for forecasting and policy simulations, a parallel test is required. A number of weaknesses that may emerge could be identified through parallel tests without interrupting the (FPAS). 3) Further research is required concerning the magnitude of current account norms and optimal capital flows, as these variables play a vital role in the ARIMBI with Extended External Sector. 31 REFERENCE Bank Indonesia (2011), The strengthening of the Monetary Policy Structure in Indonesia: Flexible Inflation Targeting Framework, October. Ball, Lawrence M (1999), “Policy Rules for Open Economies,” in Monetary Policy Rules by John B. Taylor (Eds.), January, University of Chicago Press. Capistrán, Carlos; Cuadra, Gabriel; dan Ramos-Francia, Manuel (2011), “Policy Response to External Shocks: Lessons from the Crisis,” Banco de México Working Papers, No. 2011-14, December. Harmanta; Tarsidin; Bathaluddin M.,B.; Idham (2012), “ARIMBI with Macroprudential Policy”, Working Paper Bank Indonesia, No. WP/08/2012, August Lee, Jaewoo; Milesi-Ferretti, Gian Maria; Ostry, Jonathan; Prati, Alessandro; dan Ricci, Luca Antonio (2008), “Exchange Rate Assessments: CGER Methodologies,” IMF Occasional Paper, No. 261. Svensson, Lars E.O. (1998), “Open-Economy Inflation Targeting,” Journal of International Economics, No. 50, November. Taylor, John B. (2001), “The Role of the Exchange Rate in Monetary-Policy Rules,” The American Economic Review, Vol. 91, No. 2, May Tjahjono, Endy Dwi; Harmanta; Hermawan, Danny; Munandar, Haris; Waluyo, Jati; dan Adamanti, Justina (2008), “ARIMBI: A simple Monetary Policy Model of Bank Indonesia,” Working Paper Bank Indonesia, No. WP/11/2008, July. Tjahjono, Endy Dwi; Harmanta; Purwanto, Nur M. Adhi; dan Adamanti, Justina (2010), “Short Term Forecast Model for Indonesian Economy (SOFIE) 2010,” Working Paper Bank Indonesia, No. WP/23/2010, December. Unsal, D. Filiz (2011), “Capital Flows and Financial Stability: Monetary Policy and Macroprudential Responses,” IMF Working Paper, No. WP/11/189, Agustus. Wimanda, Rizki E.; Purwanto, Nur M. Adhi; Tarsidin; and Oktiyanto, Fajar (2010), “Reestimation and Respecification of Macroeconomic Model of Bank Indonesia,” Working Paper Bank Indonesia, No. WP/15/2012, December 32