Disposals of Property, Plant and Equipment

advertisement

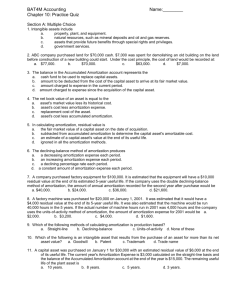

Disposals of Property, Plant and Equipment Can dispose by retirement, sale or exchange. For any disposal there are four steps required 1. Update any unrecorded amortization. (may need to record a partial year) 2. Calculate the net book value. (Cost – Accumulated Amortization = NBV) 3. Calculate the gain or loss. a. Proceeds – NBV = Gain/(loss) b. If proceeds>NBV = gain, if proceeds<NBV = (loss) 4. Record the disposal. a. Remove the cost of the asset (make it equal 0) b. Remove the accumulated amortization (make it equal 0) c. Record the proceeds (if any) d. Record the gain or loss (if any). Gains on disposal are recorded as credits because credits increase owner’s equity, shown in other revenue section; losses on disposal are recorded as debits because debits decrease owner’s equity, shown in other expenses section Journal Entry DR DR DR Cash (or other account) Accumulated Amortization Loss on Disposal OR CR Gain on Disposal CR Property, plan or equipment account Retirement: of Property, Plant, and Equipment When an asset is retired, there are no proceeds for the company. To record follow the steps 1. 2. 3. 4. Update any unrecorded amortization up to the retirement date. Calculate NBV Calculate loss – proceeds have a 0 balance Record disposal – won’t have any cash, debit accumulated amortization, won’t have a gain , could have a loss, credit property, plant or equipment. Example, A vehicle is determined to be scrap, it is towed to the scrap yard. It was purchased on Jan. 1, 2008 and had an original cost of $30,000, no expected residual value and a 6 year useful life. It was scrapped on Mar. 31, 2012. The straight-line method was used. The value of the accumulated amortization was (30000/6=5000 per year) 4*5000=20000. Steps 1. Update amortization – 5000/12 = 417 / month – 417 *3 = 1251. a. Journal Entry DR Amortization Expense 1251 CR Accumulated Amortization – Automobile (Balance is now 21251 in Accumulated Amortization) 2. Calculate NBV – 30,000-21,251 = 8749 3. Loss = 0-8749= (8749) 4. Journal Entry DR Accumulated Amortization – Automobile DR Loss on Disposal CR Automobile To record retirement of automobile 1251 21,251 8,749 30,000 Let’s look at p. 474 for an example where there is no loss Let’s do BE9-12 together Sale of Property, Plant, and Equipment 1. 2. 3. 4. Update any unrecorded amortization up to the date of disposition. Calculate the net book value. Compare the proceeds to the net book value to determine the gain or loss. Record the journal entry. Cash is debited with the proceeds, Accumulated Amortization is debited for its balance, the asset is credited for its balance, and a gain or loss is recorded if the proceeds are not equal to the net book value. Let’s use the same example, but this time the automobile was sold for $10,000 cash Steps 1. Same as above – amortization is recorded in a journal entry 2. NBV is the same as above 3. Calculate gain/loss a. Proceeds – NBV = 10,000 – 8,749 = 1,251 (gain – it is positive) 4. Journal Entry DR Cash 10,000 DR Accumulated Amortization – Automobile 21,251 CR Gain on Disposal 1,251 CR Automobile 30,000 To record sale of automobile for 10,000 Let’s do BE9-13 together Exchanges of Property Plant and Equipment In an exchange of assets, a new asset is purchased by trading in an old asset, on which a trade-in allowance is given toward the purchase price of the new asset. Cash may also be involved. Trade-in allowances seldom represent the fair market value of the asset given up, so are ignored for accounting purposes. We will use the fair market value Monetary Exchanges of Assets If the cash part of the exchange of long-lived assets is significant, the exchange is considered a monetary exchange. The exchange is viewed as both a sale of the old asset and a purchase of the new asset. The new asset is recorded at the fair market value of the asset given up plus any cash paid (or less any cash received). Accounting for the exchange of assets in these situations allows gains and losses to be recognized because the company’s economic situation has changed as a result of entering into the transaction. 1. 2. 3. 4. Update any unrecorded amortization expense to the date of the exchange. Calculate net book value (cost – accumulated amortization). Calculate any gain or loss on disposal (fair market value – net book value = gain (loss)). Record the exchange as follows: a. remove the cost and the accumulated amortization of the asset that is given up. b. record any gain or loss on disposal. c. record the new asset at the fair market value of the old asset plus any cash paid (or less any cash received). d. record the cash paid or received. Nonmonetary exchanges of similar assets A nonmonetary exchange is an exchange of nonmonetary assets with little or no cash involved. Generally nonmonetary exchanges are accounted for in the same way as monetary exchanges of long-lived assets. But, if fair values cannot be determined or if the exchange does not change the operations of the business, the new asset is recorded at the net book value of the old asset plus any cash paid (or less any cash received); no gain or loss is recorded. Let’s use the same example of the automobile. But let’s say at Mar. 31, 2012 the fair market value is $4,000. We bought a new truck with a list price of $40,000. We received a trade-in of $5,000 for our old car, therefore we paid $35,000 in cash. Steps 1. 2. 3. 4. Same as above – record amortization NBV is the same as above Calculate the gain or loss – use the fair market value = Proceeds (fair market value) – NBV = 4,000-8,749=(4,749) Record the entry DR Automobile (new) DR Accumulated Amort- Auto DR Loss on Sale CR Automobile (old) CR Cash 39,000 21,251 4,749 30,000 35,000 To record the exchange of automobiles, including cash (notice the new auto is recorded at the fmv of the old plus the cash given up) Let’s try BE9-14 together Do: E9-8,9 as homework