Document 1 - Hallandale Beach

advertisement

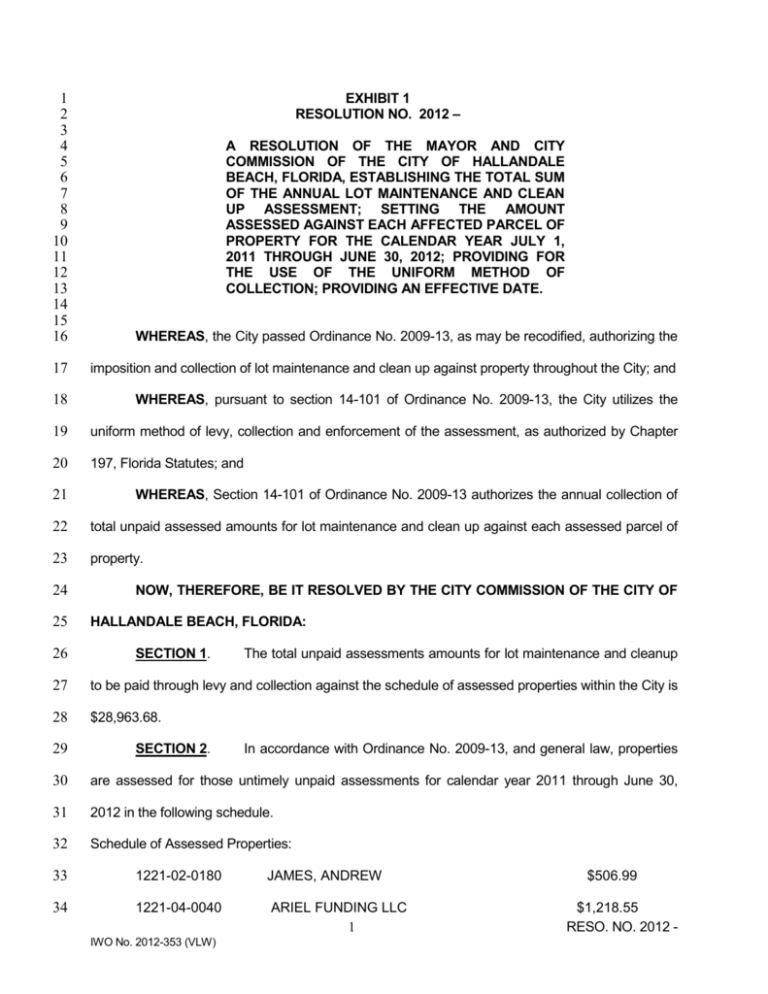

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 WHEREAS, the City passed Ordinance No. 2009-13, as may be recodified, authorizing the 17 imposition and collection of lot maintenance and clean up against property throughout the City; and 18 WHEREAS, pursuant to section 14-101 of Ordinance No. 2009-13, the City utilizes the 19 uniform method of levy, collection and enforcement of the assessment, as authorized by Chapter 20 197, Florida Statutes; and EXHIBIT 1 RESOLUTION NO. 2012 – A RESOLUTION OF THE MAYOR AND CITY COMMISSION OF THE CITY OF HALLANDALE BEACH, FLORIDA, ESTABLISHING THE TOTAL SUM OF THE ANNUAL LOT MAINTENANCE AND CLEAN UP ASSESSMENT; SETTING THE AMOUNT ASSESSED AGAINST EACH AFFECTED PARCEL OF PROPERTY FOR THE CALENDAR YEAR JULY 1, 2011 THROUGH JUNE 30, 2012; PROVIDING FOR THE USE OF THE UNIFORM METHOD OF COLLECTION; PROVIDING AN EFFECTIVE DATE. 21 WHEREAS, Section 14-101 of Ordinance No. 2009-13 authorizes the annual collection of 22 total unpaid assessed amounts for lot maintenance and clean up against each assessed parcel of 23 property. 24 25 26 NOW, THEREFORE, BE IT RESOLVED BY THE CITY COMMISSION OF THE CITY OF HALLANDALE BEACH, FLORIDA: SECTION 1. The total unpaid assessments amounts for lot maintenance and cleanup 27 to be paid through levy and collection against the schedule of assessed properties within the City is 28 $28,963.68. 29 SECTION 2. In accordance with Ordinance No. 2009-13, and general law, properties 30 are assessed for those untimely unpaid assessments for calendar year 2011 through June 30, 31 2012 in the following schedule. 32 Schedule of Assessed Properties: 33 1221-02-0180 JAMES, ANDREW 34 1221-04-0040 ARIEL FUNDING LLC 1 IWO No. 2012-353 (VLW) $506.99 $1,218.55 RESO. NO. 2012 - 35 1221-07-0360 SAUTERNES, V LLC $592.34 36 1221-11-0088 CABRERA, AMARANTO $618.86 37 1221-16-0150 SAUTERNES, V LLC $493.90 38 1221-18-0390 SAUTERNES, 1 LLC $521.44 39 1221-18-0570 SHAFAGHI, FEREIDOUN $583.90 40 1221-19-0050 TUBA IV LLC $485.46 41 1221-19-0060 COOPER, JEROME $500.25 42 1221-19-0130 GAMBOA, GLORIA $969.42 43 44 45 46 1221-19-0160 & 1221-19-0170 STRACHAN DEVELOPMENT LLC $500.25 1221-20-0420 TARPON IV LLC 47 1221-20-0650 WILSON-JOHNSON, STEPHANIE 48 1221-27-0010 ELLA III LLC 49 1222-04-0180 ARIEL FUNDING LLC 50 1222-07-0280 BENSHOSHAN, AHARON $1,015.68 51 1222-39-0140 NEAGU, STEFAN $1,523.91 52 1226-05-1320 JOHNS, NICK $989.78 53 1226-13-0460 SERUR, ELIOTT H. $991.17 54 1226-13-0630 BARBATSI, VASSILIKI $938.44 55 56 57 58 59 60 1227-18-0350, 1227-18-0360, 1227-18-0370 & 1227-18-0380 SALDIVENA OF BROWARD CORP $500.25 1227-20-0110 FIRST STATES INVEST $622.35 61 1227-21-0730 LEON, RACHEL 62 1227-32-0030 MZ REAL ESTATE LLC $990.38 63 1228-02-0170 MOLENTINO, BLANCA $1,056.25 64 1228-02-0591 KHAN, NADIR $1,071.55 IWO NO. 2012-353 (VLW) $1,016.09 $526.11 $1,028.43 $561.26 $1,100.10 2 RESO. NO. 2012 - 65 1228-03-0143 SOOROOJSINGH, HEMANT 66 1228-03-0310 SAUTERNES, V LLC $1,009.05 67 1228-09-0120 TINNIERLLO, YOLANDA $1,331.30 68 1228-15-0090 DELGADO, JANETH 69 1228-18-0230 GREENFIELD, DIANA 70 1228-29-0360 CORTES, JORGE 71 1228-30-0280 SCHWARTZ, EILEEN $1,249.43 72 1228-33-0980 CHAVEZ, MONICA $1,199.61 73 74 75 1228-33-1251 CORTES, ANAIS TOTAL 76 SECTION 3. 77 $500.25 $506.99 $1,084.15 $575.89 $583.90 $28,963.68 The assessments shall be billed and collected as provided in Ordinance 2009-13 and shall be the assessed amounts unless and until modified by Resolution. 78 SECTION 4. All other provisions of the assessment process are ratified and confirmed. 79 SECTION 5. This Resolution shall take effect immediately upon its passage and 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 adoption. APPROVED AND ADOPTED this September ____ 2012. _________________________ MAYOR-COMMISSIONER ATTEST: ___________________________________ City Clerk APPROVED AS TO LEGAL SUFFICIENCY FORM ___________________________________ V. LYNN WHITFIELD CITY ATTORNEY IWO NO. 2012-353 (VLW) 3 RESO. NO. 2012 -

![Your_Solutions_LLC_-_New_Business3[1]](http://s2.studylib.net/store/data/005544494_1-444a738d95c4d66d28ef7ef4e25c86f0-300x300.png)