view answers - Linchun Chen

advertisement

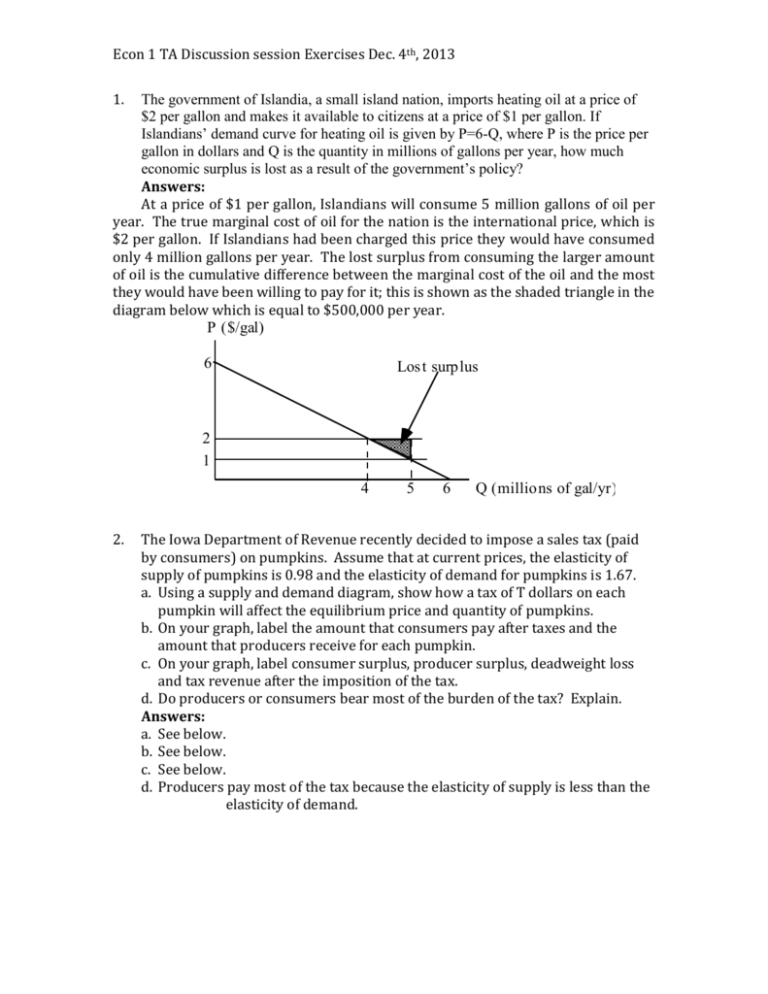

Econ 1 TA Discussion session Exercises Dec. 4th, 2013 1. The government of Islandia, a small island nation, imports heating oil at a price of $2 per gallon and makes it available to citizens at a price of $1 per gallon. If Islandians’ demand curve for heating oil is given by P=6-Q, where P is the price per gallon in dollars and Q is the quantity in millions of gallons per year, how much economic surplus is lost as a result of the government’s policy? Answers: At a price of $1 per gallon, Islandians will consume 5 million gallons of oil per year. The true marginal cost of oil for the nation is the international price, which is $2 per gallon. If Islandians had been charged this price they would have consumed only 4 million gallons per year. The lost surplus from consuming the larger amount of oil is the cumulative difference between the marginal cost of the oil and the most they would have been willing to pay for it; this is shown as the shaded triangle in the diagram below which is equal to $500,000 per year. P ($/gal) 6 Los t surplus 2 1 4 2. 5 6 Q (millions of gal/yr) The Iowa Department of Revenue recently decided to impose a sales tax (paid by consumers) on pumpkins. Assume that at current prices, the elasticity of supply of pumpkins is 0.98 and the elasticity of demand for pumpkins is 1.67. a. Using a supply and demand diagram, show how a tax of T dollars on each pumpkin will affect the equilibrium price and quantity of pumpkins. b. On your graph, label the amount that consumers pay after taxes and the amount that producers receive for each pumpkin. c. On your graph, label consumer surplus, producer surplus, deadweight loss and tax revenue after the imposition of the tax. d. Do producers or consumers bear most of the burden of the tax? Explain. Answers: a. See below. b. See below. c. See below. d. Producers pay most of the tax because the elasticity of supply is less than the elasticity of demand. Econ 1 TA Discussion session Exercises Dec. 4th, 2013 3. Textbook Page 789 #1-5: Refer to a small open economy hose production possibilities curve is as shown by the curve ACGDB in the diagram. Refrigerators/yr 3,200 L E 2,400 2,000 A C 1,600 1,000 G D B 1,000 1,600 2,000 2,400 F M Televisions sets/yr 3,200 a) What is the maximum number of television sets this country can produce each year? What is the maximum number of refrigerators? Answers: The maximum number of television sets this country can produce each year is 2,400. The maximum number of refrigerators is also 2,400. b) If refrigerators and television sets can each be bought or sold for $500 in the world market, what is the maximum number of refrigerators this country can Econ 1 TA Discussion session Exercises Dec. 4th, 2013 consume each year? The maximum number of television sets? How would your answers change if refrigerators and televison sets both sold for $1000? Answers: The absolute value of the slope of the consumption possibilities line is the price of television sets divided by the price of refrigerators, which is 1.0. This is shown in the diagram as a line with this slope that is tangent to the PPC at point G. The annual sale of 1,600 televisions and 1,600 refrigerators at $500 each yields revenue of $1,600,000 per year. The country could therefore consume a maximum of $1,600,000per year 3200television sets per year . Similarly, it could $500per televi sion set consume a maximum of 3,200 refrigerators per year. Doubling the price of both goods would double the revenue from the sale at point G but would have no effect on the consumption possibilities line, since the slope will still be equal to 1. c) If refrigerators and television sets both sell for $1000 in the world market, is it possible for this country to consume 1000 television sets per year and 2200 refrigerators? Could the country consumer 1000 refrigerators each year and 2500 television sets? Answers: Starting at point G, if the country sells 600 television sets per year, it will still have 1,000 television sets for its own consumption. The country will also receive $600,000 per year from the sale of the television sets abroad, which would enable it to buy an additional 600 refrigerators per year. This, combined with domestic production of 1,600 refrigerators, would allow them to consume 2,200 refrigerators along with 1,000 television sets. Starting at point G, if the country sells 600 refrigerators per year, it will still have 1,000 refrigerators for its own consumption. The country will also receive $600,000 per year from the sale of the refrigerators abroad, which would enable it to buy an additional 600 television sets per year. This, combined with domestic production of 1,600 television sets, would allow them to consume 2,200 television sets along with 1,000 refrigerators. Thus, they cannot consume 1,000 refrigerators and 2,500 television sets. d) If refrigerators and television sets both sell for $1000 in the world market, how many units of each good should this country produce? Answers: The absolute value of the slope of the consumption possibilities line would still be 1 and it would again be tangent to the PPC at point G. The country should continue to produce 1,600 units of each good per year. Econ 1 TA Discussion session Exercises Dec. 4th, 2013 e) If the world price of refrigerators rose to $1200 and the price of television sets remained $1000, how will the country alter the mix of the two goods it produces? How will it alter the mix of the two goods it consumes? Answers: The absolute value of the slope of the consumption possibilities line is now $1000/$1200 = 0.833, which is less than 1. In this case, the tangency will occur to the left of point G. The country should produce more than 1,600 refrigerators each year and fewer than 1,600 televisions. There is no way to be sure how the country will change its consumption of the two goods without more information about the country’s consumption preferences. 4. A small open economy must sacrifice 1.5 pounds of tea for one pound of coffee. What will this economy produce if the world price of coffee is 20 percent higher than that of tea? Answers: Domestic opportunity cost of coffee is 1.5 lb of tea; and international opportunity cost of coffee = Pcoffee/ Ptea = 1.2 lbs ot tea. (because the amount needed to buy one pound of coffee can buy 1.2 pounds of tea). There fore, the economy produces tea only.