Explanatory Document and Impact Assessment

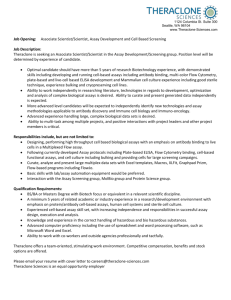

advertisement