ECON 3430 F14 Course Outline, Spotton

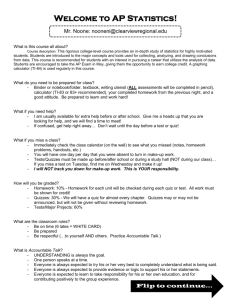

advertisement

YORK UNIVERSITY FACULTY OF LIBERAL ARTS AND PROFESSIONAL STUDIES AP/ECON 3430 3.0 A – MONETARY ECONOMICS I: FINANCIAL MARKETS AND INSTITUTIONS FALL 2014 Contact Information: Professor Brenda Spotton Visano Office: 130 McLaughlin Voice Mail: (416) 736-2100 ext. 20470 E-mail: spotton@yorku.ca Lecture Information: Monday 7pm – 10pm Classroom: ACW 006 Office hours: Monday 3pm-6pm, or by appointment Teaching Assistant: TBA Economics Main Office, Vari Hall 1144 Tel: (416) 736-5083 CALENDAR COURSE DESCRIPTION: Studies the principal financial institutions and markets in the Canadian economy. Analyzes the economic function, regulation, and operational features of these institutions and markets. Considers the corresponding institutions and markets in other countries. Prerequisites: AP/ECON 1000 3.00 and AP/ECON 1010 3.00 or equivalents. Course credit exclusion: GL/ECON 3380 3.00. PRIOR TO FALL 2009: Course credit exclusions: AK/ECON 3430 3.00, AS/ECON 3140 3.00, GL/ECON 3380 3.00. TEXTS Recommended Textbook: Stephen G. Cecchetti and Angela Redish Money, Banking and Financial Markets, McGraw-Hill Ryerson, 2010 EVALUATING INTERNET RESOURCES http://www.library.georgetown.edu/tutorials/research-guides/evaluating-internet-content EXPANDED COURSE DESCRIPTION AND LEARNING OBJECTIVES Organization of the Course: The course involves formal lectures by the instructor and guided class discussions around a series of topics designed to motivate conceptually and intuitively the topics we cover. Informal group work is encouraged. The required readings are central to the course. The lectures and class discussions will serve to motivate and enrich the crucial issues from the assigned readings. A dedicated student would ideally review the assigned materials in advance of the class, participate in class discussions, read the materials in detail after the class, and review the class questions to ensure he or she has the best possible understanding of the material. A group of dedicated students might get together to discuss that which appears confusing, to critique each other’s proposed answers/responses to the class questions and learning outcomes, and to pose additional questions for each other (or the rest of the class). Learning Objectives Guiding Course Design, Delivery, and Student Evaluation: 1. Enable a conceptual and practical understanding of the financial system as a set of formal and informal institutions designed to transfer purchasing power; identify and define the various financial instruments, prices, markets, formal institutions, and relevant legislation. 2. Critique the effectiveness of the current financial system in promoting savings and investment with reference to economic efficiency and social desirability. 3. Assess the basic decision and portfolio frameworks used to explain both financial decisions and financial institutions. 4. Explain the interaction between (a) economic and financial needs, (b) financial regulation, and (c) technological developments in explaining the evolution of the financial system. 5. Critique a model or policy position in terms of political influences and institutional assumptions; use logic and reasoning, analysis and synthesis to argue well supported assessments written in a clear, well-organized and focused manner, in a style that is compelling. EVALUATION The final grade for the course will be based on the following submissions, weights as indicated: Quizzes: 40% (4 quizzes, 10% each) Take Home Assignments: 60% (3 Assignments, 20% each) The Quizzes will comprise short essay-type questions—with and without basic calculations required. They will focus on that material which was covered in the lecture and assigned readings since the previous quiz. . Assignments: There will be THREE assignments. Late penalty (applied when no accommodation has been granted): 5/100 marks per day. Superior performance on the assignments will require more than a solid understanding of the material; superior performance will require an ability to synthesize, analyze and organize economic information in well-structured, well-written arguments supporting or refuting hypotheses related to assignment questions. Missed Quizzes: Students with a documented reason (such as illness or compassionate grounds) for missing a quiz may request accommodation from the Course Instructor. A makeup quiz will be available to students who have been granted accommodation. Additional extensions will require students submit a formal petition to their home Faculty. FALL 2014 CLASS MEETS, COURSE OUTLINE, AND CRITICAL DATES DATE September 8 First Class Introduction, C&R Ch. 1 September 15 Money, C&R Ch. 2 September 22 Financial Instruments and Markets, C&R Chs 3,4 Last Day to enroll On-line September 29 Quiz #1: 7-7:45 pm (10%) Theories of Interest Rates, C&R Ch 6 October 6 The Term Structure of Interest Rates, C&R Ch 7 Last Day to enroll with Instructor Permission October 13 Thanksgiving – No Class; University Closed October 20 Assignment #1 Due at 7pm (20%) Asset Prices and Asset Market Crashes, C&R Ch 8 October 27 Quiz #2: 7-7:45 pm (10%) Financial Intermediation, C&R Ch 11 November 3 Financial Intermediaries, C&R Ch 12, 13 November 7 Last Day to Drop without Receiving a Grade November 10 Assignment #2 Due at 7pm (20%) Regulation of the Financial System, C&R Ch 14 November 17 Quiz #3: 7-7:45 pm (10%) Central Banking, C&R Chs 15, 16 November 24 Assignment #3 Due at 7pm (20%) Financial Crises, C&R Ch 23 December 1 Quiz #4: 7-8:30 pm (10%) Last Class December 9-22 Fall Exam Period ASSIGNMENTS Assignment #1: Is the crypto-currency Bitcoin “money”? In answering this question, consider the definitions of money, the characteristics of money, and the measurement of the Canadian money supply. Should Bitcoin be regulated in the same way Canadian currency is regulated? Explain. Your answer should be 3-5 typed pages and accurately referenced. References Satoshi Nakamoto “Bitcoin: A Peer-to-Peer Electronic Cash System” Posted at http://bitcoin.org/bitcoin.pdf (Retrieved July 11, 2013) Assignment #2: Identify the appropriate interest rates/yields and plot the Canadian yield curve for interest rates 1month, 3-month, 6-months, 1 - 3years forward. Properly cite your source. Explain why you chose the rates you did. From now (Fall 2014) until October 2015, will interest rates likely go up, stay the same or decline? Explain your reasoning in detail. Include consideration of the Augmented Expectations Hypothesis of the Term Structure of Interest Rates. Your answer should be 3-5 typed pages and accurately referenced. Assignment #3: Is a payday loan company a “bank”? In answering this question, consider the definitions of a bank, the characteristics of a bank, and the regulation of financial institutions in Canada. Should a Payday Loan operation be regulated in the same way Chartered Banks are regulated? Explain. Your answer should be 3-5 typed pages and accurately referenced. P.S. SOME HUMOROUS TIPS FOR WRITING Rules for Writers (by William Safire) combined with Newsman's English (by Harold Evans) as posted http://core.ecu.edu/psyc/wuenschk/thhumor.htm (Retrieved August 29, 2006) Remember to never split an infinitive. The passive voice should never be used. Do not put statements in the negative form, and don't use no double negatives. Verbs has to agree with their subjects. Proofread carefully to see if you any words out. If you reread your work, you can find on rereading a great deal of repetition can be avoided by rereading and editing. A writer must not shift your point of view. And don't start a sentence with a conjunction. (Remember, too, a preposition is a terrible word to end a sentence with.) Don't overuse exclamation marks!! Use apostrophe's correctly, and don't use commas, which, aren't necessary. Place pronouns as close as possible, especially in long sentences, as of 10 or more words, to their antecedents. About those sentence frag- ments. Writing carefully, dangling participles must be avoided. If any word is improper at the end of a sentence, a linking verb is. Take the bull by the hand and avoid mixing metaphors. Avoid trendy locutions that sound flaky. Everyone should be careful to use a singular pronoun with singular nouns in their writing. Always pick on the correct idiom. The adverb always follows the verb. Corect speling is esential. Last but not least, avoid trite cliches like the plague.