SYLLABUS - Cameron School of Business

advertisement

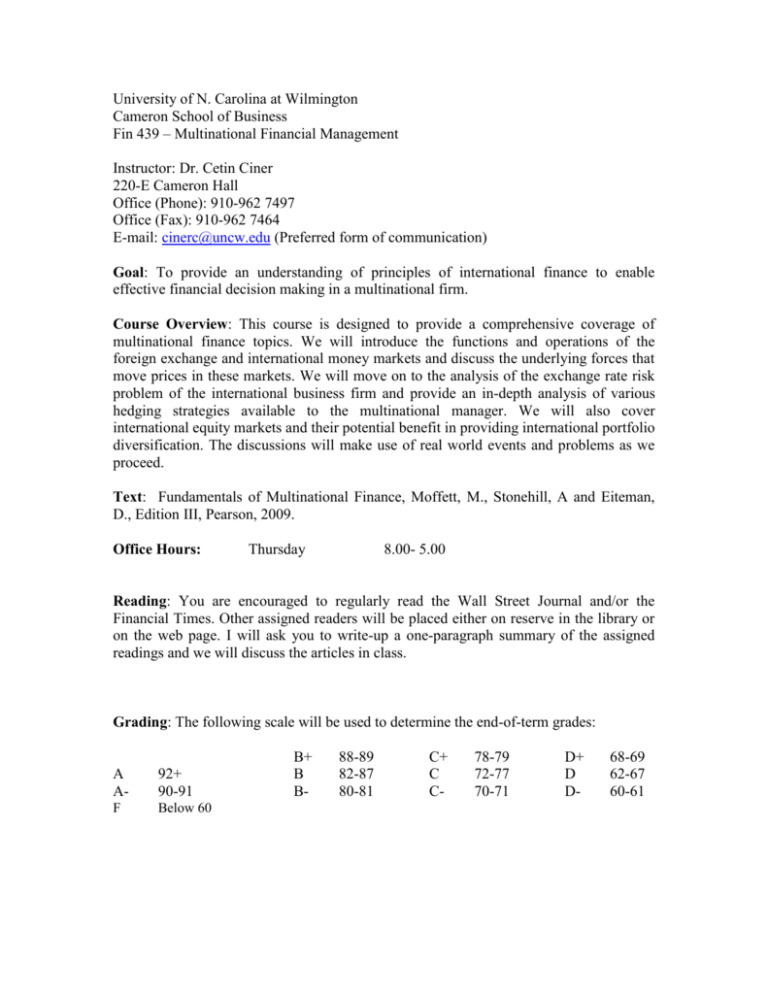

University of N. Carolina at Wilmington Cameron School of Business Fin 439 – Multinational Financial Management Instructor: Dr. Cetin Ciner 220-E Cameron Hall Office (Phone): 910-962 7497 Office (Fax): 910-962 7464 E-mail: cinerc@uncw.edu (Preferred form of communication) Goal: To provide an understanding of principles of international finance to enable effective financial decision making in a multinational firm. Course Overview: This course is designed to provide a comprehensive coverage of multinational finance topics. We will introduce the functions and operations of the foreign exchange and international money markets and discuss the underlying forces that move prices in these markets. We will move on to the analysis of the exchange rate risk problem of the international business firm and provide an in-depth analysis of various hedging strategies available to the multinational manager. We will also cover international equity markets and their potential benefit in providing international portfolio diversification. The discussions will make use of real world events and problems as we proceed. Text: Fundamentals of Multinational Finance, Moffett, M., Stonehill, A and Eiteman, D., Edition III, Pearson, 2009. Office Hours: Thursday 8.00- 5.00 Reading: You are encouraged to regularly read the Wall Street Journal and/or the Financial Times. Other assigned readers will be placed either on reserve in the library or on the web page. I will ask you to write-up a one-paragraph summary of the assigned readings and we will discuss the articles in class. Grading: The following scale will be used to determine the end-of-term grades: A A- 92+ 90-91 F Below 60 B+ B B- 88-89 82-87 80-81 C+ C C- 78-79 72-77 70-71 D+ D D- 68-69 62-67 60-61 Graded Materials Midterm Examination I Project Final Examination Homework and Participation Total 25 points 25 points 40 points 10 points 100 points Examinations: All examinations will be closed-note, closed book and will consist of multiple choice questions. However, you can use a single 3x5 note card that contains only formula. You must turn in the card with your exam, if you choose to use one. Project: In your term paper, you will investigate an important topic in international finance. You will consider different angles and viewpoints of your chosen topic and provide a thorough analysis. This is group work with three to four students in a group. Each team will present their analysis in class and also, turn in a paper of eight to ten pages. Below are some possible topics you may consider, although you are not limited to these areas. It is important to remember that this research will be your own independent work. If you use quotes from a source, you should always clearly acknowledge. Some potential topics: - Global financial crises (EMS 1992, Mexico 1994, Asia 1997-1998, Turkey 2001, US 2007-2008, among others) International exchange rate regimes and currency board experiments Role of gold and silver in global finance International equity markets and potential portfolio diversification benefits Emerging markets finance The role of the single currency, Euro Economic and political dynamics in the European Union Home bias in international investments Uncovered interest rate parity and speculation in currency markets Cross-listing trends across global equity markets Additional Points: Integrity: Full compliance with the University rules and regulations on academic integrity and honesty is expected. The Academic Honor Code can be found in the UNCW Student Handbook and Code of Student Life. Academic Honesty: As a student at UNCW, you are pledged to uphold and support the UNCW Student Academic Honor Code: The University of North Carolina Wilmington is a community of high academic standards where academic integrity is valued. UNCW students are committed to honesty and truthfulness in academic inquiry and in the pursuit of knowledge. This commitment begins when new students matriculate at UNCW, continues as they create work of the highest quality while part of the university community, and endures as a core value throughout their lives. Guidelines in support of the Honor Code, including definitions of cheating and plagiarism, may be found at: http://www.uncw.edu/policies/documents/03_100FINALHONORCODE_Aug2009.pdf Disabilities: Appropriate academic support is available for any student with a documented disability. Please notify me and/or contact the Office of Disability Services (3746) for further information. Calculator: A financial calculator, and the ability to use it, is required for this course. The BA II+ is recommended and should be brought to class every day. Time Value of Money exercises, including a list explaining BA II+ keys, are available online. Syllabus 1/6 Introduction 1/11 The Balance of Payments - Concepts and terminology Surpluses and deficits Balance of Payments Identity What causes deficits and surpluses 1/13 Cont’d 1/18 No Class 1/20 The Foreign Exchange Market - Organization of the currency market F/X quotes and prices Cross-rates and triangular arbitrage Calculating changes in exchange rates 1/25 Cont’d 1/27 International Monetary Systems - 5 3 Alternative exchange rate regimes Flexible and fixed exchange rates Advantages and disadvantages Currency boards and dollarization The Euro and the EMS 2/1 Cont’d 2/3 International Parity Conditions - 4 Covered interest rate parity Determination of forward exchange rate Speculation in currency markets and “carry trade” Unbiasedness hypothesis Purchasing power parity and real exchange rates The Big Mac standard Tests of the purchasing power parity The Fisher hypothesis and real rate of return 6 2/8 Cont’d 2/10 Cont’d 2/15 Exchange Rate Determination and Forecasting - Fundamental exchange rate forecasting Asset market approach Technical analysis Market efficiency and predictability of exchange rates 2/17 Cont’d 2/22 Review for Exam I 2/24 No Class 3/1 Midterm Examination 3/3 Foreign Currency Derivatives - No Class 3/10 No Class 3/15 Cont’d 3/17 Transaction Exposure 3/122 8 The Basics of futures and option contracts Terminology and trading Forwards vs. futures Speculation with futures and options Valuation of currency options 3/8 - 7 Hedging with forward contracts Money market hedges Hedging using currency options Cont’d 9 3/24 No Class- Business Week 3/29 Operating Exposure - Real exchange risk and the domestic and foreign firms Pricing to market strategies Strategies for managing real exchange risk 3/31 Cont’d 4/5 International Portfolio Theory and Diversification - 10 16 Organization and operation of stock markets Emerging stock markets International cross-listing and depository receipts Advantages and disadvantages of cross-listing Cont’d 4/7 4/12 - Risk and return of international investments The benefits of international diversification Integrated vs. segmented markets Home bias in international investments Country vs. industry factors in international equity markets Interest Rate and Currency Swaps Currency versus interest rate swaps Mechanics of foreign currency swaps The rationale for currency swaps The nature of interest rate swaps 4/14 Cont’d 4/19 Term Paper Presentations 4/21 Term Paper Presentations 4/24 Review for Final Examination 15