career preparedness

advertisement

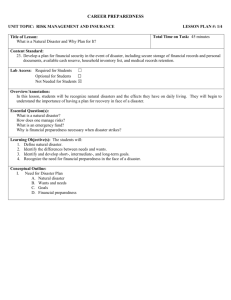

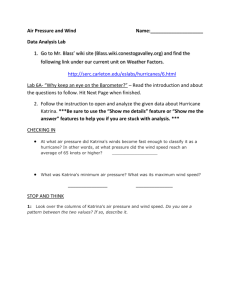

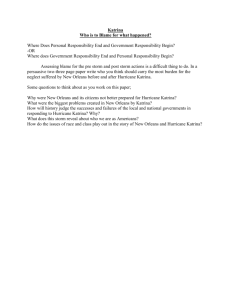

CAREER PREPAREDNESS UNIT TOPIC: RISK MANAGEMENT AND INSURANCE Title of Lesson: A Fresh Start LESSON PLAN #: 3/4 Total Time on Task: 45 to 135 minutes (See Procedures/Activities Paragraph 2: Teacher Preparation) Content Standard: 23. Develop a plan for financial security in the event of disaster, including secure storage of financial records and personal documents, available cash reserve, household inventory list, and medical records retention. Lab Access: Required for Students ☐ Optional for Students ☐ Not Needed for Students ☒ Overview/Annotation: This lesson re-enforces competencies achieved under Standards 20 and 21 as students identify the necessity of having financial means to start over after a disaster. Essential Question(s): Are you financially prepared for an emergency situation? Do you have enough cash on hand or in a bank account to cover immediate needs and financial obligations? Do you have access to credit or credit cards to meet the needs that exceed your available cash? Do you have an established banking relationship to assist in emergency situations? Learning Objective(s): The students will: 1. Explain the importance of planning for emergencies and having an emergency fund. 2. Identify the opportunity cost of having access to credit. 3. Identify ways credit can be wisely used during an emergency situation. a. Analyze types of credit and determine characteristics of each. b. Compare credit card offers. c. Define credit and debt. d. Evaluate a credit card statement. 4. Explain the consequences of unwise credit use during an emergency situation. a. Explain components of a credit score. 5. Weigh the impact of interest rates on monthly payment amounts. Conceptual Outline: I. Being Financially Prepared for an Emergency Situation A. Credit and debt B. Wise use of credit C. Loan and credit card basics D. Credit reports and scores E. Importance of savings and available credit in emergency preparedness Materials, Equipment, and Technology Resources: Materials: 1. DVD #1: Katrina's Classroom: Financial Lessons from a Hurricane (order two weeks in advance) 2. Teacher Information #1: Katrina’s Classroom—Lesson 3: A Fresh Start a. OPTIONAL Handout #1: Types of Credit (p. 22 of Teacher Information #1) b. OPTIONAL Handout #2: Analyzing a Credit Offer (p. 23 of Teacher Information #1) c. OPTIONAL Handout #3: Credit Quest (p. 24 of Teacher Information #1) 3. Assignment #1: Pre-test Your Knowledge | A Fresh Start 4. Key #1 for Assignment #1: Pre-test Your Knowledge | A Fresh Start 5. PowerPoint #1: Test Your Knowledge | A Fresh Start 6. PowerPoint #2: A Fresh Start (narrated version http://www.frbatlanta.org/edresources/classroomeconomist/13Katrina_Lesson3/index.htm) 7. Assignment #2: A Fresh Start 8. Key #2 for Assignment #2: A Fresh Start Equipment: 1. Computer with LCD projector or DVD player and television Technology Resources: 1. Internet access 2. Video #3: A Fresh Start (MP4 7:02) (http://www.frbatlanta.org/forms/katrina.cfm) a. Video Summary: “When Jacquelyn and her family returned to Biloxi, Mississippi, after Katrina, their entire neighborhood was destroyed. Today, the family has rebuilt their home, and they are rebuilding their finances by paying off credit card debt as quickly as they can. Jacquelyn’s life is also returning to normal, and she is able to save money to buy a dress so she can participate in a school pageant.” 3. http://www.frbatlanta.org/edresources/classroomeconomist/ 4. Narrated PowerPoint #2: Katrina’s Classroom: Financial Lessons from a Hurricane | Lesson 3: A Fresh Start (http://www.frbatlanta.org/edresources/classroomeconomist/13Katrina_Lesson3/index.htm) Procedures/Activities: 1. Teacher Preparation Two Weeks in Advance: Order a copy of the updated Katrina's Classroom: Financial Lessons from a Hurricane DVD from Federal Reserve Bank of Atlanta at http://www.frbatlanta.org/forms/katrina_order.cfm. Allow two weeks for delivery. Video clips are provided with this resource, but it is wise to verify these are the latest versions. Video clips can be downloaded and/or viewed from website http://www.frbatlanta.org/forms/katrina.cfm. 2. Teacher Preparation: Watch Video #3 and review Teacher Information #1 to be able to lead class discussions. Determine how much of the information about credit and debt needs to be covered beyond showing on PowerPoint #2. Copy and distribute as appropriate Optional Handouts #1-#6 found on pages 27-35 of Teacher Information #1. 3. Class Discussion: Review knowledge and skills developed under Standards 20 and 21. Introduce Video #3 by explaining to the class that “they are going to watch the story of Jacquelyn, a young woman whose family left Biloxi, Mississippi, during Hurricane Katrina. Ask them to pay attention to how Jacquelyn’s family paid for necessities while they were gone and what they are doing now to get back on track financially.” Play Video #3 then lead discussion. Video #3 Discussion Questions: How did Jacquelyn and her family manage when they were staying with Jacquelyn’s aunt? What were some of the things Jacquelyn’s family needed during and immediately after Hurricane Karina? (They needed to buy food and clothes; they needed a place to stay.) How did Jacquelyn’s family buy groceries and other necessities? (They brought cash and used credit cards.) What do you think would have happened to them if they did not have any savings in the bank, weren’t creditworthy, and didn’t have any credit cards? (They could not have covered day-to-day expenses.) What did her family need when they were forced to leave their home? (Food, shelter) There is a difference between needs and wants. Sometimes it seems that we need things that we can actuality live without. What did some of the people in this story have to live without? (Power, computers, cell phones, phones, air conditioning) What is Jacquelyn’s family doing now to get on track financially? What is the family doing about their credit card debt? (Trying to pay it back as quickly as they can) What does Jacquelyn want now that her life is getting back on track? (A dress so she can be in a school pageant) How is Jacquelyn managing her money so she can get what she wants? (Earning money by doing chores and babysitting; saving money for a goal) 4. Pre-Assessment: Distribute copies of Assignment #1. Give students a few minutes to circle answers to the 10 questions. Show PowerPoint #1 to use in scoring and reinforcing knowledge about basic financial tasks that are essential “A Fresh Start” of a disaster. Use pre-test results to affirm decision made in teacher preparation as to the amount of time and focus needed for basic financial tasks. 5. Class Discussion: Show PowerPoint #2 with Video #2 imbedded on slide 4 OR show narrated version available at http://www.frbatlanta.org/edresources/classroomeconomist/13Katrina_Lesson1/index.htm. Discuss. 6. Class Activity: Distribute copies of Assignment #2 if you wish to give the post-test as a summative assessment for Lesson 3. Alternative is to re-use PowerPoint #1 to reinforce key points. Assessment: 1. Assignment #1 (Pre-test) 2. Assignment #2 3. Class participation