aib_-_dissf_-_minutes_-_10_november_2015

advertisement

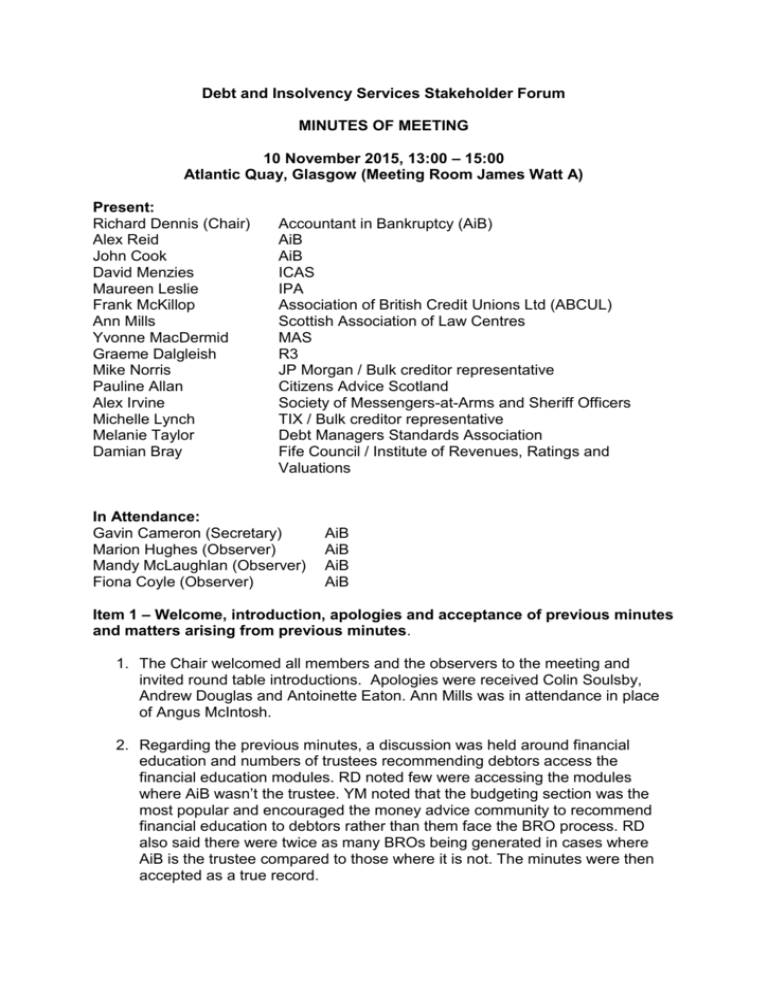

Debt and Insolvency Services Stakeholder Forum MINUTES OF MEETING 10 November 2015, 13:00 – 15:00 Atlantic Quay, Glasgow (Meeting Room James Watt A) Present: Richard Dennis (Chair) Alex Reid John Cook David Menzies Maureen Leslie Frank McKillop Ann Mills Yvonne MacDermid Graeme Dalgleish Mike Norris Pauline Allan Alex Irvine Michelle Lynch Melanie Taylor Damian Bray Accountant in Bankruptcy (AiB) AiB AiB ICAS IPA Association of British Credit Unions Ltd (ABCUL) Scottish Association of Law Centres MAS R3 JP Morgan / Bulk creditor representative Citizens Advice Scotland Society of Messengers-at-Arms and Sheriff Officers TIX / Bulk creditor representative Debt Managers Standards Association Fife Council / Institute of Revenues, Ratings and Valuations In Attendance: Gavin Cameron (Secretary) Marion Hughes (Observer) Mandy McLaughlan (Observer) Fiona Coyle (Observer) AiB AiB AiB AiB Item 1 – Welcome, introduction, apologies and acceptance of previous minutes and matters arising from previous minutes. 1. The Chair welcomed all members and the observers to the meeting and invited round table introductions. Apologies were received Colin Soulsby, Andrew Douglas and Antoinette Eaton. Ann Mills was in attendance in place of Angus McIntosh. 2. Regarding the previous minutes, a discussion was held around financial education and numbers of trustees recommending debtors access the financial education modules. RD noted few were accessing the modules where AiB wasn’t the trustee. YM noted that the budgeting section was the most popular and encouraged the money advice community to recommend financial education to debtors rather than them face the BRO process. RD also said there were twice as many BROs being generated in cases where AiB is the trustee compared to those where it is not. The minutes were then accepted as a true record. Item 2 – DISSF Brief (Paper: DISSF (15-16)11) 3. The Chair provided a summary of the information contained in the DISSF brief. 4. JC gave a brief update on the statistics and said the general trend remained a declining one, although the number of protected trust deeds was starting to normalise after a period of decline. 5. MN asked what the general view was on the numbers and whether it was difficulty in accessing debt relief and debt management products rather than demand from consumers which was contributing to the decline. 6. YM said anecdotal evidence was that FCA regulation as well as the perceived stigma of being recorded on a public register was preventing some people from seeking statutory solutions. PA added that creditors were more inclined to give debtors some breathing space rather than seek enforcement action. While welcoming this approach from creditors, MN asked whether this was helping address the problems with debt people actually had. 7. ML noted the issue of creditor forbearance was being felt in the corporate world too, as numbers of businesses failing were also on the decline. 8. AR said some local authorities were also using informal debt payment programmes to allow people longer to pay back owed council tax. DB said some local authorities were taking a more holistic approach and were now seeking a single payment from debtors who owed money to numerous council departments and were distributing internally. Item 3 – Legislative updates 9. AR gave an update on the progress with the Bankruptcy (Scotland) consolidation Bill and the progress made on the review of corporate insolvency legislation as it applies in Scotland. Following consultation with stakeholders, he said further work requires to be done to dis-entangle the 1985 Act from the 1986 Act. 10. He said the new rules would be coming into force at the same time as the new legislation in England and Wales, which at the moment is anticipated to be October 2016. 11. A revision of diligence against earnings had also been completed and had been introduced to the parliament. 12. A policy review on protected trust deeds will be coming out to consultation in the near future, which will be followed by a review of DAS and the changes made to bankruptcy ushered in by BADA(S) towards the end of 2016. 13. ML asked to be kept informed on changes to corporate insolvency rules to ensure examinations were as up-to-date as possible. 14. A further discussion was held around reviewing bankruptcy fees. RD said fees would be reviewed in due course, although this was unlikely to take place this year. Item 4 – Money Advice Service Financial Capability Strategy update 15. YM gave an update on the Money Advice Service’s 10 year Financial Capability Strategy. She indicated the specific Scottish launch of the strategy would take place in the parliament in January. This was to accommodate the differing priorities of financially vulnerable people in Scotland compared to those in England and Wales, and gave the example that research indicated council tax and multiple debts were the priorities for debtors in Scotland, compared to student loans down south. 16. She said a strategic group including representatives from Money Advice Scotland, Scottish Government, NHS, local authorities and the money advice sector had been formed to encourage large employers to assist staff to seek advice on money worries earlier. Item 5 – Treasury consultations: Public Financial Guidance consultation / Financial Advice Market review update 17. RD updated members on the launch of two HM Treasury consultations and asked the group whether they were aware of them. 18. YM said a Treasury roundtable event had been held in Edinburgh, but noted invitations were sent out at short notice and publicity had been limited. Item 6 – AiB Key Performance Indicators and Engagement Paper: DISSF (1516)12 19. GC introduced the paper asking for feedback from the group on which measures AiB should be measured on to evaluate whether it was delivering quality customer service. He also asked members whether AiB was engaging with its stakeholders enough and whether the channels it was using were appropriate. 20. MN asked whether the missing targets for unit costs for bankruptcies meant the Agency could be regarded as not delivering a quality service. He also asked whether the 85 per cent customer satisfaction rating was one AiB was happy with. 21. JC replied that the net unit costs for bankruptcies had actually reduced, while the customer service rating was very high and said the purpose of the customer survey exercise was to ensure AiB captured everything it needed to and that the questions would be refined if necessary. 22. MN said it was important the correct people from creditor organisations were approached if the customer survey exercise was to be repeated, as it was pointless talking about individual cases. He also said a survey format possibly wasn’t ideal. 23. RD said the KPI needed to be something AiB could measure. DM asked whether this KPI would drive quality within the organisation and suggested net cost would give an indication of efficiency. 24. PA said AiB telephone support should be measured as there had been inconsistencies with the quality of support given in the past. GC confirmed this was already part of the customer survey. 25. In terms of stakeholder communication, DM said it was important that all communication was delivered as widely as possible, and that broadly AiB was doing that. Item 7 – regulatory issues 26. DM updated on various regulatory issues, including the new systems of regulation of IPs to ensure they meet principles of transparency, which came into force on 1 October. He also mentioned the new powers given to the Insolvency Service over RPBs, which allows the IS to deliver financial penalties and other sanctions, but said this wasn’t an issue for ICAS given the robust procedures it already had in place. 27. He also updated members on corporate issues such as the pre-pack pool, which started operating on 1 September. ML added that it is not IPs who would be expected to use the pre-pack pool, but more it would be used by prospective purchasers, and said it remained to be seen how effective it would be. 28. DM said there had been changes to SIP1, which strengthened the code of ethics IPs operated under, empowering IPs to report instances of misconduct among fellow members. ML was very supportive of SIP1 and said it would be interesting to see whether the requirement to blow the whistle in instances of misconduct would lead to an increase in reporting. 29. ML also noted the dual licencing of IPs to allow them to operate across both personal and corporate insolvency came into force earlier in the year, but that the first licences would be unlikely to take effect until 2016 at the earliest. 30. The issue of companies using the DAS register to contact people and encourage them to take a debt relief product instead was discussed. Item 8 – IAIR update 31. RD gave a brief update on the IAIR conference and said a project had been launched to review regulators across different territories has been launched. Item 9 – Companies House liaison update 32. JC updated the group on his recent meeting with the new chief executive of Companies House and indicated the organisation was keen to strengthen relationships with AiB. How to improve exchange of data was also discussed, as were methods for ironing out inconsistencies. JC asked members to contact him if there were any issues they wanted to see raised with Companies House. Item 10 – Credit Union Working Group update 33. FM discussed the activity of the Credit Union Working Group and outlined the formation of the group last year and its ambitions to promote credit unions to large private sector businesses and encourage saving and financial capability in schools. 34. He said the Third Sector team at the Scottish Government was preparing a report on the group’s activities, which is to be launched at the Scottish Parliament on 12 February 2106. Item 11 – Policy and Cases committee update 35. FC delivered an update on the last meeting of AiB’s Policy and Cases committee, which was held on 27 October. 36. Topics covered at the meeting included the issue the current process for accessing a contribution using the Common Financial Tool, in particular surplus income when a debtor is in receipt of overtime/bonus payments. As there were no statistics to show how many cases that were actually receiving overtime/bonus payments, it was agreed to leave the current process as is prior to further consideration during formal review. 37. Also discussed was a query from the money advice sector regarding treatment of private school fees across all statutory debt solutions. The committee discussed the issue and agreed that school fees must be looked at case-by-case. Guidance will be drafted by AiB. 38. The committee’s view on the current requirements of a trustee who has exceeded the six week timescale for submitting their debtor contribution proposal was also sought. There was a consensus among stakeholders that the six week timescale is too short, but that it should be looked into at the policy review stage. Item 12 – Shared Perspectives on the Outcomes of Advice conference 39. AR gave a brief outline of the recent Improvement Service event in Glasgow which looked at national projects to improve reporting on money advice and develop quality standards for advice. YM noted there was an appetite from the sector to develop these standards. Item 13 - AOB 40. There was no other business. The Chair thanked all members for attending and closed the meeting. The date of the next meeting has still to be confirmed but will take place in March 2016. Gavin Cameron Secretary 12 November 2015