AIB Personal Current Account Application Form

AIB Personal Current Account Application Form - Sole

Account Number

ACCOUNT OPENING

Please use Block Capitals and 3 where appropriate. Sections with an * are mandatory and must be completed in full.

Personal Details

*Title Mr

(please state)

*First Name

*Surname

*Home Address

*Address Line 2

Address Line 3

*County

*Country

Gender: Male Female

Marital Status: Married/Civil Partner

*Date of Birth

*Country of Birth

Single Divorced Widowed Other

/ / (Day/Month/Year)

(as per identity documents)

County/City of Birth

Purpose of Account

Daily Banking Other

*Source of Funding for the Account

*Estimated Annual Turnover of the account

€

(as per identity documents)

Tax Reporting

Financial institutions in Ireland are required, under legislation which incorporates the US Foreign Account Tax Compliance Act (FATCA) and the OECD*

Common Reporting Standard (CRS) into Irish law, to seek answers to certain questions for purposes of identifying those accounts, the details of which are reportable to Irish Revenue for onward transmission to the tax authorities in the relevant jurisdiction(s).

If customers do not provide all of the information requested, we may not be able to proceed with opening the new account until the relevant information is provided. Existing customers of Financial Institutions such as AIB must provide the answers to these specific FATCA and CRS questions otherwise we may be obliged to include the account(s) details in the annual FATCA return and CRS return to Irish Revenue.

Please note that AIB is unable to offer taxation advice. For tax related questions and/or further information please contact your professional tax advisor or

Irish Revenue (http://www.revenue.ie/en/business/aeoi/index.html). Customers MUST advise AIB if their tax jurisdiction information changes.

* Organisation for Economic Cooperation and Development.

*Are you a US Citizen? Yes

*In what country(ies) are you tax resident?

No

If you answered yes to the US Citizen question please include the United States as one of the countries below

Jurisdiction of Tax Residence Jurisdiction of Tax Residence Jurisdiction of Tax Residence

Tax Reference Number

(e.g. Personal Public Service Number (PPSN)) Tax Reference Number Tax Reference Number

Employment Details

*Employment Type: Employee Self-employed Home Maker Retired Not currently employed

Job Description

Employer’s Name

*Basic Gross Annual Income

€

(If no Income, please enter ‘zero’, i.e. enter ‘0’ in Income field)

Will your income be paid into your bank account? Yes No

Contact Details

Home Phone No.

E-mail Address

Mobile Phone No. 0 8

Terms and Conditions apply. Allied Irish Banks, p.l.c. Registered office: Bankcentre, Ballsbridge, Dublin 4. Registered in Ireland, No. 24173.

Allied Irish Banks, p.l.c. is regulated by the Central Bank of Ireland.

Please turn over

➥

Product Information

(Required Information – Please complete)

In future we, AIB Group, would like to use your personal data for the purposes of offering you other products and services, including those available from other companies in AIB Group and carefully selected third parties, which AIB Group thinks may be of interest to you. In this connection, and occasionally for market research and statistical purposes, the services of a reputable external agency may be used. Are you happy to receive this information by the following?

Mail: Yes No Phone: Yes No E-mail: Yes No (Please indicate with a 3 )

Data Protection Notice – Use of Information

This Notice explains what “AIB” and “AIB Group” will do with your information so that you can decide whether or not to provide that information to us. “AIB” refers to Allied Irish Banks, p.l.c. and “AIB Group” refers to Allied Irish Banks, p.l.c., its subsidiaries, affiliates and their respective parent and subsidiary companies.

The personal information requested from you is required to enable AIB Group to effectively provide or administer a product or service to you. Failure to supply AIB Group with sufficient information may result in AIB Group not being able to provide or meet your product/service needs.

The information that you provide may be held by AIB Group on a computer database and/or in any other way. We may use this information:

• To administer the products and services that we supply to you and any future agreements that we may have with you and, to manage and develop AIB Group’s relationship with you.

• For direct marketing purposes, where you have given your permission to do so, to advise you of products or services.

If you wish to change your preferences at any time, please contact your local AIB branch or call us on 1890 724 724.

• To carry out searches (including verifying your identity and/or a credit search) and disclose information to credit reference agencies for the purpose of assessing applications for credit and credit related services and for ongoing credit review.

Credit reference agencies will record details of each type of search AIB Group makes whether or not your application proceeds. We may use credit scoring techniques and other automated decision making systems to either partially or fully assess your application.

• To provide details of your financial indebtedness owing to the AIB Group and how you conduct your agreement(s)/ account(s), to credit reference agencies on a regular basis.

• To review your financial position across the AIB Group, including debit and credit balances and security for advances.

• To provide your personal details to debt collection agencies and/or third party processors and contractors, who act on behalf of AIB Group, if it is necessary for the performance of a contract and/or to protect the legitimate interests of AIB

Group.

• To prevent and detect fraud or other criminal activity and to trace those responsible. If you give us false or misleading information and we suspect fraud or other criminal activity, we will record this and may report the incident to the relevant regulatory authorities.

• To carry out statistical analysis and market research or to instruct a third party to perform this on our behalf.

We may record telephone conversations to offer you additional security, resolve complaints and improve our service standards. Conversations may also be monitored for staff training purposes.

Our websites use “cookie” technology. A cookie is a little piece of text stored by your browser on your computer, at the request of our server. We may use cookies to deliver content specific to your interests and to save your personal preferences so you do not have to re-enter them each time you visit our websites. In some circumstances, AIB Group may use the data collected to contact you in relation to a product or service that may be of interest to you. You must disable your cookies if you do not want AIB Group to access or store cookies on your computer. For more information on AIB’s security policy, please visit www.aib.ie.

Under the Data Protection Acts you have the right of access to personal information we hold about you on our records on payment of a nominal fee (currently EUR 6.35). You can exercise this right by writing to your local AIB branch or to the Data

Protection Unit, Allied Irish Banks, p.l.c., Bankcentre, Ballsbridge, Dublin 4. If any of your personal information held by us is inaccurate or incorrect, please let us know and we will correct it. There is no fee for such corrections.

If you decide to proceed with this product/service or have any other communication with AIB Group through or in relation to its products and services, you consent to the use by AIB Group of your personal data as indicated above.

Deposit Guarantee Scheme Information

By signing this declaration, I acknowledge that I have been provided with, read and accept the Deposit Guarantee Scheme - Depositor Information Sheet

Signed Dated

Application/Declaration

To: Allied Irish Banks, p.l.c. (‘the Bank’)

1. Please open an AIB current account (and such other accounts as I may require) in my name under the Bank’s Terms and

Conditions, a copy of which has been/will be provided.

2. I apply for an AIB Debit Card with POS and ATM services and Personal Identification Number (PIN) under the Bank’s Terms and Conditions which will be sent to me for use with the Card. (Indicate with a 3 if required)

3. I certify the accuracy of the information given and I agree the Bank may make such enquiries about me as it considers necessary in relation to this application.

Customer

Signature: Date / / (Day/Month/Year)

Please turn over

➥

BANK USE ONLY

– All Fields are Mandatory and Application will be returned if not fully completed

(Please use Block Capitals and 3 where appropriate)

CJA Compliance

Proof of Identity: E.G. Valid Passport

OR Other

(please state)

Driving Licence with Photo National Identity Card

Proof of Address: E.G. Utility Bill

OR Other

(please state)

Correspondence from a Regulated Financial Institution

Product Name: * AIB Advantage Account – 40060

Account Details

* Do not select this product where

either customer is under 66 years of age

NSC: 9 3

Account Classification:

Staff Referral Code:

H A

Sub Office Mobile Code:

(or) ** Personal Bank Account PLUS – 40001

** Do not select this product where the customer is under 18 years of age

Statement Diary:

Date of Next Statement

Annually Quarterly Monthly

/ / (Leave blank unless customer requests specific date)

Card Order

AIB Debit Card: Yes No

Embossed Name:

Mailing Address: Customer Address To Branch

Book Order

Cheque Book: Yes No Type:

Lodgement Book: Yes No Type:

Mailing Address: Customer Address To Branch

Branch Checklist

Customer’s CJA documentation has been sighted and verified to be true and original by Official signed below: Yes

This application has been checked and all mandatory fields have been completed:

PPS No. (Tax Reference No.) documentation received:

Yes

Yes No

I confirm that the customer(s) has been provided with the DGS - Depositor Information Sheet Yes

I confirm that the customer(s) has signed and dated to acknowledge receipt of the DGS - Depositor Information Sheet Yes

Completed By:

Block Capitals

Signature:

Date: / / (Day/Month/Year)

Staff Number:

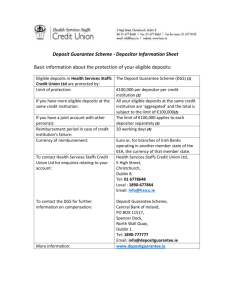

Deposit Guarantee Scheme

Depositor Information Sheet

Basic information about the protection of your eligible deposits

Eligible deposits in Allied Irish Banks, p.l.c. are protected by:

Limit of protection:

If you have more eligible deposits at the same credit institution: the Deposit Guarantee Scheme (“DGS”) (1)

€100,000 per depositor per credit institution (2)

All your eligible deposits at the same credit institution are ‘aggregated’ and the total is subject to the limit of €100,000 (2)

If you have a joint account with other person(s):

Reimbursement period in case of credit institution’s failure:

Currency of reimbursement:

The limit of €100,000 applies to each depositor separately (3)

20 working days (4)

Euro

To contact Allied Irish Banks, p.l.c. for enquiries relating to your account: Allied Irish Banks, p.l.c.

Bankcentre

Ballsbridge

Dublin 4

Tel: 0818 227 060 www.aib.ie

To contact the DGS for further information on compensation:

More information:

Deposit Guarantee Scheme

Central Bank of Ireland

PO BOX 11517

Spencer Dock

North Wall Quay

Dublin 1

Tel: 1890-777777

Email: info@depositguarantee.ie www.depositguarantee.ie

Allied Irish Banks, p.l.c. is regulated by the Central Bank of Ireland

Deposit Guarantee Scheme

Depositor Information Sheet

Additional information

(1) Scheme responsible for the protection of your deposit

Your deposit is covered by a statutory deposit guarantee scheme. If insolvency should occur, your eligible deposits would be repaid up to €100,000.

(2) General limit of protection

If a covered deposit is unavailable because a credit institution is unable to meet its financial obligations, depositors are repaid by the DGS. This repayment covers at maximum €100,000 per person per credit institution. This means that all eligible deposits at the same credit institution are added up in order to determine the coverage level. If, for instance, a depositor holds a savings account with €90,000 and a current account with €20,000, he or she will only be repaid €100,000.

(3) Limit of protection for joint accounts

In case of joint accounts, the limit of €100,000 applies to each depositor. However, eligible deposits in an account to which two or more persons are entitled as members of a business partnership, association or grouping of a similar nature, without legal personality, are aggregated and treated as if made by a single depositor for the purpose of calculating the limit of €100,000.

In some cases eligible deposits which are categorised as “temporary high balances” are protected above €100,000 for six months after the amount has been credited or from the moment when such eligible deposits become legally transferable. These are eligible deposits relating to certain events which include:

(a) certain transactions relating to the purchase, sale or equity release by the depositor in relation to a private residential property;

(b) sums paid to the depositor in respect of insurance benefits, personal injuries, disability and incapacity benefits, wrongful conviction, unfair dismissal, redundancy, and retirement benefits;

(c)

(d) sums paid to the depositor in respect of benefits payable on death; claims for compensation in respect of a person’s death or a legacy or distribution from the estate of a deceased person.

More information can be obtained at www.depositguarantee.ie

(4) Reimbursement

The responsible deposit guarantee scheme is:

Deposit Guarantee Scheme, Central Bank of Ireland, PO Box 11517, Spencer Dock, North Wall Quay, Dublin 1.

Tel: 1890-777777. Email: info@depositguarantee.ie. Website: www.depositguarantee.ie.

It will repay your eligible deposits (up to €100,000) within 20 working days until 31 December 2018; within 15 working days from 1 January 2019 until

31 December 2020; within 10 working days from 1 January 2021 to 31 December 2023; and within 7 days from 1 January 2024 onwards, save where specific exceptions apply.

Where the repayable amount cannot be made available within seven working days depositors will be given access to an appropriate amount of their covered deposits to cover the cost of living within five working days of a request. Access to the appropriate amount will only be made on the basis of data provided by the credit institution. If you have not been repaid within these deadlines, you should contact the deposit guarantee scheme.

Other important information

In general, all retail depositors and businesses are covered by the Deposit Guarantee Scheme. Exceptions for certain deposits are stated on the website of the

Deposit Guarantee Scheme. Your credit institution will also inform you on request whether certain products are covered or not. If deposits are eligible, the credit institution shall also confirm this on the statement of account.

AIB-DIS-NOSIG 11-15