How to Handle Collection Calls For A Deceased Person

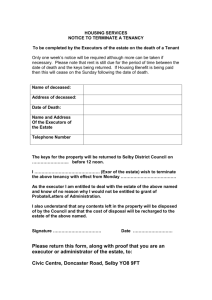

advertisement

How to Handle Collection Calls For A Deceased Person's Debt Are you being contacted about a deceased person's debt? The last thing you need when you are mourning the death of a loved one are calls from debt collectors demanding that you pay his (or her) past due debts. Yet, collecting the debts of the dead is a growing and lucrative market for debt collectors. In fact, some debt collectors receive training on how to talk to the bereaved. According to a New York Times article on the subject, one debt collection firm even transfers grieving relatives to a grief counselor who tries to help them cope with their emotions so that the collection firm will be more successful collecting from the bereaved relatives at a later date! Creepy, huh? And pretty outrageous too, especially considering that in many instances surviving relatives are under no legal obligation to pay the unpaid debts of their deceased loved ones. Sadly however, many relatives do pay deceased persons debts out of a sense of obligation to the person they have lost - even when it puts them in a financial bind. Are You Responsible For Their Debts? Here are the facts. Generally when someone dies, the outstanding debts of the deceased are paid out of her estate during the probate process. If there is not enough money in the estate to pay all of those debts, the unpaid creditors are out of luck. What's in an estate? An estate is all of the assets owned by the deceased and it’s the responsibility of the deceased’s creditors to file claims for payment from the estate with the probate court in the state where the deceased resided. Certain assets may pass to beneficiaries or spouses outside the estate and so they are not subject to claims against estate of the person who died. For example, if your relative had a life insurance policy and named you as the beneficiary, that money is yours, and cannot be taken by the deceased person's creditors. Retirement accounts left to a beneficiary are usually protected as well. Joint property you owned with the person who died may also be safe. What is probate? Probate is a legal process for administering the estate of someone who died. During probate, anyone who is owed money can file claims with the probate court requesting payment from the assets in the deceased’s estate. The "executor," or person managing the estate, pays as many of the valid claims as possible out of available assets. In many states, there are informal alternatives to the traditional probate process that allow an estate to be handled faster, and more informally. (These alternatives are also less expensive.) Also, some states allow small estates where there aren't many assets and the assets are not worth much - to avoid probate all together. Instead, the deceased persons debts are settled through a non-court process. You May Be Personally Responsible If... You may be personally liable for the debt of someone who has died in a couple of situations: You cosigned for the debt. You will be fully responsible for any joint debts after the other borrower dies. The person who died is your spouse. In this instance, you could have some obligation to pay his or her outstanding debts. If you live in a community property state: Alaska, Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin you may be responsible for debts incurred by your spouse during your marriage even if you did not cosign. A probate or estate planning attorney can help you determine whether that's the case. Of course, if your spouse left behind a large enough estate, all of those debts will get paid through the probate process. Warning! Don't get greedy!! When someone dies, his or her estate is supposed to go through the probate process (or some other state-approved process) during which as many of the deceased's debts as possible are paid out of the assets in his or her estate. Only after that happens, can any assets that may be left be distributed to the deceased's beneficaries. Therefore, if a relative of yours dies and you and your siblings (or some other relatives) decide to avoid the probate process so that there will be more of the deceased's estate for you to divide up among you, the creditors of the deceased may be legally entitled to come after you for the money they are owed. Who Handles the Debts? The tricky part for creditors and collectors has been trying to identify the person responsible for handling the financial matters of the estate when there is no formal probate process and no one has been named as executor. In some states, where a less formal process has been developed, the person handling the final matters of the estate will be called the "personal representative" though there are other names for that role. Don't be confused. Just because you are managing details like the funeral, that does not mean you are responsible for handling the deceased persons debts. Figure out who is going to be officially handling these matters and refer all creditor calls to that person. Once a debt collector has located the person acting as personal representative, executor or something similar, they must stop calling anyone else. Again, just because someone is named personal representative or executor, that does not make them personally responsible for the deceased persons debts. What If There Is No Money to Pay Debts? In this economy, many people will die with little or no assets available to pay debts. If there are no assets to pay that person's debts and a creditor or collector contacts you about paying them, you may want to simply send the creditor and/or collector a certified letter stating that fact and instructing the collector not to contact you again. (This is your right under the Fair Debt Collection Practices Act.) Once a debt collector receives your cease contact letter it must not contact you again, except to notify you of legal action (which may not happen if there is nothing left to go after.) If you aren't sure which assets of the deceased may be protected from creditors (a vehicle, savings, jewelry, bank accounts etc.) we recommend you talk with an attorney with experience in handling these kinds of issues. Are Debt Collectors Harassing You? The federal Fair Debt Collection Practices Act protects you when you are contacted by a debt collector about a debt owed by a loved one who has passed. Your state may also have a law that protects you. Talk with a consumer law attorney right away if a debt collector is: Pressuring you to pay debts of your relative that you are not sure you owe, Implying that you have a moral obligation to pay the debt, or that the person who died would have wanted you to pay the bill, Threatening you with legal action or other severe consequences, Harassing you or is saying negative things about you or the person who died, Refuses to verify the debt or send you anything in writing, Contacts you at the funeral or wake, or at another inappropriate place. Doing something that you just feel isn't right, and you need expert advice. If the collector breaks the law, you may be entitled to damages and the collection agency may have to pay your attorney's fees as well. That means the consumer law attorney may help you for free. Information provided by DebtCollectionAnswers.com. For more details, please visit their website.