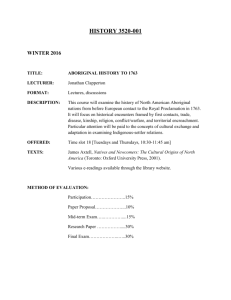

DOCX - UVic LSS

advertisement