Spring 01/02

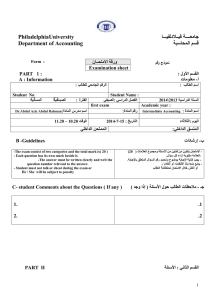

advertisement

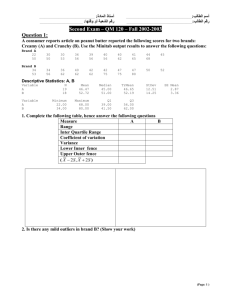

QM120_2S01 : أستاذ المادة : رقم الشعبة أو وقتها : اسم الطالب ____________________________________________________ __________________________ : رقم الطالب ____________________________________________________ __________________________ Second Exam – QM 120 - Spring 2001/2002 Question (1): A small drug store ordered copies of a news magazine for its magazine rack each week. Let X be a random variable that represents the demand for the magazine, with the following probability mass (density) function: X P(X=x) 1 1/15 2 2/15 3 3/15 4 4/15 5 3/15 6 2/15 o/w 0 (a) What is the expected demand for the magazine, its variance and its standard deviation? (b) What is the probability that the demand exceeds 4 magazines? ________________________________________________________________________________________________________________________________________________________________________________________________________________ (c) What is the probability that the demand is at most 3 magazines? ________________________________________________________________________________________________________________________________________________________________________________________________________________ (d) What is the probability that the demand is greater than 2 and less than 5 magazine? ________________________________________________________________________________________________________________________________________________________________________________________________________________ (e) Form the probability cumulative distribution function? X <1 1 2 3 4 F(X) 5 6 >6 Page: 1 QM120_2S01 Question (2): An investor has a portfolio of stock investments in Banks (B) and in Industrial (I) shares. He has monitored the prices of his portfolio investments for 180 days, and found: Banks (B) Industrial (I) Price movement of the shares Prices Prices did Prices went up not change went down (U) (F) (D) 60 30 20 40 15 TOTAL 15 TOTAL If a share type is chosen at random from his portifolio. Find the following: (1) The probability that the share price of that type went up in the last six months (180 days)? ________________________________________________________________________________________________________________________________________________________________________________________________________________ (2) What is the probability that the price of the chosen share did not change for the industrial type of shares in the last six months (180 days)? (3) Are the price movement and share type Mutually Exlusive? And why? (4) What is the probability that the chosen share is either from Bank shares or its price went down? (5) Find the probability of the event : ( F B )? (Show your work) Page: 2 QM120_2S01 Question (3): To investigate the impact of promoting certain product on the company’s sales, a sales engineer checked the company’s records for some statistical support. From the records, she found that the company has made promotion to 40% of its product in the past. From the records she also found that, if the company made promotion to its product before launching, there would 80% chance to make a sale within the first month after launching the product. However, if the company did not promote the product, there is a 90% chance of not making a sale within the first month after launching the product. Let “A” be the event that product is promoted and “B” is the event that a sale has been made. Draw the probability tree, hence answer the following questions: (1) Write down the sample space of this random experiment? ________________________________________________________________________________________________________________________________________________________________________________________________________________ (2) What is the probability that a sale was made? ________________________________________________________________________________________________________________________________________________________________________________________________________________ (3) If we know that a sale was made. What is the probability that the product was not promoted? (4) Are sale and promotion independent events? Justify (i.e. state your reasons)? Page: 3 QM120_2S01 Question (4): The following is the Minitab output of the numbers of computer terminals produced at certain company for a sample of 30 days: Raw Data: 20 21 22 23 23 23 23 24 25 26 26 27 27 27 27 28 28 28 29 29 31 31 31 32 33 33 33 34 35 35 The following is the output from MINITAB: Descriptive Statistics: terminal Variable terminal N 30 Mean 27.800 Median 27.500 TrMean 27.808 Variable terminal Minimum 20.000 Maximum 35.000 Q1 23.750 Q3 31.250 StDev 4.310 SE Mean 0.787 (1) Compute the inter quartile range of the number of terminals.? ________________________________________________________________________________________________________________________________________________________________________________________________________________ (2) Compute the value of the Lower Outer Fence of the Box Plot for the above data? (3) The following is the Box Plot of the number of terminals. Looking at the box plot, we conclude that the distribution of the number of terminals is: (a) Skewed to the left (c) Symmetric (b) Skewed to the right (d) None of the above (4) Compute the percentage of the number of terminals that lie between 2 standard deviations from the mean, hence discuss whether the data closly follow Chebyshev’s rule or the emparical rule? (5) What is the probability that the number of terminals in any day lies inside the box? ________________________________________________________________________________________________________________________________________________________________________________________________________________ (6) What is the probability that the number of terminals in any given day exceeds the Upper Inner Fence (UIF)? Page: 4