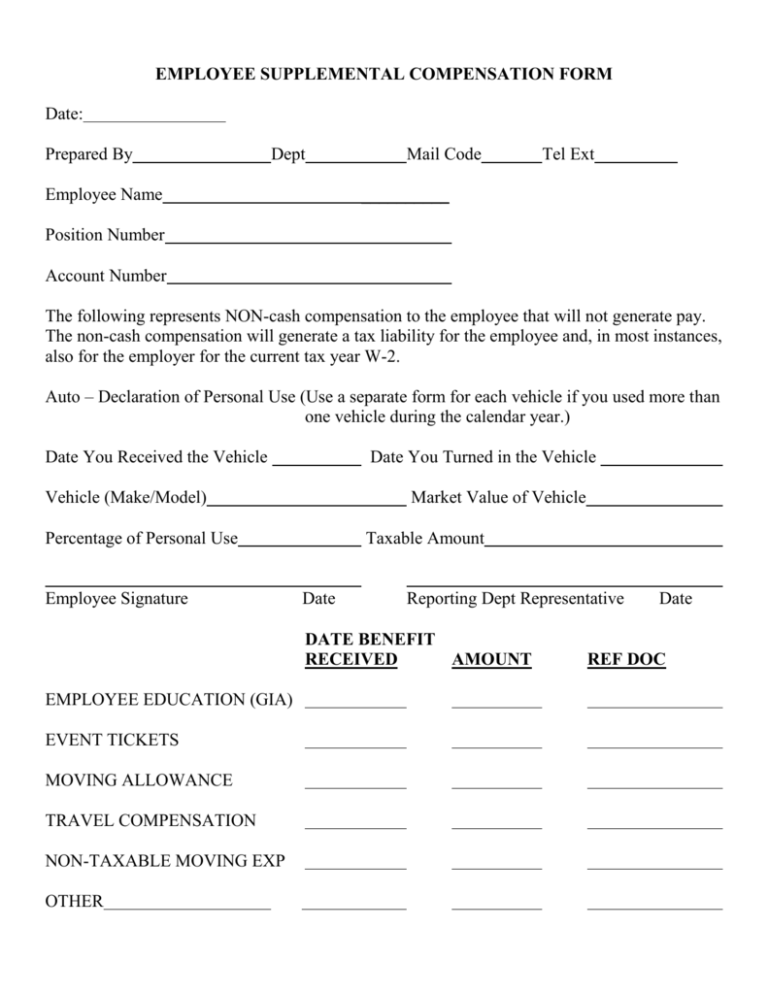

EMPLOYEE SUPPLEMENTAL COMPENSATION FORM

advertisement

EMPLOYEE SUPPLEMENTAL COMPENSATION FORM Date: Prepared By Dept Employee Name Mail Code Tel Ext __________ Position Number Account Number The following represents NON-cash compensation to the employee that will not generate pay. The non-cash compensation will generate a tax liability for the employee and, in most instances, also for the employer for the current tax year W-2. Auto – Declaration of Personal Use (Use a separate form for each vehicle if you used more than one vehicle during the calendar year.) Date You Received the Vehicle Date You Turned in the Vehicle Vehicle (Make/Model) Market Value of Vehicle Percentage of Personal Use Employee Signature Taxable Amount Date Reporting Dept Representative DATE BENEFIT RECEIVED AMOUNT EMPLOYEE EDUCATION (GIA) EVENT TICKETS MOVING ALLOWANCE TRAVEL COMPENSATION NON-TAXABLE MOVING EXP OTHER Date REF DOC