Practical Guide for Common Decision Logic: Cash Transfer

advertisement

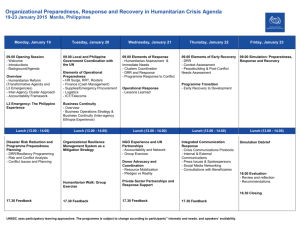

Practical Guide for Common Decision Logic Cash Transfer Programme in Emergency [April 2015] [BANGLADESH CASH WORKING GROUP] Abbreviations CP: Contingency Plan CTP: Cash Transfer Programme CWG: Cash Working Group EMMA: Emergency Market Mapping and Analysis HEA: Household Economic Approach PCMMA: Pre-Crisis Market Mapping and Analysis RAM: Rapid Assessment for Markets TK: Takka (Bangladesh Currency, 1USD≈TK78) Developed as part of ECHO funded Humanitarian preparedness and response through strengthened coordination, increased capacity and advocacy to deliver appropriate Cash Based Programming in the humanitarian sector in Bangladesh Purpose of the decision tool The purpose of this decision tree is to guide humanitarian responders of multi sector to draw logical conclusion for designing response programme based on market information collected through various market assessment tools, relevant to the context. The decisions tree can be used to make decision before and after crisis. The range of market analysis approaches, like Rapid Assessment for Markets (RAM); Emergency Market Mapping and Analysis (EMMA); Pre-Crisis Market Mapping and Analysis (PCMMA); etc can be used based on agency’s expertise and appropriateness. For the first week market related information can be gathered using 48-hrs need assessment tool as well. This document is not designed to help the reader understand how to do the Need assessment, market analysis, cash feasibility and cash risk assessment. However, the logical decision on appropriate response rely on these standard process of doing Need assessment, market analysis, cash feasibility and cash risk assessment. Who are the target users? The document has two broad sections-the narrative part and the decision flow chart. The narrative part helps the reader understand the flow chart better and also provide key questions to proceed with the decision logic. Hence, the market practitioners with limited understanding of cash and market programme will find the guide helpful only if they go through both the parts. Reader with good cash and market understanding may skim through the second part for making quick decision based on market information. When to use this guidance? The decision tree can be used before crisis for developing market to make it resilient to recurring crisis in the area; understanding possible impact on market system for better preparedness; invest on traders and partners capacity building on various modalities of CTP; and improve contingency planning. It can also be used after crisis to quickly design a response programme that doesn’t undermine people’s dignity and harm local market system. In contexts where government restrictions affect the implementation of a response that is seen to be appropriate, (e.g. cash interventions in some countries are not seen favourable despite markets functioning) then the use of the Decision Tree can be limited. The following section will follow the phases shown in the flow chart and contains brief outline of what needs to be done in each phase to come into logical conclusions. Phase 1: Preparedness & contingency planning Market assessment during normal time can be done based on the Pre-crisis market assessment (PCMMA) guide available at http://emma-toolkit.org/practice/pre-crisismarket-mapping-and-analysis/ Key questions to be investigated What are the most likely shocks and threats that the population may face in the future? Who are the most vulnerable groups? What are the most critical needs of the target groups? How is the seasonal fluctuation in terms of demand and supply of the critical needs? What are the most likely impact of the likely shock and threat on the market system? What need to be done to make the market system help target group? Are the traders familiar with voucher system? Does the partner have sufficient expertise on CTP? Vulnerable or target group can be identified by doing livelihood and wealth ranking adapting Household Economic Approach (HEA). For detail visit http://www.heawebsite.org/about-household-economy-approach Collecting information with reference to above broad questions will lead towards understanding whether local market system has capacity to supply required quality and quantity of goods/services; understand experience of traders and partners in CTP and identify vulnerable groups to be targeted before and after crisis. Having these understanding there will be two different response options. Response option 1: The option is appropriate if the local market system doesn’t have sufficient capacity and there is a need for strengthening market system to make it resilient. Thus, there is a need to involve development team for interventions focusing on market development projects. Consideration should be given to increase adaptability of market system to the potential risk from likely shock or threat. Such interventions could be one or more intervention(s) from following non-exhaustive list: Start enterprise development project on the most critical needs of the target group(s) Value chain development interventions to hit the log jam Map alternative market place Enhance market integration by linking local market to the neighbouring markets Support to productive and sustainable agriculture Employment creation programme Enrich contingency plan with market information and prepare necessary annexes for price monitoring, complaint handling, agreement with third party, etc. Response option 2a: If the local market system can supply required quantity and quality of goods/services as and when required then implementing market integrated projects would help strengthen market system. Partners and the beneficiaries need to be familiar with various modalities and enhance their capacity to implement Cash Transfer Programme (CTP) at scale in case of crisis. The interventions could be one or more of the following: Conditional cash grant or Cash for Work for vulnerable families through partners and pure traders Mapping of vendors, their supply and stock capacity and framework agreement with potential suppliers of emergency goods and services Voucher programme to ensure traders and partners familiarity with voucher transfer modalities Cash distribution to vulnerable households by using different delivery instruments Market fair in coordination with local traders Enrich contingency plan with market information and prepare necessary annexes for price monitoring, complaint handling, agreement with third party, etc. PS: While choosing either of the options the project need to mainstream Disaster Risk Reduction for reducing impact of likely shock or threat to the market system and should prepare a contingency measures to cope with forecasted crisis. Developed as part of ECHO funded Humanitarian preparedness and response through strengthened coordination, increased capacity and advocacy to deliver appropriate Cash Based Programming in the humanitarian sector in Bangladesh Phase 2: Assessment and analysis Assess type and quantity of goods/services needed by the target group in the aftermath of crisis, duration and scale of needs. This need assessment can be done by using multi sectoral tool or sector specific tool based on the agency priority. Apart from need assessment it is important to understand the situation of local market. In the first week this can be assessed by using part of 48 hrs tool (available at http://www.ecbproject.org/ecb/efsl-48-hour-assessment-tool) or in case of more than a week by using EMMA (see emma-toolkit.org) or any other market analysis approach that the organization is comfortable with. Key questions to be investigated 1 Are the goods and services that people needs are available in local market? 2 Is local market able to respond to an increased demand for commodities? 3 What is the gap for goods and services that affected people need? The market situation can be at one of the four different situations; Scenario 1: Local Market System can supply goods/services to meet the need Scenario 2: Local Market System can supply goods/services within a week to meet the need Scenario 3: Local Market System has limited capacity & need support to supply goods/services to meet the need Scenario 4: Local market has no capacity even with support PS: One scenario for a particular item or commodity doesn’t necessarily means the same for others. Eg. If the market is green for rice, it is not necessarily green for hygiene kit. The above scenarios are represented in the form of market traffic light, with Scenario 1&2 as Green; Scenario 3 and 4 as amber and red, respectively. The CTP best fits into the Green and Amber situations while the response should be in-kind if the market situation is at Red. If the market is in Green or Amber the need and market assessment should be coupled with cash feasibility assessments. The cash feasibility assessment will give an idea about potential delivery mechanism that would be appropriate to the context. The final decision should consider the cash risk analysis. The cash feasibility assessment should explore Financial institutions capacity; Functionality and accessibility to the technology; Organizational capacity to implement CTP and manage risk and; Social issues and beneficiaries’ preference of cash over in-kind or vice versa Key questions to be investigated Can cash be delivered and spent safely? What might the entry points for a response be? Could our response harm the market? Might there be multiplier effects for markets? Anticipate risks (inflation, price distortion, security) Based on context, beneficiaries preferences and cost and other practical challenges the humanitarian agency might choose to deliver cash through following mechanisms; Bank* Mobile phones** Retailers Directly in an envelop Phase 3: Risk analysis In situations when market conditions are at green/amber and CTP is found to be feasible option, the agency should do the risk assessment considering the risk to the beneficiaries, agency and its staff that may arise due to institutional, programmatic or contextual risks. The response action by an organization; selection of CTP modalities and delivery mechanism are influenced by organization’s ability to take risk. Understanding risk will allow us to manage or control it. The good response programme shall look at possibility of mitigating risk through each CTP modality (both conditional and unconditional cash grant; Cash for Work; and cash/value voucher and commodity voucher) and various delivery mechanisms before choosing the best one or the combinations. The response decisions need to balance the risk and urgency of need for cash. Phase 4: Response options analysis The response options analysis is the stage to decide on programme design to meet the needs through logical conclusion based on phase 2 and 3. The pre-crisis response options influence speed and efficiency of response in the post-crisis situation. Response option 2b: When the market after crisis can supply goods/services to meet the needs immediately (Scenario 1) or within a week (Scenario 2) and CTP is feasible and safe then market integrated response would best fit with the context. One week is considered to be the time required for the response implementation and for the cash received by the beneficiaries to reach market. Hence, practically, the scenario 2 is temporary phase and market situation will be at Scenario 1. Hence, both scenarios follow the same response option. The interventions could be one or more of the following: Cash grant or Cash for Work for affected families through partners and pure traders Voucher programme Market fair involving local traders Response option 3: When the local area market has some capacity but needs support to supply the commodities/services to quantity and to quality to address target groups’ needs (Scenario 3) then supporting local traders would turn Amber to Green, if not supported then Amber market situation may turn into Red as the time passes. The interventions in this situation would be one or more of the following: Support beneficiary traders (loan, grant, transport subsidies, temporary storage, rehabilitation of ware house, etc) to rebuild market Distribute cash through beneficiary traders Voucher programme through beneficiary traders *Currently, using Bank to deliver cash in Bangladesh has several challenges as there is no provision for zero balance account & opening an account is complicated. This would require advocacy by the humanitarian agencies to influence policy. However, Bank or other financial service providers can still facilitate cash distribution through their branches or agents. **Most common form of delivering cash through third party in Bangladesh, despite having mobile bank account is lengthy process and the maximum cash that can be transferred using mobile is TK30,000. The cases of agent charging commission from beneficiaries have been reported in several instances. Developed as part of ECHO funded Humanitarian preparedness and response through strengthened coordination, increased capacity and advocacy to deliver appropriate Cash Based Programming in the humanitarian sector in Bangladesh Response option 4: When the market has the capacity to provide required quantity and quality of goods/services with or without support but the providing cash is adding risk to the beneficiaries then the response to bringing back market to the affected community would be the best option. The risk to the community is not only security risk; it can also be the risk to their livelihood needs. For example if the beneficiaries has to pay high transport fare to use their cash in local market providing cash would encourage them to sell their productive assets while coming to the market to buy goods/services that is needed. Possible interventions under response 4 are: Purchase commodities from the local market and distribute Organize market/voucher fair Response option 5: When the local market doesn’t have capacity to supply required goods or services, even with the support then the supply need to be done from the market outside the regular market for affected people. However, the agency should look at possibility of buying from the neighbouring market. The procurement will require agency to follow standard procurement policy. Developed as part of ECHO funded Humanitarian preparedness and response through strengthened coordination, increased capacity and advocacy to deliver appropriate Cash Based Programming in the humanitarian sector in Bangladesh Pre-Crisis Market Assessment (PCMMA) Response option 1 Response option 2a <Phases> 1. Preparedness & contingency planning Consider market integrated projects to increase knowledge of staff and traders - Deliver Cash to the vulnerable families through partner/pure traders - Improve your Contingency plan with market information (include ready to use annex in CP) - Coordinate with Development team to Design and implement market development projects on selected Critical Local Market System can supply required quality and quantity of goods/services Yes -Commodity/Cash Voucher No goods/services -Map out alternative market place and facilitate market integration (linkage with neighbouring market) CRISIS 2. Assessment & analysis Need Assessment Local Market System can supply goods/services to meet the need Market Assessment No Local Market System can supply goods/services within a week to meet the need No Local Market System has limited capacity & need support to supply goods/services to meet the need Yes Yes Cash feasibility assessment (Financial institutional capacity; technology; Cash Risk Analysis organizational capacity; social issues and beneficiaries’ preference) 3. Risk Analysis Cash Risk Analysis Yes Both men and women have easy and safe access to local market Response options Response option 2b analysis No Consider market integrated projects - deliver Cash to the vulnerable families through partner/pure traders -Commodity/Cash Voucher Local market has no capacity even with support No Response option 3 Response option 4 Response option 5 - Support beneficiary traders to rebuild market -distribute cash through beneficiary traders -voucher prog through beneficiary traders -Purchase commodity from the local market and distribute -Organize market/voucher fair -Purchase commodity from Continue Market monitoring till it is green to switch to Response option 2/4 (sometime it may change to red to inform response option 5) Figure: Decision flow chart for multi cluster Cash Transfer Programming neighbouring market (localregional-national-international) and distribute (In-Kind support) Legend Refer to the document (in this case the narrative part) Intermediate process Pre-defined process Start/end Decision Developed as part of ECHO funded Humanitarian preparedness and response through strengthened coordination, increased capacity and advocacy to deliver appropriate Cash Based Programming in the humanitarian sector in Bangladesh This guideline is the product of ECHO funded project entitled “Humanitarian preparedness and response through strengthened coordination, increased capacity and advocacy to deliver appropriate Cash Based Programming in humanitarian sector in Bangladesh”. The guideline was developed with the active participation of member organizations in the Cash Working Group, Bangladesh. The participating members (GRC, WFP, FAO, Oxfam, Care, Christian Aid, Concern World-wide, Plan,.............) contributed to bring this guide to the current shape by giving their inputs during the workshop held on 31 March-01 April, 2015 in Dhaka. The discussion was facilitated by Rajesh Dhungel, Regional Capacity Builder from Oxfam in Asia and Eun Jung Yi, Technical Coordinator for CWG, Bangladesh and contributed to bring this product for your refence. Developed as part of ECHO funded Humanitarian preparedness and response through strengthened coordination, increased capacity and advocacy to deliver appropriate Cash Based Programming in the humanitarian sector in Bangladesh