Comparison of Delegation of Powers * FMA Act to PGPA Act

advertisement

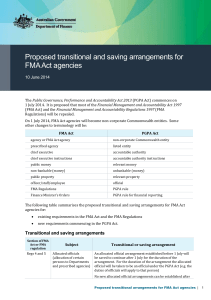

Comparison of Delegation of Powers – FMA Act to PGPA Act Delegation under PGPA Act and Rules Delegation under FMA Act and Regulations Comments Banking Section 53(1): banking by the Commonwealth in Australia – non-Finance accountable authorities (non-corporate) Section 53(1): banking by the Commonwealth outside Australia – various non-Finance accountable authorities (non-corporate) Banking Section 8: to enter into arrangements with banks – non-Finance chief executives Section 8: to enter into arrangements with banks – Future Fund chief executive Section 8: to enter into arrangements with banks (overseas) – various chief executives Section 9: to open and maintain bank accounts in Australia – non-Finance chief executives Section 9: to open and maintain bank accounts in Australia – Future Fund chief executive Section 9: to open and maintain overseas bank accounts - various chief executives The Finance Minister’s banking powers under the PGPA Act are similar to the powers under the FMA Act. The proposed delegation for bank accounts in Australia has been streamlined, with the detailed banking processes removed from the delegation instrument and included instead in a separate draft guidance document. Borrowing Section 56(2): for overseas overdrafts – DFAT accountable authority Section 56(2): for credit cards – non-Finance accountable authorities (non-corporate) Borrowing Section 38(1) for overseas overdrafts: DFAT chief executive Section 38(2) for credit cards: non-Finance chief executives The Finance Minister’s powers to borrow on behalf of the Commonwealth under the PGPA Act are unchanged from those under the FMA Act. No change to the current delegation is proposed. All accountable authorities can enter into arrangements for the use of Commonwealth credit cards and the accountable authority of the Department of Foreign Affairs and Trade has the additional power in relation to overseas overdrafts. Investment Section 58: various non-Finance accountable authorities (non-corporate) Investment Section 39: various chief executives The Finance Minister’s powers to invest on behalf of the Commonwealth under the PGPA Act are unchanged from those under the FMA Act. No change to the current delegation is proposed where selected accountable authorities have been given the power to invest in relation to specified special accounts. Indemnities Section 60: non-Finance accountable authorities (non-corporate) (up to specified thresholds) The delegation to open and maintain bank accounts outside Australia has been tightened to limit this power to countries specified in the instrument rather than the current broad power to open and maintain bank accounts overseas generally. The PGPA Act contains a new power of the Finance Minister for giving indemnities, guarantees, and warranties on behalf of the Commonwealth. It is proposed to delegate the power to enter into routine, low risk indemnities to accountable authorities. This is consistent with the current delegation under FMA Regulation 10 for indemnities except that the threshold has been increased from $20m to $30m to bring it into line with current Budget thresholds. Other differences to the current delegation under FMA Regulation 10 are: (a) to allow accountable authorities to give indemnities above the specified thresholds 1 Comparison of Delegation of Powers – FMA Act to PGPA Act Delegation under PGPA Act and Rules Delegation under FMA Act and Regulations Comments without the approval of the Finance Minister where the indemnities have been explicitly agreed by Cabinet; and (b) no restrictions on the length of the timeframe of the arrangement containing the indemnity has been proposed in the delegation (currently 22 years for departmental items and 10 years for administered items under FMA Regulation 10), consistent with the principle that only significant items (in terms of risk and amount), will need the Finance Minister’s approval. Waiver of debts Section 63(1): ASIC and Comsuper accountable authorities Section 63: non-Finance accountable authorities (payments by instalments of deferral of time only) Waiver of debts Section 34(1)(a): ASIC and Comsuper chief executives Section 34(1)(c): non-Finance chief executives Section 34(1)(d): non-Finance chief executives Like section 34 of the FMA Act, the PGPA Act provides the Finance Minister with the power to waive an amount owing to the Commonwealth or otherwise modify the terms and conditions on which the amount is to be paid. No substantive change is proposed to the current delegation of the Finance Minister’s power. All non-corporate Commonwealth entity accountable authorities can modify the terms of payment of an amount owing to the Commonwealth. In addition, the accountable authorities of the Australian Securities and Investments Commission and ComSuper have limited powers to waive debts. It is proposed that the interest rate required to be applied to outstanding amounts be increased to the 90 day bank-accepted bill rate (it is currently ‘the 90 day bank-accepted bill rate ...less 10 basis points’) to better reflect the opportunity cost of unpaid amounts due to the Commonwealth. Gifts Section 66*: non-Finance accountable authorities (non-corporate) *There is a proposed amendment to section 66 of the PGPA Act which would provide the Finance Minister with the power to authorise the gifting of relevant property for non-corporate Commonwealth entities. This would provide the Finance Minister with the same power currently provided under the FMA Act. Gifts Section 43(b): non-Finance chief executives The proposed delegation of this power is slightly broader in scope than the current FMA delegation in that it allows accountable authorities to gift low value, surplus items where it is: (a) uneconomical to otherwise dispose of them, or (b) it is consistent with Commonwealth policy objectives. Accountable authorities will need to apply this power in the context of their broader duties under the PGPA Act (e.g. the duty to promote the proper use and management of public resources), and the requirement under the delegation not to set an undesirable precedent. 2 Comparison of Delegation of Powers – FMA Act to PGPA Act Delegation under PGPA Act and Rules Payment of amount owed at time of death Section 25 (Rule): non-Finance accountable authorities (non-corporate) Delegation under FMA Act and Regulations Comments Outsiders handling public money Section 12: non-Finance chief executives ‘Outsider’ arrangements under section 12 of the FMA Act are now dealt with under the ‘other CRF money’ provisions in the PGPA framework (section 105 of the PGPA Act and section 29 of the draft PGPA Rule). These provisions place requirements on accountable authorities rather than providing the Finance Minister with a power. No delegation is required. Drawing Rights (issuing, revoking or amending) Section 27(1)&(4): non-Finance chief executives Delegations for drawing rights (FMA Act section 27) are not required as they are not a feature of the PGPA framework. Accountable authorities will be responsible for ensuring appropriate internal controls are in place for their entities for making payments under the PGPA framework. Arrangements for which there is insufficient appropriation Regulation 10: non-Finance chief executives (up to specified thresholds) No direct replacement of this requirement under the PGPA framework, but see: Payments pending probate Regulation 30: non-Finance chief executives There is no proposed change to the delegation of the power to make payments of amounts owed to persons at the time of their death (section 25 of the PGPA Rule and FMA Regulation 30). (a) above for the new requirement for indemnities under PGPA Act section 60, and (b) the duties of accountable authorities. The PGPA Act places principles-based requirements for financial management on all accountable authorities. This includes the duty to govern the entity (PGPA Act section 15), which includes promoting the financial sustainability of the entity and considering the effect of decisions on public resources generally. The draft guidance material issued by Finance for section 15 points out that in meeting these obligations, an accountable authority should consider whether proposed commitments can be met from known appropriations, and whether, by entering into long-term commitments, they are locking away future flexibility to accommodate new policy and program priorities. The accountable authority would be expected to implement internal controls to support this duty (PGPA Act section 16). 3