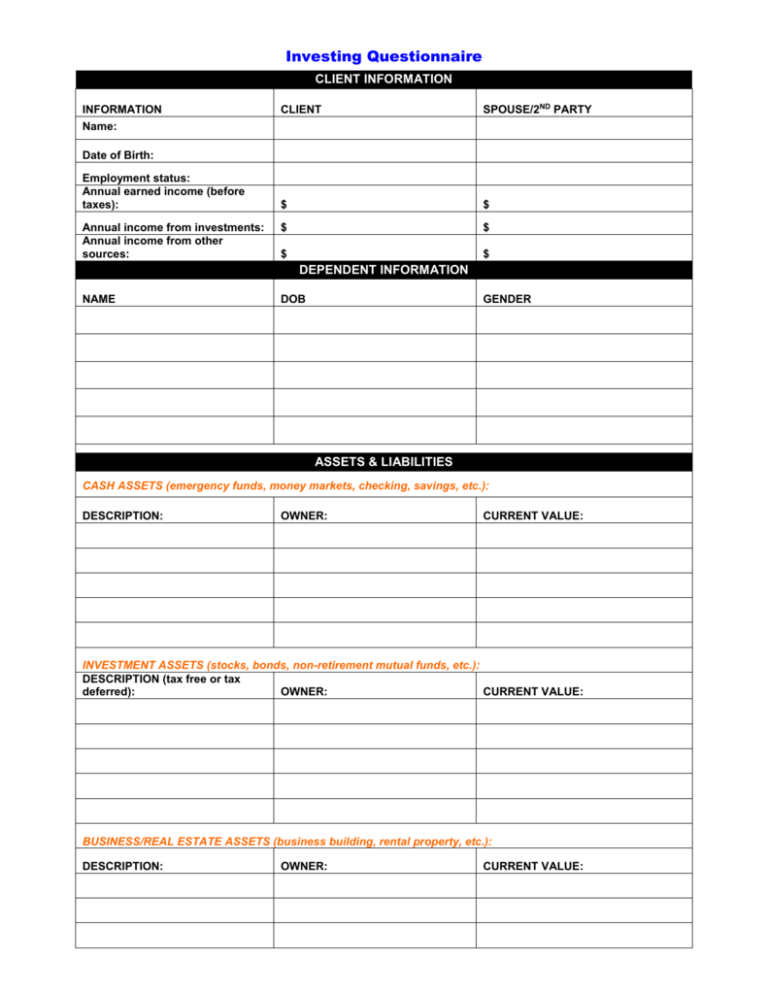

Investing Questionnaire

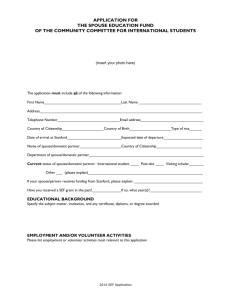

advertisement

Investing Questionnaire CLIENT INFORMATION INFORMATION CLIENT SPOUSE/2ND PARTY $ $ $ $ Name: Date of Birth: Employment status: Annual earned income (before taxes): Annual income from investments: Annual income from other sources: $ $ DEPENDENT INFORMATION NAME DOB GENDER ASSETS & LIABILITIES CASH ASSETS (emergency funds, money markets, checking, savings, etc.): DESCRIPTION: OWNER: CURRENT VALUE: INVESTMENT ASSETS (stocks, bonds, non-retirement mutual funds, etc.): DESCRIPTION (tax free or tax deferred): OWNER: CURRENT VALUE: BUSINESS/REAL ESTATE ASSETS (business building, rental property, etc.): DESCRIPTION: OWNER: CURRENT VALUE: PERSONAL ASSETS (home, 2nd home, jewelry, art, etc.): DESCRIPTION: OWNER: CURRENT VALUE: STOCK OPTIONS of a publicly traded company: DESCRIPTION: OWNER: CURRENT VALUE: RETIREMENT ASSETS OF CLIENT (401-k, 403-b, SEP, Roth IRA, Traditional IRA, etc.): CURRENT ANNUAL EMPLOYER TYPE: VALUE: ANNUAL CONTRIBUTION: CONTRIBUTION: RETIREMENT ASSETS OF SPOUSE/2ND PARTY (401-k, 403-b, SEP, Roth IRA, Traditional IRA, etc.): ANNUAL EMPLOYER TYPE: VALUE: ANNUAL CONTRIBUTION: CONTRIBUTION: Liabilities/Debt Obligation (consumer loans, automobile loans, mortgages, home equity loan, etc.): RESPONSIBLE CURRENT MONTH TYPE: PARTY: BALANCE: PMNT: % RATE TAX DEDUTCTIBLE? $ $ Yes: No: $ $ Yes: No: $ $ Yes: No: $ $ Yes: No: $ $ Yes: No: INCOME PROTECTION Life Insurance - CLIENT: TYPE: OWNER: BENEFICIARY: DEATH BENEFIT: CASH VALUE: ANNUAL PREMIUM: $ $ $ $ $ $ DEATH BENEFIT: CASH VALUE: ANNUAL PREMIUM? $ $ $ $ $ $ Life Insurance – SPOUSE/2ND PARTY: TYPE: OWNER: How important is it to provide financial resources for your spouse, dependents, or others, in the case of your death? BENEFICIARY: Very Somewhat Neutral Somewhat unimportant Unimportant SPOUSE/2ND PARTY: CLIENT: Do you have a plan, at work, or individually, which provides continuing income if you are unable to work due to accident or illness? YES: What %age of your income will be replaced by this plan? __________% __________% How many years of coverage does this plan provide? __________Years ___________Years CLIENT: < 8 weeks months SPOUSE/2ND PARTY: < 8 weeks months How long could you live on your current assets in the event you become disabled or suffer a prolonged illness? NO: YES: 2-6 6-12 months >1 NO: 6-12 months 2-6 > 1 year year How important is it to replace your earned income in the event you become disabled or suffer a prolonged illness? Are you financially prepared for high costs associated with long life in retirement, such as longterm care? Do you have any parents, siblings, etc., that may become your financial dependent? How important is it to provide long-term care funding for you, your spouse, or our dependents? Very Somewhat Neutral Unimportant Yes No Yes No Very Somewhat Neutral Unimportant FINANCIAL CONCERNS CLIENT: No will When did you last review your will? 3-7 Years SPOUSE/2ND PARTY: No will < 3 Years > 5 Years 3-7 Years < 3 Years > 5 Years How important is it to reduce or eliminate your debt? Very Unimportant Somewhat Neutral How important is it to consolidate your debt? Very Somewhat Neutral Somewhat Neutral Somewhat Neutral Somewhat Neutral Somewhat Neutral Unimportant How important is it to accumulate funds for future goals besides retirement and education goals? Very Unimportant How important is it for you to have assistance in reviewing your different IRA choices, i.e., Roth vs Traditional, etc.? Very Unimportant How important is it for you to have assistance in moving retirement funds from a previous employer? Very Unimportant How important is it for you to have assistance in reviewing your investments? Very Unimportant RETIRMENT PREPARATION What age do you CLIENT: ____________ want to retire? On average, what percentage of your combined income (after tax) do you feel you will need when you retire to live comfortably? How much impact do you feel inflation will have on your retirement? SPOUSE/2ND PARTY: ____________ ___________________% Major Some SPOUSE/2ND PARTY CLIENT If you are employed, does your employer provide a defined benefit pension plan? Yes Not sure No Yes No EDUCATION PLANNING & LIFE EVENTS Do you plan to (help) fund the educational needs of your children, etc.? Approximately what amount of money do you anticipate needing to fund these college/graduate school needs? Do you feel you are adequately prepared to fund these needs? Do you anticipate any of these life changing events in the next year? Yes $_____________College No $_____________Graduate School Yes No Please circle: Change of employment Starting a new business Birth of a child Dependent entering college Major (home, etc.) purchase Retirement RISK TOLERANCE Do you agree with the statement “reducing losses is more important than receiving high returns?” How comfortable are you with risk? Strongly agree Agree Somewhat disagree Lower risk/lower return Disagree Moderate risk/moderate return High risk/higher return How would you describe your investment philosophy? I want my investments to consistently generate a steady return. (This usually translates to a low level of risk tolerance.) I am not concerned about periodic fluctuations and understand that this could mean some large losses. (This usually translates to a medium level of risk tolerance.) I am comfortable with a portfolio that will lose and regain value, over time, with an understanding that, overall, the rate of return will be higher than average. (This usually translates to a high level of risk tolerance.) If the value of your investments fell 20% in one year, what would your reaction be? I would be inclined to move my money in to a different investment. I would be concerned and consider moving my money in to a different investment. I would leave my money alone and continue to invest according to my long-term plan. I would leave my money alone and probably invest more. What life stage of investing are you currently in? Early years Middle years High income & savings years Early retirement years Retirement