Mr. Maurer Name: AP Economics (Macro) Chapter 16 – Final

advertisement

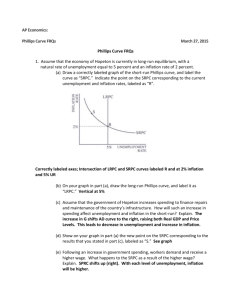

Mr. Maurer AP Economics (Macro) Name: __________________________ Chapter 16 – Final Problem Set (Quiz Review) 1. What does the short-run Phillips curve indicate about inflation and unemployment? There is an inverse relationship between the two, or there is a “trade-off” between employment and inflation in the short run. 2. What is the most likely cause of “stagflation” – that is, a rise in the price level and in unemployment (or a rise in price level with no decrease in unemployment)? A negative supply shock (which causes cost-push inflation). 3. What effect will an advance in technology that improves productivity have on long-run aggregate supply? It will shift the LRAS to the right. Nominal wages will increase due to the higher price level and low unemployment. This will shift SRAS to the left as companies’ costs increase. 4. Explain the process by which the economy depicted in the graph above will be restored to long-run equilibrium. Write your answer in the spaces next to the graph. 5. An economy is in short-run equilibrium at less than full employment. What will happen to output level and price level in the long run? Output level will return to full employment output. Price level will drop. 6. If aggregate demand decreases, what will be the long-run effect on prices and output? Prices will drop, but output will not change in the long run. 7. How will the short-run Phillips curve reflect an increase in aggregate demand? (Hint: draw it if you have to.) The short-run Phillips curve will show a movement up and to the left (toward higher inflation and lower unemployment). That is, it will be a movement along the curve to a point higher and to the left. 8. The short-run Phillips curve predicts that lower inflation rates will bring what? Higher unemployment. 9. For an economy in long-run equilibrium with an upward-sloping short-run aggregate supply curve, what effect will an adverse supply shock have on the following in the short run? a. price level ______Increase_________________________________ b. nominal wages ________No change (they never change in the short run)___________ c. real wages ____Decrease___________________________________ 10. Fiscal or monetary policies designed to reduce demand-pull inflation will have what effect (increase, decrease, or none) on each of the following in the short run? a. Real GDP ______Decrease______________________________ b. Price level _____________Decrease_______________________ c. Unemployment ___Increase_____________________________ d. Nominal Wages ____No change___________________________ 11. According to the Phillips curve, what is the relationship between inflation and unemployment in the long run? There is no relationship in the long-run. 12. Draw an AD/AS graph that shows an economy in long-run equilibrium. Now indicate the changes caused if workers’ wages increase faster than productivity. Explain the changes you drew on your graph. What happens to output and price level in the short run? 13. What type of inflation is most likely to be caused by an adverse (or negative) supply shock? Cost-push inflation. 14. What type of curve is pictured at left? Be specific. Short-run Phillips curve. 15. What would be the effect of a positive supply shock (sudden reduction in input costs or a sudden increase in productivity) on output and price level? Draw an AD/AS graph that represents a positive supply shock. Output goes up, price level goes down. Graph at left. 16. Assume the economy is in long-run equilibrium. A change in aggregate demand will cause a change in which one (and only one) of these in the long run (circle your choice). Output Price level Unemployment 17. Assume the economy is in equilibrium. If aggregate demand increases, what will be the effect on nominal interest rates and bond prices? Explain. Nominal interest rates will increase due to the increased inflation. Lenders must raise nominal interest rates to maintain real interest rates. Bond prices will decrease because they are inversely related to interest rates. 18. What does the long-run Phillips curve say about the relationship between inflation and unemployment? No relationship. 19. The graph at left shows the macroeconomic conditions of Wattsonia. Many economists estimate that the natural rate of unemployment is 6 percent. If this is true and the current rate of unemployment is 5.1 percent, in what range of real gross domestic product is the economy currently producing? Provide your answer in terms of Y1 and/or Y2. Output would be greater than Y2 because unemployment is lower than the natural rate. 20. What causes “stagflation?” Cost-push inflation or a negative supply shock. 21. The economy of Yilandia is currently in short-run equilibrium as shown at left. Describe the process by which the economy will return to long-run equilibrium in the absence of government intervention. Wages will fall due to high unemployment and lower prices, SRAS will shift to the right. Output will increase, prices will fall. 22. How will a favorable supply shock, for example a decrease in the price of oil, affect price level and output in the short-run? Price level will decrease, output will increase. 23. Which of the two graphs above (left or right) demonstrations conditions likely to lead to stagflation? The graph on the right. Stagflation is caused by an adverse supply shock (an leftward shift of aggregate supply). 24. According to the long-run Phillips curve, what effect do monetary and fiscal policy that change aggregate demand have on the natural rate of unemployment? No effect. Mr. Maurer AP Economics (Macro) Name: __________________________ Unit 4: The Extended AD/AS Model FRQ #6 25. The unemployment rate in the country of Southland is greater than the natural rate of unemployment. (a) Using a correctly labeled graph of aggregate demand and aggregate supply, show the current equilibrium real gross domestic product, labeled YC, and price level in Southland, labeled PLC. The president of Southland is receiving advice from two economic advisers—Kohelis and Raymond—about how best to reduce unemployment in Southland. (b) Kohelis advises the president to decrease personal income taxes. (i) How would such a decrease in taxes affect aggregate demand? Explain. (ii) Using a correctly labeled graph of the short-run Phillips curve, show the effect of the decrease in taxes. Label the initial equilibrium from part (a) as point A, and the new equilibrium resulting from the decrease in taxes as point B. (c) Raymond advises the president to take no policy action. (i) What will happen to the short-run aggregate supply curve in the long run? Explain. (ii) Using a new correctly labeled graph of the short-run Phillips curve, show the effect of the change in the short-run aggregate supply you identified in part (c)(i). (a) – see graph at left (b)(i) – Aggregate demand would increase as consumers have more disposable income. (b)(ii) – See graph bottom left. (c)(i) – It will shift to the right as nominal wages drop in response to high unemployment. This will lower firms’ costs. (c)(ii) – See graph below, the short-run Phillips curve will shift to the left as lower rates of inflation now become the norm for full employment output.