Figure 12.6

advertisement

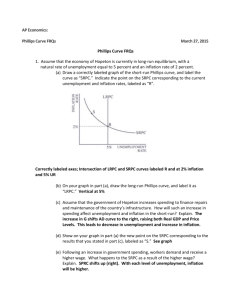

Numerical Problems 1. Since the natural rate of unemployment is 0.06, e – 2(u – 0.06), so u – 0.06 0.5( e – ), or u 0.06 0.5( e – ). (a) Year 1: u 0.06 0.5(0.08 – 0.04) 0.06 0.02 0.08. The unemployment rate is 0.02 higher than the natural rate. The percentage that output falls short of full-employment output is 2 0.02 0.04, or 4%. Year 2: u 0.06 0.5(0.04 – 0.04) 0.06. The unemployment rate equals the natural rate, since inflation equals expected inflation. Since unemployment is at its natural rate, output is at its full-employment level. Since the output loss was 4 percentage points and inflation declined by 8 percentage points, the sacrifice ratio is 4/8 0.5. (b) Use equations: u 0.06 0.5( e – ), output shortfall 2 (u – 0.06). Year e u u – 0.06 Output Shortfall 1 2 3 4 0.08 0.04 0.04 0.04 0.10 0.08 0.06 0.04 0.07 0.08 0.07 0.06 0.01 0.02 0.01 0.0 0.02 0.04 0.02 0.0 The total output shortfall is 0.02 0.04 0.02 0.0 0.08 8-percentage points of output lost. Inflation fell by 8 percentage points. So the sacrifice ratio is 8/8 1. Notice that, compared with part a, the sacrifice ratio is higher, for this slower disinflation. 2. (a) Equating aggregate demand to short-run aggregate supply gives: 300 10(M/P) 500 P – Pe, or 300 (10 1000/P) 500 P – 50, or 10,000/P 150 P. Multiplying both sides of the equation by P and rearranging gives P2 150P – 10,000 0, which can be factored as (P – 50) (P 200) 0. This has the nonnegative solution P 50. Since Pe is also 50, the expected price level equals the actual price level, so output is at its full-employment level of 500 and the unemployment rate is at the natural rate of 6%. These are the long-run equilibrium values of the three variables as well. (b) When the nominal money supply increases unexpectedly to 1260, we again equate aggregate demand to short-run aggregate supply, which gives: 300 10(M/P) 500 P – Pe, or 300 (10 1260/P) 500 P – 50, or 12,600/P 150 P. Multiplying both sides of the equation by P and rearranging gives P2 150P – 12,600 0, which can be factored as (P – 60)(P 210) 0. This has the nonnegative solution P 60. When P 60, the short-run aggregate supply curve gives Y 500 P – Pe 500 60 – 50 510. Output of 510 is 2% above full-employment output of 500, because (510 – 500)/500 0.02. With a natural unemployment rate of 0.06, Okun’s Law gives 0.02 – 2(u – 0.06). This can be solved to get u 0.05. In the long run, Pe adjusts to equal P, output adjusts to its full-employment level of 500, and unemployment adjusts to the natural rate of 0.06. To find P, use the aggregate demand curve to get 500 300 10(1260/P), or 200 12,600/P, which can be solved to get P 63. The results of this exercise are consistent with the existence of an expectations-augmented Phillips curve. Unexpected inflation reduces unemployment in the short run. In the long run, however, inflation is higher and unemployment returns to its natural rate. 3. (a) 0.10 – 2(u – 0.06) 0.22 – 2u. This is shown as the Phillips curve labeled PCa in Figure 12.6. If the Fed keeps inflation at 0.10, then u 0.06, the natural rate of unemployment. Figure 12.6 (b) With expected inflation rising to 12%, the Phillips curve is 0.12 – 2(u – 0.06) 0.24 – 2u. This is the Phillips curve labeled PC b in the figure. The higher rate of expected inflation has caused the curve to shift up relative to where it was in part (a). With the actual inflation rate at 10%, the Phillips curve equation is 0.10 0.12 – 2(u – 0.06), which has the solution u 0.07. So if the Fed tries to maintain the existing rate of inflation after a shock has raised inflation expectations, the unemployment rate increases. However, if the Fed could convince people that the inflation rate really would not rise, so that e remains at 0.10, then the short-run Phillips curve would remain at PC a, and the unemployment rate would not increase. (c) With the natural rate of unemployment rising to 0.08 at the same time that expected inflation rises to 0.12, the Phillips curve equation is 0.12 – 2(u – 0.08) 0.28 – 2u. This is the Phillips curve labeled PC c in the figure. The new short-run Phillips curve is even higher than those for parts (a) and (b). With the actual inflation rate held to 10%, the equation becomes 0.10 0.28 – 2u, which can be solved to get u 0.09. The unemployment rate rises both because the Fed holds inflation below expected inflation and because the natural rate has increased. This time, even if the Fed convinced people that inflation would remain just 10%, the unemployment rate would still rise to 8%, since the natural rate has increased to that level. 4. (a) Beginning in long-run equilibrium, with M 4000, output must be at its full-employment level of 6000 and the unemployment rate must be equal to the natural rate of .05. Using the values for Y and M in the AD curve, 6000 4000 2(4000/P), which gives P 4. This is also the expected price level. Because M has been constant for a long time and is expected to remain constant, e 0. (b) With P e 4, the SRAS curve is Y 6000 100(P – 4). The AD curve is Y 4000 2(4488/P). The intersection of the two curves occurs when 6000 100(P – 4) 4000 2(4488/P). Simplifying terms gives 100P2 1600P – 8976 0, which has the solution P 4.4. Plugging this into the SRAS curve gives Y 6040. From the Okun’s Law equation we get (6040 – 6000)/6000 –2 (u – .05), so – 0.00333 u – .05, so u .0467. Cyclical unemployment is u – u –.0033. Unanticipated inflation is (P – Pe)/Pe .10 10%. (c) The Phillips curve equation is e – h(u – u ), which gives .10 0 – h(.0467 – .05). This is solved to get h 30. So the slope of the Phillips curve is –30.