Sample Question 3

advertisement

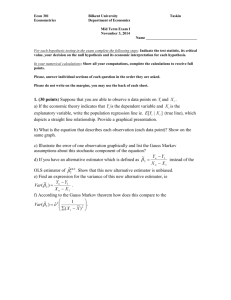

Econ 301. Econometrics Bilkent University Department of Economics Taskin/Yigit Sample questions 3 2. The simple Keynesian consumption expenditure function explain consumption expenditures as a function of disposable income with the following statistical model: Ct Yt t for t 1920,,,1949 This model is estimated using Least square estimation method in the following two forms: Eq. 1: Cˆt 58335 0.791Yt R 2 0.8771, Eq. 2: Cˆt 0.82Yt with the reported values of DW 0.89 SS Re s 11943 102 with the reported values of R 0.8096, DW 1.51 SS Re s 8387 102 where Ct Ct Ct 1 and Yt Yt Yt 1 2 a) Which of assumptions regarding the error term is violated in the Eq 1 ? Explain why? b) If Eq. 2 is estimated instead of Eq.1, what kind of transformations are done on the variables of Eq.1 to obtain Eq. 2? Explain the necessary assumption on t that requires this transformation.(What is the assumed value) c) Can you make further assumption about the data generating process of the error structure, t ? d) Did the above transformation solve the problem regarding the error term? 1. Consider the function that represents the demand for ice cream: Qt 1 2 Pt 3 It 4 Ft t where Qt , Pt , It , Ft are the quantity demand of ice cream in pints, price of pint in dollars, weekly income in dollars and mean temperature in Fahrenheit, in year t respectively. Thirty observations are used to estimate the above regression equation and the following results are obtained: LS // Dependent Variable is Q Date: 04/19/04 Time: 15:33 Sample: 1 30 Included observations: 30 Variable Coefficient C P I F 0.197315 -1.044414 0.003308 0.003458 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat Std. Error 0.718994 0.686570 0.036833 0.035273 58.61944 1.021170 t-Statistic 0.270216 0.834357 0.001171 0.000446 Prob. 0.730212 -1.251759 2.823722 7.762213 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 0.4718 0.2218 0.0090 0.0000 0.359433 0.065791 -6.479173 -6.292346 22.17489 0.000000 a) Do all the coefficients have expected signs? Explain by comparing the expected sign and the estimated sign. b) Are all the coefficients significantly different from zero? Conduct formal tests to decide. c) Write the statistical equation that will describe the error structure if you assume first order autoregressive error structure (AR(1)). d) Test for the first order autoregressive error structure. State the null hypothesis of the test, the formula of the test and your conclusion and interpretation. e) Suppose you use OLS to estimate the model, Are your estimates (i) biased, (ii) inefficient (iii) consistent? What are the properties of the reported standard errors of the i ' s . f) If the estimation of the following regression et et 1 t where the error term have the properties E (t ) 0, Var (t ) 2 , E (t , s ) 0 for t s , produces ˆ 0.70 or eˆt 0.70eˆt 1 illustrate the necessary correction for correcting the autocorrelation problem in a small sample and hence adjustment for the lost observations is required. 4. Suppose that the following equation represents the power demand in mining production, where POWt is the power use, PROt is the mining production, t is time trend: ln( POWt ) 1 2t 3t 2 4 ln( PROt ) t The estimated equation is as follows: ˆ ) 4.260 0.006t 0.001t 2 0.086ln( PRO ) ln( POW t t R 2 0.80 t-stat and SSR 0.203 DW 0.200 (32.60) (0.30) (-0.26) (3.01) T 110 ˆ ) 4.227 0.006t 0.001t 2 0.094 ln( PRO ) 0.980 e -0.072 e ln( POW t t t 1 t 2 t-stat R 2 0.82 (68.05) (0.26) (-0.23) (6.88) (9.91) (-0.71) T 108 SSR 0.193 DW 1.98 where et is the residuals obtained from the first regression estimation. a. If the above is the estimation output, do the signs of the coefficients conform to the expected signs. b. Which ones are significant at 5% significance level? c. Can you say that the errors follow an autoregressive error structure? Indicate what we mean by the autoregressive error structure and how do we test for that? Specifically test for et et 1 vt I) AR(1) and et 1et 1 2et 2 vt II) AR(2) What is your decision about the error term behaviour? [The null hypothesis, the test statistic and your conclusion should be stated] d. What is the value of estimated ? e. Indicate and describe necessary correction (if any) by explicitly writing out the transformed regression variables that should be used in estimation? 5. In the following model yt 1 2 xt et , where yt is the dependent variable and xt is the non-random explanatory variable and et is the random error that satisfies the following properties: E (et ) 0 Var (et ) e2 but Cov(et e s ) 0 , In this model random error changes according to the following equations: et et 1 ut where E (ut ) 0 Var (ut ) u2 but Cov(ut u s ) 0 In this model a1 is the least square estimator of the parameter 1 and a2 is the least square estimator of the parameter 2 . This estimator a2 can be expressed as : a2 2 ( xt x ) et . ( xt x ) 2 a. Show whether a2 is an unbiased estimator of 2 . b. Do you think that a2 is the best unbiased estimator? Why? State in words. c. What is the Var (a2 ) ? Derive. [Furthermore Var (et ) e2 u2 and 1 2 it will be easier if you call wt Cov(et et k ) e2 k , ( xt x ) ] ( xt x ) 2 6. For the model Yt 1 2 X t t where t t 1 t , the following test statistics that can be used to test the first order autocorrelation is: T DW (e e t 1 t t 2 )2 T e t 1 2 t a. Derive and intuitively explain the relationship between DW and . b. What are the range of values DW and , and their relationship? c. If the estimated value of DW = 1.13 with T=30, what will be your decision about the presence of the autocorrelation problem (Write out the null and the alternative hypothesis). d. Compute the estimated value of implied by the DW statistic. e. If you find that there is autocorrelation problem how will you correct it? Write out a hypothetical dependent and independent variable matrix that includes the correction necessary for Generalized Least Square estimation. 7. In the following model Yt 1 2 xt t , where Yt is the dependent variable and X t is the non-random explanatory variable and t is the random error that satisfies the following properties: E ( t ) 0 Var ( t ) 2 but Cov( t s ) 0 , In this model random error changes according to the following equations: t t 1 t where E ( t ) 0 Var ( t ) u2 but Cov( t s ) 0 In this model 1 is the least square estimator of the parameter 1 and 2 is the least square estimator of the parameter 2 . This estimator 2 can be expressed as: 2 2 ( Xt X ) t . ( X t X )2 d. Show whether 2 is an unbiased estimator of 2 . e. Do you think that 2 is the best unbiased estimator? Why? State in words. f. What is the Var (2 ) ? Derive. [Furthermore Var ( t ) 2 2 and 1 2 [Hint: it will be easier if you call wt Cov( t t k ) 2 k ] , ( Xt X ) ] ( X t X )2 8. For a sample of 570 respondents from the U.S. National Longitudinal Survey of Youth, a researcher has data on Y, hourly earnings in 1994, measured in dollars, S, years of schooling, measured as highest grade completed, and the highest educational qualification obtained: no qualification (high school drop-out), high school diploma, associate of arts degree (awarded by two-year colleges), and bachelor of arts degree (awarded by four-year colleges). He defines dummy variables EDUCDO, EDUCHSD, and EDUCBA, and EDUCBA corresponding to these four categories. He regresses the logarithm of Y on: i. S alone ii. EDUCDO, EDUCAA, and EDUCBA iii. S, EDUCDO, EDUCAA, and EDUCBA The results are presented in the table below. (1) 0.079 S (2) (3) -0.173 (0.075) 0.040 (0.019) -0.055 (0.094) EDUCDO (0.008) - EDUCAA - 0.129 (0.074) 0.065 (0.080) EDUCBA - 0.420 (0.047) 0.246 (0.095) 1.359 (0.113) 2.321 (0.027) 1.824 (0.236) R2 0.141 0.145 0.152 RSS 132.12 131.48 130.44 Constant Standard errors in brackets, RSS = Residual Sum of Squares a) Discuss whether it is possible to give an interpretation of the constant in model (1). b) Provide an interpretation of the coefficients of the dummy variables in model (2). c) Discuss whether it is possible to give an interpretation of the constant in model (2). d) Perform a test of the joint explanatory power of the dummy variables in model (3), explaining how the result of the test should be interpreted. e) At a seminar someone says that the researcher ought to have used drop-outs as the omitted category because they were the lowest educational category. How should the researcher reply to this? h) At the seminar the researcher says that the coefficients of EDUCAA and EDUCBA were lower for males than for females when he fitted model (2) for males and females separately. He has not tested whether they are significantly different however. Explain how you would conduct such an exercise, writing your model as well. 9. An expenditure model is estimated where Y is the total expenditures, X 2 is the interest rates, X 3 is the wage and salary income and X 4 is the total corporate profits. The estimated statistical equation is: Y 1 2 X 2 3 X 3 4 X 4 u The estimation for the whole sample gives the following results: (the values in parentheses are t-stats) Y 4.68 107 596.66 X 2 3.24 X 3 0.191X 4 (0.56) (-5.71) (13.64) (8.12) R 2 0.99 SSR 6.48 108 N 50 a) What are the expected signs for the coefficients and do they correspond to the estimated signs? b) The researcher suspects that Var (ut ) 2 X 22 and estimates the following two additional equations. For the subsample which includes data with SMALL X 2 values: Y 8.85 107 662.71X 2 1.93 X 3 0.232 X 4 (2.06) R 2 0.94 (-3.57) (5.87) (5.78) SSR 5.01 106 N 17 For the subsample which includes data with LARGE X 2 values: Y 2.48 107 524.64 X 2 3.58 X 3 0.162 X 4 (0.06) R 2 0.99 (-2.18) (7.34) SSR 4.89 108 (5.78) N 17 Conduct a Goldfeld-Quandt test to test for the above assumption. Write the null and the alternative hypothesis, formula of the test, its statistical distribution and your conclusion about the variance. What can you say about the variance of the error terms? c) According to your conclusion in part (b), what will be the properties of OLS estimators of the above model? d) How will you correct the problem? Explain and write the equation you will estimate to correct this problem. What is the name of this technique? 10 . Data on gross gross income and tax paid by a cross section of 30 companies in the year 1988 and the same 30 companies in the year 1989 are used to estimate the following relationship: taxt 1 2 incomet et Since heteroschedasticity is common with cross section data, the researcher decides to apply Goldfeld and Quant test by doing separate estimations for each year. The following is the output of these two separate regression results: (with standard errors in parentheses underneath the coefficient estimates) are for 1988: t tax =0.0180 + 0.17628 incomet (0.0357) (0.0059) R2=0.9695 SSErrors=0.172260 for 1989: t tax =0.1085 + 0.22658 incomet (0.629) (0.0100) R2=0.9478 SSErrors=0.52226 =0.0734 + 0.20369 incomet (0.0517) (0.0084) R2=0.9103 SSErrors=1.48152 t for 1988 1989: tax a) Why do you think that the intercept has the reported sign? b) Test the hypothesis that errors are homoskedastic at 5% level of significance. State the null and the alternative hypothesis. Give the formula of the test and the result. Explain your conclusion. c) If you ignore the problem of heretoskedasticity will the estimated coefficients be unbiased and efficient (minimum variance)? d) How should you correct for the problem of heteroskedasiticity? Describe in detail. Show all the steps you will do. What is the name of this estimation technique? e) Do you think that the coefficients 1 and 2 are the same for both years 1988 and 1989. Test for this restriction. State the test statistic, the application, the results and the interpretation in detail. 6. Consider the model S t Yt At Pt et where S t is the sales of a firm in district t, Yt is the total income in the state, and At is the amount of money spent by the company advertising and Pt is the population in that district (t 1,2,...,50) . You suspect that the random error term et is heteroscedastic with variance 2 that is related to the Advertising expenditure At . Assume that you have the following information about the error structure. For each of the following cases, explain how you would revise the estimation technique to obtain estimates that are BLUE. Write an hypothetical dependent variable and independent variable set for each assumption and prove that errors of the transformed model is acually homoskedastic. i) var( et ) t2 2 At . ii) var( et ) t2 2 (1 / At4 ) iii) var( et ) t2 2 ( Pt 2 At2 ) iv) std (et ) t At 11. Do question 9.3 from your book.