Bootstrapping with bond prices

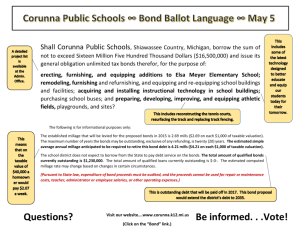

advertisement

Division of Applied Mathematics School of Education, Culture and Communication MMA 708 Analytical Finance II Lecturer: Jan Röman Bootstrapping with bond prices Written by: Dmytro Sheludchenko Arad Tahmidi Daria Novoderezhkina Abstract The purpose of this assignment was to create a bootstrap application in Excel with help of linear interpolation/extrapolation, given Swedish Government Bonds data. Zero coupon rates, forward rates, as well as discount factors had to be calculated, and their term structures plotted accordingly. 2 Table of Contents 1.Introduction……………………………………………………………………………………………………………………….4 2.Bootstrappingof bonds.…………………………..…………………………………………………………………………4 3.Spot rates……………….……………………………………………………………………………………………………….…5 4.Forward rates……………….……………………………………………………………………………………………………5 5.Discount factors…………………………………………………………………………………………………………………6 6.Interpolation………………………………………………………………………………………………………………………6 Conclusion…………………………………………………………………………………………………………………….….…..7 References…………………………………………………………………………………………………………………………….8 3 1.Introduction Bonds can be considered as quite simple fixed-income instruments. The concept is as follows: a bonds issuer is borrowing money from an investor through the bonds sale, and compensates by making interest payments and repaying the principal amount on the bonds maturity. A substantial amount of bonds can be traded in a secondary market, just like stocks and other securities. The main components that must be taken into consideration when pricing a bond are: Principal (notional amount of a loan), or it is also known as par value or face value. Bonds principal, as it has been already mentioned above, is paid at the end of bonds life. Maturity – expiration of the instrument Interest payments, or coupons. These cash flows are received periodically by owners of majority of bonds. Call provisions and other special features Credit quality of the issuer Theoretical price of the bond can be found by discounting all the cash flows, that are to be received by bond holder, to their present values, and then summing them all up. Often bond traders use the same discount rate for all the coupon payments, which is not really accurate. For each cash flow underlying a bond, there should be a different zero rate considered. Understanding of how to correctly approach bond pricing is vital for traders and investors nowadays. 2.Bootstrapping of bonds Bootstrap method can be summarized as an algorithm for calculating the zero-coupon yield curve from the market data. Term structure of interest rate: Yield curve – is simply a plot of bonds yield to maturity against time. It can be derived from zero-coupon bonds. Shape of the yield curve can be either concave or convex. There exist a number of theories that try to explain why it is shaped in this manner. In order to observe the dynamic behavior of interest rates, we have to use a term structure model. What is really significant, is that term structure models imply the possibility of derivation of an entire term structure from the stochastic behavior of just few variables. The reason why it is so important to calculate the whole term structure lies in our desire to maintain internal consistency between model prices. 4 Yield and Yield to Maturity: As has already been mentioned above, we are interested in calculating zero-coupon rates using Bootstrap method. If the yield curve is already given to us, then it is possible to implement bootstrapping technique to find the spot rates and plot their term structure. This implies “stripping” bonds with purpose to construct artificial zero-coupon bonds of the coupons and the principal. STRIPS is an abbreviation for “Separate Trading for Registered Interest and Principal of Securities”. To strip the bond means to separate coupons and the principal. Bootstrapping: Linear bootstrapping can be used to calculate and build a yield curve, or as it can also be referred to: plotted spot and forward rates’ term structures. In order to do that, we first have to derive bonds prices from the yield. This can be done with the following formula(for the bond that pays dividends): 𝑛 𝑁 𝐶 𝑃= + ∑ 𝑇 (1 + 𝑦𝑡𝑚) (1 + 𝑦𝑡𝑚)𝑡𝑖 𝑖=1 Where C is the coupon, N – face value and ytm – yield to maturity. 3.Spot rates We start with the first spot rate. If the first bond doesn’t bear any coupon, then it is a zerocoupon bond and its spot rate can be found directly. For the other bonds, we follow the same algorithm: we make the price of the bond equal to the discounted values of the coupons and the principal, by simply substituting known to us values in the equation above. As long as the bonds’ prices have already been calculated, the only unknown value that we are looking for in each equation will be the next spot rate. We repeat the same procedure until all the spot rates have been found out and then plot them against dates on which coupon payments are due. 4.Forward rates The relationship between spot and forward rates can be expressed as follows: 𝑓𝑜𝑟𝑤𝑎𝑟𝑑 𝑟𝑡2 −𝑡1 (1 + = ( (1 + 1 𝑠𝑝𝑜𝑡 𝑡2 𝑡2 −𝑡1 𝑟𝑡2 ) 𝑡1 ) 𝑟𝑡𝑠𝑝𝑜𝑡 ) 1 −1 5 5.Discount factors Discount factors are calculated as: 1 (1+𝑠𝑝𝑜𝑡 𝑟𝑎𝑡𝑒)𝑡𝑠𝑝𝑜𝑡 6.Interpolation During our calculation of the spot rates we have used linear interpolation in order to find all values that we were interested in. Interpolation between two known points can be summarised as below: 𝑦 = 𝑦0 + (𝑥 − 𝑥0 ) 𝑦1 − 𝑦0 𝑥1 − 𝑥0 Where the two known points are given by the coordinates (𝑥0 , 𝑦0 ) 𝑎𝑛𝑑 (𝑥1 , 𝑦1 ). 6 Conclusion In this assignment we calculated zero-coupon rates using Swedish bonds market data, obtained forward rates from them and plotted both term structures. Graph of the derived discount factors dynamics had also been constructed. 7 References 1). John C. Hull (2003) Options, Futures and Other Derivatives, Fifth Edition, Prentice Hall, Upper Saddle River 2). Lecture Notes: Jän Roman 3). http://nasdaqomxnordic.com/bonds/sweden 8