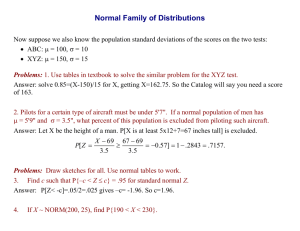

Case Study #3

advertisement

Case Study #3 XYZ COMPANY Consider the following facts: a. XYZ is a publicly traded company that has been cited three times in the past five years for ethics violations. Its board of directors vetoed an ethics code. b. The auditors of XYZ are Big 4 Accounting, L.L.P. c. The chairwoman of Big 4 personally knows the chairperson of the PCAOB and verbally informs him that Big 4 will be auditing XYZ and other publicly traded companies. d. Big 4 has a policy to retain working papers of its clients for five years. e. Recent cost-cutting measures at Big 4 have left Partner Smith as the sole partner on the XYZ audit. Smith has been its auditor for the past 10 years. f. XYZ informs Big 4 that the internal controls that Big 4 has designed and maintained are working well. g. Jones, a former partner of Big 4 who worked on the XYZ audit last year, is now its CEO. h. In addition to auditing XYZ, Big 4 does the bookkeeping and taxes for XYZ. i. Washington, also a partner at Big 4, specializes in valuation and has been retained by XYZ to value prospective companies that it is considering to take over. j. Johnson, another partner at Big 4, performs background checks on new employees of XYZ. Fees for this service amount to 3 percent of all fees that XYZ pays to Big 4. k. Last year, XYZ changed its accounting procedures from LIFO to FIFO and restructured its methods for determining the useful lives of its assets. l. Adams, the corporate attorney for XYZ, is involved in another case that will take much time and has asked his next door neighbor, Smith, to overlook certain issues that are material to the financial statements of XYZ. m. Jones, who just got married, has borrowed money form XYZ to purchase a vacation home in Florida. n. Two weeks ago, XYZ sold 3 percent of its shares to an Australian conglomerate that is interested in getting into the U.S. market. o. Smith’s wife plays bridge with the wife of the chairman of XYZ’s audit committee. Smith, being overwhelmed by the new laws affecting corporations, asked his wife to let the chairman’s wife know of the material changes in certain of XYZ’s accounting policies. Discuss the Sarbanes-Oxley implications on the preceding facts. Cite specific provisions of SOX that are identified. Discuss areas where other violations could occur. a. Under SOX Title 4, the company must disclose in its financial reports that it does not have an ethics code for senior management. The absence of an ethics code may result in larger penalties in the event that the company is convicted of fraud. b. There are no special implications resulting from the choice of the auditor. c. There is nothing wrong with an auditor telling her client that she will be auditing her client and other companies. d. The 5-year working paper policy is consistent with SOX Title 1. PCOAOB audit standards require they be retained for 7 years. e. This presents a problem with SOX Section 203, which prohibits either the primary or reviewing audit partner from providing audit services to a client that he or she audited in each of the five preceding years. In other words, neither the primary nor the reviewing partner can audit the same client for more than five consecutive years. Two new partners will need to be assigned to XYZ. f. XYZ must do more than inform the auditors; XYZ must certify the internal controls as required by Section 404. g. Section 206 prevents a public accounting firm from auditing a client if the client’s CEO, chief accountant, or chief financial officer worked for the public accounting firm and participated in auditing of that client in the 12 months prior to the beginning of the audit. Therefore, Big 4 must decline the audit engagement with XYZ. h. Section 206 prohibits the bookkeeping services. The tax services are permissible with prior approval by the audit committee. i. Section 206 prohibits valuation services. j. Section 206 prohibits human resources services. k. The changes of accounting methods represent an audit issue and not a SOX compliance issue. l. Section 307 requires attorneys to report “evidence of a material violation of securities law or breach of fiduciary duty or similar violation by the company or any agent thereof, to the chief legal counsel or the chief executive officer of the company.” The report must be made to the company’s chief legal counsel or CEO. If the CEO or chief legal counsel does not respond with the appropriate corrective actions, the reporting attorney must refer to matter to the company’s audit committee. The attorney may be free to seek the advice of others, but she remains responsible to properly dispose of any problem brought to her attention. If the matter is serious, she should handle it herself. m. Section 402 forbids personal loans to directors and executives. Some exceptions are permitted, including to those made by insured depositories if they do not violate Federal Reserve insider-lending restrictions. In this case, the loan should be repaid immediately. n. This may necessitate the filing of SEC forms, but it does not present a SOX compliance issue. o. SOX prescribes the means of communications between the audit committee and the external auditor. It does not prescribe how the CEO and audit committee should communicate. But common sense says that it should be done directly and in writing.

![waiver of all claims [form]](http://s3.studylib.net/store/data/006992518_1-099c1f53a611c6c0d62e397e1d1c660f-300x300.png)