Taxes and Public Goods Lesson

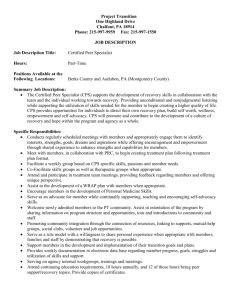

advertisement

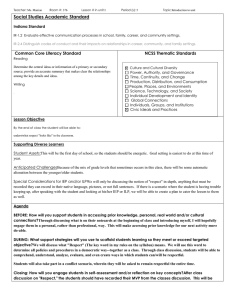

Teacher: Katie Hetlage Room #: Lesson # in unit: Period (s): 7 Topic: Taxes Social Studies Lesson Objective and Assessment: By the end of class the student will be able to: identify what goods and services the government provides using tax dollars. NCSS Thematic Standards Culture and Cultural Diversity Power, Authority, and Governance Time, Continuity, and Change Production, Distribution, and Consumption People, Places, and Environments Science, Technology, and Society Individual Development and Identity Global Connections Individuals, Groups, and Institutions Civic Ideals and Practices Supporting Diverse Learners Using the think-pair-share strategy as an anticipatory set for Chapter 9 will benefit students of multiple learning styles. The activity lends itself to students who work best independently, in partners or small groups, or in a whole class setting. The video shown ahead of time will aid visual and audio learners. Strategies/Activities Selected: Methods for Instruction Class/Group Discussion Cooperative Learning Small Group Guided Practice Lecture or Direct Instruction Bookwork (Reading) Question/Answer Learning Stations Teacher Modeling/Demo. Journal writing Role Play Hands-on Inquiry Learning Game Simulation/Role Playing Independent Learning Other: Think-Pair-Share Use of Materials Use of Technology Teacher Manual pg # Student Text pg # Picture Books More Activities That Teach Handouts: Manipulative Maps Artifacts Related Equipment: Other: Adapted materials Cell Phone PollEverywhere.com CPS Clickers Elmo Document Camera Software Student Computers Teacher Computer w/LCD Video Clips/DVD http://www.blinkx.com/ce/oaQTYDwhS A2OsHh0w5IijOgb2FRVFlEd2hTQTJPLXNI aDB3NUlpak9nb2FRVFlEd2hTQTJPLX N Website Other Agenda: Anticipatory Set: I will begin by asking the students as a whole class what they know about taxes and what their feelings towards paying taxes are (why we do it, if they see taxes as good or bad, etc.). Then I will show a video to introduce them to the main concepts of taxes. During: I will ask the students to think independently about how they got to school this morning. Then they will create a list of all of the goods/services they used, encountered, or saw on their way to school that were provided by the government using tax dollars. Once their lists are created, students will pair up and discuss/build their lists with a partner. Once they have had a few minutes to discuss, I will have the students share their lists with the class. If there are any obvious goods or services that the students missed, we will address those as a class. Wrap up/Closing: After the students have shared their lists, I will ask them if their views on taxes have changed at all. If time allows, we can discuss how paying taxes for these government-provided services is different from these services being provided by private companies. Daily Assessment How do you know your Formative: Summative: students met your lesson objective(s) and to what degree? Bloom’s Taxonomy knowledge comprehension application analysis synthesis evaluation Class discussion CPS clickers Email teacher Entrance/Exit slip Teacher Observe Listened to conversations Quiz Thumbs up, neutral, or down Homework check Video quiz Voting Whiteboard Check Other Test Project Report Presentation Final Exam Other Additional Teacher Preparation: Copy: Locate: Daily Reflection This would be a section at the end for the teacher to note any strengths or weaknesses of the plan. What are next the steps for students and how will you get them there? What worked well? This lesson went pretty well. Students were engaged in the video, so that is something I would keep. I might have something for the students to complete while they watch the video from now on though. Students struggled with thinking of things that are paid for by taxes, so if I were to do this lesson again I would spend more time going over this information before the activity. Many students wrote down private businesses on their lists, so I would make sure to note ahead of time that private businesses are not paid for by taxes and explain why this is. Aside from that, the activity went well. I think that the students gained a basic understanding of what taxes are and why we pay them, so for the next class I would move on to the different types of taxes and what each of them pays for.