Investment risk management

advertisement

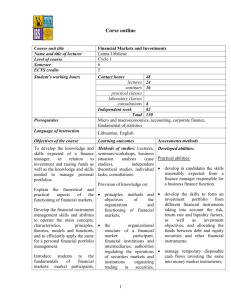

Investment risk management PROF. ELENA BECCALLI COURSE AIMS The course aims to give an in-depth overview of risk management in the context of portfolios of stocks and fixed income securities. At the end of the course, the students are expected to have an understanding of: the analysis and management of investment risk from a theoretical and empirical perspective; techniques for measuring and managing risk. Throughout, the course spends a significant amount of time on practical applications and on empirical evidence on the theories that are introduced. COURSE CONTENT Instructional objectives that the student should have achieved before taking the course Before taking the course, the student should: – be able to calculate present values and capital and interest on the basis of discrete and continuous capitalisation; – be able to estimate the share price using discounted cash flow and multiples; to understand the significance of the main aggregates of the income statement; – be able to calculate price, yield, duration and convexity of a bond and to calculate spot rates and forward rates; – to understand the concept of an equity security's alpha and beta; – be able to calculate expected value and standard deviation of a random variable; – be able to calculate a matrix of variances and covariances and correlation matrices and to understand the significance thereof; – to understand the main symmetric and asymmetric derivatives instruments and the related basic valuation methods. Instructional objectives that the student is expected to achieve with the course Risk management in the context of portfolios of stocks After having completed the study of the material, the student is expected to be able. Equity securities – to understand the empirical evidence in relation to risk and returns associated with trading strategies based on fundamental analysis with regard to contrarian and momentum investment styles; – to understand the empirical evidence in relation to risk and returns associated with trading strategies based on technical analysis with regard to contrarian and momentum investment styles; – to reconcile from a theoretical and empirical perspective the contrarian and momentum trading strategies from the standpoint of fundamental and technical analysis; – to understand the empirical evidence on trading strategies in the context of IPOs (initial public offerings) and Internet stocks; – to understand the empirical evidence on forecasts errors in analyst forecasts and their determinants. Risk management in the context of portfolios of fixed income securities – to calculate the risk and return for a bond portfolio; – to understand the techniques for hedging bond portfolios against changes in inflation. Measurement of investment risk-adjusted performance After having completed the study of the material, the student is expected to be able: – to know how to calculate money-weighted rate of return (MWRR), internal rate of return (IRR) and time-weighted rate of return (TWRR) and to know how to select the indicator appropriate for different situations; – to understand the reasons for the use of risk-adjusted performance indicators and to know how to calculate and use them. READING LIST Slides from the lectures and other instructional material (in particular, articles and working papers) to be made available on the Blackboard platform. E.J. ELTON-M.J. GRUBER-S.J. BROWN-W.N. GOETZMANN, Modern Portfolio Theory and Investment Analysis, John Wiley and Sons, 2009, 8th edition (ISBN: 9780470388327). Recommended readings: E. BECCALLI-P. FRANTZ, Valuation and securities analysis, London University Press, London, 2007 (Chapters 7, 9, 10, 11, 12). TEACHING METHOD The course will be taught through lectures, assignments and seminars by experts on the subject. Students are expected to apply their knowledge in a team project work named “Portfolio simulation project”. ASSESSMENT METHOD 60-minute written exam, 3 questions. Students will have the opportunity to undertake a team project work named “Portfolio simulation project”, with the aim to simulate portfolio management strategies and to present the results to the class and practitioners. Maximum 5 people in each group. It is worth 10% of the final grade. NOTES Place and time of consultation hours Further information can be found on the lecturer's webpage or on the Faculty notice board. Office hour: Friday at 10.00, presidenza Facoltà Scienze bancarie, finanziarie e assicurative (Largo Gemelli 1).