ING Final - University of Texas Health Science Center at Houston

advertisement

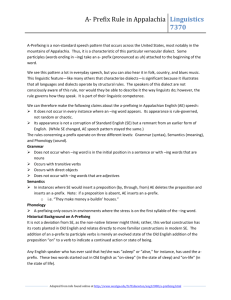

Changes to the investment menu at ING Dear UT System Retirement Program participant: You are receiving this letter because you are either currently contributing to, or you have assets with, a UT Retirement Program fund that will be changing effective November 15, 2011. The University of Texas System Retirement Program and ING Life Insurance and Annuity Company (ING) are dedicated to helping you plan for the future you want. As part of that commitment, the investment funds are regularly monitored according to established criteria that includes (but is not limited to) overall performance, objective, fees, fund management, and fit within the line-up. The goal is to maintain an array of investments to help diversify your account according to your individual retirement planning needs, while offering an appropriate number that can be effectively monitored. As a result of the latest review, we are pleased to announce the introduction of a streamlined fund line-up with competitively performing funds and competitive fees. This streamlined fund line-up provides you an array of high quality funds across the risk spectrum while making it easier for you to select the investment options that best fit your individual situation. These changes will occur on November 15, 2011. The details of the changes are outlined in the follow pages. Not all investments listed in the charts will apply to you. To review your exact investment holdings, log in to your ING account at www.ingretirementplans.com or call 1-866-506-2199. IMPORTANT: Actions to Consider If you are satisfied with how your current contributions will be redirected, then you do not need to take any action. However, if you would like to change how your future contributions will be redirected prior to the fund change occurring, then you must update your asset allocation no later than November 14, 2011 by 4:00 p.m. Eastern Time. After this date and time you will still have the ability to change the direction of your future contributions, but it will be for a future effective date. Any assets that you currently have in any fund that will no longer be available after November 15, 2011, will remain in that fund unless you take action to transfer those assets to another investment fund offered after November 15, 2011. You may wish to take this opportunity to contact ING at 1.800.525.4225 or your ING representative in order to review your overall retirement plan investments and goals. For additional information about your retirement fund offerings or for assistance with making any fund changes, please contact ING at 1.800.525.4225 or logon to www.ingretirementplans.com. Dear UT System Retirement Program Participant, As you may know, ING Life Insurance and Annuity Company (ING) and the University of Texas Retirement Program are introducing a streamlined line-up of investment options designed to offer you an array of funds across the risk spectrum while making it easier for you to select the investment options that best fit your individual situation. To support this effort, ING is notifying you of changes to the investment options available through the Variable Annuity contracts and Mutual Fund programs offered by ING Life Insurance and Annuity Company (ILIAC), a member of the ING family of companies. Highlights of the changes to the University of Texas plans with ING: Effective November 15, 2011, A new, streamlined menu of investment options will be available for contributions going forward to the variable annuity contracts and mutual fund programs. The new menu will allow future contributions be directed to the new investment option menu. If you are satisfied with how your current contributions will be redirected, then you do not need to take any action. What Actions do you need to consider? Effective November 15, 2011, the current menu of investment options is being discontinued for new contributions. Any assets that you have in a discontinued investment option will remain in the discontinued option, unless you take action to transfer those assets to one of the new investment options. New contributions made after the effective date cannot be made to the discontinued investment options. You can choose how to redirect your future contributions to the new investment options prior to the fund change. You would need to update your asset allocation no later than 4:00 p.m. ET on November 14, 2011. If you choose to take no action prior to 4:00 p.m. ET on November 14, 2011, then you are agreeing that your future contributions will be redirected to the new investment options as shown in the charts that accompany this letter. Your future contributions, based on your future contributions on record with ING as of November 14, 2011, will be redirected from the current (discontinued) investment option to a similar investment option in the new menu, based on fund strategy and objectives, underlying investments, and long-term performance potential. These allocations will remain in place unless and until you make an alternate investment direction. Please refer to Investment Options charts for details. You should consider the investment objectives, risks, and charges and expenses of the variable product and its underlying fund options; or mutual funds offered through a retirement plan, carefully before investing. The prospectuses/prospectus summaries/information booklets containing this and other information can be obtained by contacting your local representative. Please read the information carefully before investing. 2 We appreciate the trust and confidence you have placed in ING, and look forward to continuing to work with you to help you plan for your financial future. You may wish to take this opportunity to contact your local ING representative to review your overall retirement plan investments and goals. In addition, if you have any questions regarding these investment option changes, please contact your ING representative or our toll free Customer Service line at 1-866-506-2199. IMPORTANT INFORMATION Variable annuities and mutual funds under a retirement plan are long-term investments designed for retirement purposes. If withdrawals are taken prior to age 59 ½, an IRS 10% premature distribution penalty tax may apply. Money taken from the annuity will be taxed as ordinary income in the year the money is distributed. Account values fluctuate with market conditions, and when surrendered the principal may be worth more or less than its original amount invested. An annuity does not provide any additional tax deferral benefit, as tax deferral is provided by the plan. Annuities may be subject to additional fees and expenses to which other tax-qualified funding vehicles may not be subject. However, an annuity does provide other features and benefits, such as lifetime income payments and death benefits, which may be valuable to you. For 403(b)(1) fixed or variable annuities, employee deferrals (including earnings) may generally be distributed only upon your: attainment of age 59½, severance from employment, death, disability, or hardship. Note: Hardship withdrawals are limited to employee deferrals made after 12/31/88. Exceptions to the distribution rules: No Internal Revenue Code withdrawal restrictions apply to ’88 cash value (employee deferrals (including earnings) as of 12/31/88) and employer contributions (including earnings). However, employer contributions made to an annuity contract issued after December 31, 2008 may not be paid or made available before a distributable event occurs. Such amounts may be distributed to a participant or if applicable, the beneficiary: upon the participant's severance from employment or upon the occurrence of an event, such as after a fixed number of years, the attainment of a stated age, or disability. For 403(b)(7) custodial accounts, Employee deferrals and employer contributions (including earnings) may only be distributed upon your: attainment of age 59½, severance from employment, death, disability, or hardship. Note: hardship withdrawals are limited to: employee deferrals and ’88 cash value (earnings on employee deferrals and employer contributions (including earnings) as of 12/31/88). Insurance products, annuities and retirement plan funding are issued by ING Life Insurance and Annuity Company. Securities are offered through ING Financial Advisers, LLC (Member SIPC), One Orange Way, Windsor, CT, 060954774. All companies are members of the ING family of companies. Securities may also be distributed through other broker-dealers with which ING Financial Advisers, LLC has selling agreements. Insurance obligations are the sole responsibility of each issuing company. Products and services may not be available in all states. Products and services offered through the ING family of companies. C11-0822-009R (08/2011) 3 Discontinued and New Investment Option Charts for the University of Texas Retirement Programs offered by ING If you choose to take no action prior to 4:00 p.m. ET on November 14, 2011, then your future contributions will be redirected to the new investment options as shown in the Charts below. There are two charts. Please refer to the chart that applies to you. 1. Investment Options for the Variable Annuity contracts 2. Investment Options for the Mutual Fund program Effective November 14, 2011, at the market close, generally 4:00 p.m. Eastern Time (ET) the investment options shown below under Existing Fund Names will no longer be available to new contributions, fund transfers or allocation changes under the University of Texas plans with ING. You should consider the investment objectives, risks and charges, and expenses of the variable product and its underlying fund options, or mutual funds offered through a retirement plan carefully before investing. The prospectuses/prospectus summaries/information booklets containing this and other information can be obtained by contacting ING at 1-866-506-2199or your local representative. Please read the information carefully before investing. Investment Options – Variable Annuity Contracts (includes Mentor, Direct and Legacy ING contracts) The options listed in Discontinued Investment Option column on the left will no longer be available for new contributions. If you take no action, new contributions to the Discontinued Investment Options will instead be directed to the options listed in the New Investment Options column on the right. The chart also shows the fund number for each new investment options. Fund # Discontinued Investment Option To: New Investment Option Fund # Asset Allocation ING Strategic Allocation Growth Portfolio - Class I 33 ING Strategic Allocation Conservative Portfolio - Class I 32 ING Strategic Allocation Moderate Portfolio - Class I 193 Pax World Balanced Fund Individual Investor Class Global/International ING T. Rowe Price Capital Appreciation Port - Serv Class 788 779 Oppenheimer Developing Markets Fund - Class A 190 EuroPacific Growth Fund® Class R-4 573 31 ING JPMorgan Emerging Markets Equity PortfolioService 1331 830 Pioneer Emerging Markets VCT Portfolio - Class I ING Artio Foreign Portfolio Service Class 1551 ING International Index Portfolio - Class I 770 ING T Rowe Price International Stock Portfolio 4 Fund # Discontinued Investment Option Global/International To: New Investment Option 107 Fidelity VIP Overseas Portfolio - Initial Class 228 ING International Value Portfolio - Class I Small/Mid/Specialty EuroPacific Growth Fund® Class R-4 ING Templeton Foreign Equity Portfolio - Initial Class 573 53 ING Index Plus MidCap Portfolio - Class I ING Fidelity® VIP Mid Cap Portfolio - Service Class ING T. Rowe Price Diversified Mid Cap Growth Port - Initial Wanger Select ING Russell™ Mid Cap Growth Index Portfolio - Class S ING Russell™ Mid Cap Index Portfolio - Class I ING FMR Diversified Mid Cap Portfolio - Service Class 1560 Lord Abbett Series Fund Mid Cap Value Portfolio - Cl VC ING Pioneer Mid Cap Value Portfolio - Institutional Class Lazard U.S. Mid Cap Portfolio Open Shares 1315 ING Clarion Real Estate Portfolio - Service Class ING Index Plus SmallCap Portfolio - Class I ING Baron Small Cap Growth Portfolio - Service Class ING Clarion Global Real Estate Portfolio - Inst Class ING Russell™ Small Cap Index Portfolio - Class I Wanger USA 1613 Franklin Small Cap Value Securities Fund - Class 2 Wells Fargo Advantage Special Small Cap Value Fund - Class A ING American Century SmallMid Cap Value Portfolio Service 440 50 ING BlackRock Science and Technology Opp Port - Class I ING T. Rowe Price Growth Equity Portfolio - Initial Class 111 771 ING MFS Utilities Portfolio Service Class 789 432 ING Oppenheimer Global Portfolio - Initial Class ING Global Resources Portfolio - Service Class USAA Precious Metals and Minerals Fund - Adviser Shares ING Van Kampen Growth and Income Portfolio - Service Class New Perspective Fund® - Class R-4 ING Russell™ Large Cap Index Portfolio - Class I ING Small Company Portfolio - Class I 407 449 820 2718 75 1214 1019 52 436 73 191 2040 2656 42 ING JPMorgan Small Cap Core Equity Portfolio - Service Class Fund # 1586 778 1563 821 818 1557 752 5 Fund # Discontinued Investment Option Ariel Fund To: New Investment Option 1560 Oppenheimer Main Street Small- & Mid-Cap Fund/VA ING Wells Fargo HealthCare Portfolio - Service Class ING Russell™ Mid Cap Index Portfolio - Class I ING JPMorgan Small Cap Core Equity Portfolio - Service Class Fidelity® VIP Contrafund® Portfolio - Initial Class ING PIMCO Total Return Portfolio- Service Class American Funds The Bond Fund of AmericaSM - Class R4 ING Pioneer High Yield Portfolio - Initial Class ING Intermediate Bond Portfolio - Class 004 ING PIMCO High Yield Portfolio - Service Class 787 ING Growth and Income Portfolio - Class I Invesco V.I. Core Equity Fund Series I Shares ING Thornburg Value Portfolio Initial Class ING UBS U.S. Large Cap Equity Portfolio - Initial Class ING Davis New York Venture Portfolio - Service Class ING Pioneer Fund PortfolioInstitutional Class American Funds Fundamental InvestorsSM - Class R-4 ING Growth and Income Portfolio - Class S ING Janus Contrarian PortfolioService Class Amana Income Fund Fidelity® VIP Contrafund® Portfolio - Initial Class 133 ING Index Plus LargeCap Portfolio - Class I ING U.S. Stock Index Portfolio Institutional Class ING Russell™ Large Cap Index Portfolio - Class I 1557 Fidelity® VIP Equity-Income Portfolio - Initial Class ING Van Kampen Comstock Portfolio - Service Class ING T. Rowe Price Equity Income Portfolio - Service Class ING Pioneer Equity Income Portfolio - Institutional Class ING Russell Large Cap Value Index Portfolio - Class S ING Van Kampen Growth and Income Portfolio - Service Class 789 American Funds Washington Mutual Investors FundSM - R-4 ING Van Kampen Growth and Income Portfolio - Service Class 789 187 832 776 Fund # 752 133 Bonds 439 1003 1220 Large Cap Value 1 79 100 105 264 772 1208 1290 1307 1595 35 829 108 437 617 1213 2711 819 6 Fund # Discontinued Investment Option Large Cap Growth 76 106 109 572 783 1413 1612 2015 2713 2714 Invesco V.I. Capital Appreciation Fund - Series I Shares ING Legg Mason ClearBridge Aggressive Growth Port Initial Fidelity VIP Growth Portfolio Initial Class The Growth Fund of America® - Class R-4 ING BlackRock Large Cap Growth Portfolio - Service Class ING Marsico Growth Portfolio - Institutional Class Amana Growth Fund ING BlackRock Large Cap Growth Portfolio – Institutional ING Russell Large Cap Growth Index Portfolio - Class I ING Russell™ Large Cap Growth Index Portfolio - Class S To: New Investment Option Fund # ING Large Cap Growth Portfolio- Institutional Class 742 Balanced ING Invesco Van Kampen Equity and Income Portfolio Initial 101 Calvert VP SRI Balanced Portfolio Stability of Principal ING T. Rowe Price Capital Appreciation Port - Serv Class 788 005 ING Fixed Account 002 ING Fixed Account 002 452 006 ING Guaranteed Accumulation Accounts- Short Term ING Guaranteed Accumulation Account-Long Term 7 Investment Options – Mutual Fund Program The options listed in Discontinued Investment Option column on the left will no longer be available for new contributions. If you take no action, new contributions to the Discontinued Investment Options will instead be directed to the options listed in the New Investment Options column on the right. The chart also shows the fund number for each new investment options. Fund# Discontinued Investment Option Stability of Principal 3 ING Money Market Portfolio - Class I * To New Investment Options ING Money Market Portfolio - Class I * Fund# 003 Bonds 1035 ING Limited Maturity Bond Portfolio ING Money Market Portfolio - Class I * Service Class *An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1.00 per share, there is no assurance it will be able to do so. While the fund's objective includes the preservation of capital, it is possible to lose money by investing in the fund. Franklin High Income Fund - Class A ING PIMCO High Yield Portfolio - Service Class Vanguard® Inflation-Protected Securities American Century Inflation-Adjusted Fund - Investor Shares Bond Fund - Investor Class American Century Inflation-Adjusted Bond Fund - Investor Class PIMCO Real Return Fund - Class A 1031 PIMCO GNMA Fund - Class A 1036 PIMCO Total Return Fund - Class A 1041 TCW Total Return Bond Fund - Class N 1044 1003 Vanguard® Intermediate-Term Bond Index Fund - Investor Shares The Bond Fund of AmericaSM - Class R-4 178 Templeton Global Bond Fund - Class A 781 1012 801 1001 003 787 1001 ING PIMCO Total Return Portfolio Service Class 439 ING U.S. Bond Index Portfolio - Class S 1555 Templeton Global Bond Fund - Class A 178 1026 Oppenheimer International Bond Fund Class A Asset Allocation 032 767 ING Strategic Allocation Moderate Portfolio Class I ING Solution Income Portfolio - Initial Class ING Solution Income Portfolio - Initial Class 767 746 ING Solution 2015 Portfolio - Initial Class ING Solution 2015 Portfolio - Initial Class 746 790 ING Solution 2025 Portfolio - Initial Class ING Solution 2025 Portfolio - Initial Class 790 761 ING Solution 2035 Portfolio - Initial Class ING Solution 2035 Portfolio - Initial Class 761 764 ING Solution 2045 Portfolio - Initial Class ING Solution 2045 Portfolio - Initial Class 764 8 There is no guarantee that any investment option will achieve its stated objective. Principal value fluctuates and there is no guarantee of value at any time, including the target date. The "target date" is the approximate date when you plan to start withdrawing your money. When your target date is reached, you may have more or less than the original amount invested. For each target date Portfolio, until the day prior to its Target Date, the Portfolio will seek to provide total returns consistent with an asset allocation targeted for an investor who is retiring in approximately each Portfolio's designation Target Year. The Target Year is specified in the Portfolio's name. For example, the ING Solutions 2045 Portfolio bears an asset allocation that the investment adviser believes balances the risk and return objectives of the "average" investor who will be retiring in the year 2045. With the exception of ING Solution Growth and Income Portfolio, ING Solution Growth Portfolio, ING Solution Income Portfolio and ING Index Solution Income Portfolio, each Portfolio is structured and managed around a specific target retirement or financial goal date (”Target Date”) as follows: 2055, 2045, 2035, 2025 and 2015. The ING Solution Growth and Income Portfolio, ING Solution Growth Portfolio, ING Solution Income Portfolio and ING Index Solution Income Portfolio are for those who are retired, nearing retirement or in need of drawing down income from their Portfolio soon. Prior to choosing a Target Date Portfolio, investors are strongly encouraged to review and understand the Portfolio's objectives and its composition of stocks and bonds, and how the asset allocation will change over time as the target date nears. No two investors are alike and one should not assume that just because they intend to retire in the year corresponding to the Target Date that that specific Portfolio is appropriate and suitable to their risk tolerance. It is recommended that an investor consider carefully the possibility of capital loss in each of the target date Portfolios, the likelihood and magnitude of which will be dependent upon the Portfolio's asset allocation. On the Target Date, the Portfolio's investment objective will be to seek to provide a combination of total return and stability of principal consistent with a low to moderate risk asset allocation which is targeted to the "average" retiree. Stocks are more volatile than bonds, and portfolios with a higher concentration of stocks are more likely to experience greater fluctuations in value than portfolios with a higher concentration in bonds. Foreign stocks and small and midcap stocks may be more volatile than large cap stocks. Investing in bonds also entails credit risk and interest rate risk. Generally investors with longer timeframes can consider assuming more risk in their investment portfolio. The ING Solution PortfoliosSM are actively managed and the asset allocation adjusted over time. The portfolios may merge with or change to other portfolios over time. Refer to the prospectus for more information about the specific risks of investing in the various assets classes included in the ING Solution Portfolios. Balanced 1013 Franklin Income Fund - Class A 788 ING T. Rowe Price Capital Appreciation Portfolio - Service Class The Income Fund of America® - Class R-4 1005 616 823 452 ING T. Rowe Price Capital Appreciation Portfolio - Service Class 788 Neuberger Berman Socially Responsive Fund® - Trust Class 1120 ING RussellTM Large Cap Index Portfolio Class S 1558 Fundamental InvestorsSM - Class R-4 1208 ING MFS Total Return Portfolio - Service Class American Balanced Fund® - Class R-4 193 ING Van Kampen Equity and Income Portfolio - Initial Class Pax World Balanced Fund 915 Oppenheimer Capital Income Fund - Class A Large Cap Value 1027 923 Oppenheimer Main Street Opportunity Fund® - Class A Pioneer Fund - Class A 1010 Evergreen Enhanced S&P 500® Fund - Class IS 1040 T. Rowe Price Dividend Growth Fund 1024 Neuberger Berman Partners Fund® - Trust Class ING Growth and Income Portfolio - Class I 1 105 ING UBS U.S. Large Cap Equity Portfolio Initial Class 9 Fund# Large Cap Value Discontinued Fund To New Investment Option Fund# ING Van Kampen Growth and Income Portfolio - Service Class 789 ING T. Rowe Price Equity Income Portfolio Service Class 819 Washington Mutual Investors FundSM Class R-4 Large Cap Growth ING T. Rowe Price Equity Income Portfolio - Service Class 617 572 The Growth Fund of America® - Class R-4 American Funds AMCAP Fund® - Class R4 1002 1002 AMCAP Fund® - Class R-4 1006 The New Economy Fund® - Class R-4 2714 ING T. Rowe Price Growth Equity Portfolio - Initial Class 111 593 ING RussellTM Large Cap Growth Index Portfolio - Class S Franklin DynaTech Fund - Class A Allianz CCM Capital Appreciation Fund Administrative Class ING BlackRock Large Cap Growth Portfolio Service Class ING Marsico Growth Portfolio - Service Class 1007 Calvert Social Index Fund - Class A Neuberger Berman Socially Responsive Fund® - Trust Class 1120 ING RussellTM Mid Cap Index Portfolio Class S AIM Mid Cap Core Equity Fund - Class A 1561 789 371 ING Van Kampen Growth and Income Portfolio - Service Class Van Kampen Comstock Fund - Class A 617 905 1029 783 Small/Mid/Specialty 1046 187 Vanguard® Strategic Equity Fund - Investor Shares Ariel Fund 456 Ariel Appreciation Fund 778 ING FMR SM Diversified Mid Cap Portfolio Service Class Morgan Stanley Institutional Fund Trust Mid Cap Growth Portfolio - Class P ING MidCap Opportunities Fund - Class A Managers Cadence Mid-Cap Fund - Class A ING T. Rowe Price Diversified Mid Cap Growth Portfolio - Initial Class ING FMR SM Diversified Mid Cap Portfolio - Service Class 778 1008 1032 Columbia Mid Cap Value Fund - Class A Allianz OCC Renaissance Fund - Class A ING Pioneer Mid Cap Value Portfolio Institutional Class 1214 752 ING JPMorgan Small Cap Core Equity Portfolio - Service Class Oppenheimer Main Street Small Cap Fund® Class A Legg Mason Partners Small Cap Growth Fund - Class A Vanguard® Explorer Fund - Investor Shares ING JPMorgan Small Cap Core Equity Portfolio - Service Class ING RussellTM Small Cap Index Portfolio - Class S ING SmallCap Opportunities Portfolio Class I 752 ING American Century Small-Mid Cap Value Portfolio - Service Class Amana Growth Fund 440 2532 Vanguard® Small-Cap Value Index Fund Investor Shares Allianz RCM Wellness Fund - Class A 1000 Invesco Leisure Fund - Class A Fundamental InvestorsSM - Class R-4 1208 1023 428 1030 449 1028 1038 1042 1045 290 1564 080 1612 10 Fund# Small/Mid/Specialty Discontinued Fund 1011 Evergreen Precious Metals Fund - Class I 1039 DWS Gold & Precious Metals Fund - Class A 776 1034 Wells Fargo Health Care Portfolio - Service Class Allianz RCM Technology Fund - Class A 1009 Columbia Technology Fund - Class A 1016 ING Global Real Estate Fund - Class A 1019 292 ING Clarion Real Estate Portfolio - Service Class* ING Real Estate Fund - Class A 1014 Franklin Utilities Fund - Class A To New Investment Option Fund# American Funds AMCAP Fund® - Class R4 1002 ING Clarion Global Real Estate Portfolio Institutional Class* 1613 ING Van Kampen Growth and Income Portfolio - Service Class 789 EuroPacific Growth Fund® - Class R-4 573 ING Templeton Foreign Equity Portfolio Initial Class New Perspective Fund® - Class R-4 1586 ING International Index Portfolio - Class S 1552 Global/International 573 EuroPacific Growth Fund® - Class R-4 830 ING Artio Foreign Portfolio - Service Class 176 Templeton Foreign Fund - Class A 1004 Capital World Growth and Income FundSM Class R-4 New Perspective Fund® - Class R-4 818 432 177 818 ING Oppenheimer Global Portfolio - Initial Class Templeton Growth Fund, Inc. - Class A Insurance products, annuities and retirement plan funding are issued by ING Life Insurance and Annuity Company. Securities are offered through ING Financial Advisers, LLC (Member SIPC), One Orange Way, Windsor, CT, 06095-4774. All companies are members of the ING family of companies. Securities may also be distributed through other broker-dealers with which ING Financial Advisers, LLC has selling agreements. Insurance obligations are the sole responsibility of each issuing company. Products and services may not be available in all states. Products and services offered through the ING family of companies. C11-0822-009R (08/2011) 11