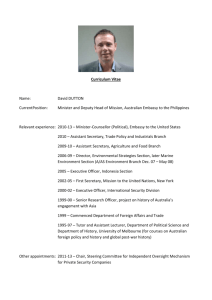

Department of Foreign Affairs and Trade (DFAT)

advertisement