Module 03 – In Class Group Assignment #2 Student #1: Student #2

advertisement

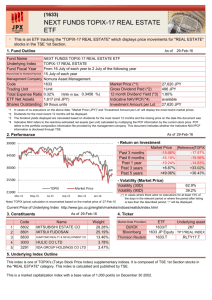

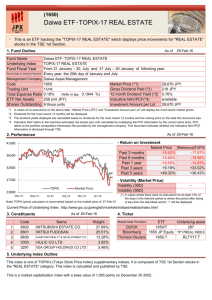

Module 03 – In Class Group Assignment #2 Student #1: Student #2: Student #3: Student #4: Student #5: Student #6: Read the HBS case The Nikkei 225 Reconstitution (9-207-109). The following questions can help your group prepare to discuss the case in class. Answers the following questions will not fully prepare your group. Students should be able answer the question: What should Taka Haneda do? What trades should Haneda place? Stocks? Amounts? Timing? 1. What type of event typically conveys more information about a company’s future prospects? Check the box that best applies: Index Additions Dividend Increases 2. For deletion 4022 Rasa Industries, what is the value of Pi / (FVi / 50) before the reconstitution? __________________ Which of the additions has the largest positive ratio of its index weight after the reconstitution to its market cap weight? Calculate (Index Wgt After ÷ Mkt Cap Wgt). Give the TSE code: __________________ Which of the deletions has the largest positive ratio of its index weight before the reconstitution to its market cap weight? Calculated as Index Wgt Before ÷ Mkt Cap Wgt. Give the TSE code: __________________ For all 195 remainders, the index weight will drop after the reconstitution. Which company is expected to have the largest drop in index weights (assume constant prices)? Give the TSE code: __________________ For the remainders, calculate the change in the index weight times the total amount indexed (given in JPY on p.1 of the case). Which stock has the most negative value? Give the TSE code: __________________ 3. 4. 5. 6. 7. For the remainders, calculate the average daily volume in JPY. To estimate this quantity, multiply the daily volume in shares by the price. Which stock has the highest volume in JPY? Give the TSE code: __________________ 8. For all remainders, calculate the ratio of your answer to #6 to #7 ( 6 ÷ 7 ). Which stock has the most extreme/negative value? Give the TSE code: __________________ 9. Whom do market makers prefer to trade against? Check the box that best applies Investors with information Investors who need to liquidate a position Simplifying assumption. We are going to look at change in index weights and assume the change in market weights are close to zero. We will use only one market cap (in JPY bn) for the whole assignment. Score: