Bismarck-Henning`s Financial Outlook (Past and Present)

advertisement

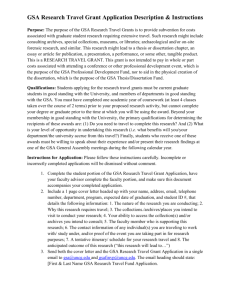

Bismarck-Henning’s Financial Outlook (Past and Present) Why are Illinois Schools facing a lack of fiscal funds? As you may be aware from media reports, Illinois is experiencing a significant fiscal crisis. This problem has been growing for years and unfortunately has no end in sight. From prorated State Aid payments to payments for grants such as special education, transportation, etc. being 4-5 months behind, the cash flow issues have every indication of continuing, The money will come eventually, but it seems to come the following fiscal year after the books are closed. At the end of Fiscal Year 2012 (FY 12), the State owed B-H CUSD #1 $330,549.37 ($225,900.77 in the Education Fund; $104,648.60 in the Transportation Fund). As of May 21, 2013, the State still owes B-H CUSD #1 a total of $353,923.58 ($294,226.93 in the Education Fund; $59,696.65 in the Transportation Fund). How has this impacted our district? B-H has been hit twice as hard. We have lost significant revenue at the local and at the State level. Local Impact From 2005-2009, the district has been able to hold steady even in the midst of the States’ financial crisis. As the tax base increased, the district was able to increase revenue while only increasing the tax rate from $4.75 in 2005 to $4.85 in 2009. In a couple cases, we able to decrease the tax rate from the previous year. From 2005 to 2009 the district’s EAV increase by almost 15% or an increase $11,317,062. This resulted in a 5 year average increase of $66,507 in new money each year in the Education Fund more than the previous year. As the recession and the States’ fiscal crisis blew out of the starting gates, it resulted in lower property value across the state, and B-H was in the middle as most district were. The property value began to decrease which resulted in lower EAV’s and this negatively impacted the tax base. With the EAV at its’ all time high in 2009 of $75,624,737, the EAV in 2012 dropped to $71,470,734. As of May 20, 2013, the EAV is projected to be at $71,665,773. From the 20092013, the EAV has decreased by more the 5%. As previously stated, the district was receiving an average of $66,507 in new monies while only slightly increasing the tax rate. For the past 2 years, the change has been an average decrease of $23,678 in the Education Fund. What does this mean for B-H? In order to keep the same funding in the tax levy on a yearly basis…the tax rate has to be increased to cover the loss in the EAV. The Education Fund, like the O & M, Transportation, Working Cash, Fire Prevention & Safety, Special Education, and Lease Equipment, is capped (or has a limit to the tax rate). As our EAV decreases, so does the amount of locally generated revenue we can expect to receive. The Education Fund is the largest fund for the school district and is the most often discussed fund. Year Extended Extension Amount Change from Previous Year % Change 2013 2012 2011 2010 2009 2,042,475 2,034,078 2,111,091 2,130,134 2,155,305 $8,397 $77,013 $19,000 $25,171 $84,779 .41% 3.79% .90% 1.00% 1.20% State Impact The two primary state funding sources for schools are General State aid (GSA) and mandated Categorical Aid. GSA is the money provided by the state to “support” public education. This is supposed to be done in an equitable manner. This done through the Foundation Level. This is the minimum per child expenditure, as established by the Illinois State Legislature. The Foundation Level is $6,119. The GSA/Foundation level we receive is determined by a state formula that combines state and local property tax resources. Only once back in the mid 90’s did the state not uphold their end of the bargain and failed to pay all of the state aid as promised. This was called the “mysteriously lost 24th payment”. In FY12, the GSA was prorated at 95%. In FY13, it was prorated at 89.16%. The following table provides a picture of our GSA losses. Fiscal Year General State Aid Difference Prorated Percentage Received From Previous Year FY09 $2,286,002 $667,369 FY10 $2,391,560 $105,558 FY11 $2,814,038 $422,478 FY12 $2,620,496 $193,542 95% ($131,025) FY13 $2,510,210 $111,286 89.16% ($305,155) Total Loss of Prorated Dollars $436,180 As stated above, the second primary funding source of revenue from the state is Mandated Categorical Aid. This aid’s purpose is to reimburse districts for expenses associated with providing services to and for target populations. The area hit hardest by reductions in state revenue is transportation. Since FY 09, the State of Illinois has instituted a $133.7 million or 39.4% reduction in transportation funding. Other programs like Reading Improvement and ADA Block Grant have cut completely. When combined with the reduction sin GSA, this has been a major reduction in state funding for B-H. The following table indicates the level of cuts to B-H. Regular Transportation Special Education Transportation ADA Block Grant Reading Improvement Block Grant Early Childhood Total 2009 2010 2011 2012 2013 199,153 209,946 135,739 152,855 143,197 FY9 to FY13 Difference ($55,956) 73,658 105,625 85,292 93,379 95,831 $22,173 30,385 7,405 0 0 0 ($30,385) 24,651 21,140 0 0 0 ($24,651) 121,883 118,894 121,174 121,254 111,652 ($10,231) $449,730 $463,010 $342,205 $367,488 $350,680 ($99,050) What can B-H do? Like a household budget, a district budget cannot operate year after year with higher expenditures than revenue. Two options exist when revenue shortages occur. The first is to increase revenue, and unfortunately, very few options exist for a school district. Fees can be raised, but they further increase the burden on parents / guardians. Another option is to sell working Cash Bonds. Selling bonds can help to replenish the reductions in the fund balances created by the revenue shortfall, and as an insurance against future funding shortages. The second option is to implement further reductions in expenses by reducing budgets and layoffs or Reductions in Force. For FY14, the district has tried to save in multiple ways, but no limited to: 1. Elimination of 2 FTE (1 at the Elementary School / 1 at the Junior High) 2. Change Employee insurance to a different provider at a lower cost. 3. Reduce School Psychologist time from VASE. 4. Higher lower costing employees when veteran (higher costing employees) retire or resign. 5. Reduce building level budgets 6. Reduce main bus route from 9 to 8 and employ 1 less full-time route driver. The compounding effect of those reductions is tremendous for our district; however, it has not kept pace with the reduction in revenue and has caused a significant lowering of the fund balances reserve. In fact, district expenses in 2008-2009 school year were more than $300,000 higher than the budget amount for the 2012-2013 school year (four years later). The following graph (in millions) shows the expenditures have been fairly static in the Education Fund the past 5 years except for 2010. Education Fund $7.0 $6.8 $6.6 $6.4 $6.2 $6.0 $5.8 $5.6 $5.4 $5.2 $5.0 2006 2007 2008 Revenue 2009 2010 2011 2012 Expenditures The following graph (in millions) shows the revenue and expenditures in the Operating Funds. The Operating Funds include the Educational, Operations & Maintenance, Transportation, and Working Cash Funds. Operating Funds $7.9 $7.7 $7.5 $7.3 $7.1 $6.9 $6.7 $6.5 2008 2009 2010 Revenue 2011 2012 Expenditures What does the future hold? The majority of this article focuses on state and local funding shortages. The reality is that the district is also beginning to suffer due to federal fiscal issues and laws. Take for example the federal dollars we get for Title I and Title II salaries. The district pays the State’s TRS system 9.4% for employees. If we use federal grant dollars to fund employee salaries, the rate the district pays has increased to 35.41%. Additional information has come down through the federal pipeline that Title Grants may have further cuts or may even be exacerbated by the sequestration cuts to be implemented by the federal government. Unfortunately, there also appears that there is no end in sight for the financial crisis for Illinois schools. Governor Pat Quinn’s budget proposal included a cut of about $300 million to education. Approximately 50% would be taken out of GSA and a majority of the remaining 50% would reduce the transportation reimbursement fund. The Governor proposed a $150 cut to GSA which would take the districts from having GSA prorated at 89% to approximately 82% or $5,452 per child. As stated earlier, the Foundation Level amount is and should be funded at $6,119 per child. That proration, combined with enrollment numbers used in the formula, would likely reduce our state aid by an additional $180,000-$200,000 reduction in GSA. The $145 million cut in the Transportation Reimbursement line would result in a 19% proration in the reimbursement that school districts are owed for operating student transportation as required by Illinois School Law. This cut would result in a loss of approximately $242,000 in transportation funding for B-H schools. To put it simply, we really have no idea what the future will hold. If revenue continues to decrease and expenditures continue to rise, schools will have little choice but counteract the trend with major reductions in force and/or significantly increase tax rates. We have always tried to manage the districts’ finances with great care and consideration for what the tax payers want and need. We will continue to do so even in these tough times. Careful consideration will need to be given to all aspects of education which could lead to possibly “weeding” out the lesser of the needs.