Computation of NTD Realized Gains

advertisement

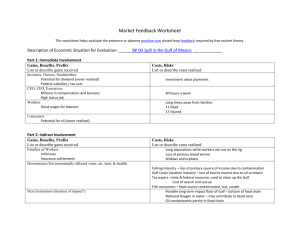

Method of calculating “Accumulated NTD Realized Gains” for Offshore Overseas Chinese, Foreign Nationals, and Mainland Area Investors Engaging in Futures Trading 1 Legal basis The legal basis is Article 44-9, paragraph 4 of the Operating Rules of the Taiwan Futures Exchange Corporation. 2 Purpose of calculation "Accumulated New Taiwan dollar realized gains" shall be reported daily in order to accurately state and control the actual daily after-market amount of New Taiwan dollars ("NT Dollars") held in the account of each offshore overseas Chinese, foreign national, or mainland area investor, which may not exceed the limit set by the foreign exchange authority. 3 Method of calculation The method of calculating "accumulated NT Dollar realized gains" for reporting by offshore overseas Chinese, foreign nationals, and mainland area investors is as follows: (1) Formula for calculation: Reported "accumulated NT Dollar realized gains" (A) = (current day) accumulated NT Dollar realized gains or losses (B) ± (current day) foreign exchange settlement amounts - (current day) losses on open futures positions - (current day) initial margin requirements for open positions (2) Explanation: 1. Reported "accumulated NT Dollar realized gains" (A) refers to the actual NT Dollar amount held by offshore overseas Chinese, foreign nationals, and mainland area investors, and reported daily to the foreign exchange authority. Reported amounts may be positive or negative. 2. (Current day) accumulated NT Dollar realized gains or losses (B) = (previous day) account balance ± (current day) gains or losses on closed or matured futures positions ± (current day) option premium receipts or payments ± (current day) gains or losses on expired options - (current day) transaction fees - (current day) futures transaction taxes. 2.1 [ (Current day) accumulated NT Dollar realized gains or losses (B) ± (current day) foreign exchange settlement amounts] (C), is the "account balance" in the customer trade report of the futures commission merchant, and after 1 totaling is carried over to the next day. 2.2 (Current day) gains or losses on closed or matured futures positions: gains or losses on futures trades after closing out trades in same-month contracts of the same futures product. For settlement at maturity, gains or losses are calculated based on the difference between the final settlement price and the initial purchase (or sale) price. (Government bond futures are calculated based on the difference between the final settlement price and the initial purchase (or sale) price; stock futures are calculated by using the final settlement price to calculate the underlying value of the contract). 2.3 (Current day) option premium receipts or payments: the balance of receipts and payments of premiums on options traded. 2.4 (Current day) gains or losses on expired options: When an option is exercised and settled at maturity, realized gain or loss is calculated as the spread between the final settlement price and the strike price. 2.5 (Current day) transaction fees: Transaction fees related to futures trading. 2.6 (Current day) futures transaction taxes: tax amounts payable pursuant to the provisions of the Futures Transaction Tax Act. 3. (Current day) foreign exchange settlement amount: When NT Dollars are converted to a TAIFEX-announced foreign currency, the amount of that settlement shall be stated as a deduction from the reported accumulated NT Dollar realized gains; when foreign currency is converted to NT Dollars, the amount of that settlement shall be stated as an addition to the reported accumulated NT Dollar realized gains. When the accumulated NT Dollar realized gains and losses are negative (i.e., there is a realized loss), the time and amount of the settlement shall be handled as set out in the appended "Details of Foreign Exchange Settlements for Accumulated NT Dollar Realized Losses by Offshore Overseas Chinese, Foreign Nationals, and Mainland Area Investors." 4. (Current day) amount of losses on open futures positions: Current day amount of losses on open futures positions: the amount of "Floating gains or losses on open positions" listed in daily trade reports; if that amount is a negative value, it shall be a deduction from accumulated NT Dollar realized gains. 5. (Current day) initial margin requirement for open positions: Initial margin requirements for open positions include the following: 5.1 The initial margin requirement for open long or short futures positions. 5.2 Initial margin requirements for open options positions: the combined margin required for short positions and combination positions. 6. (Current day) accumulated NT Dollar realized gains or losses (B) plus or 2 minus (current day) foreign exchange settlement amount, i.e., (C), is the "account balance" given in the customer trade report of the futures commission merchant, and is carried over to the following day; (current day) losses on open futures positions and (current day) initial margin requirements for open positions are adjusted daily on a marked-to-market basis. (Attachment) Instructions for Exchange Settlement of Accumulated NTD Realized Losses by Offshore Overseas Chinese, Foreign Nationals, and Mainland Area Investors Points to consider in exchanging USD into NTD to cover the accumulated NTD realized losses of offshore overseas Chinese, foreign nationals, and Mainland Area investors When an offshore overseas Chinese, a foreign national, or a Mainland Area investor incurs “accumulated NTD realized losses” from futures trading, that is, the “accumulated NT Dollar realized gains or losses” (B) is negative, the FCM should determine whether to make exchange settlement (exchange USD into NTD) on behalf of its foreign client to cover the NTD shortfall. To lessen the amount and frequency of exchange settlement by offshore overseas Chinese, foreign nationals, and Mainland Area investors, the “net value of NTD account” provided in the FCM’s customer account statement is taken into consideration when determining whether to make an exchange for a client’s accumulated NTD realized losses. Provided an offshore overseas Chinese, a foreign national, or a Mainland Area investor has a positive NTD balance in its account when it has accumulated NTD realized losses, it does not need to make an exchange. If the NTD account balance of an offshore overseas Chinese, a foreign national, or a Mainland Area investor is not sufficient to cover the expenses, the FCM may proceed with exchange settlement in accordance with Article 44-9, the Operating Rules of the Taiwan Futures Exchange Corporation Time to settle currency exchanges and the amount of exchanges 1. When the “accumulated NT Dollar realized gains or losses” (B) is < 0, but the “net value 3 of NTD account” is > 0: Since the offshore overseas Chinese, a foreign national, or a Mainland Area investor has sufficient NTD to cover the “accumulated NTD realized loss,” it does not need to make an exchange settlement. If the FCM makes an exchange on behalf of an offshore overseas Chinese, a foreign national, or a Mainland Area investor, the amount of the exchange shall be up to the amount of “accumulated NT Dollar realized gains or losses” (B). 2. When the “accumulated NT Dollar realized gains or losses” (B) is < 0, but the “net value of NTD account” is < 0: When an offshore overseas Chinese, a foreign national, or a Mainland Area investor does not have sufficient NTD to cover the “accumulated NTD realized loss” and its NTD account balance is negative, it should make an exchange (exchange USD into NTD). The FCM should exchange at least the absolute value of the lesser of the “accumulated NT Dollar realized gains or losses” (B) or the “net value of NTD account”, but no more than the amount of the “accumulated NT Dollar realized gains or losses” (B). 4 範例: 累計新台幣已實現虧損是否結匯暨其結匯金額說明 幣別 CASE 1 NTD 1.前日餘額 2.本日存提淨額 3.期貨沖銷損益 4.權利金收付 5.手續費 6.期交稅 7.帳戶餘額 【 i.e. (C) 】 7a.未平倉損益 7b.帳戶淨值 8.原始保證金 9.維持保證金 10.超額保證金 【 i.e. (A) 】 11a.買方權利金市值 11b.賣方權利金市值 12. 帳戶市值 0 0 -30,000,000 0 -1,000 -1,000 -30,002,000 40,000,000 9,998,000 累計新臺幣已實現損益 (B) 新臺幣帳戶淨值 -30,002,000 9,998,000 是否結匯 結匯金額 NA NA NA CASE 3 NTD 0 0 -30,000,000 0 -1,000 -1,000 -30,002,000 -20,000,000 -50,002,000 100,000,000 NA -150,002,000 0 0 -30,000,000 -60,000,000 -1,000 -1,000 -90,002,000 80,000,000 -10,002,000 CASE 4 NTD 0 0 -30,000,000 50,000,000 -1,000 -1,000 19,998,000 -40,000,000 -20,002,000 CASE 5 NTD 0 -10,000,000 -50,000,000 40,000,000 -1,000 -1,000 -20,002,000 40,000,000 19,998,000 NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA NA 得結匯 Min Max CASE 2 NTD NT$0 NT$30,002,000 -30,002,000 -50,002,000 應結匯 -90,002,000 -10,002,000 應結匯 NT$30,002,000 NT$30,002,000 NT$10,002,000 NT$90,002,000 19,998,000 -20,002,000 無需結匯 NT$0 NT$0 -20,002,000 19,998,000 得結匯 NT$0 NT$20,002,000 備註:1. 上表對帳單中之「3.期貨沖銷損益」金額含括期貨及選擇權到期損益。 2. 上表「10. 超額保證金」與公式中之申報「累計新臺幣已實現盈餘」(A) 略有不同,二者差異僅在未平倉獲利。公式中 (A)含括未平倉部位之損失,但未計入其獲利,主要係因獲利尚未實現,爲避免增加(A)之金額,以降低結匯機率,因而 (A) 無須計入未平倉獲利,但可抵減未平倉損失。 5 Example: Determining whether to exchange USD into NTD to cover accumulated NTD realized losses and the amount of exchange Currency Case 1 Case2 Case 3 Case 4 Case 5 NTD NTD NTD NTD NTD 1. Previous day balance 0 0 0 0 0 2. Day’s net deposit/withdrawal 0 0 0 0 -10,000,000 -30,000,000 -30,000,000 -30,000,000 -30,000,000 -50,000,000 0 0 -60,000,000 50,000,000 40,000,000 5. Commission fees -1,000 -1,000 -1,000 -1,000 -1,000 6. Transaction tax -1,000 -1,000 -1,000 -1,000 -1,000 -30,002,000 -30,002,000 -90,002,000 19,998,000 -20,002,000 40,000,000 -20,000,000 80,000,000 -40,000,000 40,000,000 9,998,000 -50,002,000 -10,002,000 -20,002,000 19,998,000 8. Initial margin NA 100,000,000 NA NA NA 9. Maintenance margin NA NA NA NA NA 10. Excess margin【i.e. (A)】 NA -150,002,000 NA NA NA 11a. Buyer’s premium value NA NA NA NA NA 11b. Writer’s premium value NA NA NA NA NA 12. Account market value NA NA NA NA NA -30,002,000 -30,002,000 -90,002,000 19,998,000 -20,002,000 9,998,000 -50,002,000 -10,002,000 -20,002,000 19,998,000 3. Offset gain/loss on futures 4. Premium received/paid 7. Account balance【i.e. (C)】 7a. Open position loss 7b. Account balance- Net Accumulated NT Dollar realized gains or losses (B) NTD account - Net 6 Exchange settlement? Optional Yes Yes No Optional Exchange mount Min NT$0 NT$30,002,000 NT$10,002,000 NT$0 NT$0 Max NT$30,002,000 NT$30,002,000 NT$90,002,000 NT$0 NT$20,002,000 7