SUPPLEMENTARY MATERIAL Overconfidence and risk seeking in

advertisement

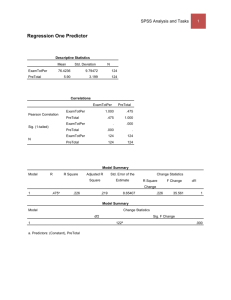

SUPPLEMENTARY MATERIAL Overconfidence and risk seeking in credit markets: An experimental game David Peóna,b, Manel Anteloc, Anxo Calvod In this Supplementary Material we detail the technical specifications for the statistical analyses implemented in Peón et al. (2015). Additionally, some supplementary statistical information is provided regarding raw data of the participants’ responses, regression models and others. Statistical analysis. Technical specifications IBM SPSS Statistics version 21 was used for statistical analysis. Technical specifications, provided by the statistical package, of the analyses implemented are in order. First, the tests of Normality implemented were the Kolmogorov-Smirnov test with the Lillefors Significance Correction, and the Shapiro-Wilk test. Additionally, the probability distributions of each variable were compared against a Normal distribution using Q-Q plots and box-and-whiskers plots. All statistical regressions used a stepwise procedure for variable selection that applies the criteria “Probability of F to enter ≤ 0.05; probability of F to remove ≥ 0.10”. The number of observations to be included in the regression considered a ‘missing pairwise’ criteria in all instances. Factorial analyses considered the following specifications. The extraction method used was a Principal Component Analysis (PCA) of the correlation matrix. Descriptive measures provided are the Kaiser-Meyer-Olkin measure of sampling adequacy (KMO) and the Bartlett’s test of Sphericity. The rotated component matrix was obtained using a Varimax normalization as the rotation method. Finally, the Cluster analysis considers the average linkage between groups as a method of clustering and the squared Euclidean distance as a measure. Grupo BBVA and the Department of Financial Economics and Accountancy, University of A Coruna, Campus Elviña s/n, 15071 A Coruña. Email: david.peon@udc.es b Corresponding author. c Department of Economics, University of Santiago de Compostela, Campus Norte, 15782 Santiago de Compostela (Spain). E-mail: manel.antelo@usc.es d Department of Financial Economics and Accountancy, University of A Coruna, Campus Elviña s/n, 15071 A Coruña. Email: anxo.calvo@udc.es a Raw data and supplementary statistical information In what follows we provide two pieces of information. First, Tables SM.1 and SM.2 provide the raw data of the strategies implemented by participants in the experiment. Second, Tables SM.3 to SM.6 provide additional statistical information not included in the article regarding histograms, normal QQ plots, and box-and-whisker plots of the game indicators, regression models of game indicators to behavioral variables, correlations among variables and factors, and regression models of variables and factors of three instances: game factors to behavioral factors, game factors to behavioral variables, and game indicators to behavioral factors. TABLE SM.1 – Raw data from Simulation Game (1/2) STRATEGY GAME 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 1P 1V 2P 2V 3P 3V 4P 4V 5P 5V 6P 6V 17.0% 100 16.0% 200 17.0% 150 14.0% 300 17.0% 150 16.0% 100 16.0% 150 17.0% 125 16.0% 190 14.5% 270 17.0% 0 15.0% 250 10.0% 100 15.0% 200 12.5% 250 13.0% 250 12.0% 240 14.0% 280 13.0% 200 18.0% 50 16.0% 150 10.0% 200 16.0% 150 14.0% 300 15.2% 200 18.0% 0 17.0% 150 16.0% 200 15.0% 250 12.0% 400 16.5% 175 15.0% 250 15.0% 250 15.7% 215 17.0% 150 15.5% 225 14.5% 250 13.5% 0 14.6% 250 16.5% 175 16.5% 175 15.5% 225 17.0% 150 17.0% 150 18.0% 100 17.9% 105 17.0% 150 16.0% 200 19.0% 0 18.5% 65 17.0% 130 18.0% 85 17.5% 125 18.0% 100 16.0% 200 16.0% 150 16.0% 120 17.0% 120 16.0% 150 13.0% 300 15.7% 215 16.8% 160 15.4% 230 18.5% 75 17.5% 100 14.0% 300 18.0% 90 19.0% 0 14.0% 280 16.0% 150 15.0% 230 17.0% 120 18.0% 100 16.0% 150 14.5% 275 15.2% 240 16.5% 175 14.2% 290 17.0% 150 17.0% 150 18.0% 100 15.5% 225 18.5% 75 18.0% 100 16.5% 175 18.5% 75 16.5% 175 18.0% 100 19.0% 50 17.5% 125 16.0% 0 18.5% 75 15.0% 250 15.0% 250 15.0% 250 13.0% 350 16.7% 165 17.1% 145 16.9% 155 14.9% 255 15.3% 235 15.8% 210 15.0% 150 15.0% 250 15.0% 250 15.0% 250 15.0% 160 15.0% 250 16.0% 200 17.0% 150 15.0% 250 15.0% 250 15.0% 250 15.0% 250 16.0% 170 15.0% 210 16.0% 200 16.0% 190 16.5% 175 17.0% 150 17.0% 150 17.0% 150 17.0% 150 18.0% 100 16.0% 200 16.0% 200 12.0% 400 0.1% 0 12.0% 10 16.0% 200 15.0% 250 15.0% 240 16.0% 200 15.0% 250 14.0% 300 15.0% 250 15.0% 250 15.0% 250 16.4% 180 18.0% 0 16.0% 200 15.0% 250 16.0% 200 16.0% 200 17.0% 100 18.0% 75 14.0% 300 13.5% 300 14.0% 300 14.0% 300 16.5% 175 18.0% 100 15.0% 200 17.0% 150 11.0% 0 16.8% 163 17.5% 120 15.8% 210 17.2% 135 18.1% 95 20.0% 0 16.9% 155 16.5% 170 15.4% 200 14.4% 270 16.5% 165 16.7% 160 14.5% 275 17.0% 150 20.0% 0 18.0% 100 18.0% 100 19.0% 50 17.0% 150 17.5% 120 17.6% 120 16.0% 170 16.0% 190 17.0% 150 15.5% 225 17.1% 145 16.0% 200 16.0% 200 16.5% 150 16.9% 140 16.0% 200 17.0% 150 14.0% 225 15.0% 225 15.3% 150 16.4% 150 13.3% 335 17.0% 150 0.0% 0 16.5% 175 16.5% 175 16.5% 175 14.9% 255 17.0% 150 15.0% 250 14.0% 300 15.0% 250 15.0% 250 16.0% 200 16.0% 180 15.0% 0 15.5% 200 15.5% 200 15.0% 250 14.4% 280 17.0% 125 20.0% 0 16.0% 180 13.2% 320 13.6% 300 15.5% 220 18.0% 100 17.0% 150 13.0% 350 18.0% 100 18.0% 100 16.0% 200 19.0% 25 19.0% 50 19.0% 50 19.0% 50 16.5% 175 16.0% 200 17.5% 125 20.0% 0 16.0% 200 15.5% 225 15.0% 250 12.0% 400 17.0% 150 18.0% 100 15.0% 250 16.0% 200 18.0% 100 16.0% 200 15.0% 250 15.0% 250 15.0% 250 16.0% 200 17.0% 150 15.0% 250 17.3% 138 17.3% 125 16.0% 200 19.0% 35 20.0% 0 16.0% 200 18.0% 90 19.0% 0 16.0% 200 15.0% 250 16.0% 200 15.0% 250 17.5% 110 15.0% 225 16.0% 180 17.0% 150 17.0% 130 16.0% 200 16.0% 200 15.0% 250 16.0% 200 15.0% 0 18.0% 0 17.0% 150 17.3% 130 16.0% 190 14.0% 225 10.5% 465 16.0% 175 13.0% 345 15.5% 225 15.1% 245 16.0% 200 16.5% 175 19.0% 50 16.4% 180 17.0% 150 19.0% 30 18.0% 100 15.0% 225 13.0% 300 17.0% 150 13.0% 200 15.0% 100 18.0% 0 10.0% 250 13.0% 350 17.0% 100 17.2% 140 18.6% 70 17.6% 120 16.5% 175 15.0% 250 17.4% 130 17.5% 125 16.0% 200 15.5% 225 15.0% 250 16.0% 200 15.0% 250 15.0% 100 12.5% 320 12.5% 200 16.0% 0 14.5% 275 13.0% 350 14.0% 200 18.0% 50 13.0% 250 12.0% 400 15.0% 250 16.0% 200 13.4% 290 17.6% 100 17.3% 130 15.3% 235 15.3% 235 16.0% 200 17.0% 130 17.0% 140 14.0% 280 13.0% 310 14.5% 250 14.5% 265 17.5% 120 16.8% 160 16.9% 155 15.5% 225 15.4% 230 15.9% 205 17.4% 100 16.0% 0 12.0% 400 12.4% 350 12.0% 400 14.6% 270 14.0% 200 18.0% 100 17.0% 150 18.0% 100 15.0% 250 16.0% 200 17.0% 150 15.0% 250 15.0% 250 14.0% 300 15.0% 250 16.0% 200 14.5% 250 14.3% 288 14.8% 250 14.5% 275 14.6% 270 13.5% 250 17.0% 150 0.0% 0 15.0% 250 15.0% 250 15.0% 250 15.0% 250 16.5% 175 16.5% 175 13.0% 350 15.0% 250 16.0% 200 16.0% 200 17.0% 150 18.0% 100 16.0% 200 15.5% 225 16.0% 200 16.3% 185 12.0% 30 0.0% 0 15.1% 245 15.8% 210 15.5% 225 15.5% 225 16.0% 200 0.0% 0 16.0% 200 16.6% 170 16.0% 200 16.3% 185 13.5% 300 14.0% 275 14.0% 300 18.0% 75 20.0% 0 15.0% 225 14.6% 255 17.3% 115 15.0% 230 16.0% 0 15.0% 245 15.5% 221 15.6% 220 18.0% 100 14.3% 285 15.4% 230 16.2% 190 16.7% 165 17.7% 110 14.7% 260 12.5% 370 18.0% 0 16.0% 0 16.0% 200 17.3% 138 18.0% 100 16.0% 200 15.0% 250 16.5% 175 14.0% 300 TABLE SM.1 – Raw data from Simulation Game (2/2) STRATEGY GAME 1P 1V 2P 2V 3P 3V 4P 4V 5P 5V 6P 6V 17.3% 135 17.4% 130 16.4% 180 16.2% 190 15.7% 215 13.0% 350 17.0% 150 16.0% 200 14.0% 300 16.0% 200 16.0% 200 16.0% 200 16.0% 200 17.0% 150 18.0% 100 18.0% 100 18.0% 100 15.7% 218 16.5% 175 13.0% 300 10.0% 500 16.5% 175 17.0% 150 13.0% 350 17.9% 100 16.0% 200 17.0% 150 14.6% 270 18.0% 100 18.7% 65 15.0% 200 15.0% 250 16.0% 200 14.0% 250 16.0% 200 14.0% 280 17.4% 130 16.1% 195 16.0% 200 18.1% 85 19.2% 30 16.7% 165 18.2% 75 17.0% 150 16.8% 160 19.5% 17 19.5% 10 19.5% 25 16.0% 200 16.2% 180 15.5% 225 16.5% 100 15.5% 225 16.0% 195 16.8% 160 15.0% 250 13.6% 320 18.0% 100 18.0% 100 14.5% 275 16.2% 190 10.0% 0 16.0% 200 16.0% 200 17.0% 150 17.0% 150 16.5% 150 18.5% 75 16.5% 175 16.5% 175 16.0% 200 17.5% 125 18.0% 100 16.0% 200 17.0% 150 14.5% 275 18.0% 100 18.3% 85 15.4% 185 16.2% 180 11.9% 400 16.0% 200 14.5% 270 13.9% 305 16.7% 165 17.0% 150 15.6% 220 18.0% 100 18.0% 20 14.6% 270 17.5% 125 13.0% 350 15.0% 250 18.0% 100 16.0% 200 16.0% 200 18.0% 0 17.0% 150 17.0% 150 17.0% 150 17.0% 150 17.0% 150 17.5% 110 16.0% 100 12.8% 360 14.0% 300 15.1% 245 14.3% 285 16.0% 200 15.0% 200 12.0% 400 13.0% 350 14.5% 275 16.0% 200 18.0% 100 12.0% 200 16.0% 200 14.0% 300 13.5% 325 16.0% 200 18.0% 100 20.0% 0 18.0% 100 15.6% 220 14.8% 260 15.8% 210 11.0% 450 16.0% 200 14.9% 258 13.2% 340 14.3% 285 15.0% 250 18.0% 50 15.5% 225 14.5% 275 18.5% 75 17.8% 110 13.9% 305 14.5% 275 15.0% 250 16.0% 200 15.0% 220 12.0% 0 17.0% 150 16.0% 200 16.0% 200 16.0% 200 16.0% 200 15.6% 220 15.2% 240 19.0% 40 17.0% 150 14.0% 300 15.0% 250 16.0% 100 19.0% 30 18.0% 20 17.0% 150 16.0% 190 17.5% 100 19.0% 0 16.5% 175 14.5% 170 11.3% 400 14.0% 300 18.5% 10 18.0% 45 17.0% 150 17.2% 140 17.2% 140 15.0% 250 15.0% 250 16.2% 190 17.5% 125 18.0% 75 18.0% 100 16.0% 200 10.0% 500 14.0% 300 16.0% 200 13.0% 350 14.5% 275 17.0% 150 18.0% 100 14.5% 275 17.0% 150 14.6% 265 18.0% 100 14.8% 255 16.1% 192 15.8% 210 14.7% 265 16.3% 170 16.7% 150 16.8% 145 17.3% 127 15.1% 240 13.6% 315 16.0% 20 15.5% 25 12.0% 380 10.5% 425 12.0% 350 15.0% 250 18.0% 100 18.0% 100 16.0% 200 15.0% 0 13.0% 350 14.0% 300 14.5% 6 11.0% 10 14.5% 100 17.0% 60 17.0% 80 13.0% 115 18.0% 100 18.0% 100 12.5% 375 18.0% 100 14.0% 300 16.9% 155 17.0% 150 17.0% 130 14.5% 275 14.0% 0 19.0% 0 17.0% 150 18.2% 90 18.4% 75 14.8% 240 16.0% 200 16.9% 155 14.7% 265 17.0% 150 16.0% 200 15.5% 225 15.5% 225 16.5% 175 16.0% 0 16.0% 200 16.0% 200 16.0% 200 15.0% 250 15.5% 225 16.0% 200 19.0% 0 19.0% 0 14.0% 300 11.0% 450 15.0% 250 15.0% 250 16.0% 195 17.5% 120 17.5% 120 18.0% 95 16.5% 175 16.5% 175 18.0% 100 0.0% 0 17.0% 150 16.0% 200 16.0% 200 16.0% 200 17.0% 150 17.0% 150 17.0% 150 16.0% 200 17.0% 150 17.0% 150 16.5% 175 18.1% 95 15.4% 230 17.0% 150 17.0% 0 17.6% 120 18.0% 100 16.0% 200 15.0% 250 16.0% 200 16.0% 200 14.5% 275 14.0% 200 17.0% 150 15.0% 250 17.5% 125 17.0% 150 14.0% 300 14.0% 200 16.0% 150 14.8% 200 15.5% 160 14.0% 250 16.0% 200 13.0% 350 15.0% 100 13.0% 325 14.0% 300 16.0% 200 15.0% 250 18.0% 100 15.0% 250 15.0% 250 19.0% 50 19.0% 50 16.0% 200 16.8% 160 16.1% 195 13.9% 305 13.6% 320 15.6% 220 15.6% 220 14.0% 290 15.0% 240 12.0% 400 12.0% 400 16.0% 200 14.0% 300 18.0% 100 18.0% 0 17.0% 0 16.0% 200 15.0% 250 15.0% 250 16.0% 200 16.0% 200 14.0% 300 15.0% 250 15.0% 250 13.0% 350 15.0% 200 15.0% 100 14.0% 300 14.0% 300 16.0% 200 14.0% 300 AVRG 16.3% 154.9 15.6% 139.6 15.3% 219.5 15.7% 193.9 16.0% 178.3 15.5% 216.7 M EDIAN 16.8% 150.0 16.1% 150.0 15.5% 200.0 16.0% 200.0 16.0% 200.0 15.9% 202.5 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 100 101 102 103 104 105 106 107 108 109 110 111 112 113 114 115 116 117 118 119 120 121 122 123 124 125 126 Note: In order to preserve participants’ anonymity, results in Table SM1 have been ranked in terms of gender and age. TABLE SM.2 – Estimated indicators from the Simulation Game (1/2) pavg pvol Vind Vmax,ind NPL Qavg Qvol 1 16.2% 15.8% 1000 0.870 6.1% 0.980 0.941 2 16.4% 15.5% 985 0.916 5.9% 1.052 0.953 3 12.8% 13.0% 1320 0.607 5.7% 0.843 0.878 4 14.5% 13.8% 1050 0.636 6.0% 0.813 0.848 5 15.9% 14.5% 1200 0.968 5.9% 0.943 1.150 6 15.8% 15.7% 1265 1.000 6.0% 1.081 1.077 7 16.3% 15.4% 1075 0.960 6.2% 0.948 1.043 8 17.2% 17.0% 855 1.000 6.2% 1.018 1.027 9 18.2% 17.7% 505 0.918 5.3% 1.037 1.002 10 15.7% 15.3% 1040 0.800 6.1% 1.089 1.127 11 16.3% 15.7% 1080 0.977 5.9% 1.119 1.105 12 16.7% 15.4% 870 0.870 5.7% 0.961 1.067 13 15.7% 15.3% 1230 0.961 5.6% 1.112 1.102 14 17.3% 17.0% 800 1.000 6.4% 0.962 0.939 15 17.7% 17.3% 700 1.000 6.3% 1.019 1.007 16 16.1% 14.6% 1175 1.000 5.2% 1.075 1.045 17 16.1% 15.9% 1165 1.000 6.1% 0.942 0.939 18 15.0% 15.0% 1310 0.873 5.9% 1.000 1.000 19 15.5% 15.4% 1350 1.000 6.0% 0.979 0.989 20 16.1% 16.0% 1095 0.932 6.2% 1.010 1.017 21 16.8% 16.7% 950 1.000 6.1% 1.020 1.011 22 15.0% 14.1% 1100 0.733 7.1% 0.915 0.929 23 15.0% 14.9% 1500 1.000 6.0% 1.045 1.045 24 16.6% 15.8% 1030 1.000 6.1% 0.912 0.982 25 15.1% 14.3% 1375 0.932 5.6% 0.967 0.984 26 17.2% 16.5% 788 0.940 6.1% 1.075 1.029 27 17.6% 16.9% 715 0.986 6.0% 1.114 1.075 28 15.7% 15.4% 1240 0.954 5.8% 1.122 1.126 29 18.2% 17.5% 550 1.000 6.3% 0.982 1.015 30 16.6% 16.4% 975 0.956 5.9% 1.029 1.035 31 16.4% 16.3% 1035 0.963 6.0% 1.052 1.052 32 15.2% 14.8% 1235 0.852 5.7% 1.151 1.161 33 16.9% 16.1% 930 1.000 5.9% 0.973 1.071 34 15.3% 15.1% 1400 1.000 5.9% 1.044 1.040 35 16.1% 15.2% 1110 0.941 6.0% 0.932 1.039 36 15.9% 14.6% 1145 0.927 6.0% 0.850 0.890 37 16.7% 15.7% 1000 1.000 5.5% 1.174 1.223 38 18.1% 17.1% 550 0.957 5.5% 1.009 1.015 39 16.0% 14.5% 1200 1.000 5.6% 1.000 1.178 40 16.7% 16.3% 1000 1.000 5.9% 1.041 1.055 41 15.5% 15.4% 1350 1.000 6.2% 1.067 1.056 42 17.6% 16.6% 698 0.962 5.7% 1.142 1.080 43 16.7% 15.7% 990 0.990 5.6% 0.961 1.028 44 16.4% 16.2% 995 0.926 5.9% 1.096 1.097 45 17.3% 15.9% 800 1.000 6.2% 1.167 1.011 46 14.5% 13.5% 1530 0.922 5.8% 1.019 0.918 47 16.4% 16.0% 1075 1.000 6.3% 1.074 1.033 48 16.5% 15.4% 955 0.910 6.3% 0.833 0.828 49 14.7% 12.9% 1000 0.625 6.8% 0.692 0.754 50 17.1% 16.6% 885 1.000 6.3% 0.909 0.903 51 15.8% 15.7% 1250 1.000 5.8% 1.043 1.028 52 14.6% 13.3% 1245 0.766 5.6% 1.303 1.152 53 14.7% 13.9% 1350 0.844 6.1% 0.872 0.908 54 15.8% 15.4% 1190 0.948 6.6% 0.864 0.869 55 15.0% 14.6% 1375 0.917 5.8% 0.978 0.966 56 16.3% 16.2% 1095 0.995 6.0% 0.976 0.964 57 14.7% 12.9% 1520 0.961 5.6% 0.896 0.981 58 16.3% 15.9% 1000 0.909 6.3% 0.922 0.905 59 15.3% 15.1% 1400 1.000 6.0% 1.000 0.981 60 14.4% 14.4% 1583 0.934 6.2% 1.026 1.026 61 16.2% 15.3% 1150 1.000 5.8% 0.940 1.031 62 15.5% 15.2% 1350 1.000 5.9% 1.044 1.073 63 16.5% 16.3% 1060 1.000 6.0% 0.964 0.972 64 15.7% 15.4% 935 0.716 5.3% 0.856 1.008 65 16.8% 16.2% 955 1.000 6.2% 0.929 1.002 TABLE SM.2 – Estimated indicators from the Simulation Game (2/2) pavg pvol Vind Vmax,ind NPL Qavg Qvol 66 15.8% 14.3% 1175 0.922 6.2% 1.198 1.008 67 16.2% 15.3% 1066 0.941 6.3% 1.039 0.945 68 16.0% 15.7% 1190 1.000 6.2% 0.963 1.001 69 16.8% 14.5% 940 0.984 5.4% 1.336 1.261 70 16.1% 15.7% 1163 1.000 5.8% 1.016 1.045 71 16.0% 15.5% 1200 1.000 5.7% 1.051 1.100 72 15.8% 15.6% 1250 1.000 5.9% 1.065 1.075 73 17.1% 16.8% 868 1.000 6.3% 1.027 1.025 74 14.3% 13.2% 1650 0.971 5.6% 1.389 1.424 75 17.0% 16.4% 885 0.994 6.2% 0.977 0.955 76 15.0% 14.9% 1380 0.920 6.1% 1.000 1.002 77 17.3% 16.7% 805 0.976 5.9% 1.121 1.100 78 18.4% 17.4% 437 0.920 6.0% 1.073 1.085 79 16.0% 15.9% 1125 0.926 6.1% 1.006 1.001 80 16.0% 15.3% 1205 1.000 5.7% 1.225 1.221 81 17.0% 16.4% 890 1.000 6.2% 0.928 0.995 82 16.9% 16.7% 900 0.973 6.2% 0.933 0.946 83 17.0% 16.4% 910 1.000 6.1% 0.984 0.951 84 14.7% 14.2% 1540 0.960 5.8% 1.093 1.130 85 16.7% 16.0% 925 0.920 5.8% 1.117 1.112 86 15.9% 15.3% 1225 1.000 5.9% 1.170 1.176 87 17.5% 17.0% 750 1.000 5.4% 1.059 1.000 88 15.0% 14.4% 1400 0.924 5.6% 1.081 1.087 89 14.4% 14.0% 1625 0.970 6.0% 1.012 1.035 90 14.9% 14.5% 1325 0.869 5.9% 1.034 0.977 91 17.0% 16.0% 890 1.000 6.0% 0.900 0.948 92 14.1% 13.6% 1783 1.000 6.6% 0.840 0.825 93 16.4% 15.3% 1040 0.954 5.3% 1.237 1.241 94 16.3% 15.3% 1095 0.973 6.5% 1.031 0.930 95 15.8% 15.8% 1260 1.000 6.1% 1.008 1.010 96 16.7% 15.4% 870 0.870 5.7% 1.000 1.027 97 17.5% 16.7% 635 0.847 5.2% 1.121 1.068 98 15.5% 13.7% 1075 0.804 6.0% 1.207 1.162 99 16.4% 16.1% 1095 1.000 6.0% 0.974 0.983 100 15.3% 13.6% 1375 0.982 5.9% 0.840 0.735 101 15.7% 14.9% 1300 1.000 6.8% 0.938 0.902 102 15.7% 15.3% 1287 0.990 6.2% 0.979 1.009 103 16.0% 15.5% 1147 0.948 6.0% 1.034 1.058 104 13.5% 12.2% 1450 0.744 5.4% 0.906 0.851 105 16.5% 14.8% 1050 1.000 5.6% 1.063 0.920 106 14.5% 14.9% 371 0.225 5.1% 1.260 1.244 107 16.2% 15.0% 1130 1.000 5.6% 1.055 1.079 108 17.6% 16.0% 705 0.972 5.8% 1.175 1.079 109 16.5% 15.9% 1025 0.976 5.5% 1.067 1.101 110 16.8% 16.0% 975 1.000 6.4% 0.951 1.031 111 15.8% 15.7% 1275 1.000 6.2% 0.969 0.966 112 15.8% 13.3% 1250 1.000 5.4% 0.939 0.860 113 17.0% 16.8% 880 0.978 6.4% 0.981 0.972 114 17.2% 16.4% 850 1.000 5.8% 0.943 0.998 115 16.8% 16.8% 950 1.000 6.2% 0.980 0.976 116 17.4% 16.6% 770 1.000 6.1% 1.047 1.010 117 15.9% 15.6% 1225 1.000 5.7% 1.099 1.087 118 15.8% 15.4% 1175 0.922 5.9% 1.054 1.058 119 15.1% 14.9% 1160 0.781 6.2% 0.929 0.925 120 14.3% 14.0% 1525 0.897 6.3% 1.000 1.002 121 17.0% 16.0% 900 1.000 5.6% 1.217 1.210 122 15.3% 15.0% 1420 1.000 5.9% 1.009 0.996 123 13.8% 13.5% 1830 0.989 6.0% 1.024 1.011 124 17.3% 15.6% 800 1.000 6.1% 0.891 1.061 125 14.8% 14.6% 1550 1.000 5.9% 1.070 1.087 126 14.7% 14.5% 1400 0.875 5.9% 1.047 1.051 Note: In order to preserve participants’ anonymity, results in Table SM.2 have been ranked in terms of gender and age. TABLE SM.3 – Histograms of game indicators TABLE SM.4 – Normal Q-Q plot and Box-and-whiskers plot of game indicators (1/2) TABLE SM.4 – Normal Q-Q plot and Box-and-whiskers plot of game indicators (2/2) TABLE SM.5 – Regression models. Game indicators to behavioral biases (1/3) Variables Entered/Removed Model Variables Entered/Removed a Variables Removed Variables Entered Model Method 1 Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). gamma a. Dependent Variable: Volume ratio (r) a. Dependent Variable: Average Price Model Summary Model Summary Model 1 R Adjusted R Square R Square .184 a .034 Std. Error of the Estimate .026 Model 2 .010 ANOVA Sum of Squares Regression Residual Total df Mean Square 4.422 1 4.422 126.444 130.865 120 121 1.054 .088 F Sig. 4.197 .043 b Model 2 Sum of Squares Regression .061 Residual Total df Mean Square .042 1 .042 0.434 0.475 117 118 .004 F Sig. 11.287 .001 b b. Predictors: (Constant), gamma - B Coefficients a a Unstandardized Coefficients Unstandardized Coefficients Standardized Coefficients Std. Error 15.743 .175 .655 .320 Beta t 90.120 .184 2.049 Sig. .000 Model 2 B Standardized Coefficients Std. Error (Constant) .920 .068 gamma - .043 .012 .020 Beta .297 t 76.798 3.360 Sig. .000 .001 a. Dependent Variable: Volume ratio (r) a. Dependent Variable: Average Price Excluded Variables a Excluded Variables a Model 1 .080 a. Dependent Variable: Volume ratio (r) Coefficients Overprecisión 2 .297 a Std. Error of the Estimate ANOVAa b. Predictors: (Constant), Overprecisión 2 (Constant) Adjusted R Square R Square a a. Dependent Variable: Average Price Model 1 R a. Predictors: (Constant), gamma - a. Predictors: (Constant), Overprecisión 2 Model 1 Method 2 Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). Overprecisión 2 Variables Entered a Variables Removed Beta In t -0.107 -1.181 Partial Sig. Correlation .915 -.010 .240 -.108 Collinearity Statistics Tolerance Overplacement t -1.154 -1.015 .548 Overprecision 1 .079 b .879 .381 .081 .973 .991 Overprecisión 2 alpha + .079 -.044 b b .880 -.488 .381 .627 .081 -.045 .979 .982 alpha - -.019 b -.205 .838 -.019 .894 gamma + loss aversion 1 .101 -.045 b b 1.112 -.505 .268 .614 .103 -.047 .937 .999 Loss aversion 2 (r) -.023 b -.259 .796 -.024 1.000 Overplacement -.107 b Overprecision 1 -.034 b -.278 .782 -.025 alpha + alpha - -.096 b -1.065 .289 -.097 .112 b 1.253 .213 .114 .998 gamma + -.118 b -1.323 .188 -.120 1.000 gamma loss aversion 1 .035 -.066 b b .384 .702 .035 .979 -.723 .471 -.066 .985 Loss aversion 2 (r) -.015 b -.163 .871 -.015 .963 .972 .979 Beta In Tolerance b -.010 Model 2 Collinearity Statistics -.102 -.090 b Overestimation b Partial Sig. Correlation .251 -.107 .312 -.094 Overestimation a. Dependent Variable: Average Price a. Dependent Variable: Volume ratio (r) b. Predictors in the Model: (Constant), Overprecisión 2 b. Predictors in the Model: (Constant), gamma - .999 .995 TABLE SM.5 – Regression models. Game indicators to behavioral biases (2/3) Variables Entered/Removed Model Variables Entered a Variables Entered/Removed Variables Removed Method 3 Model Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). gamma - Variables Entered Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). gamma + a. Dependent Variable: Quality Ratio Model Summary R Method 4 a. Dependent Variable: Non-performing loans Model 3 a Variables Removed R Square .219 a Model Summary Adjusted R Square .048 Std. Error of the Estimate .040 Model 4 .003 a. Predictors: (Constant), gamma - R Adjusted R Square R Square .258 a .066 Sum of Squares Regression Residual Total df Mean Square .645 1 .645 12.791 13.436 120 121 .107 F Sig. 6.054 .015 b Model 4 Sum of Squares Regression Residual Total df Mean Square .093 1 .093 1.306 1.398 120 121 .011 F Sig. 8.526 .004 b a. Dependent Variable: Quality Ratio b. Predictors: (Constant), gamma - b. Predictors: (Constant), gamma + Coefficients a Unstandardized Coefficients B (Constant) Coefficients a Standardized Coefficients Std. Error 5.812 .263 gamma - .063 .107 Beta .219 Unstandardized Coefficients t 91.620 2.460 Sig. .000 .015 a. Dependent Variable: Non-performing loans Model 4 B (Constant) gamma + Beta In Overestimation Standardized Coefficients Std. Error 1.091 -.108 .026 .037 Beta -.258 t 42.556 -2.920 Sig. .000 .004 a. Dependent Variable: Quality Ratio Excluded Variables a Model 3 .104 ANOVAa a. Dependent Variable: Non-performing loans Model 3 .059 a. Predictors: (Constant), gamma + ANOVAa Model 3 Std. Error of the Estimate t b Excluded Variables a Partial Sig. Correlation .371 .082 .885 -.013 Overplacement .080 -.013 b 0.899 -.145 Overprecision 1 -.079 b -.869 .387 -.079 Overprecisión 2 alpha + -.040 .118 b b -.440 1.316 .661 .191 -.040 .120 alpha - -.081 b -.863 .390 gamma + loss aversion 1 .146 -.057 b b 1.599 -.643 Loss aversion 2 (r) -.058 b -.650 Collinearity Statistics Tolerance .999 .995 Model 4 Beta In Overestimation t Partial Sig. Correlation .854 .017 .163 .128 Collinearity Statistics Tolerance b Overplacement .016 .124 b 0.184 1.405 .973 Overprecision 1 .126 b 1.429 .156 .130 .999 .979 .982 Overprecisión 2 alpha + .049 b .555 -1.252 .580 .213 .051 -.114 1.000 .643 -.079 .894 alpha - .050 b .559 .577 .051 .991 .112 .522 .145 -.059 .937 .999 gamma loss aversion 1 .124 -.089 b b 1.365 -1.010 .175 .314 .124 -.092 .937 .995 .517 -.059 1.000 Loss aversion 2 (r) -.037 b -.416 .678 -.038 .991 -.137 b a. Dependent Variable: Non-performing loans a. Dependent Variable: Quality Ratio b. Predictors in the Model: (Constant), gamma - b. Predictors in the Model: (Constant), gamma + .997 .989 TABLE SM.5 – Regression models. Game indicators to behavioral biases (3/3) Variables Entered/Removed Model a Variables Removed Variables Entered Method 5 gamma + Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). Overprecision 1 Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). 6 a. Dependent Variable: Weighted Quality (r) Model Summary Model R Adjusted R Square R Square Std. Error of the Estimate 5 .216 a .047 .039 .09199 6 .298 b .089 .073 .09031 a. Predictors: (Constant), gamma + b. Predictors: (Constant), gamma +, Overprecision 1 ANOVAa Model 5 6 Sum of Squares Regression df Mean Square .050 1 .050 Residual 1.015 120 .008 Total 1.065 121 Regression .095 2 .047 Residual .971 119 .008 1.065 121 Total F Sig. b 5.886 .017 5.797 .004 c a. Dependent Variable: Weighted Quality (r) b. Predictors: (Constant), gamma + c. Predictors: (Constant), gamma +, Overprecision 1 Coefficients a Model 5 6 Unstandardized Coefficients B Std. Error (Constant) 1.071 .023 gamma + -.079 .033 (Constant) 1.047 .024 gamma + -.082 .032 .075 .032 Overprecision 1 Standardized Coefficients Beta t Sig. 47.387 .000 -2.426 .017 42.795 .000 -.223 -2.545 .012 .205 2.343 .021 -.216 a. Dependent Variable: Weighted Quality (r) Excluded Variables a Model 5 6 Beta In Overestimation t Partial Sig. Correlation .920 -.009 Collinearity Statistics Tolerance b -.100 Overplacement .095 b 1.059 .292 .097 Overprecision 1 .205 b 2.343 .021 .210 .999 Overprecisión 2 .039 b .431 .667 .039 1.000 alpha + -.061 b -.549 .584 -.050 .643 alpha - -.016 b -.178 .859 -.016 .991 gamma - -.006 b -.063 .950 -.006 .937 loss aversion 1 -.100 b -1.117 .266 -.102 .995 Loss aversion 2 (r) -.016 b -.177 .860 -.016 .991 Overestimation .017 c .190 .850 .017 .981 Overplacement .104 c 1.182 .240 .108 .987 -.009 .997 .989 Overprecisión 2 -.182 c -1.546 .125 -.141 .546 alpha + -.017 c -.154 .878 -.014 .623 alpha - -.018 c -.206 .837 -.019 .991 gamma - -.041 c -.450 .654 -.041 .913 loss aversion 1 -.111 c -1.269 .207 -.116 .992 Loss aversion 2 (r) -.035 c -.395 .694 -.036 .982 a. Dependent Variable: Weighted Quality (r) b. Predictors in the Model: (Constant), gamma + c. Predictors in the Model: (Constant), gamma +, Overprecision 1 TABLE SM.5 – Factorial analysis. Correlations VARIABLES TO FACTORS Correlations E Strategy Quality Pearson Correlation P Mmed Mavg alpha + alpha - gamma + gamma - βmed βavg (r) -.049 -.121 .061 .145 -.059 .135 -.095 .029 -.032 .024 Sig. (2-tailed) .590 .180 .499 .108 .515 .133 .293 .745 .720 .795 N 125 125 124 124 125 125 125 125 125 122 -.037 .051 .150 .040 -,196* .017 -,269** -.091 -.056 .009 Sig. (2-tailed) .678 .571 .097 .660 .028 .853 .002 .314 .538 .917 N 125 125 124 124 125 125 125 125 125 122 Pearson Correlation *. Correlation is significant at the 0.05 level (2-tailed). **. Correlation is significant at the 0.01 level (2-tailed). FACTORS TO INDICATORS Correlations Pavg OC Gains Losses Pearson Correlation Pvol Vind Vmax,ind (r) NPL Q avg Q vol (r) -.103 -.122 .111 -.112 .046 .038 .001 Sig. (2-tailed) .252 .175 .220 .223 .613 .671 .994 N 125 125 125 121 125 125 124 -.139 -.079 .085 .051 .157 -,285** -,223* Sig. (2-tailed) .120 .381 .346 .577 .078 .001 .013 N 126 126 126 122 126 126 125 Pearson Correlation .093 .116 .069 ,299** ,189* .068 -.042 Sig. (2-tailed) .301 .197 .444 .001 .035 .450 .644 N 126 126 126 122 126 126 125 Pearson Correlation Loss aversion Pearson Correlation -.008 .000 -.032 -.076 -.085 -.061 -.072 Sig. (2-tailed) .933 .999 .721 .406 .345 .501 .426 N 126 126 126 122 126 126 125 **. Correlation is significant at the 0.01 level (2-tailed). *. Correlation is significant at the 0.05 level (2-tailed). TABLE SM.6 – Factorial analysis. Regressions (1/5) FACTORS TO FACTORS Variables Entered/Removeda Model 1 Variables Entered Variables Removed Method Stepwise (Criteria: Probab.-of-Fto-enter <= .050, Probab.-of-Fto-remove >= .100). Gains a. Dependent Variable: Quality Model Summary Model 1 R Adjusted R Square R Square .266 a .071 Std. Error of the Estimate .063 .948 a. Predictors: (Constant), Gains ANOVAa Model 1 Sum of Squares Regression df Mean Square 8.363 1 8.363 Residual 109.740 122 .900 Total 118.103 123 F Sig. 9.297 .003 b a. Dependent Variable: Quality b. Predictors: (Constant), Gains Coefficients a Unstandardized Coefficients Model 1 B Standardized Coefficients Std. Error (Constant) -.016 .085 Gains -.261 .086 Beta t Sig. -.183 .855 -.266 -3.049 .003 a. Dependent Variable: Quality Excluded Variables Model 1 a Collinearity Statistics Overconfidence -.016 b -.187 .852 Partial Correlation -.017 Losses -.069 b -.789 .432 -.072 1.000 Loss aversion Factor -.040 b -.458 .648 -.042 1.000 Beta In a. Dependent Variable: Quality b. Predictors in the Model: (Constant), Gains t Sig. Tolerance 1.000 TABLE SM.6 – Factorial analysis. Regressions (2/5) VARIABLES TO FACTORS Variables Entered/Removeda Model Variables Removed Variables Entered Method 1 Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). gamma + a. Dependent Variable: Quality Model Summary Model R 1 Adjusted R Square R Square .269 a .072 Std. Error of the Estimate .064 .948 a. Predictors: (Constant), gamma + ANOVA Model 1 Sum of Squares Regression a df Mean Square 8.377 1 8.377 Residual 107.806 120 .898 Total 116.183 121 F Sig. 9.324 .003 b a. Dependent Variable: Quality b. Predictors: (Constant), gamma + Coefficients a Unstandardized Coefficients Model 1 B Std. Error (Constant) gamma + Standardized Coefficients .645 .233 -1.029 .337 Beta t -.269 Sig. 2.772 .006 -3.054 .003 a. Dependent Variable: Quality Excluded Variables a Model 1 Beta In Overestimation t Partial Correlation Sig. Collinearity Statistics Tolerance -.023 b Overplacement .080 b .903 .368 .083 Overprecision 1 .158 b 1.817 .072 .164 .999 Overprecisión 2 .034 b .386 .700 .035 1.000 alpha + -.055 b -.503 .616 -.046 .643 alpha - -.008 b -.093 .926 -.009 .991 gamma - -.025 b -.276 .783 -.025 .937 loss aversion 1 -.074 b -.840 .402 -.077 .995 Loss aversion 2 (r) -.017 b -.187 .852 -.017 .991 a. Dependent Variable: Quality b. Predictors in the Model: (Constant), gamma + -.256 .798 -.023 .997 .989 TABLE SM.6 – Factorial analysis. Regressions (3/5) Model 1 Dependent VMAXind variable 2 3 4 NPL Qavg Qvol Constant 0.955 5.950 1.021 1.020 OC - - - - - - (s ignific .) Gains (s ignific .) Losses (s ignific .) -0.031 -0.021 0.001 0.013 - - - - - 0.089 0.036 0.081 0.050 0.082 0.028 0.074 0.042 0.019 0.001 Loss Aversion - 0.063 0.035 (s ignific .) R2 2 adj. R TABLE SM.6 – Factorial analysis. Regressions (4/5) FACTORS TO INDICATORS Variables Entered/Removeda Model Variables Entered Variables Entered/Removeda Variables Removed Method 1 Model 2 Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). Losses Variables Entered a. Dependent Variable: Non-performing loans Model Summary R 1 Method Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). Losses a. Dependent Variable: Volume ratio (r) Model Variables Removed R Square .299 a Model Summary Adjusted R Square .089 Std. Error of the Estimate .082 Model R 2 .061 a. Predictors: (Constant), Losses Adjusted R Square R Square .189 a .036 Sum of Squares df Mean Square Regression .043 1 .043 Residual .440 119 .004 Total .483 120 F Sig. 11.684 .001 b Model 2 Sum of Squares Regression df Mean Square .489 1 .489 Residual 13.280 123 .108 Total 13.769 124 F Sig. 4.532 .035 b a. Dependent Variable: Non-performing loans b. Predictors: (Constant), Losses b. Predictors: (Constant), Losses Coefficients a Unstandardized Coefficients B Coefficients Standardized Coefficients Std. Error (Constant) .955 .006 Losses .019 .006 Beta t .299 a Unstandardized Coefficients Sig. 172.785 .000 3.418 .001 a. Dependent Variable: Volume ratio (r) Model 2 B (Constant) Losses Standardized Coefficients Std. Error 5.950 .029 .063 .030 Beta t 202.449 .189 2.129 Sig. .000 .035 a. Dependent Variable: Non-performing loans Excluded Variables Model 1 .003 ANOVAa a. Dependent Variable: Volume ratio (r) Model 1 .028 a. Predictors: (Constant), Losses ANOVAa Model 1 Std. Error of the Estimate Beta In Overconfidence Gains Loss aversion Factor t a Excluded Variables Partial Correlation Sig. Collinearity Statistics Tolerance b -1.615 .109 -.147 .991 .051 b .581 .562 .053 1.000 -.076 b -.867 .387 -.080 1.000 -.141 Model 2 Beta In t a Partial Sig. Correlation .752 .029 Collinearity Statistics Tolerance Overconfidence .028 b .316 Gains .157 b 1.794 .075 .160 1.000 -.085 b -.957 .341 -.086 1.000 Loss aversion Factor a. Dependent Variable: Volume ratio (r) a. Dependent Variable: Non-performing loans b. Predictors in the Model: (Constant), Losses b. Predictors in the Model: (Constant), Losses .991 TABLE SM.6 – Factorial analysis. Regressions (5/5) Variables Entered/Removeda Model Variables Entered Variables Entered/Removeda Variables Removed Model Method 3 a. Dependent Variable: Weighted Quality (r) Model Summary R 3 Method Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). Gains a. Dependent Variable: Quality Ratio Model Variables Removed 4 Stepwise (Criteria: Probab.-ofF-to-enter <= .050, Probab.-ofF-to-remove >= .100). Gains Variables Entered R Square .285 a Model Summary Adjusted R Square .081 Std. Error of the Estimate .074 Model R 4 .103 a. Predictors: (Constant), Gains Adjusted R Square R Square .223 a .050 Sum of Squares Regression df Mean Square .116 1 .116 Residual 1.317 123 .011 Total 1.433 124 F Sig. 10.866 .001 b Model 4 Sum of Squares Regression df Mean Square .054 1 .054 Residual 1.029 122 .008 Total 1.083 123 F Sig. 6.357 .013 b a. Dependent Variable: Weighted Quality (r) b. Predictors: (Constant), Gains b. Predictors: (Constant), Gains Coefficients a Unstandardized Coefficients B Coefficients Standardized Coefficients Std. Error (Constant) 1.021 .009 Gains -.031 .009 Beta t 110.322 -.285 a Unstandardized Coefficients -3.296 Sig. .000 Model 4 .001 a. Dependent Variable: Quality Ratio B Standardized Coefficients Std. Error (Constant) 1.020 .008 Gains -.021 .008 Beta t 123.653 -.223 -2.521 Sig. .000 .013 a. Dependent Variable: Weighted Quality (r) Excluded Variables Model 3 .092 ANOVAa a. Dependent Variable: Quality Ratio Model 3 .042 a. Predictors: (Constant), Gains ANOVAa Model 3 Std. Error of the Estimate Beta In t a Excluded Variables Partial Sig. Correlation .700 .035 Overconfidence .033 b .386 Losses .068 b .784 .434 .071 -.061 b -.699 .486 -.063 Loss aversion Factor Collinearity Statistics Tolerance Model 4 Beta In t a Partial Sig. Correlation .972 -.003 Collinearity Statistics Tolerance Overconfidence -.003 b -.036 1.000 Losses -.042 b -.471 .638 -.043 1.000 1.000 Loss aversion Factor -.072 b -.813 .418 -.074 1.000 1.000 a. Dependent Variable: Quality Ratio a. Dependent Variable: Weighted Quality (r) b. Predictors in the Model: (Constant), Gains b. Predictors in the Model: (Constant), Gains 1.000