Report for compliance with the conditions of the bonds loan issue

advertisement

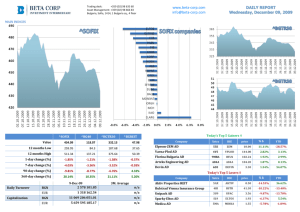

REPORT For 1Q 2014 as at 31.03.2014 on the compliance with the terms and conditions of the debenture loan issue of corporate convertible bonds ISIN Code BG2100006134, issued by Industrial Holding Bulgaria Plc in 2013 This Report on compliance with the terms and conditions of the debenture loan – issue of corporate convertible bonds ISIN code BG2100006134 issued by Industrial Holding Bulgaria Plc. /IHB Plc. or the Holding/ includes information regarding the maintenance of the financial ratio presented with the consolidated report for 1Q 2014 as at 31.03.2014. 1. Performance of the obligations of IHB Plc under the issue terms and conditions 1.1. Convertible bonds listing at Bulgarian Stock Exchange - Sofia AD On 03.06.2013 the trading of corporate bonds issue 2013 of IHB Plc started at BSE-Sofia AD, bonds segment. The stock exchange code is 4IDE. The issue amount is BGN 29,999,800.00 and the number of bonds is 299,998 with nominal value of BGN 100 each. The market batch is one lot equal to 10 bonds. The listing price as of 03.06.2013 is 100% of the nominal value. The transaction cash settlement is executed in BGN. 1.2. Holding of General Meeting of Bondholders and election of a Representative of the bondholders On 17.05.2013 the First General Meeting of Bondholders was held and Mrs. Antoaneta Mihailova Dimolarova, attorney, was elected as a Representative of the bondholders. The Representative will be entitled to a monthly remuneration of BGN 250 (two hundred and fifty). 1.3. Interest payments Nominal interest rate in the current issue of convertible bonds is fixed at annually rate of 6.5 percent over the life of the loan. The interest payment period is a 6-month period with fixed dates as follows: 18.10.2013; 18.04.2014; 18.10.2014 and 18.04.2015. Bondholders registered as such in the Central Depository AD not later than 3 /three/ business days prior to interest payment date, respectively 5 /five/ business days prior to final interest payment date, which is the final maturity date of the issue have the right to interest payment. On 18 October 2013 was made the first interest payment and on 16 April 2014 – the second interest payment of the issue convertible bonds was made. The interest payments are made by Central Depository AD. 1.4 Conversion ratio and conversion price With the decision for bond issue 2013, the Managing Board of Industrial Holding Bulgaria has determined the number of new shares to be converted into one bond when exercising the right of conversion and their price, the so called conversion ratio and respectively conversion price. The conversion price is equal to the nominal value of a share divided by the conversion ratio – the price on each new share is acquired when converting bonds into shares. The Managing Board of Industrial Holding Bulgaria set a conversion ratio of 100.00 shares for each bond with a nominal value of BGN 100 which defines conversion price of BGN 1.00; Report for 1Q 2014 as at 31.03.2014 on the compliance with the terms and conditions of the debenture loan issue of corporate convertible bonds ISIN Code BG2100006134, issued by Industrial Holding Bulgaria Plc in 2013 Under the terms and conditions of the debenture loan it is possible to adjust the conversion ratio and conversion price when certain events occur – for example issue of new shares (capital increase of Industrial Holding Bulgaria through cash), issue of new incremental shares (capital increase of Industrial Holding Bulgaria by converting profit into capital), payment of dividends, reduction of capital. The issuer will notify the bondholders in due time in the same manner that it discloses information to the Financial Supervision Commission, Bulgarian Stock Exchange, Central Depository and the public. 2. Utilization of the debenture loan funds in 2013 As specified in the Prospectus, the Holding intends to use the funds raised through the issue to reimburse the debenture loan under a previous issue of convertible bonds - ISIN BG 2100018113, issued by Industrial Holding Bulgaria Plc in 2011 for partial refinancing of Dimond Sky Ship, expansion of Dockyard Port Burgas and financing other small projects of subsidiaries. Use Repayment of debenture loan Amount (BGN) 21,713,900 Note Issue of convertible bonds ISIN code BG 2100018113 Dimond Sky Ship (N 102) 6,200,000 Partial refinancing Dockyard Port Burgas AD 1,000,000 Port expansion Other projects TOTAL Up to 1,044,208 Other projects of subsidiaries 29,958,108 On 17.04.2013 the public offering was successfully closed and on 24.24.2013 the Trade Registry published announcement for opening of new debenture loan. The amount received from the subscribed and paid convertible bonds is BGN 29,999,800.00. The net amount of proceeds from the public offering after deducting the expenses of the Issuer, paid commissions, fees, etc.. expenses, including fees paid to the FSC amount to BGN 29,864,047 . As stated in the Prospectus, the principal amount of funds raised from the bond issue in 2013 is intended for early repayment of the loan under the previous issue of convertible bonds ISIN code BG 2100018113 issued by IHB in 2011. On 26.04.2013 the last interest payment and the payment of the principal amounting to BGN 21,713,900 of the issue convertible bonds issued by Industrial Holding Bulgaria PLC, ISIN code: BG2100018113 and BSE code 4IDD was made. Bondholders registered with the Central Depository as have had the right on interest payment 5 working days prior to the date of repayment of principal. The interest rate is 8 % annually. With the remaining funds raised from the issue IHB provides refinancing and financing of investment projects of its subsidiaries mainly in maritime transport and port activities. IHB provides this in the form of loans and / or acquisition of shares of these companies, including and subscription of shares from capital increase. In order to partially refinance the construction of the last ship Diamond Sky (with construction number 102) in April 2013 General Meeting of Shareholders of KLVK AD decided to increase the capital through the issuance of 2,200,000 ordinary registered voting shares with a nominal value of BGN 1 and issue price of BGN 2.78 each. All shares of the capital increase are subscribed for by Industrial Holding Bulgaria AD. The amount of BGN 6,116,000 is from funds raised by the new bond issue. The capital increase was registered in the Registry Agency on May 20, 2013. 2 Report for 1Q 2014 as at 31.03.2014 on the compliance with the terms and conditions of the debenture loan issue of corporate convertible bonds ISIN Code BG2100006134, issued by Industrial Holding Bulgaria Plc in 2013 Bulyard SI aims to maintain employment capacity with repair, reconstruction of vessels and manufacturing of metal hulls and ship sections. The rest of the area will be used as a warehouse. The Company can rent vacant land and warehouses or use them for other production. In 2013 the company took active measures to optimize its production capacity by focusing on a small area and improve management. As a result it realised revenue from sale of non-operating assets - mainly machinery and equipment. In 2013 IHB provided loans to Bulyard SI amounting to BGN 5, 195 thousand in total based on three contracts with maturity date in 2015, of which BGN 2,034 thousand are raised by the new bond issue. Under on of these contract additional BGN 331 thousand were granted in 1Q 2014. The funds are for payment under letters of credit in connection with operating activities, repayment of loans to related parties and working capital of the company. As at 31.03.2014 IHB has utilised the funds raised under bond ISIN code BG 2100006134. Financing of investment projects of subsidiaries is carried out in order of their occurrence in time. Priority is given to ongoing projects. IHB is ready to finance current projects through bank loans and leasing schemes. In view of the trends and uncertainties regarding the development of the different branches, the IHB management reserves the right to restructure the investment intentions within the group in accordance with the change in priorities. For example, financing provided for the expansion of the port of Dockyard Port Bourgas has evolved over time. In April 2013 the company negotiated a lease plan for about BG 2 million for supply and installation of 64-ton mobile crane LIEBHERR used in port activities and in operation from August 2013. It significantly increased the capacity of the port and shorten cargo handling time, which will improve the competitiveness of the company. The term of the lease expires in October 2016. In the coming years new capital expenditure within the group can be made in relation to financing or development of new or ongoing projects of IHB and its subsidiaries, including expansion of port terminal in Burgas, contracts for construction of new ships, investing in priority projects and more. If necessary, IHB will continue to fund the development of subsidiaries. Capital expenditures can be made for acquisitions and the expansion Decisions about the amount and sources of the necessary funds will be made in each case. of businesses. 3. Maintenance of financial ratios for 1Q as at 31.03.2014 All calculations have been made on a consolidated basis. The data for 2011 have been reclassified in 2012 for comparative purposes. Financial ratios (on a consolidated basis) 2008 2009 Liabilities/assets ratio Current liquidity 39% 1.7 42% 1.5 2011 2010 reclassif 2012 ied data 42% 46% 45% 1.0 1.3 0.3 Interest-bearing debt/assets ratio 8% 15% 22% 34% 34% 2013 2013 – 2015 projection 1Q 2014 36% 0.5 ≤ 65% ≥ 0.5 35% 0.43 31% ≤ 50% 31% Liabilities/assets ratio 3 Report for 1Q 2014 as at 31.03.2014 on the compliance with the terms and conditions of the debenture loan issue of corporate convertible bonds ISIN Code BG2100006134, issued by Industrial Holding Bulgaria Plc in 2013 Liabilities/assets ratio is calculated by dividing the total short-term and long-term borrowed funds by the total assets as per the balance sheet as at a particular date. IHB Plc has undertaken to maintain its liabilities/assets ratio not higher than 65%. The interest-bearing debt/assets ratio as at 31.03.2014 is 35%. Current liquidity The current liquidity is calculated by dividing the total short - term assets in the balance sheet by the total shortterm liabilities. IHB Plc has undertaken to maintain its current liquidity ratio at the minimum of 0.5 utill debenture loan repayment. The current liability ratio as at 31.03.2014 is 0.43. It is calculated based on assets held for sale, respectively liabilities directly associated with those assets as current assets, as short-term assets, respectively short-term liabilities, given the management's intent to sell them in short term. Until the maturity date of the bond issue in April 2015 the ratio of current liquidity will be affected by the fact that from April 2014 the obligation should be classified as current. Despite the decrease of the indicator compared to the end of 2013, IHB has no problems with liquidity. Management believes that there is no problem to meet its obligations under the debenture loan. Indicative of this is the regular payment of interest, which constitute 33% of all interest expenses of the Group in the first quarter of 2014. On 04.16.2014 the second interest payment on the new bond issue was made. In the first quarter of 2014, total interest-bearing debt of the Group was reduced by more than BGN 3.3 million compared to the end of 2013, the obligations to the bank will be met on time. In April 2014, with an investment loan maturing in 2018 were paid BGN 966 thousand represented as a current liability as at 31.03.2014. In order to further reduce the total credit exposure group, respectively to improve the current liquidity on a consolidated basis measures for early repayment of part of the Bank's obligations were taken. In 2014 was agreed repayment of USD 240 thousand under syndicated bank loan of Serdica Ltd. represented solely as a current liability. Management of the Holding has taken measures to reduce the period of collection of receivables from customers and to increase sales of its subsidiaries. Interest-bearing debt/assets ratio Interest-bearing debt/assets ratio is calculated by dividing the total short-term and long-term interest payables by the total assets as per the balance sheet as at a particular date. IHB Plc has undertaken to maintain its interest-bearing debt/assets ratio within the limit of 50% utill debenture loan repayment. The interestbearing debt/assets ratio as at 31.03.2014 is 31%. Daneta Zheleva, CEO of Industrial Holding Bulgaria PLC 4