Issue Paper #3 - Billing Options

advertisement

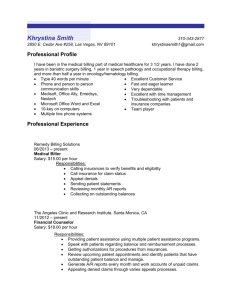

ISSUE PAPER #3 BILLING OPTIONS Issue Once funding source(s) and the associated customer base have been determined, the new county service district must turn to the practicalities of billing for, collecting, and accounting for its revenues. This paper analyzes potential processes and partners for billing and then provides a recommendation based on that analysis. Alternatives Available options for billing depend on the revenue sources involved. Property tax revenues—whether from a permanent rate or an operating levy—are billed by the county tax collector. In Lane County, this is the Assessment & Taxation Department. To the extent that the district imposes user charges, it must decide between developing an in-house billing capability or contracting this function to an entity that already has such a capability. We focus on this decision in the analysis below. Analysis Lessons Learned in Clackamas County Because Clackamas County is the pioneer in using county service districts for stormwater management, we spoke with Doug Waugh, Financial Services Manager for Water Environment Services. He described some financial lessons learned: Use assessor data. A stormwater utility is unlike water and sewer utilities in the sense that there are no connections and no requests to start service. The utility must proactively account for all its customers and their properties. The assessor has the best data for that purpose. Have a deliberate communications process. Customers of a new stormwater utility should be (1) notified well in advance of any billing and (2) given an opportunity to challenge the utility’s computations. The assessor is the best single source of data available, but those data are not always clear, current, or even correct. Decide if in-house billing is economical. The county service districts in Clackamas County created an in-house billing operation from the beginning, and they use software from Tyler Technologies (www.tylertech.com) to support that operation. An important factor in choosing in-house billing was the fact that the districts also bill for wastewater. Waugh speculated that billing for stormwater only might be accomplished more economically on a contract basis. No new districts. Waugh was unaware of any current efforts in Oregon to create new county service districts for stormwater. In-House Billing Although the County has a robust e-commerce capability (ecomm.lanecounty.org), the organizational infrastructure required for largescale utility billing can be found only in the Assessment & Taxation FCS GROUP 1 www.fcsgroup.com Lane County ISSUE PAPER # 3 –BILLING OPTIONS 09/29/2011 Department. Certain assessments that are not related to property tax can be collected by the county assessor under Oregon law. However, the list is short and does not include any charge that can be imposed by a county service district. Therefore, any in-house billing capability would have to be developed from scratch. For a stormwater-only utility, the cost of this capability is likely to be a high percentage of the revenue requirement. Contract Billing The alternative to in-house billing is contracting with a third-party billing agent. Depending on the service area to be billed, one organization that might be a good fit for this role is the Eugene Water and Electric Board (EWEB). The City of Eugene has a long history of contracting with EWEB for the billing of the City’s wastewater and stormwater customers. Currently, EWEB’s fee for this service is $1.17 per bill per month (a reduction from the previous year’s fee of $1.22 per bill per month). This fee is based on a three-year average of EWEB’s actual costs. The fee’s basis in cost of service suggests that it is meaningful as a ballpark estimate of the price that a county service district might expect. Another possible partner is the City of Portland’s Revenue Bureau. Although the Bureau’s primary responsibility is the collection of taxes and fees for the City of Portland, it also provides contract billing and collection services. Its most notable customer is Multnomah County, whose business income tax is administered by the Bureau. The Bureau also had conversations with the City of Eugene about administration of a proposed income tax (which was defeated in May, 2011). However, the Bureau does not specialize in utility billing as EWEB does. This list of potential contractors is not intended to be exhaustive, but rather to suggest that reasonable options are probably available. All Billing Is Costly Whether user charges are billed in-house or through a third party, a stormwater-only utility should expect billing expenses to be a higher percentage of the total revenue requirement than would be the case for a utility that included water, wastewater, and stormwater systems. This is one reason why a permanent rate property tax may be a good funding option. Recommendation FCS GROUP To the extent that the proposed county service district depends on monthly or bimonthly utility charges, we recommend that the County seek the partnership of a third-party billing agent. If, on the other hand, user charges are limited to one-time fees and/or system development charges, we recommend in-house billing that leverages the County’s current e-commerce capability. 2 www.fcsgroup.com