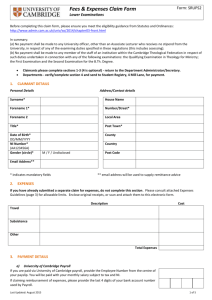

Expenses claim form

advertisement

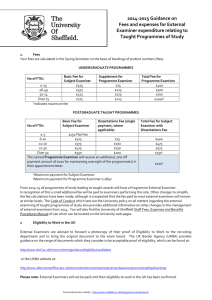

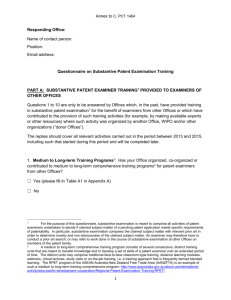

Graduate School ref. no.: EXTERNAL EXAMINER’S (RESEARCH DEGREES) EXPENSES CLAIM FORM - ACADEMIC YEAR 2015/2016 Please print this information or use BLOCK CAPITALS PERSONAL DETAILS (to be completed by all claimants) Title: Forename Middle name(s) Surname: Gender: Date of Birth: Nationality: National Insurance number: Address (please provide your HOME address): Postcode: Name of student examined: Date of examination: Start destination: End destination: BANK DETAILS Name of account holder: Bank name: Branch: Sort code: Account number: Email address: RECEIPTS MUST BE ATTACHED PLEASE Air fare (Ticket or receipt required): Train fare (Ticket or receipt required): Taxi (Receipt required): Tube fare: Mileage: _____________ miles (see overleaf for mileage rates): Meals: Other Expenses e.g. postage (Receipt required): Total Expenses Claim £ p SIGNATURE OF EXTERNAL EXAMINER: I certify I have worked on the dates indicated above. Date: ......................................................................................................... PLEASE NOTE This form should be forwarded to The Graduate School, Level 3, Link Building, Plymouth University, Drake Circus, Plymouth PL4 8AA Graduate School/Finance staff use only Account: 1609 Department: 7202 Work order: Budgetary Authority signature: Print name: .............................................................................. Finance Authority: .............................................................................. Document type checked (Passport/Visa/Full UK Birth certificate) please specify: Checked by (print name): Document1 GA110027-101 Date: Date: Date: EXPENSES FOR EXTERNAL EXAMINERS (RESEARCH DEGREES) ACADEMIC YEAR 2015/16 TRAVEL AND SUBSISTENCE TO COMPLY WITH HMRC REGULATIONS PLEASE NOTE THAT THE UNIVERSITY WILL ONLY REIMBURSE EXPENSES INCURRED ON THE PRODUCTION OF VALID TICKETS AND RECEIPTS. TRAVEL The University will pay first class rail fare plus taxi fare to local station. Examiners may travel by air if this is more economic. Where travel is by car the University will reimburse mileage at the following rates: for the first 100 miles of any journey* you may claim 45p per mile, thereafter 25p per mile. *The definition of a journey is a continuous period away from home. SUBSISTENCE Breakfast Lunch Dinner maximum maximum maximum £8.00 (leave home before 7.30 am) £10.50 £33.00 (arrive home after 8.30 pm) BED AND BREAKFAST £83.00 PER NIGHT (Unless booked and paid direct by the University) Please note that we will not pay for incidentals such as telephone bills, newspapers, gratuities, minibar, movies etc. Please settle these bills with the hotel before leaving. The University will no longer pay for examiners staying with family and friends. Please note that claims for payment of subsistence allowances, travelling and incidental expenses must be submitted within six months of being incurred. HONORARIUM Please note that you also need to complete the External Examiner’s Honorarium form which is attached. As this fee is subject to tax by the HM Revenue & Customs it has to be processed via the University’s monthly payroll system and therefore there may be some delay in payment. External Examiner Expense Claims 1. Status External Examiners are deemed to be employees of the University by HMRC and therefore their claims must be scrutinised for items that may be taxable. Examiners’ claims are therefore processed by the University’s Payroll team. 2. Expenses Claims Payments to External Examiners will be in accordance with the University’s travel and subsistence policy, with the following exceptions: Alcohol may be claimed. Claims for first class rail travel may be met for examiners at the Graduate School’s discretion. Receipts must be provided to support all claims made. No round sum allowance can be made. If exceptionally, an examiner has mislaid receipts the Graduate School may choose to honour the claim; however it will become a taxable payment. Business entertaining provided to external examiners is treated by the Inland Revenue as employee entertaining and would therefore be taxable. 3. General Rail cards can only be paid for when the savings from train journeys exceed the cost of the rail card. So based on future expected rail journeys the railcard can be authorised for payment. As a railcard can be used for personal journeys as well as business, refurbishments of this expenditure would be taxable. Examiners may travel to Plymouth by air if this is more economic. Itemised receipts or original travel tickets must be provided in accordance with HMRC regulations, otherwise expenses cannot be claimed. Under the University’s financial regulations credit card receipts are not acceptable. Document1