inland revenue tax and national insurance, asylum and immigration

advertisement

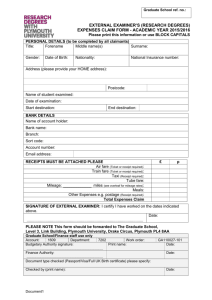

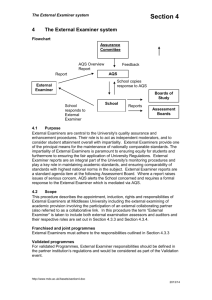

External Examiners HMRC TAX AND NATIONAL INSURANCE, ASYLUM AND IMMIGRATION ACT 1996, ELIGIBILITY TO WORK (PROOF OF NATIONAL INSURANCE) AND CUSTOMS AND EXCISE (VAT) REQUIREMENTS The University engages External Examiners as individuals under a contract of employment; it does not contract external examining services. The University is therefore bound by statute, as a Schedule ‘E' employer, to operate the PAYE scheme, which means that Income Tax and National Insurance contributions will be deducted from Examiners gross fees at source, through payroll. However, individuals who have a substantial business or profession relating to their engagement as an expert External Examiner may apply to be assessed for another tax status such as ‘Selfemployed'. Please note, this only relates to Tax; you are deemed to be an employee for National Insurance and all payments will be subject to 'Class 1' deductions, as appropriate, without exception. This is not a matter of personal choice, but is determined by the terms and conditions of a particular engagement. There are specific guidelines relating to External Examiners. If you consider that another status may apply to you for this employment, please follow the advice below. HMRC - Tax If you believe that your income from this engagement should be treated as income from ‘Selfemployment because you already have a substantial related business or profession, you should read and complete form LIP15R which is available on the HR Information Library (http://hrinformationlibrary.arts.ac.uk), giving as much information as possible to assist in the determination of your status for this employment. The completed form must again be returned with the other documents to Academic Affairs. Please refer to the LIP15R for information about completing the form and the process to establish status. HMRC - National Insurance The Inspector for National Insurance Contributions responsible for the University has ruled that the contracting arrangements for External Examiner deems individuals as employees covered by HMRC (Categorisation of Earners) Regulation 1978 and gross payment will therefore be subject to deduction of Class 1 contributions at source, through Payroll; this is irrelevant of any other status you may hold personally, or any other contributions you may make due to other income (i.e. those registered as self-employed paying Class 2 and possible Class 4 contributions). However, there are exceptional rules where an employee is already working for another Schedule E employer and paying the maximum Class 1 contributions in that employment. In this circumstance you may be able to obtain from your HMRC (Formerly DSS) Contributions Agency branch office a ‘Deferment of Contributions Order (Form CA2700 or equivalent). If you obtain this exception order before commencing your employment as an Examiner please send the form to the Academic Affairs office, if it is after, you should send it directly to Payroll, UAL, 16 John Islip St, London, SW1P 4JU. Payroll will operate a non-contributory status, and refund any previous deducted contributions within the dates specified on the deferment order, or the whole tax year, as appropriate (Please note the higher earning 1% employees rate will still be deducted as appropriate and in accordance to the regulations and amendments). Other exceptions and exemptions: Reduced rate contribution - Some married women or widows who elected to pay a reduced rate stamp before 11th May 1977 continue to have the right to pay reduced rate National Insurance if they hold a valid certificate of Election (Form CA4139, CF383, CF380A). Age Exemption – Some individuals no longer have to pay National Insurance due to their age and hold the ‘Certificate of Age Exception' (Form CA4140 or CF384). If either of these exceptions applies you must send the originals of the relevant certificates when you return your contract paperwork to the employing Department/College. Note: All CA2700 deferment orders must be renewed annually, it is the responsibility of the employee to make application on a timely basis, and without renewal National Insurance deduction will revert to standard deduction rates as applicable. Note: Self-employed individuals may be able to receive a refund or reduction on Class 2 contribution is they have paid a significant Class 1 contribution as an employee. Further information can be obtained through your Contribution agency office or your accountant. Asylum & Immigration Act 1996 – Section 8(5) The University is legally required to hold copies of evidence of your right to work in the United Kingdom, before you commence your employment, to comply with the Asylum & Immigration Act. You will need to provide proof in the form of a Passport, Visa or British birth certificate. National Insurance Proof The University is also required to hold copies of proof of your National Insurance number, before you commence your employment. You will need to provide at least one these documents – a National Insurance Card, a P45, or a P60. It may also be acceptable to send an officially marked tax letter, displaying your NI number. Note: Documentation provided must not display a temporary number. Note: Payment will not be made without the required documents. If you live outside the UK and/or do not hold a British National Insurance number please contact Academic Affairs on 020 7514 6011 to discuss the documentation needed. All External Examiners are required to complete and return form P46 – see details of completing this form under ‘Inland Revenue (Tax)' above. Customs and Excise - V.A.T External Examiners have been deemed to be employees for both Tax and National Insurance, irrelevant of any separate recognition of "Self- employed" status for tax, due to the terms of the contract of employment, V.A.T is not payable. The Customs and Excise (V.A.T Inspectorate) have agreed that although an individual may be registered as self employed and subject to charging V.A.T for the provision of services, they may also hold separate status as an employee whilst engaged on a contract of employment with a schedule E employer, and therefore not liable to charging V.A.T for the work performed. It is advisable that you maintain a separate record of your earning derived from your employment with the University and retain any relevant documentation sent to you relating to your work as an Examiner, e.g. payslips, tax documentation etc; this may be required as evidence to prove employee status for this employment to your V.A.T inspector. If you have concerns about the legality or procedures regarding V.A.T and employee status you are advised to contact your own V.A.T inspector.