2014-2015 Guidance on Fees and expenses for External Examiner

advertisement

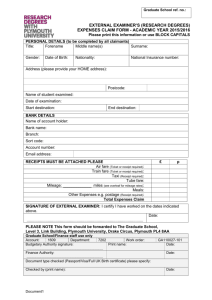

2014-2015 Guidance on Fees and expenses for External Examiner expenditure relating to Taught Programmes of Study 1. Fees Your fees are calculated in the Spring Semester on the basis of bandings of student numbers (ftes). UNDERGRADUATE PROGRAMMES Basic Fee for Subject Examiner 0-25 £325 26-49 £375 50-74 £525 Over 75 £775 1 indicates maximum fee No of FTEs Supplement for Programme Examiner £75 £125 £175 £225 Total Fee for Programme Examiner £400 £500 £700 £10001 POSTGRADUATE TAUGHT PROGRAMMES No of FTEs Basic Fee for Subject Examiner Dissertations Fee (single payment, where applicable) Total Fee for Subject Examiner with Dissertations Fee 0-5 £150 Flat Fee 6-10 £325 £75 11-20 £375 £100 21-50 £425 £150 Over 50 £550 £200 The named Programme Examiner will receive an additional, one off payment amount of £100 for maintaining oversight of the programme(s) in their appointment letter. £400 £475 £575 £7502 £1003 2 Maximum payment for Subject Examiner. Maximum payment for Programme Examiner is £850 3 From 2014-15 all programmes of study leading to taught awards will have a Programme External Examiner. In recognition of this a small additional fee will be paid to examiners performing this role. Other changes to simplify the fee calculations have been made, although it is expected that the fee paid to most external examiners will remain at similar levels. The Code of Conduct which sets out the University policy on all matters regarding the external examining of taught programmes of study also provides additional information on other changes to the management of external examiners from 2014. You will also find the University of Sheffield Staff Fees, Expenses and Benefits Procedures Manual of use which can be located on the University web pages. 2 Eligibility to Work in the UK External Examiners are advised to forward a photocopy of their proof of Eligibility to Work to the recruiting department and to bring the original document to the exam board. The UK Border Agency (UKBA) provides guidance on the range of documents which they consider to be acceptable proof of eligibility, which can be found at: http://www.shef.ac.uk/hr/recruitment/guidance/eligibility/candidates or the UKBA website at: http://www.ukba.homeoffice.gov.uk/sitecontent/documents/employersandsponsors/preventingillegalworking/ Please note: External Examiners will not be paid until their eligibility to work in the UK has been confirmed. External Examiners website : https://www.sheffield.ac.uk/lets/pp/assessment/external 3. Deduction of Income Tax The University is required to deduct tax at the basic rate when paying fees to its Examiners. To allow the University to accurately report payments and tax deductions to the Inland Revenue, it will be necessary for Examiners to provide their National Insurance number on the claim form for expenses and fees. Your National Insurance number identifies you in the records of the Inland Revenue. Please ensure you complete the necessary details on the claim form at each submission. Payment of expenses for travelling and subsistence which are incurred wholly, necessarily and exclusively in the performance of examining duties are currently paid without deduction of Income Tax. Any Examiner who has no other employment and where income from all sources does not exceed the threshold for taxation should notify Learning and Teaching Services as soon as possible as it will be necessary to complete a statement to this effect (which will be forwarded on request). It is only under these exceptional circumstances that the University may be permitted to pay an Examiner for a taught programme of study without deduction of basic rate Income Tax. Examiners should retain all payslips issued by the University for identification of the fees and expenses paid which may be subject to further enquiry by the Inland Revenue. 4. Payment of VAT Where an External Examiner is VAT registered, VAT can be charged on their fee by way of an invoice from the External to Learning and Teaching Services, which will then be paid in the usual way. 5. Payment of Fees and Expenses All fees and expenses will be paid directly into your nominated bank account using the BACS system. To enable the University to reimburse you promptly, please complete the Expenses form as fully as possible including date of birth, National Insurance number and full bank details. Notes on claiming Expenses 1. General Information Payment of External Examiners’ expenses is governed by The University of Sheffield’s Financial Directives. The Directives have been prepared in light of the Income Tax and National Insurance Contributions regulations and in consultation with the University’s Tax Office to ensure compliance with Inland Revenue requirements. External Examiners are classed as “casual staff” for the purpose of expenses payments (Inland Revenue definition). 2. Evidence and Payment of Expenses All requests for payment of expenses should come through on the appropriate University of Sheffield claim form (one of which is enclosed in the External Examiners appointment pack). Alternatively you can request a form electronically from examiners@sheffield.ac.uk or download a copy from the website. All claims should be accompanied by original receipts and other supporting documentation (in accordance with the University’s financial directives, which are dictated by the requirements of the Inland Revenue). Credit/debit card slips and photocopies of receipts are not acceptable. Please do submit full receipt in order to claim back expenses incurred. It may not be possible to settle claims which are not accompanied by appropriate supporting evidence. Claims received between the 1st and 2nd week of the month will be paid at the end of the same month. All claims should be made no later than three months after the date they were originally incurred. Claimants should ensure that they have submitted full bank details on the Claim Form, (one of which is provided in the External Examiners appointment pack) to the University to facilitate prompt payment. Additionally, claimants should ensure that the claim form is fully completed with all requested information including signatures as appropriate. 3. Travel Expenses You are asked to travel by standard class rail only. Any claims received outside of this will only be reimbursed up to the cost of Peak Standard Class rail fare. It is very much regretted that this request has to be made but, as you will know, the current financial climate is such that the University has had to take all reasonable steps to reduce expenditure. External Examiners website : https://www.sheffield.ac.uk/lets/pp/assessment/external Motor mileage allowance (40p per mile) will be paid where travel by car is essential, although the use of a private vehicle would be regarded as exceptional where rail services are available for journeys exceeding 40 miles from Sheffield. Indication of “special circumstances” will be expected for claims falling outside this regulation. Air fares may sometimes prove more economical for a journey, or may be required for those External Examiners travelling to or from foreign countries. Where this need occurs tickets should be economy class and should be agreed with Learning and Teaching Services in advance of making a reservation. Taxi fares will be reimbursed where appropriate e.g. as completion of journey from station to the University. However, taxis should not be used as the main form of transport for a journey. Parking costs are allowable but will only be paid with appropriate evidence. If you are in any doubt about whether travel expenses will be reimbursed or have any queries please contact the External Examiners Team in Learning and Teaching Services in advance of any expenses being incurred. 4. Accommodation Examiners should book accommodation in a reasonable quality, reasonably priced hotel (c£85 per night) of which there are many around the City of Sheffield. Wherever possible such bookings should be made via the relevant academic department. The University’s preferred method of payment is direct with the hotel. Reimbursement will be made for the cost of the room, evening meal, breakfast and one reasonable private telephone call per night. Where meals are not taken in the hotel, separate receipts should be obtained. Items of a personal nature such as mini-bar drinks, newspapers or pay per view films will NOT be reimbursed by the University. Where these items appear on a bill, they should be settled by the individual on checking out or deducted from the amount claimed. Where examiners choose not to stay in hotel accommodation but instead are able to stay with friends or relatives, an allowance of £25 per night may be claimed as a contribution towards cost incurred by the relatives or friends providing board and lodgings. This allowance covers the evening meal, overnight accommodation and breakfast the following day. 5. Subsistence Subsistence expenses (within reason – see below), and any others essential to the performance of your duties, will also be paid. (Childcare costs do not fall into this category). The daily subsistence allowance for lunch and breakfast (where breakfast is not included in the cost of accommodation) is up to a maximum of £10. For lunch / day requirements alone, it is up to a maximum claim of £6. Receipted evening meals for individual examiners will be paid for in full. However, excessively expensive claims or those where it appears that the examiner is claiming for more than one person will be challenged. The University reserves the right to decline payment, either in part or in full, of any expense item which is considered to be unreasonable or excessive 6. Hospitality costs for Departments and Schools Hospitality costs (within reason), and any others essential to the performance of the examiners duties, will be paid to departments or schools. Entertaining examiners at either lunch OR dinner will be paid in full, subject to a ratio of one member of staff per external examiner. Meals for additional members of staff must be paid for from departmental funds. It should also be noted that: 7. LeTS WILL adjust any hospitality claim where the quantity/cost per bottle of alcohol (including bottles of wine) is considered to be excessive or unreasonable. LeTS will NOT reimburse departments for the cost of tips added to restaurant bills. Due to budgetary restrictions and the increasing number of expensive restaurants opening in Sheffield, departments are strongly encouraged to patronise restaurants where the resulting bill will not exceed a maximum of £30 per person. Gifts External Examiners website : https://www.sheffield.ac.uk/lets/pp/assessment/external Where a department wishes to purchase gifts for outgoing examiners it should be noted that LeTS does not have a budget for this type of expenditure and claims for reimbursement should not be made. Departments attention is drawn to the University’s Financial Regulations (level 2) at http://www.sheffield.ac.uk/polopoly_fs/1.293457!/file/Financial_Regulations.pdf 8. Completed Examiner’s Report for a taught programme of study The University takes the comments and issues raised by External Examiners very seriously and we would ask you to ensure that issues you wish to raise are reflected in your completed report for further consideration by faculties and the Quality and Scrutiny Sub Committee. The Report should be returned within four weeks after the completion of your duties for the current session/after the relevant meeting of the Examination Board and returned electronically to examiners@sheffield.ac.uk. 9. Completed claim forms and original receipts Please submit completed, signed claim forms , with original receipts, within six months of the expense occurring to the address below. If you have any queries regarding claiming expenses, or mode of travel, please contact a member of the External Examiners Team in Learning and Teaching Services – Tel 0114 2221364 or 2220416 or email examiners@sheffield.ac.uk Completed forms should be returned to Rebecca Swift or Eve Grant, External Examiners Office, Learning and Teaching Services, New Spring House, 231 Glossop Road, Sheffield, S10 2GW. External Examiners website : https://www.sheffield.ac.uk/lets/pp/assessment/external