Word Version

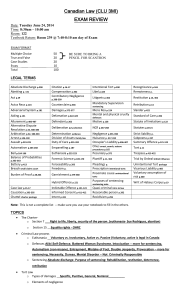

advertisement