Brisbane City Council Annual Plan & Budget 2014-15

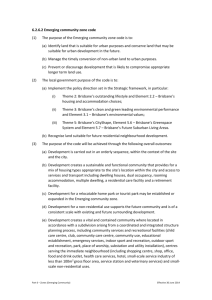

advertisement