virtual energy: making money on the bias between iso day ahead

advertisement

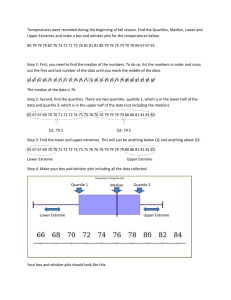

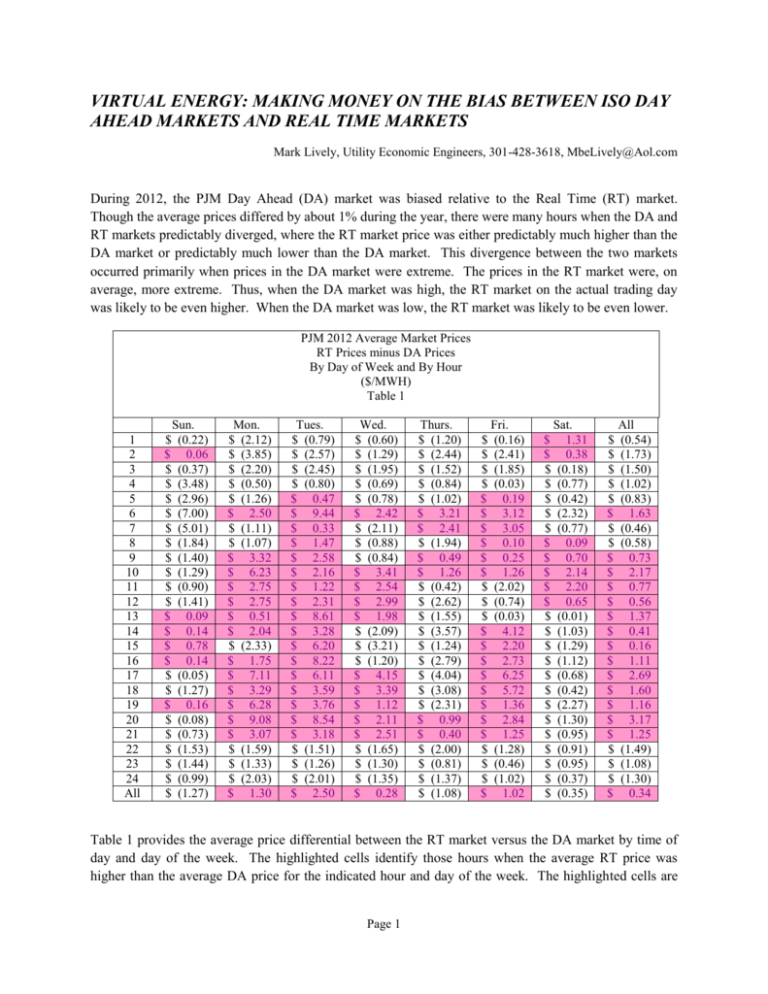

VIRTUAL ENERGY: MAKING MONEY ON THE BIAS BETWEEN ISO DAY AHEAD MARKETS AND REAL TIME MARKETS Mark Lively, Utility Economic Engineers, 301-428-3618, MbeLively@Aol.com During 2012, the PJM Day Ahead (DA) market was biased relative to the Real Time (RT) market. Though the average prices differed by about 1% during the year, there were many hours when the DA and RT markets predictably diverged, where the RT market price was either predictably much higher than the DA market or predictably much lower than the DA market. This divergence between the two markets occurred primarily when prices in the DA market were extreme. The prices in the RT market were, on average, more extreme. Thus, when the DA market was high, the RT market on the actual trading day was likely to be even higher. When the DA market was low, the RT market was likely to be even lower. PJM 2012 Average Market Prices RT Prices minus DA Prices By Day of Week and By Hour ($/MWH) Table 1 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 All $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Sun. (0.22) 0.06 (0.37) (3.48) (2.96) (7.00) (5.01) (1.84) (1.40) (1.29) (0.90) (1.41) 0.09 0.14 0.78 0.14 (0.05) (1.27) 0.16 (0.08) (0.73) (1.53) (1.44) (0.99) (1.27) Mon. $ (2.12) $ (3.85) $ (2.20) $ (0.50) $ (1.26) $ 2.50 $ (1.11) $ (1.07) $ 3.32 $ 6.23 $ 2.75 $ 2.75 $ 0.51 $ 2.04 $ (2.33) $ 1.75 $ 7.11 $ 3.29 $ 6.28 $ 9.08 $ 3.07 $ (1.59) $ (1.33) $ (2.03) $ 1.30 Tues. $ (0.79) $ (2.57) $ (2.45) $ (0.80) $ 0.47 $ 9.44 $ 0.33 $ 1.47 $ 2.58 $ 2.16 $ 1.22 $ 2.31 $ 8.61 $ 3.28 $ 6.20 $ 8.22 $ 6.11 $ 3.59 $ 3.76 $ 8.54 $ 3.18 $ (1.51) $ (1.26) $ (2.01) $ 2.50 Wed. $ (0.60) $ (1.29) $ (1.95) $ (0.69) $ (0.78) $ 2.42 $ (2.11) $ (0.88) $ (0.84) $ 3.41 $ 2.54 $ 2.99 $ 1.98 $ (2.09) $ (3.21) $ (1.20) $ 4.15 $ 3.39 $ 1.12 $ 2.11 $ 2.51 $ (1.65) $ (1.30) $ (1.35) $ 0.28 Thurs. $ (1.20) $ (2.44) $ (1.52) $ (0.84) $ (1.02) $ 3.21 $ 2.41 $ (1.94) $ 0.49 $ 1.26 $ (0.42) $ (2.62) $ (1.55) $ (3.57) $ (1.24) $ (2.79) $ (4.04) $ (3.08) $ (2.31) $ 0.99 $ 0.40 $ (2.00) $ (0.81) $ (1.37) $ (1.08) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Fri. (0.16) (2.41) (1.85) (0.03) 0.19 3.12 3.05 0.10 0.25 1.26 (2.02) (0.74) (0.03) 4.12 2.20 2.73 6.25 5.72 1.36 2.84 1.25 (1.28) (0.46) (1.02) 1.02 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ Sat. 1.31 0.38 (0.18) (0.77) (0.42) (2.32) (0.77) 0.09 0.70 2.14 2.20 0.65 (0.01) (1.03) (1.29) (1.12) (0.68) (0.42) (2.27) (1.30) (0.95) (0.91) (0.95) (0.37) (0.35) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ All (0.54) (1.73) (1.50) (1.02) (0.83) 1.63 (0.46) (0.58) 0.73 2.17 0.77 0.56 1.37 0.41 0.16 1.11 2.69 1.60 1.16 3.17 1.25 (1.49) (1.08) (1.30) 0.34 Table 1 provides the average price differential between the RT market versus the DA market by time of day and day of the week. The highlighted cells identify those hours when the average RT price was higher than the average DA price for the indicated hour and day of the week. The highlighted cells are Page 1 VIRTUAL ENERGY: MAKING MONEY ON THE BIAS BETWEEN ISO DAY AHEAD MARKETS AND REAL TIME MARKETS predominately during the week during the middle of the day, when the market prices are predictably high. The highlighted cells indicate that the RT prices were predictably even higher than the DA prices. PJM 2012 Average Market Prices RT Prices minus DA Prices Sorted ($/MWH) Table 2 DA Higher RT Higher All Hours Count 5,640 3,133 8,7831 Average -$4.429 $8.930 $0.341 Extension $(24,982) $ 27,978 $ 2,996 Table 2 provides the average price differential between the RT market versus the DA market sorted by which market was higher. The DA market was higher for 5,640 of the hours in 2012, about 64% of the time. During these hours, the differential averaged $4.429/MWH. The RT market was higher for 3,133 hours, about 36% of the time. During these hours the differential averaged $8.930/MWH. The relative sizes of the price differentials slightly more than overcame the large differential in the number of hours. Figure 1 provides a scatter diagram of DA prices plotted against the corresponding RT price. They are relatively well linearly correlated, depending on the level of R-Square one is expecting. Perfect correlation is 1.00. Of more importance is the relative variation of the two sets of data. The DA price 1 2012 had 8,784 hours. One hour of data was lost due to the switch to and from Day Light Savings time. The hours do not add because of the hours when the DA and RT prices were equal. Page 2 VIRTUAL ENERGY: MAKING MONEY ON THE BIAS BETWEEN ISO DAY AHEAD MARKETS AND REAL TIME MARKETS range from zero to just over $250/MWH. The RT prices vary much more greatly, from a negative price lower than $100/MWH to a positive price just over $400/MWH. Figure 2 is a price duration curve for DA prices. The DA prices are sorted and then plotted against the resulting index of DA prices. Figure 2 is similar to the standard electric system load duration curve. The plot of the DA price for any hour (for instance, hour 2,580) shows the price ($28.02/MWH for hour 2,580) which equals or exceeds the price for the indicated number of hours during the year. The RT prices are then plotted against the same index of DA prices. The RT prices are generally above the DA prices on the center and right side of Figure 2, significantly enough to show up despite the size of the plotting markers. Conversely, the RT prices are generally below the DA price on the extreme left side of Figure 2. Page 3 VIRTUAL ENERGY: MAKING MONEY ON THE BIAS BETWEEN ISO DAY AHEAD MARKETS AND REAL TIME MARKETS Figure 3 differs from Figure 2 by the choice of indices. Where Figure 2 used the index of DA prices, Figure 3 uses the index of RT prices. Figure 4 presents a price duration curve for the difference between the RT market and the DA market plotted against the index for the DA market. Under the DA index, the DA market price climbs sharply on the right extreme of Figure 2. Here in Figure 4 the differentials also climb sharply at the right extreme, though there is noticeable noise with some of the differentials negative on the right extreme. Page 4 VIRTUAL ENERGY: MAKING MONEY ON THE BIAS BETWEEN ISO DAY AHEAD MARKETS AND REAL TIME MARKETS PJM 2012 Average Market Prices RT Prices minus DA Prices Sorted Within DA Quartiles ($/MWH) Table 3 Count Average Extension Lowest DA Quartile DA Higher RT Higher All Hours 1,604 584 2,193 -$4.292 $1.598 -$2.715 $ (6,884) $ 933 $ (5,951) 2nd DA Quartile DA Higher RT Higher All Hours 1,670 528 2,200 -$2.686 $1.553 -$1.666 $ (4,486) $ 820 $ (3,665) 3rd DA Quartile DA Higher RT Higher All Hours 1,567 625 2,195 -$3.803 $1.775 -$2.210 $ (5,959) $ 1,109 $ (4,850) Highest DA Quartile DA Higher RT Higher All Hours 799 1,396 2,196 -$9.577 $17.991 $7.952 $ (7,652) $ 25,115 $ 17,463 Table 3 effectively summarizes the data in Figure 4, using the same analytic tools as were used in Table 2. The hours across the bottom of Figure 4 are separated into quartiles, and sorted within each quartile by whether the difference is positive or negative. In most quartiles, the DA price is dominant, in that the DA price is generally higher than the RT price, in that the DA counts are generally greater than the RT counts. Further, the DA average price for the entire quartile is generally greater than the RT average price, resulting in negative average differentials for all the hours in the quartile. However, in the highest DA quartile, that is, covering the data in the right quarter of Figure 4, there are relatively fewer hours in which the DA price is higher, and the differential is $17.991/MWH when the RT price is higher versus a differential of $7.952/MWH for the entire quartile. The bias between the RT and DA markets is due the asymmetry in the way that electric systems are able to respond to unanticipated changes in the supply demand equilibrium curve when the electric system is strained. A lessening of that strain results in a movement along the generation marginal cost curve, where there are other generators of similar cost structure to compete for the sale of electricity. However, when the strain on the system increases, the supply demand equilibrium curve is poorly defined and subject to the vagaries of the participants trying to optimize the results for participants loads and generators. This optimization attempt is extremely critical when the system is at maximum and minimum loads, which is when the DA prices are likely to be the highest and the lowest. The effect is likely to become more noticeable during the minimums as the systems experience greater amounts of intermittent generation such as solar and wind. Additional work is needed on identifying those hours when the DA prices are likely to be extreme, and whether such bias continued into 2013. Such work would allow participants to install hedging techniques by taking greater positions in the DA markets that were then settled advantageously in the RT market. Some of the work should include an analysis of the depth of the DA market, in that a large hedging Page 5 VIRTUAL ENERGY: MAKING MONEY ON THE BIAS BETWEEN ISO DAY AHEAD MARKETS AND REAL TIME MARKETS position would likely influence the DA market and lessen the arbitrage potential with the RT market. The influence of optimization efforts are likely to become more apparent in the left side of Figures 2 and 4, both with the growth of renewable generation and as large base loaded generators realize the implications of their bidding actions during such events. For instance, while the RT prices were higher for only 27% of the lowest quartile, RT prices were higher for only 18% of the lowest decile, with the average price differential being $6.30/MWH when the DA prices were higher and $1.76/MWH when the RT prices were higher. Page 6