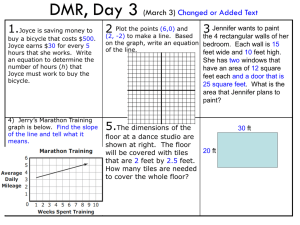

Bicycle Industry Training Project

advertisement