Global Governance and Political Economy, Chap. 1.

advertisement

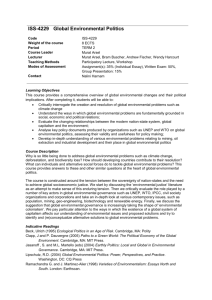

David Kennedy Chapter One: Struggle: Global Governance as Political Economy Draft of Tuesday, October 15, 2013 12,084 words The most pressing global policy challenges arise from this simple fact: there is no public hand stabilizing and ameliorating the results of global economic competition and political struggle. “Global governance” is a misnomer: no one has an effective political mandate to act in the global public interest, however many may clothe their actions in these terms. Although a variety of transnational institutions aim to manage global economic instability, none serve as sites for collective political response to the unequal consequences of global economic activity. Meanwhile, global markets have been progressively disembedded from local political contestation and the stabilizing hand of national authority. As a result, it would be more accurate to think of “global governance” as a chaotic and brutal struggle wherever global economic activity collides with local political structures. All kinds of economic and political actors take part, but it is no one’s job to view things from the perspective of global welfare. Nevertheless, the process has a structure. Law provides the framework and technical vernacular, confirms the outcome and often provides the stakes for the unruly struggles through which the world is governed. It does so in ways that confirm the disconnection between economic consequences and political responsibility. This chapter explores how this has come to pass and how we should understand the process of global governance as a result. The political economic challenge Across the world, political constituencies demand better economic outcomes and economic actors demand the protection only politics can provide. Unfortunately, problems rooted in global economic movements are not amenable to solution on the scale of our political life. Nor are global economic actors mandated to grapple with political economic challenges or assess the choices they face from the perspective of world welfare. As these political economic issues have everywhere become more urgent, they threaten to destabilize contemporary political and economic structures. A rapid process of factor price equalization and technological assimilation has allowed people everywhere to aspire to a refrigerator and an air conditioner, along with the public and private institutions necessary to realize those ambitions. The relative hegemony of a North Atlantic political and economic center has abruptly eroded. Change on this scale is profoundly destructive and relative income equalization is an extremely uneven business. A global economy 1 is not a uniform economy. Things turn at different speeds. People are left out. People are dragged down. When people turn to their sovereigns for help, the results are terribly uneven. Some are too big to fail – others too small to count. Workers, consumers, businesses large and small turn to the nation state for support against the competitive pressures and uncertainties of global markets, only to find there is often little their sovereign will do. Government everywhere is buffeted by economic forces, captured by economic interests, and engaged in economic pursuits. As people at the top and bottom of the world economy have moved and sold their skills across ever greater distances, the middle classes of the advanced industrial democracies have remained locked to territory and dependent on a territorial politics. For so long the center of political gravity, they are left to confront a new political and economic impotence. Governments now operate in the shadow of disenfranchised and disillusioned publics who have lost faith in the public hand – in its commitment to the public interest, in its sovereignty, its relevance, its capacity to grasp the levers that affect the conditions of social justice or economic possibility. Political life has drifted into neighborhood and transnational networks, been diffused into the capillaries of professional management and condensed in the laser beam of media fashion, transformed into a unifying, if impotent, spectacle. The inability of politics to offer public interest solutions to policy challenges has encouraged political cultures ever less interested in doing so. Politics has come to be about other things: symbolic and allegorical displays, on the one hand, and the feathering of nests on the other. At the same time, the public hand everywhere has become a force multiplier for leading sectors, nations, regions, heightening rather than ameliorating the imbalances and inequalities of the global economy. The programs of political parties routinely aim to protect and promote local winners – if only rarely effectively -- sometimes with a vague promise of transfer payments to compensate local losers. Just as it makes sense for economic actors to compete in the global market, it makes sense for every individual or city or firm or nation to try to upgrade its position in global trade to engage in what are called “high value” activities. They are called “high value” because those who do them, under current arrangements, can exclude others and capture a higher share of the global gains from undertaking them. Those who are excluded, bypassed, or outcompeted will capture less. It is not possible for every nation to be a highest tech, greenest, innovation driven knowledge economy, any more than everyone can be the lowest wage manufacturer. Indeed, it is hard to understand how so unlikely a promise could be a plausible political program. These niche market dreams function as justifications for mobilizing resources behind the successful, deferring rather than underwrite the promise to compensate. They bear witness to sovereign weakness, not wisdom, heightening the vertiginous competition among global economic actors by harnessing local politics to their demands. Pursued everywhere, this strategy drives a relentless struggle among public and private actors exacerbating inequalities and speeding the 2 destructive rise and fall of confidence, political and economic security in one location after another. In a national economy, we anticipate that economic competition takes place against the background of a public hand capable of supporting, stabilizing and regulating the market in the public interest while protecting the vulnerable, formulating and implementing shared values. As economic activities become global, national public authorities are ever less able to play this role at home. No one does this globally. Meanwhile, local and national authorities are competing ruthlessly with one another to affect the distribution of political authority and economic reward. Economic actors are doing exactly the same thing. Understanding the process by which the world is governed requires analysis of the iterative micro and macro processes through which conflict among putatively “public” and “private” authorities takes place, whether we think of that conflict initially as “economic competition” or “political struggle.” From a global perspective, the important question is how opportunities and powers to upgrade are themselves distributed – who can become a winner and to what extent to their gains reinforce their dominance? This is at once a political and an economic question. Governing the world in the public interest would mean struggling to link those who lead with those who lag in reciprocal and virtuous productive cycles, rather than encouraging growth here to impoverish there in the hopes that one day the losers may be made whole. This seems impossible to place on the agenda of available political or economic elites. No site is available where the arrangements that distribute opportunities for growth could be contested. Politics has no platform to engage, while economics seems unable to think it as its problem. As a result, the world’s political and economic arrangements seem unable to grasp the injustice of the world, the urgency of change and the need to respond to the rumbling fault lines of social and economic dualism haunting our world. The wild horse to be ridden now is this dynamic of dualism between sectors, regions, industries and nations. No longer a dualism between first and third worlds, the schism of leading from lagging rends the political economic life of nations, cities and regions. The framework for struggle between winners and losers and the machinery for allocating gains or losses is at once a political and an economic project. It is in this sense that big issues today are at once political and economic. The distribution of growth has displaced ideological hegemony and great power competition as the framework for global political struggle. The most pressing governance issues are not political questions, if by that we mean issues to be addressed by governments acting alone or negotiated through conventional diplomatic circuits. They are not economic issues, if by that we mean issues to be resolved by the operations of markets, guided by the hand of robust competition in the shadow of regulation. In the global economy, the conditions for macroeconomic stability, the challenges posed by global imbalances and inequality and the distribution of opportunities to generate and retain rents have replaced concern 3 about whether nation states support or distort private market activity. The problem is not to figure out the appropriate relationship between politics and economics, such as how far public power might harness the economy through regulation, or how economic activity might best be supported by and freed from the public hand. The challenge is how and where to contest outcomes that arise from interactions can seem political, economic and both at once. The ubiquity of law in a world with no Agora The global economy has no “commanding heights” and the world political system has no sovereign center. The institutional structure for both economics and politics has been broken up. As a result, the answers to classic questions of political economy are formulated through dispersed interactions among people across the world with diverse powers and vulnerabilities arising from diverse political and economic arrangements. This is where law comes in. Although it is easy to think of international affairs as a rolling sea of politics over which we have managed to throw but a thin net of legal rules, in truth the situation today is more the reverse. There is law at every turn, if only the most marginal opportunities for structured political contestation over its forms and consequences. Even war today is an affair of rules and regulations and legal principles. Nor is the global market a space of commercial freedom outside of law. Global trade – even informal and clandestine trade – takes place in a dense regulatory environment among entities whose capacities and bargaining power are structured by legal powers, obligations and privileges. The dispersion and fragmentation of economic and political power brought about by their globalization has only accelerated their legalization. The result has been a tremendous proliferation of law and the vernacular of legal expertise. Yet global life is governed less by a functioning system of rules and institutions than by a hodge-podge of local, national and international norms, made, interpreted, enforced or ignored by all manner of public and private actors. We live in a world of conflicting and multiplying jurisdictions, in which people assert the validity or persuasiveness of all manner of rules to one another with no decider of last resort. The law of global governance matches neither the horizontal picture of private law solidifying relations among consenting parties nor the vertical picture of sovereign prerogative and administrative authority. Law is rather the vernacular and instrument for a host of struggles that run orthogonal to these axes, in which one of the things at stake may be whether something is called and treated as public or private, vertical or horizontal. The law of global governance is a disparate series of instruments of persuasion, arrangements of affiliation, adhesion or distinction, calls on authority to defend gains and prerogatives, as well as a repository of hegemonic meanings, moral injunctions and social rankings. It is both worth struggling over --- define things my way, reinforce my entitlements, defend my prerogatives – and a record of past wins and losses. 4 The law of global life is neither written by a sovereign hand nor concluded by consenting parties. It is a far more fluid affair. The footprint – official and unofficial – of national rules and national adjudication extends far beyond their nominal territorial jurisdiction. And no sovereign presides alone at home. Public and private power waxes and wanes, jurisdictional boundaries are made and remade. And then there are the many overlapping private arrangements, financial institutions and payment systems, an alternate world of private ordering through contracts and corporate forms, standards bodies. It was, after all, a network of impenetrable private obligations which tied our global financial system in knots and has yet to be unwound. Even global liquidity is as much a matter of private leverage and securitization as it is a function of central bank determinations about the money supply. We have seen the power of private entitlements over public coffers, whether foreign bondholders or local pensioners. It may be surprising, but informal rules are as important for global economic activity as formal contracts and public regulations: the informal sector is also global. Remittances, barter, trade and exchange internal to families or firms, black markets and corruption rackets all have rules and institutions – and enforcement mechanisms. Stigmatizing them, ignoring them – or utilizing them --- is, for every public and private actor, a strategic choice. Consequently, the world’s elites inhabit an extremely fluid policy process which has no center and no common direction. They operate on a terrain of invention, routine and struggle, without a common or coherent constitutional narrative. The system they manage is neither transparent nor democratic. Institutional changes, political realignments -- even technological changes – can alter the distributions of power and opportunity in this chaotic world. Within the European Union, for example, a change in the institutional structure for managing bailouts – like the 2012 European Stability Mechanism --- may consolidate a distributive settlement of risk among economic players and narrow the channel for political debate within and between member nations. The invention of new legal instruments --- the “credit default swap” – may destabilize settled expectations and risk allocations. We might call such changes “constitutional:” they shift the institutional terrain, settle some debates while opening others, strengthen some political and economic actors while weakening or excluding others. We might call many things “constitutional” in this sense without imagining that they add up to a coherent global, or even regional, regime. Calling something constitutional may also help to make it so. as a result, constitutionalisation – locking some things in, locking some actors out – at the global level is a strategy in governance rather than a map or foundation for government. This leaves us with some puzzles. Although law and regulation form the terrain and often the stakes of global governance struggle, they seem powerless to affect its course, unable to be harnessed by anyone in anything like “the public interest.” Although the lines between business and government, private and public, have everywhere been blurred, it remains terribly difficult for anyone to address questions of global political economy – questions which cross the fields of economics and politics. This takes some explaining. It turns out that law and legal 5 expertise have been deployed to organize economic and political life in such a way as to ensure that no one will be mandated to engage global political and economic issues together in the public interest. It is worth a moment to recall why this seemed like a good idea at the time. Constructing a world of horizontal economics and vertical politics The problem is not that we have somehow failed as of yet to construct machinery for global governance in the public interest, whether through a strengthened United Nations or otherwise. It is rather that we have systematically rearranged the world in ways which make a coherent global public order unthinkable and unworkable. I have repeatedly been struck over the last years, whether at Davos or Occupy Wall Street, by the frequency with which people bemoan the absence of political will and capacity to address global problems while affirming that obviously, they do not think a “world government” is desirable or possible. Given what we think “government” is and the machinery we have created for politics at the national level, they are undoubtedly right. The insulation of economic life from political contestation and the absence of any actor empowered to take a global view have their roots in an enormous global undertaking to construct a world in which economics and politics could be pursued on different scales and in altogether different metaphorical “spaces.” To put it succinctly, the economy has become global, organized as an infinitely scalable horizontal structure of mobile products and factors of production, while political order remains lashed to local and territorial governments, organized as a vertical structure of authority and accountability between a people, a territory, and a ruler. The result is a rupture between a vertically oriented local and national politics on the one hand, and a horizontal arrangement of global economy and society on the other. The relative mobility of economics and territorial rigidity of politics have rendered each unstable as political and economic leadership have drifted apart. So long as politics remains local or territorial, while economics floats freely across the globe, a coherent “political economy” will be terribly difficult to imagine. Instead, political and economic leadership have drifted apart. A spiral has begun --as the winners lock in an ever weaker territorial politics and an ever more dominant economic order. Political leadership has everywhere become peripheral to economic management. This world has been constructed through a series of legal, institutional and professional projects. Big ideas were important – ideas about what politics is, what an economy is, how they should relate to one another. These ideas were made up and made real in small steps. The machinery which produced and sustains a territorial politics and a de-territorialized economics is technical and legal. Economic activity can only happen on a global scale if the institutional arrangements are in place to support it, just as political activity can only be concentrated territorially if the institutions responsible for political life have distinct jurisdictions. The people who made our political and economic worlds were not philosophers or visionary business moguls or powerful statesmen with big picture ideological commitments. They were 6 professionals, doing their jobs, seeking to manage their piece of a chaotic economic and public world. They did so in the shadow of a loose consensus within the global policy class about the natural teleology for economic and political life. Making an economy global: idea and technique The economic idea is simple. Although it is common to think of an “economy” as something nations have – the German economy, the Japanese economy –when we think of an economy as a “market,” it is difficult not to think of it as something that can be scaled up or down. And to think that scaling up is generally good. Ever more people, products, resources and ideas ought to be able to find their markets in the shadow of a common price system across ever greater distances. As a result, when putting an economy together, it is a good idea to try to link as many things together as efficiently as possible at the national, regional and global levels. This has always been more idea than reality. Nevertheless, since the Second World War, policy elites aghast at the consequences of the Great Depression have remembered the world of nineteenth century liberalism this way and have sought to build their way back to it institutionally. It matters little that the nineteenth century was not like this, nor that local and sectoral specificities, informal networks, oligopolies, barter, intra-enterprise trade, market failures, bottlenecks and other anomalies remain ubiquitous today. It is part of the background consciousness of ruling classes everywhere that the virtuous destiny of economic life is an ever more undifferentiated global market in which goods and services follow prices to more productive uses. This idea has had dozens of practical corollaries. A system of “world prices” seems to require that exchange rates either be stable or extremely fluid and accompanied by legal arrangements to manage exchange risk. Private actors – investors, employees, managers, corporations – should be capacitated to operate globally. They should be dis-embedded from the local arrangements that once made employers feel they should hire from among a particular union, or corporations feel beholden to specific locations or constituencies. Economic entities themselves should be able to be reconstituted and unbundled, able to be re-organized, parceled out for sale and redeployment. Supply chains, information channels, labor markets, investment patterns ought all to be rendered global through institutional and legal integration. Where regulation or contract impose artificial obstacles to the vertiginous destruction and creative reinvention of economic relations, they need to be unwound. The legal arrangements necessary to keep all this going should be protected from interference by local political and judicial authorities. These are background goals or assumptions – not iron laws. None of these things needs to happen absolutely – all may be a matter of more or less. The technical management of the global economy is undertaken through innumerable small scale projects to fine-tune the 7 institutional conditions for market efficiency in local settings. This fine-tuning takes place as people argue with one another about just what is required to liberate and stabilize economic flows. These arguments take place in a range of professional vernaculars. As a general matter, they all aim to identify territorially enforced public policy which distorts rather than supports market prices and therefore needs to be either eliminated or harmonized as part of a stable background for global market transactions. Transnational institutional arrangements to promote commerce, from the European Union to the General Agreement on Tariffs and Trade, approach national regulatory and administrative measures in this spirit. The institutional structure for a global economy emerges as a byproduct of struggles over specific benefits or opportunities carried out by experts as disputes about just which rules are, in fact, market supporting and which market distorting. This is the vernacular through which trade disputes are waged at the WTO: public action which distorts the market is presumptively improper. Convincing your government to oppose foreign regulations which hamper your business strategy means making the case that these regulations are distortive, while a regulatory terrain which would permit you to garner a larger portion of the gains from economic activity represent a “level playing field.” As distinctions like this are interpreted and implemented across dozens of institutional settings, a professional sensibility or common sense emerges about the substantive and territorial limits of public power and about the scale and naturalness of economic flows. Exercises of public authority which support the market travel more easily than those which regulate or otherwise distort the market. Private rights, understood to lie outside or before politics, travel very easily – if you own something here, you own it when you get off the plane somewhere else. Public policies, the stuff of politics, do not travel, except as necessary to support the broader market. Political institutions have the legal authority to enforce private agreements and private rights established elsewhere, although they cannot regulate beyond their borders. In this spirit, regulatory regimes supporting the market --- criminal law, financial regulation, antitrust law --are routinely enforced extraterritorially, while labor law, environmental law or antidiscrimination law are not. Implementing these ideas is a matter of argument. There is no analytically satisfying way to figure out whether a given situation represents the exercise of public power or private right. Sometimes the state acts by not acting – and private rights are nothing but promises that the state will intervene to enforce a duty on some other actor. Establishing a stable legal framework for transnational financial activity requires an argument about the private nature of finance and the importance of public respect for private contract. Establishing the privilege to discriminate or union bust on foreign job sites requires an argument that labor or antidiscrimination law are public regulations rather than terms of contract law. Arguments in this vernacular establish a kind of bandwidth within which people debate what governments and private actors are and do. As these arguments are resolved this way or 8 that, global economic life comes to be consolidated around what come to seem the natural limits of territorial government and public law regulation. For this to happen, there does not need to be an analytic for distinguishing market supporting from market distorting. This apparently technical distinction can rest happily on unexamined cultural and political mores. It is enough that differences can be transposed into a technical vernacular of argument and professional management and become the stuff of regulatory strategy and struggle. As a political ruler operating in the shadow of the rough consensus which emerges from these struggles, you find your interests, constituencies and authority defined and managed by the expert votaries of various institutional sites who interpret your mandate and explicate the force of legalized interests. Linking politics to polities On the political side, the idea is also pretty simple. Politics is all about a “polity:” a community of people associated with a geographically defined territory. Where economies scale horizontally, politics should be deepened and rendered responsive along a vertical axis of authority, representation and accountability between rulers and their constituents. Political authority is a matter of mandated competences and geographically specific jurisdiction or power. Good governance means respect by those in power for the specificity of mandates based on specialized knowledge, the separation of governance functions, and established hierarchies of responsibility for a given territory, as well as ruler responsiveness to local constituencies, encouraged by citizen empowerment, transparency and other machinery of accountability. The perfection of the polity requires and produces a transformation of both rulers and ruled. Rulers should aim to perfect their expertise and inhabit their role in a scheme of divided and specialized competences. The governed should understand themselves as citizen constituents of rulers, expressing their political wishes through the responsive channels made available by their polity: where available, through the channels of responsive democracy and the “rule of law.” Institutions organized as vertical channels of authority and accountability have a monopoly on political life: hence the equation of “politics” with the work of “government.” Politics is the work of people with specialized competences linked to the institutional arrangements we call government: specialists in transport policy and industrial policy, as well as political consultants, media commentators, and the very specific set of people we call “politicians.” Although ideas about what constitutes “good governance” come in and out of fashion --- at one moment elections and constituent service, at another, stakeholder engagement, negotiation and transparency, at still another judicial review and the “rule of law” --- as a general rule, these political specialists should aim to perfect their special technical expertise or competence and intensify their representational links to local constituencies through mechanisms of accountability and transparency. Meanwhile, citizens should prioritize affiliations with others inside their polity and identify their political aspirations with the competences of government. The horizon of political realism is defined by the technical tools and jurisdictional 9 limits of territorial government. The media which arose alongside national political parties as gatekeeper for the apparatus, personnel and subject matter of political life now operate internationally, reflecting the activity of governments back as the privileged site of politics. Politics everywhere has come to be defined as the activity of specialized people who have or aspire to have government power in states exercising delegated competences within their jurisdiction. It is hard to say just when the polity everywhere came to mean the state. International law remembers it as the promise of the 1648 Peace of Westphalia. In diplomatic and political history it is more usual to equate it with the rise of nationalism in the second half of the nineteenth century, setting in motion a process of global political reorganization which reached the majority of the world’s peoples only in the second half of the twentieth century. The state as polity has always been as much a work of imagination as an institutional or lived reality. The institutional projects through which the imaginary world of polity-states we find in literature or political theory has been given shape differ from place to place. Some elements are now common more or less world-wide. Reconstituting people as individual citizens of specific states required a range of technical innovations from passports to voting privileges. From the eighteenth century forward, the vernacular of rights – civil rights, human rights --- redefined justice as an appropriate relationship between an individual and a state. Political significance was slowly leeched from intermediate social groupings as newly specialized political parties were formed to link individual citizenship to the political organs of the state. Civic institutions that might once have played a political role – professional guilds, unions, tribes – were either assimilated to national political parties or transformed into cultural and economic rather than political institutions, their members unleashed to engage with the national political world as individuals. Linguistic, religious and other minorities were accommodated either by recognizing their demands for political autonomy through secession or, more commonly, assimilating them into a national polity as citizens with enforceable individual and minority rights. Political and economic relations between the state and smaller territorial units were transformed into technical legal matters of jurisdiction and competence, suitable for professional interpretation and management through legal doctrines defining things like “federalism,” “subsidiarity,” “states rights,” and “home rule.” Governments were assembled in capital cities, capable of sending and hosting diplomatic representatives. Each state came to have a flag, an anthem, a national museum, an Olympics team, a “traditional” costume and all the other accoutrements of statehood. If this is “politics,” it is not surprising no one thinks it is possible or desirable globally. At that level, all we can imagine is some kind of horizontal engagement among these already constituted polities. The fantasy arrangement of the political world into “states” has equated world politics with the diplomatic and military conversations among people linked to governments, re-imagined from this perspective as parallel “sovereigns.” A transnational 10 diplomatic class of government officials and military officials carries on a conversation by word and by deed which has come to be understood as the site for world politics. Across the twentieth century, this international conversation came to have an ever more legal and institutional form during both war and peace. International lawyers, international civil servants, representatives of civil society organizations all began to participate, fine-tuning the limits and possibilities in their common vernacular. Their interaction has encouraged and has been encouraged by the emergence of a common global media conversation in which all these people may imagine themselves participating as part of a common “international community” rooted in the horizontal relations among states. Indeed, the most striking thing about “world politics” today is the extent to which it is understood to be about the relations among national institutions as they unfold among specialized professionals --- diplomats, soldiers and national political leaders under the watchful gaze of this imagined community of expert commentators. All the other social activity that occurs around the world is something else – commercial activity or cultural activity perhaps, but not “politics.” Like the economic polestar of “market efficiency,” a government of delegated powers and specialized competence linked to a territorial policy is more idea than practical reality. Although constitutions are drafted with this in mind and people often do dispute one another’s powers in these terms, the reality of political struggle in most capitals is a far more confused affair. Informal loyalties, tribal and ethnic affiliations, economic alliances and transnational solidarities matter everywhere. Private and economic actors not mentioned in constitutions often have enormous political authority. Nevertheless, power struggles are routinely undertaken in a vernacular focused on monitoring, managing and strengthening the vertical relationship between a sovereign power and its polity by policing procedures for selection of leaders, the delegation of authority, the allocation of competence and the exercise of jurisdiction. The details are different in each country. They may be a matter of intense local veneration or popular indifference. But argument about what a public agent should and should not do is everywhere undertaken in a technical vernacular of accountability, jurisdiction and mandated competence. Over time, a kind of common sense emerges about what it is reasonable or wise for government to do and the appropriate horizon of responsibility for leaders. This is the common sense we hear in the maxim “all politics is local” or that leads European leaders to see the boundaries of European Union as a kind of natural limit to their international political responsibility. Economic science lends the terms used to build a global economy a patina of objective analytic rigor, as if there were a way to distinguish market supporting from market distorting measures, even if this repeatedly turns out to be a matter of dispute, the outcome a function of background legal arrangements and reciprocal accommodations among participants in struggle over its meaning. On the political side, the diversity of constitutional arrangements and the absence of a theory of justice with the apparent global authority of economic theory makes it more apparent in transnational discussion that what is an appropriate exercise of “jurisdiction” or 11 mandated “competence” is more obviously a matter of judgment about which reasonable people could and do differ. Diplomatic specialists have a number of paths for asserting that their interests and the actions they prefer express the universal interest. International law provides a broad range of tools for saying, as U.S. President Barack Obama did confronting Syria, “I didn’t set a red line. The world set a red line.” Specialists routinely refer to the objectivity and authority of “science” to settle transnational argument about how and whether to regulate what. Things that “shock the conscience of mankind” or contravene “general principles of law recognized by civilized nations” may also seem clear enough to feel objective in their application. Political and intellectual fashions, given form in the shared common sense of global experts, operate as a kind of ideological flywheel for debates carried out in these terms. The availability of a technical vernacular rooted in the idea that “sovereignty” follows “territory” lends many international discussions their objective feel. One can ask where something happened, whose territory was affected, who has violated whose sovereignty. The answers are rarely decisive. By definition, in matters of dispute, two sovereigns and two territories will be involved. The search for a satisfying formulation which allows a resolution to be found leaving both sovereigns unscathed has led to a wide range of ingenious doctrinal solutions. Perhaps one sovereign “impliedly consented” to the other’s action. By meditating abstractly on the “nature” of sovereignty – how absolute territorial powers might be imagined to relate to one another – one may be able to deduce principled limits. One’s sovereignty may not be “abused” at the expense of another. One should engage with other sovereigns in “good faith.” The specifically territorial nature of sovereignty suggests limits, for example, to a sovereign’s interest in the protection of his nationals abroad. The reciprocal nature of inter-sovereign discussion suggests limits to the kinds of claims one sovereign must be expected to entertain: they must be important, grave, the nationality of those involved linked in a genuine way to the legitimate interests of the sovereign demanding a response. Argument about such matters opens a broad terrain for professional struggle over the meaning of sovereignty, the bases and reasonable limits of jurisdictional authority. By working out the details of imaginary relations among the “territorial sovereigns” of one’s imagination, practical accommodations among rivals may be able to be worked out. Over time, law makes this fantasy land of characters and places real. Although there are no global rules determining who has jurisdiction over what, political and legal professionals have devised technical ways to talk around direct conflicts between opposing jurisdictional assertions also rooted in ideas about the relationship between sovereign “interests” and territory. As a practical matter, we know that exercises of public power rarely fill the territorial space: one cannot “exercise sovereignty” everywhere at once. The sociological effects of public power just as routinely overspill territorial boundaries, regardless 12 of whether one intended to “exercise jurisdiction” extraterritorially. Claims to exercise jurisdiction of various kinds – juridical, administrative, legislative – are made by public officials at all levels in every state. Public international law asks each authority to weigh and balance a series of factors to ensure their exercise of jurisdiction is “reasonable,” factors as wide ranging as how important the case or value or interest is to each state, whether the exercise of jurisdictional exercise might lead to discord or conflict among sovereigns, and more. Perhaps one can say where the central activity in the dispute occurred, where the effects were most significant, the sovereign interest most compelling. Shared ideas about what is “reasonable” matter a great deal in such discussions. A question which remains off the table: whether the exercise of public power would or would not be in the global public interest. This is simply not anyone’s remit to ask. Political affiliations and concerns which are more difficult to articulate in vertical language of sovereigns and territories are harder to remember, inhabit or defend. The result is a remarkably homogenous global political order of fragmented government and local politics, operating against the background of an economy organized to link things together by detaching them from the very spatial and communal identifications with which government struggles to intensify its connection. As a result, the global nature of “problems” and the local nature of “government,” whether linked to a city, a state or to the international order itself, is not only a troubling fact to be overcome. It is the product of a very particular political economy written into a historically specific set of legal and institutional arrangements which are maintained through professional practices we can identify. Professional practices which are not necessarily about maintaining a dysfunction political economy --- they are usually narrow battles over resources and opportunity conducted as technical debates about more or less --- nevertheless have that effect. In the end, political and economic life pull away from one another – a self-confident and technical form of global economic management detached from the locations and modes of production and a media centered politics disconnected from the technical management of government, pursued gladiatorial spectacle and allegorical morality tale. Meanwhile, in the background, government has become technical by division of competences, authorities and mandates, while economics has grown technical by consolidation in ever more rapidly interlinked and speculative markets. Global governance as struggle The only constant is struggle. Both public and private actors engage the international legal and institutional terrain strategically, seeking to make their standards the global standards and to defeat arrangements which would impede their political or business strategies. Economic actors seek to harness the public hand to define their market while politicians mobilize and promote private interests in the public interest. As everyone tries to impede their competitive rivals, global legal environment has become a variable to be managed, an asset to be harnessed 13 and a risk to be mitigated. The result is a jumble of norms, made, interpreted, enforced or ignored by all manner of public and private actors. As a result, global governance is unlike governance within a national economy and polity. It is difficult to think about “governance” without imagining some constituted public hand above the struggle among individuals and groups, addressing questions of welfare in the general interest of all. “Sovereignty” rarely lives up to this fantasy, of course, even in a small town. The public hand at all levels is routinely instrumentalized by one or another faction, sector, class or individual. On the global stage, there is no constituted global public hand which is supposed to be addressing questions of global welfare in the global public interest. A global as-if sovereign capacity implied by the phrase “global governance” is a purely imaginary effect of people speaking for their own interests as if they represented the general interest. Nor is there a constituted order through which struggle over economic opportunities and political powers occurs. The opportunity to govern – to make your sense of the good the public good – is itself up for grabs. The global governance struggle is precisely a battle over allocation of opportunities to determine winners and losers and to allocate or preserve gains and losses. In the absence of government, struggle on the international stage is rarely organized around the ideologically freighted alternatives of “business vs. government” or “public vs. private” which often define political conflict at the national level. Governments struggle with one another. They are often internally divided and fractious. All are, in one or another way, available for instrumentalization by economic players – some, of course, more directly and completely than others. Public forces are as prone to shield private action as to regulate it. Business is also diverse and divided. They harness political and economic tools in their competition with one another. All economic actors rely on legal entitlements protected by states – from property rights to administrative licenses and regulatory guidelines. And many perform so-called “public” functions – not just avoiding or influencing regulation, but making and enforcing it. Business is as likely to seek regulatory protection as to condemn the protection of its adversaries. And public/private partnerships are everywhere. Rather than business and government or private and public, the ideological thematic of global governance is a confrontations between two interpretive frameworks: the clash of universal norms with particular interests and the confrontation of opposing particulars. We saw this vividly in the international crisis sparked by rebellion in Syria. Some framed the issue as one of global norms disregarded, others as a geostrategic clash of religious sects, regional and global powers. Trade wars are similarly framed both as universal norms demanding local compliance and as competitive struggles between opposing economic interests and nations. In this sense, global governance struggles are conducted as struggles about global governance itself. In such a chaotic situation, it is not surprising that global governance is neither about global problem solving nor the implementation of consensus values. People struggle to define 14 the struggle as well as to exercise their powers, lock in their gains and defend their privileges. Global governance is the byproduct of this self-interested and ruthless activity. I am repeatedly surprised by the look of astonishment on students’ faces when they first realize the norms and institutions of global governance were made by and for winners. Talk about an “international community” capable of exercising coherent authority on behalf of the world’s citizens obscures the simple fact that global governance demands allies and creates losers. Global governance is less deliberative demos than distributive struggle in which the benefits of “good governance” will be unevenly distributed and provide the platform for a further round of engagement. The political-economic struggle over rents Struggle in the arena of global trade and transnational economic activity illustrates the kind of struggle which also takes place politically, culturally and socially. We might begin with Ricardo’s simple trading model taught in every introductory college course on the economics of trade. It illustrates the potential for “gains from trade” between two countries producing two products with different resource endowments or technologies. The theory is simple, if somewhat counterintuitive: even where one country needs more inputs to produce both products (is at an absolute disadvantage in the production of each), there will be gains from trade if that country exports the product in which it has a relative or comparative advantage. So, for example: Country A Inputs Radios Inputs Televisions 2 6 2 4 6 6 4 4 Inputs Radios Inputs Gain 2TVs Televisions Country B In the classic demonstration, although country B takes more inputs to make both radios and televisions, if country B exports four televisions to country A, country A can release two units of input, apply them to the production of radios, export six radios to country B, which can use them to release six units of input. Applying those six units to TV production allows for the production of six televisions, a gain of two televisions overall. Country B has a comparative advantage in television production. 15 The principle could, of course, be equally well demonstrated from the perspective of country A, which has a comparative advantage in radio production. Country A Inputs Radios Inputs Televisions 3 Units 2 6 Gain=3 Radios 2 4 6 TVS 6 Inputs 6 4 Radios Inputs 4 Televisions Country B Here, country A exports six radios, allowing country B to release six units of input, apply them to television production and export six televisions. Country A, in turn, is able to release three units of input from television production, apply them to radios, and achieve a gain of three radios. This is all quite straightforward. The governance question arises when we try to understand how the gains from trade will be distributed. Will we end up with the equivalent of two more televisions in country B or three more radios in country A? This will depend upon an enormous number of variables. We might start by imagining state trading companies facing one another. Their respective bargaining power will not only be a matter of their relative size, prestige, wealth or military might. It will also be a function of the structure of these (and other) industries in both countries, the relative power of labor and capital invested in the two industries, the relative monopoly power of producers in each industry and each country, and so on. If we imagine this exchange in a global market, their bargaining power will also be a function of the relative competitiveness of the global markets for these two products, the substitutability of each in various consumer markets. What we call “competitiveness” and “substitutability” will depend on many legal and institutional arrangements which affect things like costs of production and barriers to entry in the two industries, preferences and the process by which preferences are shaped in the two countries, and so on. If we relax the assumption that the price will be found through a two sided bargain between state traders, many others will seek to capture the gain from this trade – the respective industries, their labor forces, their bankers, the consumers of each product. Each will have some level of power to capture the gains and to defend that capture over time. Each may have the 16 ability to harness other actors to their own agenda. Each state trading company may have been captured by one or another interest, either within the country or outside. No authority oversees these struggles or determines how they will be carried out. The rules and institutional arrangements affecting the outcome of the myriad relationships among sectors and actors bearing on the allocation of gains among people with a potential interest in gains from this trade are determined at an enormous variety of sites and are themselves open to struggle and bargain. The World Trading Organization, often imagined as providing a governance framework for global trade, has almost nothing to say about how these many rules and institutional arrangements are set. Nor is the WTO itself structured as a governing institution above member states. At best it provides a framework for horizontal bargaining among governments about tariffs and regulations which can be understood to function like tariffs, along with a dispute resolution mechanism whose enforcement depends on the relative willingness and ability of member governments to exact or bear costs vis-à-vis one another. The WTO is simply one space among many within which the governance struggle over gains from trade takes place. It provides one vernacular, one institutional setting, one style of expert discussion through which governments can engage one another as they seek to capture gains from trade. The model of global economic life implicit in the WTO’s own structure --- and suggested by Ricardo’s two country model --- is increasingly out of date. Governments are not good aggregators of economic interests “within” their national jurisdiction or territory. They are often captured or harnessed by one or another interest, including interests of traders, investors, financiers, economic sectors or foreign nations outside their borders. More importantly, economic interests are no longer local, as the endless disputes about the allocation of income for tax purposes within distributed multinational operations makes clear. It would be more accurate to think of the global economy less as the aggregation of national economies than as a collage of overlapping sectors or industries operating transnationally. Global finance, the global automotive industry, the global aviation industry, the global agricultural or energy systems are all transnational arrangements of public and private actors. Gains from economic activity are distributed among actors in those systems – and between the systems – through a complex process which is not located within the jurisdiction of any public authority. Value today is generated across enormously complex global supply chains: hence their rebranding in the literature as “global value chains.” How an increase in value will be distributed across the chain is also a matter of bargaining power – but not, on the whole, the bargaining power of nations which may be members of the WTO. The bargaining power of workers, investors, suppliers, distributors, suppliers of transport, retailers, consumers and others depends on the capacity of these various actors to bargain for gains against others in the chain. We might express their bargaining power in a variety of ways: their ability to get the corner on one or another indispensable link in the chain, to erect barriers to entry around the 17 piece of global production they dominate, to exercise relative monopoly power and exclude competitors, or their capacity to extract “rents” from the economic activity they provide. It was Ricardo who identified the centrality of “rents” to the distribution of gain in his analysis of landlords’ ability to exploit their property entitlement to highly productive land to charge more than the cost of production as demand increased and less productive land came into use. As a theoretical matter, it is notoriously hard to say what portion of the price of anything represents “rent” as opposed to the cost of production. Obtaining and securing the property right could as easily be seen as another cost of production or service. We might see the term “rent” simply as a pejorative for profit or gain: other people’s profits may always be recast as unearned “rents.” They arise from the immunity to competition that comes with the ability to exclude. Whether that ability arises within the firm, within the sector or within the nation, they rest on entitlements, even where they look like quality or price advantages. It is here that entitlements are the stakes in governance struggle: the distribution of gain across global economic systems will often be a function of the power to exclude, itself a function of legal and institutional arrangements. Looked at from this perspective, the ability of various actors to capture gains arising in a global value chain is not a function of “competition” or “supply and demand.” It is a function of the entitlements and bargaining power with which those actors come to the generation of the gain and struggle over its allocation. Relative market dominance, monopoly power and bargaining power are all in large part a function of legal arrangements – the structure of firms, the structure of finance, the structure of labor bargaining, consumer entitlement and more. These are the levers to be pulled as firms, unions and others struggle to increase their relative stock of entitlements and reinforce their dominance vis-a-vis others in the chain. In some industries, intellectual property provides the crucial lever. In others, it is the relative concentration of monopoly power at one place in the global chain – the large automotive manufacturer and credit institutions vis-a-vis both suppliers and retailers; or the major consumer product retailers through their dominance of access to large chains of retail stores. Protection for innovation or access to an educated labor force may be crucial. So might privileged access to energy or transport, or privileged access to low wage labor, or the privilege to despoil the environment. As a result, firms, cities, regions, industries and nations all struggle to upgrade their position in global value chains by increasing their privileged access to one or another moment in the production of value. Economists often speak about the strategic imperative for companies – and countries – to enter and hold “high value” segments of the global production process. It is common to think of a ladder running naturally from natural resource exploitation through processing to assembly, manufacturing, design, branding and invention. It seems a rule of thumb that high wage “innovation” or “knowledge” based activities will offer opportunities to retain a greater portion of the overall gain from economic activity in the value chain than low skill manufacturing. It is important to understand how much this hierarchy of value depends on legal arrangements. A shift in intellectual property law and labor law, for example, might sharply 18 diminish the exclusivity of innovation based activities and reduce the availability of the privilege to access low wage labor. At the margin, regulatory shifts in the many rules governing access to returns from different activities in global value chain can alter what is and is not a “high value” activity. It is no wonder, therefore, that we see intense struggle over those rules, undertaken in an extremely unruly and disparate fashion, among producers, consumer groups, investors, firms, cities and nations. By definition, not everyone can succeed – that’s why it is a struggle. Upgrading is a relative accomplishment. A country might think that securing a low wage niche through a special tariff arrangement would offer the opportunity to upgrade from agricultural to industrial labor only to find that others have easily secured the same advantage and compete viciously on price. A firm may think that locating the industrial capability to process logs into plywood close to the forest will secure it a privileged position only to find those who finance the lumbering of the forest locked into a long term contract with foreign plywood manufacturers. The local government may have gotten a cut for ensuring the exclusivity of their access to the trees. If there is a constitutional struggle in global economic governance, it is over the authority to allocate and secure privileges and other entitlements. Against this background, it is not surprising that things like low wages, environmental damage, inequality and even war will also arise from legal arrangements. Global poverty, conflict and inequality are not technical challenges which might yield to expert consensus or be addressed by the benevolent hand of global governance. They are the legal and institutional byproducts of the struggle through which we are governed. In the same way that people think of the WTO as the place where global trade relations are governed, many also think of international law as a compendium of regulation in the global public interest. Nothing could be further from the truth. I am often struck by how earnestly law students accept their textbook’s presentation of “international environmental law” as all about protecting the environment – as if law offered nothing to those who would cut down the forest and soil the sea. After all, despoiling the rainforest is not only an economic decision – it is also the exercise of legal privilege. In a similar way, many accept the idea that the “law of war” is all about limiting violence and beating swords into ploughshares. The military knows better – and have coined a term for it: “lawfare”---- law as a weapon, a strategic ally. There are things you can do with law – and governance – that you could also do with a gun. You can take out a satellite with contract, you can hold territory, delegitimate your adversary, solidify your alliances, define the battlefield – all with law. It is not so different in commercial life. Things like inequality, conflict, injustice are reproduced through the routine – if also chaotic and ruthless – process of struggle over regulation in pursuit of business or political strategy. After all, economies configured differently will operate differently, just as different allocations of legal capacities and authority will generate divergent polities. By tracing the 19 impact of legal forms on the economic and political actors and activities they constitute, people can identify choices among different political and economic trajectories. They can struggle to identify and build alternative, even equally efficient or democratic, modes of economic and political life with diverging patterns of inequality, alternate distributions of political power and economic benefit, more or less space for experimentation or contestation. Regulatory strategy: the perspective of people in the struggle In my experience, those who participate routinely in global economic life know this. Certainly their corporate risk managers know it. Transnational business occurs across a terrain of multiple and shifting rules, standards and principles, offering business strategic opportunities and posing a variety of risks. For transnational economic actors, the regulatory environment is indeed a variable to be managed. You can try to influence it. You can try to avoid it – by moving or flying beneath the radar. You can comply with it, tacitly or by certification. You can seek to replace it or substitute for it – by developing your own internal or sector specific private standards. But the regulatory environment is also an asset to be harnessed. This is the “lawfare” part of the story: regulation as a barrier to your competitor’s market entry. What business would not like to see their standard imposed as the industry standard, the national standard, the global standard? Regulation can also be an offensive weapon – slowing competitors’ speed to market, entangling competitors in compliance or litigation. Or a market asset, as where compliance functions as brand enhancement. There is something Clausewitzian about this – where regulation is an asset for you, it is a liability for your competitor, and vice versa. It remains conventional for business to think of regulation only as a risk to be mitigated: one ought to move elsewhere or comply with local law to avoid civil or criminal liability, the reputational damage of becoming entangled in prosecution or suit and the costs associated with defense. Those are real risks and moving on, like complying, is a common strategy. But the game is more complex than that. There is also the risk that your competitor will harness the regulatory terrain as an asset or that the entire terrain for business activity will shift. The rate of return in a given market, with a given business partner, in a given sector, always rests on a legal foundation. Where that foundation shifts, calculations shift. We often think of these as “political risks,” but they arise where market opportunities shift through regulation: think of new export or financial controls in an important market. The globalization of economic activity has heightened the importance of regulation in each of these senses: as a variable to be managed, as an asset to be harness and as a risk to be mitigated. Where economic activity routinely spans the regulatory terrain of first and third worlds, of North Atlantic nations and the rising nations or emerging markets of the semiperiphery, the business risks and opportunities multiply exponentially. Precisely because there is no central driver or harmonious center to the global regulatory space, the number of relevant public and private players struggling chaotically with one another is simply greater. 20 In many businesses, the person responsible for thinking about all this is called the “compliance officer.” That person may be – often is – a legal professional, perhaps the general counsel, perhaps not. As the regulatory environment has become more chaotic and diffuse, this is no longer the best term. A better title might be “regulatory strategist,” charged with aligning regulatory and business strategy in the global governance struggle. There is a parallel discussion in military circles: how and when should the operational guys engage the lawyers? After you have figured out what you want to do to be sure you don’t get in trouble – or earlier? It is no surprise that in today’s global, often asymmetric military environment, lawyers are forward deployed ever more routinely. With lawfare comes the engagement of legal professionals in military strategy. With struggle over gains from economic activity comes the engagement of regulatory professionals in business strategy. Transforming compliance officers into regulatory strategists and engaging them in that spirit can be a challenge. The largest challenge may be knowledge: gaining an overview of regulatory risks and opportunities and turning that knowledge into a strategic opportunity. Here again, we inherit an unfortunate term: “due diligence.” Due diligence is certainly crucial to compliance and to regulatory strategy. What is the terrain? Who are the regulatory players? Who are your business partners? Due diligence is one tool for maintaining internal and context awareness in diverse and distributed business environments, where supply chains are lengthy and business partners both many and diverse. A better word, however, would be “strategic awareness.” Front line players must not only do the diligence to ensure compliance. They must also remain alert for strategic opportunities and be trained in the arts of regulatory combat. If we imagine everyone operating in this spirit --- public and private actors, you and your competition, globally and locally --- this is the reality of global governance in action. The role of professional creativity in this dystopic political economic order The rift between economics and politics is not simply the result of an ideological commitment to their distinctiveness – a kind of “neo-liberal” overreach. Popular discourse has been full of voices for and against a “laissez-faire” separation of politics from economic life for more than a century. Although the professionals who build and manage the political economy of today’s world sometimes argue in such hyperbolic terms, when it comes to the details where the rubber meets the road, their differences are minor. At least privately, most easily acknowledge the interpenetration of politics and economics, the unavoidable need for economic regulation and the importance of political leadership for sound economic policy. The roots for the rift between local politics and global economics lie deeper in the dynamic consequences of those everyday details and will require more to reverse than an ideological conversion. In some sense, the relationship between politics and economics is simply a matter of interpretation and perspective. The smallest market transaction – a T-shirt sells in Ghana – can be interpreted to illuminate the politics or the economics of the planet. Yet alternative disciplines have sprung up to reflect divergent interpretations of this same transaction. 21 Economists and politicians understand the scale and “logic” of the transaction differently and embed it in a different social, institutional and intellectual context. Their differences emerge as different styles of analysis, different default interpretations and background assumptions. And as alternative legal domains. Yet the professional vernaculars through which the political economic order is managed are not based on a sharp conceptual boundary between politics and economics. Economics and politics are not powers absolute within delimited spheres, defined in a kind of global constitutional settlement and managed by the interpretation of formal distinctions and boundaries. Although people sometimes imagine them this way, just as it is common to imagine sharp distinctions between property entitlements – your land / my land -- or political jurisdictions and competences, this is not accurate. Individual political and economic “rights,” even to property, rarely work in this kind of on-off way. The relationship between you and me is all about what each of us can do with our land that may affect the other, about the terms of our relationship rather than the demarcation of our difference. When managed by jurists or policy professionals, those terms are detailed matters of more or less, determined by the balancing of competing interests and objectives. In the professional communities where economics and politics are carried out, this is also widely understood. Just as experts know private right and public power blend into one another in many ways, they also know that politics can be hard to distinguish from economics in any categorical sense. The practical differences between them are produced almost as a byproduct of the routine professional making -- and unmaking – of an infinite series of small scale technical distinctions which can be experienced by the experts who interpret them as matters for subtle balancing rather than sharp line drawing: between public and private, national and international, family and market, between regulations which support the market and those which distort market prices, or between acts of the state which enforce private rights and those which burden them with regulation. Such distinctions may not, in the end, be logically or philosophically satisfying, but they often work as a practical matter, at least sufficiently that experts may find professionally satisfactory ways of distinguishing situations that seem to go “too far” in one or the other direction. As those who manage the institutions of political economic life repeatedly find ways to draw the line in specific situations, professional traditions emerge devoted to each domain. International private law experts think differently than those focused on transnational regulation. The professions responsible for the management of public and of private law, or of marketmaking and market regulating, have grown apart, coming to occupy different institutional sites and to speak about the world in divergent vernaculars. Over time, the divergent styles of technical interpretation in different disciplines harden the differences between domains that no one thinks distinct. 22 It is important to understand that this dysfunction has been a joint product of economic and political ideas. It was not only the “neo-liberal” preoccupation with liberating markets from government distortion. It was also the more conventionally “liberal” association of “good governance” with vertical responsiveness and respect for divided competence. The problem is not an incompatibility between these projects – indeed, more the opposite. In some way these projects complement one another. If economics means efficient markets and politics means democracy and the rule of law – these all seem like good ideas. It is appealing to think that they go together naturally, or that movement toward one might start a virtuous cycle toward the other. Unfortunately, the technical management of the tensions between these grand projects has accelerated the distance between politics and the public interest while liberating economic life from the social and political context necessary for its successful stabilization and management in a kind of vicious spiral. A great deal of professional management in each project could be seen as boundary work: ensuring the compatibility of the two projects. Jurisdictions and mandates should be interpreted to perfect the vertical relationship with a polity – not to regulate global economic flows in the global public interest. The corollary economic distinction between market distorting and supporting public action should be managed to liberate global economic flows without unraveling the appropriate relationship between governments and national or local polities. Professionals in each area typically respond by calling for more of both – ever more integrated economic markets and ever more responsive and specialized government: more democracy, more efficient markets, both promoted by more rule of law. The common professional challenge seems to be to build intermediate institutions and doctrinal schemes for the technical accommodation of national politics to a global economy and for a satisfying management of the interface between them. The trade regime is the most obvious example – a set of economic and political commitments, doctrines and interpretive institutions designed to encourage national political support for global economic activity and economic accommodation of divergent national political settlements. The issue is not the incompatibility of these endeavors. It is the dysfunctional global political economy which has been the result of their pursuit. Precisely because ideas about the links between sovereign power and policy or the institutional requirements for allocative efficiency are also about managing the relationship between economics and politics, neither need be fully implemented to divide politics from economics. Indeed, neither could be fully implemented. Neither is sociologically realistic: both efficient global markets and responsive government limited to its polity are ideals for which no example exists. More crucially, they are not coherent ideals. There is no intellectually satisfying way of determining when authority is mandated and responsive absent some kind of myth about the origin of a polity. Nor is there an available analytic for figuring out when adjacent such powers ought to defer to one another and when they should be permitted to pursue their interest at one another’s expense --- just as there is no intellectually satisfying way to 23 distinguish market supporting and market distorting government action when every element of economic life is a legal institution which might be constructed in a variety of ways. Both market efficiency and good governance rest on shared about the “normal” polity and the normal market. Nevertheless, each provides a vernacular and orienting frame for struggle about what politics and economics are and might become. As a consequence, the fault line between politics and economics cannot be undone by legal fiat any more than by ideological reversal. The rift between politics and economics is a project undertaken everywhere at once by professionals and experts who are simply doing their job. Only by bending the arc of their routine work will the political economy of the world be transformed. How might political economic dysfunction be reversed? Only rarely can a good solution be reverse engineered from identification of the problem. Nevertheless, here is a thought experiment. What would happen were the governance professions suddenly re-oriented to reversing these logics, aiming to reconnect the political and the economic while fragmenting the space of economic activity and multiplying the modes through which politics is undertaken? Such a program would be familiar to the world’s leading risk managers who have seen the dangers of over-integration in economic life. Financial risk management today often requires the reintroduction of stop-gaps and go-slow provisions against the damage of contagion and the volatility of speculative flows. Supply chain risk management now requires the reintroduction of inventories to guard against the disruptions of a tsunami here or a nuclear accident there. Imagine continuing on this path, reintroducing institutional forms for economic life linked to territory and to the constituencies whose economic and political possibilities rise and fall with their location: public unions, publically owned enterprises, corporate forms responsive to public policy as well as shareholder profit, banking and credit reoriented to local economic development. Large scale regional institutions – central banks, development banks -- might be reorganized to be more responsive to diverse local economic and political imperatives, their investments delinked from world market benchmarks. It is not impossible to imagine how this could be done. It has been done before. Intermediary organizations that now seem like pure economic irrationality and inefficiency only a generation ago were spaces of political engagement: professional monopolies, corporations linked to local stakeholders, unions forcing negotiations over the forms and costs of public goods. This is simply a thought experiment – a utopian heuristic. Thought experiments like this are important precisely because they focus attention on the large scale background ideas experts carry around in their heads about what politics or economics are about, where they are heading, and how law fits in. When the world’s managers focus only on the technical issues of 24 institutional form or regulatory policy which their professional disciplines mark out for attention, they are not simply rearranging the deck chairs on a vulnerable world – they are part of the process by which the world unravels. If rulership professionals are to develop the analytic habits and perspectives necessary to understand and remap the political economy of the world, they will need to break free of the technical agendas which orient the work of the professions. The professionals who manage our economic and political affairs could remake the political economy of the world through their routine work. Before setting out to do so, they will want to recall now long it took to disentangle politics and economics, to organize the world in nation states and then to build a global economy. For all the agony that has come with success, building a national public politics across the planet had a strong emancipatory dimension: slaves, women, workers, peasants, colonial dominions obtained citizenship in relationship to the new institutional machinery of a national politics. It will not yield easily. It was equally difficult to build a global economy atop that political order. For all the vulnerability, instability and inequality wrought by the effort, the global economy has also lifted hundreds of millions from poverty while enriching tens of thousands, some beyond imagining. It will not be un-built in a day. Building a new political economy will require more than political will and economic resource. It will require new habits of mind among the world’s quotidian professional rulers. Unfortunately, today those rulers are not only responsible for reinforcing a disconnection between politics and economics. The next chapter focuses on their role in the equally significant process by which political and economic inequalities are reproduced. 25