2015-35 - National Association of Insurance Commissioners

advertisement

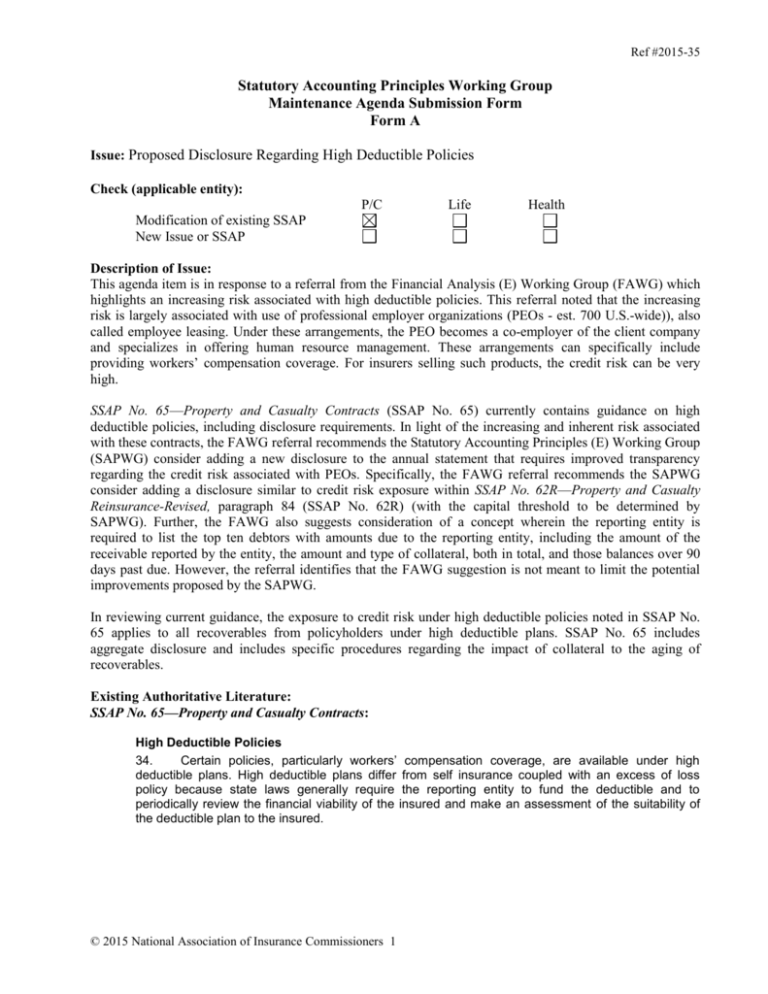

Ref #2015-35 Statutory Accounting Principles Working Group Maintenance Agenda Submission Form Form A Issue: Proposed Disclosure Regarding High Deductible Policies Check (applicable entity): P/C Life Health Modification of existing SSAP New Issue or SSAP Description of Issue: This agenda item is in response to a referral from the Financial Analysis (E) Working Group (FAWG) which highlights an increasing risk associated with high deductible policies. This referral noted that the increasing risk is largely associated with use of professional employer organizations (PEOs - est. 700 U.S.-wide)), also called employee leasing. Under these arrangements, the PEO becomes a co-employer of the client company and specializes in offering human resource management. These arrangements can specifically include providing workers’ compensation coverage. For insurers selling such products, the credit risk can be very high. SSAP No. 65—Property and Casualty Contracts (SSAP No. 65) currently contains guidance on high deductible policies, including disclosure requirements. In light of the increasing and inherent risk associated with these contracts, the FAWG referral recommends the Statutory Accounting Principles (E) Working Group (SAPWG) consider adding a new disclosure to the annual statement that requires improved transparency regarding the credit risk associated with PEOs. Specifically, the FAWG referral recommends the SAPWG consider adding a disclosure similar to credit risk exposure within SSAP No. 62R—Property and Casualty Reinsurance-Revised, paragraph 84 (SSAP No. 62R) (with the capital threshold to be determined by SAPWG). Further, the FAWG also suggests consideration of a concept wherein the reporting entity is required to list the top ten debtors with amounts due to the reporting entity, including the amount of the receivable reported by the entity, the amount and type of collateral, both in total, and those balances over 90 days past due. However, the referral identifies that the FAWG suggestion is not meant to limit the potential improvements proposed by the SAPWG. In reviewing current guidance, the exposure to credit risk under high deductible policies noted in SSAP No. 65 applies to all recoverables from policyholders under high deductible plans. SSAP No. 65 includes aggregate disclosure and includes specific procedures regarding the impact of collateral to the aging of recoverables. Existing Authoritative Literature: SSAP No. 65—Property and Casualty Contracts: High Deductible Policies 34. Certain policies, particularly workers’ compensation coverage, are available under high deductible plans. High deductible plans differ from self insurance coupled with an excess of loss policy because state laws generally require the reporting entity to fund the deductible and to periodically review the financial viability of the insured and make an assessment of the suitability of the deductible plan to the insured. © 2015 National Association of Insurance Commissioners 1 Ref #2015-35 35. The liability for loss reserves shall be determined in accordance with SSAP No. 55. Because the risk of loss is present from the inception date, the reporting entity shall reserve losses throughout the policy period, not over the period after the deductible has been reached. Reserves for claims arising under high deductible plans shall be established net of the deductible, however, no reserve credit shall be permitted for any claim where any amount due from the insured has been determined to be uncollectible. 36. If the policy form requires the reporting entity to fund all claims including those under the deductible limit, the reporting entity is subject to credit risk, not underwriting risk. Reimbursement of the deductible shall be accrued and recorded as a reduction of paid losses simultaneously with the recording of the paid loss by the reporting entity. 37. If the reporting entity does not hold specific collateral for the policy, amounts accrued for reimbursement of the deductible shall be billed in accordance with the provisions of the policy or the contractual agreement and shall be aged according to the contractual due date. In the absence of a contractual due date, billing date shall be utilized for the aging requirement. Deductible recoverables that are greater than ninety days old shall be nonadmitted. However, if the reporting entity holds specific collateral for the high deductible policy, ten percent of deductible recoverable in excess of collateral specifically held and identifiable on a per policy basis, shall be reported as a nonadmitted asset in lieu of applying the aging requirement; however, to the extent that amounts in excess of the 10% are not anticipated to be collected they shall also be nonadmitted. The collateral requirements of this paragraph may be satisfied when an insured provides one collateral instrument to secure amounts owed under multiple policies, provided that the reporting entity has the contractual right to apply the collateral to the high deductible policy. Collateral obtained at a group level that is not supported by an existing pooling agreement requires a written allocation agreement among all collateral beneficiaries. The terms of such agreement must be fair and equitable. Documentation supporting any allocation of collateral among reporting entities must be maintained to allow proper calculation of the nonadmitted amounts and prohibit double counting of collateral. 38. The financial statements shall disclose the amount of reserve credit that has been recorded for high deductibles on unpaid claims and the amounts that have been billed and are recoverable on paid claims. 39. Refer to the preamble for further discussion regarding disclosure requirements. SSAP No. 62R—Property and Casualty Reinsurance-Revised: 84. Unsecured Reinsurance Recoverables: a. If the entity has with any individual reinsurers, authorized, unauthorized, or certified an unsecured aggregate recoverable for losses, paid and unpaid including IBNR, loss adjustment expenses, and unearned premium, that exceeds 3% of the entity’s policyholder surplus, list each individual reinsurer and the unsecured aggregate recoverable pertaining to that reinsurer; and b. If the individual reinsurer is part of a group, list the individual reinsurers, each of its related group members having reinsurance with the reporting entity, and the total unsecured aggregate recoverables for the entire group. Activity to Date (issues previously addressed by SAPWG, Emerging Accounting Issues WG, SEC, FASB, other State Departments of Insurance or other NAIC groups): This agenda item is in direct response from a 2015 referral received from FAWG regarding high deductible policies. Information or issues (included in Description of Issue) not previously contemplated by the SAPWG: None Recommending Party: Steve Johnson, Chair of Financial Analysis (E) Working Group © 2015 National Association of Insurance Commissioners 2 Ref #2015-35 Staff Review Completed by: Robin Marcotte – July 10, 2015 NAIC staff Recommendation: It is recommended by staff and the sponsor that the Working Group receive the referral from FAWG, move this item to the nonsubstantive active listing and expose nonsubstantive disclosure revisions to SSAP No. 65 as described and illustrated below. The concern that the FAWG referral highlights regarding the credit risk for amounts recoverable from policyholders under high deductible plans applies to all high deductible receivables including recoverables from PEOs which have the possibility of concentrating the credit risk. The following two disclosures are proposed: The first disclosure would include the top ten obligors under high deductible policies regardless of collateralization. The second proposed disclosure is modeled on the disclosure in SSAP No. 62R, paragraph 84 which is referenced in the referral. This disclosure would require disclosure of all unsecured amounts by obligor, including whether the obligor is part of a group if the aggregate unsecured recoverables are over 3% of policyholder’s surplus Proposed revisions to SSAP No. 65: High Deductible Policies 38. The financial statements shall disclose the amount of reserve credit that has been recorded for high deductibles on unpaid claims and the amounts that have been billed and are recoverable on paid claims. In addition, disclose the top ten obligors to the reporting entity under high deductible policies for including the amount receivable by the reporting entity for paid and billed claims, the amount and types of collateral, both in total, and those balances over 90 days past due. 39. 40. Unsecured High Deductible Recoverables: a. If the entity has in the aggregate, any unsecured recoverables for paid and billed claims on high deductible policies that exceed 3% of the entity’s policyholder surplus, list each obligor and the unsecured aggregate recoverable pertaining to that obligor; and b. If the individual obligor is part of a group under the same management or control including the same manger such as a professional employer organization (PEO), list the individual obligors, each of its related group members, and the total unsecured aggregate recoverables on high deductible policies for the entire group. Refer to the preamble for further discussion regarding disclosure requirements. Status: On August 15, 2015, the Statutory Accounting Principles (E) Working Group moved this item to the nonsubstantive active listing and exposed revisions to SSAP No. 65, as illustrated above, to capture information regarding recoverables from policyholders under high deductible policies. G:\DATA\Stat Acctg\3. National Meetings\A. National Meeting Materials\2015\Summer\NM Exposures\15-35 High Deductible Policies .docx © 2015 National Association of Insurance Commissioners 3