STRIVE-corporate tax reformconcise

advertisement

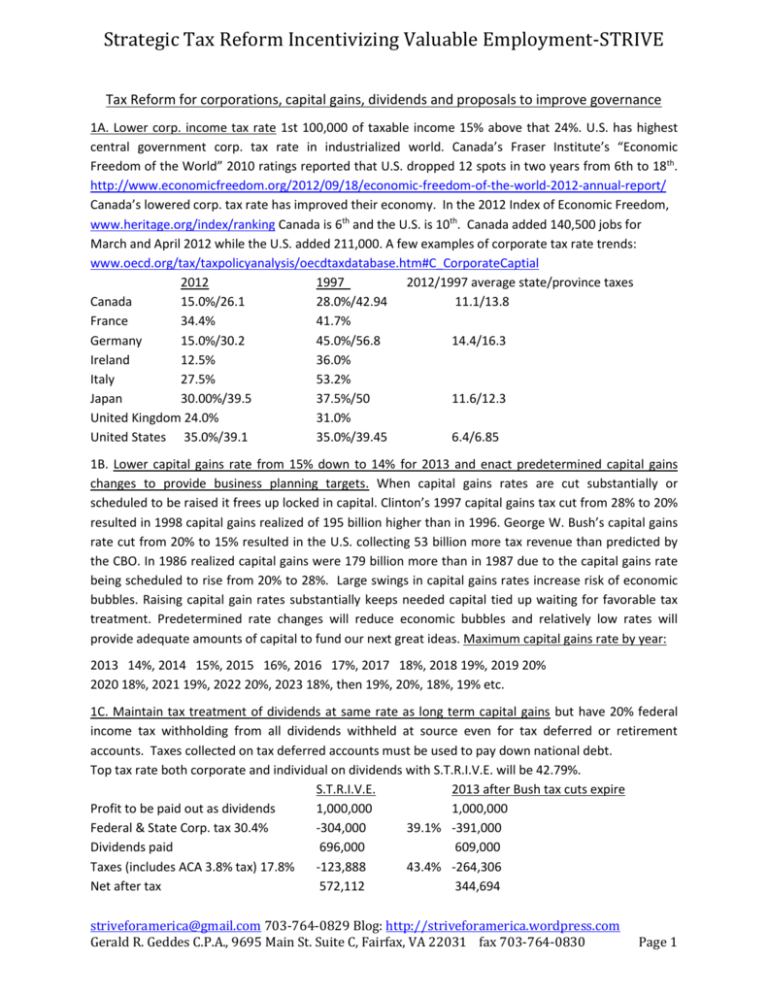

Strategic Tax Reform Incentivizing Valuable Employment-STRIVE Tax Reform for corporations, capital gains, dividends and proposals to improve governance 1A. Lower corp. income tax rate 1st 100,000 of taxable income 15% above that 24%. U.S. has highest central government corp. tax rate in industrialized world. Canada’s Fraser Institute’s “Economic Freedom of the World” 2010 ratings reported that U.S. dropped 12 spots in two years from 6th to 18th. http://www.economicfreedom.org/2012/09/18/economic-freedom-of-the-world-2012-annual-report/ Canada’s lowered corp. tax rate has improved their economy. In the 2012 Index of Economic Freedom, www.heritage.org/index/ranking Canada is 6th and the U.S. is 10th. Canada added 140,500 jobs for March and April 2012 while the U.S. added 211,000. A few examples of corporate tax rate trends: www.oecd.org/tax/taxpolicyanalysis/oecdtaxdatabase.htm#C_CorporateCaptial 2012 1997 2012/1997 average state/province taxes Canada 15.0%/26.1 28.0%/42.94 11.1/13.8 France 34.4% 41.7% Germany 15.0%/30.2 45.0%/56.8 14.4/16.3 Ireland 12.5% 36.0% Italy 27.5% 53.2% Japan 30.00%/39.5 37.5%/50 11.6/12.3 United Kingdom 24.0% 31.0% United States 35.0%/39.1 35.0%/39.45 6.4/6.85 1B. Lower capital gains rate from 15% down to 14% for 2013 and enact predetermined capital gains changes to provide business planning targets. When capital gains rates are cut substantially or scheduled to be raised it frees up locked in capital. Clinton’s 1997 capital gains tax cut from 28% to 20% resulted in 1998 capital gains realized of 195 billion higher than in 1996. George W. Bush’s capital gains rate cut from 20% to 15% resulted in the U.S. collecting 53 billion more tax revenue than predicted by the CBO. In 1986 realized capital gains were 179 billion more than in 1987 due to the capital gains rate being scheduled to rise from 20% to 28%. Large swings in capital gains rates increase risk of economic bubbles. Raising capital gain rates substantially keeps needed capital tied up waiting for favorable tax treatment. Predetermined rate changes will reduce economic bubbles and relatively low rates will provide adequate amounts of capital to fund our next great ideas. Maximum capital gains rate by year: 2013 14%, 2014 15%, 2015 16%, 2016 17%, 2017 18%, 2018 19%, 2019 20% 2020 18%, 2021 19%, 2022 20%, 2023 18%, then 19%, 20%, 18%, 19% etc. 1C. Maintain tax treatment of dividends at same rate as long term capital gains but have 20% federal income tax withholding from all dividends withheld at source even for tax deferred or retirement accounts. Taxes collected on tax deferred accounts must be used to pay down national debt. Top tax rate both corporate and individual on dividends with S.T.R.I.V.E. will be 42.79%. S.T.R.I.V.E. 2013 after Bush tax cuts expire Profit to be paid out as dividends 1,000,000 1,000,000 Federal & State Corp. tax 30.4% -304,000 39.1% -391,000 Dividends paid 696,000 609,000 Taxes (includes ACA 3.8% tax) 17.8% -123,888 43.4% -264,306 Net after tax 572,112 344,694 striveforamerica@gmail.com 703-764-0829 Blog: http://striveforamerica.wordpress.com Gerald R. Geddes C.P.A., 9695 Main St. Suite C, Fairfax, VA 22031 fax 703-764-0830 Page 1 Strategic Tax Reform Incentivizing Valuable Employment-STRIVE Tax deferred accounts may elect to pass through dividends and taxes withheld currently not subject to early withdrawal penalty or segregate taxed funds to avoid double taxation upon final distribution. 1D. REDUCE CONFLICT OF INTEREST FOR AUDITORS Eight year term limits for auditors. Set up SEC publicly traded company funding mechanism so that auditors are paid 35% directly from the corporations they are auditing, 35% from a SEC funding pool with the last 30% paid from general government revenues and 5% to fund SEC oversight. The 35% paid by the audited company will provide an incentive to have an efficient audit but will allow the auditors to concisely disclose more of the business’ questionable practices without fear of economic ruin. Enron was a scandal hidden in plain sight, John R. Emshwiller, a Wall Street Journal reporter uncovered it from looking at the company’s financial statements and interviewing officers at Enron. This provision will improve financial reporting which will allow us to scale back anti-competitive provisions of Sarbanes Oxley and Dodd-Frank. 1E. Repeal code section 162(m) that generally limits to $1,000,000 the tax deduction for annual compensation paid to an executive officer of a publicly traded corporation. This “unconstitutional” Clinton era provision led to stock option fraud such as Enron, Micro Strategy, Adelphia Communications and WorldCom and to reduced tax collected because executive wages were converted to capital gains. 1F. Reduce deficit by collecting taxes from foreign income of U.S. based multinational corporations Eliminate permanent deferral of U.S. taxation on unrepatriated income of Corporations and carried interest from hedge funds and private equity firms of U.S. citizens by phasing in a maximum deferral of ten years. Apple showed deferred U.S. taxes as of 9/2010 of $4,300,000,000. Lowering our corporate tax rate takes away an irrational incentive to never bring investment dollars back into the U.S. but ten year deferral allows capital to move around world freely with time to plan to pay the tax. 1G. Repeal section 199 Domestic Production Activities Deduction. These provisions are complicated and economically suspect. Low corp. tax rates will solve the problem that this legislation addressed. 1H. Tax rate of personal service corporations tax rate reduced from 35% to 24%. Medical practices: sic codes 8010 Offices & clinics of medical doctors, to not be considered personal service corporations to provide tax incentive with goal of retaining Drs. and getting more talented young people to become Drs. 1I. Repeal 2.3% medical device tax. This will have disastrous effect of reducing medical innovation. G. H. W. Bush’s luxury tax killed shipbuilding in the U.S. and provided net less tax revenue for government. 1J. Raise 2014 threshold of employers required to provide health insurance from 50 employees to 99. U.S. is in danger of going from 40 to 58 hour work week with no overtime as companies cut hours to max of 29 hours per week to avoid Affordable Care Act. 600,000 new part time jobs September 2012. 1K. Claw-back 2% reduction of social security withheld on government employees wages for years 2011 and 2012 on 2012 tax return when adjusted gross income above $250,000 for married filing joint and $200,000 for all other filers. striveforamerica@gmail.com 703-764-0829 Blog: http://striveforamerica.wordpress.com Gerald R. Geddes C.P.A., 9695 Main St. Suite C, Fairfax, VA 22031 fax 703-764-0830 Page 2